|

市場調查報告書

商品編碼

1642141

印度設施管理:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)India Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

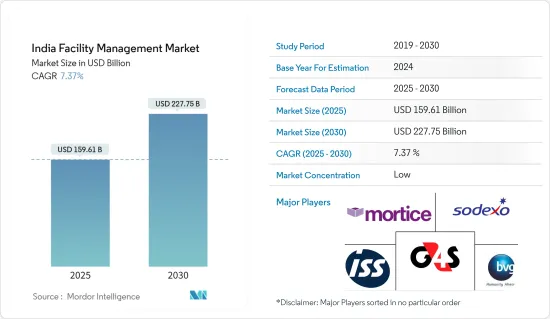

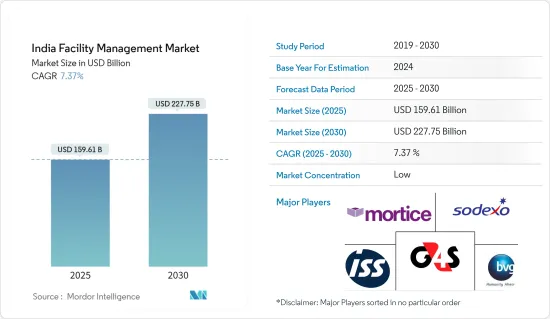

印度設施管理市場規模預計在 2025 年為 1,596.1 億美元,預計到 2030 年將達到 2,277.5 億美元,預測期內(2025-2030 年)的複合年成長率為 7.37%。

FM 涵蓋管理的各個方面,包括建築物、組織的基礎設施和職場的整體協調。該系統簡化了組織流程並標準化了服務。

主要亮點

- 由於城市的快速發展、建築業的蓬勃發展、對綠色建築的日益重視以及對外包非核心業務活動所帶來的好處的認知不斷提高,設施管理在印度變得越來越受歡迎。

- 從複雜度和發展程度來看,印度是設施管理服務外包最大的市場之一。雖然規模較小的本地企業專注於單一合約和單一服務解決方案,但該地區的 FM 企業卻透過與不同洲的大型供應商簽訂綜合合約來運作。鑑於該地區不斷變化的形勢,以新的方式將設施管理與企業房地產結合的機會越來越多。

- 公共部門的客戶熱衷於減少供應商數量並削減成本。因此,捆綁服務合約預計將受益於預算削減以及許多政府機構持續努力精簡業務。隨著對全面設施管理 (TFM) 的需求不斷成長,該地區的公共部門組織越來越希望將其所有「非核心業務活動」外包給單一服務供應商,以便他們能夠更加專注於核心業務。

- 此外,隨著 IT 和 OT 系統不斷整合,公司評估其 OT 環境中的潛在網路風險並採取措施加強其安全態勢比以往任何時候都更加重要。隨著威脅情勢繼續以驚人的速度變化,設施管理人員可能能夠提供一些重要的內部建議,以製定和實施嚴密的網路安全計畫來保護關鍵的 OT 系統。

- COVID-19 疫情對印度的 FM 公司產生了各種經濟影響。人員流動的限制已導致一些客戶所在地的計劃工作和活動減少。受疫情影響,一些市場巨頭被迫關閉,包括 BVG 和 CBRE Group。

印度設施管理市場趨勢

軟體服務推動市場成長

- 軟服務的主要類別包括清潔、回收、保全、病蟲害防治、雜工服務、場址維護和廢棄物管理。基於德里、海得拉巴和其他城市的計劃日益複雜,FM 公司將先進的清潔服務視為其業務的成長機會。

- 物聯網 (IoT) 的採用正迅速成為 FM 軟服務的關鍵促進因素。透過提供連續、即時的資料流,物聯網能夠幫助各行各業改善決策並最佳化工作流程。外包服務的需求正在成長,公司優先考慮可靠、高效和增值的客製化服務,如風險管理以管理當地勞動法和 HSE。

- 此外,加爾各答等新興城市商業房地產的持續成長預計將為應對成熟市場堵塞等挑戰的現有企業提供成長前景。儘管由於新分店開發和軟 FM 外包等區域變量,當前市場滲透率仍然(相對)有限,但需求預計仍將繼續成長。

- COVID-19 疫情導致設施和服務運作方式改變。您的組織的未來可能需要仔細考慮和客製化規劃。因此,FM服務提供者的角色也可能發生變化,變得更加具有策略性和長期性。

預計北方將佔據主導市場佔有率

- 為了服務更廣泛的客戶並擴大市場佔有率,該地區的公司正在實現產品線多樣化。例如,位於德里國家首都轄區的 MASCOP 設施服務公司提供全面的設施管理服務,以確保辦公空間的無故障維護和運作。該公司的客戶包括企業實體、產業、政府機構、製造公司、購物中心、飯店、機構、賓館、醫院、影城和大型辦公大樓。

- 預計大多數新興市場將隨著智慧城市的發展而保持有組織的結構,並避開無組織的部門,使 FM 供應商更容易推出他們的服務。該國的 IT 熱潮加上電子商務投資,尤其是 Shopify 和亞馬遜等公司的投資,宣布了整體基礎設施的發展,從而推動了對 FM 服務的需求。

- 對於各類供應商來說,綜合設施管理可以簡化業務和任務並進行有效的管理。這種方法的主要好處是所有管理業務都從一個整合觀點進行管理,從而減少需要管理的合約、團隊和資源。 IFM 提供了更好的可視性,可以有效管理團隊、降低營運費用、更快地回應請求、減少員工停工時間並增強對整體情況的關注,而不是多次管理每個單獨的相關人員和活動。與 IFM 服務提供者合作還可以更輕鬆地在許多站點和服務中實施重大變更。

- 共享辦公空間對於印度不斷發展的零工經濟和Start-Ups文化至關重要。近年來,「印度的共享辦公空間」呈指數級成長。透過出租單獨的辦公空間,這些中心減輕了Start-Ups和大公司設立新辦公室的巨大負擔。共享辦公空間的需求不再局限於德里、班加羅爾和孟買等印度大城市。此外,共享辦公空間也正在向印度其他二線城市擴張。

印度設施管理產業概況

印度設施管理市場較為分散。主要企業包括索迪斯設施管理服務印度私人有限公司、ISS 設施管理 BVG 印度有限公司、G4S 印度和 Mortice Group PLC (TenonFM)。

2023 年 3 月,索迪斯設施管理服務印度私人有限公司開始為蘭契的 AHPI 附屬醫療保健提供者和診斷中心提供專業知識,對臨床設備進行維修、維護和保養,從而為患者照護。該倉庫設有一個最先進的維修實驗室,用於儲存患者照護必需設備的關鍵備件和配件。

2022年6月,南丹麥大學(SDU)、顧問公司K-Jacobsen、Signal Architects、ISS以及科技公司Ubiquisense和Enabled Robotics推出了跨學科創新計劃「FacilityCobot」。該計劃的目標是開發一種新型移動機器人,將智慧建築感測系統與人機介面相結合,將清潔員工從繁重而重複的任務中解放出來。透過整合上述技術,機器人將能夠與清潔人員一起有效地工作,特別是在辦公室和自助餐廳等開放空間。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素簡介

- 市場促進因素

- 更重視外包非核心活動

- 商業地產領域穩定成長

- 綠色實踐和安全意識

- 市場限制

- 技術純熟勞工短缺和宏觀波動

第6章 市場細分

- 設施管理類型

- 硬體服務

- 軟體服務

- 依行業類型

- 無組織

- 組織

- 按最終用戶

- 商業的

- 工業

- 基礎設施

- 按地區

- 北

- 西方

- 南部

- 東

第7章 競爭格局

- 公司簡介

- Sodexo Facilities Management Services India Private Limited

- BVG India Limited

- ISS Facility Management

- G4S India

- Mortice Group PLC(TenonFM)

- Quess Corporation

- Dusters Total Solutions Limited

- ServiceMax Facility Management Private Limited

- EFS Facilities Services

- Updater Services Private Limited

第8章投資分析

第9章 市場機會與未來趨勢

The India Facility Management Market size is estimated at USD 159.61 billion in 2025, and is expected to reach USD 227.75 billion by 2030, at a CAGR of 7.37% during the forecast period (2025-2030).

FM encompasses all aspects of managing a building, an organization's infrastructure, and the overall coordination of the workplace. This system streamlines processes and standardizes services for an organization.

Key Highlights

- Facility management in India is increasingly gaining popularity due to rapid urban development, the booming construction sector, increasing emphasis on green buildings, and a growing awareness of advantages arising from outsourcing non-core business activities.

- Regarding sophistication and development, India is one of the largest markets for outsourced facility management services. Small local companies focus on single contracts and single-service solutions, while the region's FM business operates with integrated contracts given by significant vendors from different continents. Given the changing dynamics in the region, there are more chances to combine facility management and corporate real estate in novel ways.

- The public sector clients are eager to reduce the number of suppliers and decrease costs. Therefore, bundled service contracts are expected to profit from the budget cuts, keeping with the ongoing efforts of many government agencies to streamline their operations. As the need for total facility management (TFM) grows, public sector firms in the region are progressively outsourcing all "non-core business activities" to a single service provider, allowing them to focus more on their core businesses.

- Moreover, the need for enterprises to evaluate possible cyber risks across their OT environments and take action to strengthen their security posture is more than ever as IT and OT systems continue to converge. Facility managers may offer crucial insider advice in developing and implementing a diligent cybersecurity plan to safeguard critical OT systems as the threat landscape continues to change at an alarming rate.

- The COVID-19 pandemic had a mixed economic impact on FM companies in India. Limiting people's movement resulted in declining project work and activity at several customer locations. The pandemic lockdowns harmed significant companies in the market, including BVG, CBRE Group, and others.

India Facility Management Market Trends

Soft Services to Drive the Market Growth

- The primary categories of soft services are cleaning, recycling, security, pest control, handyman services, grounds maintenance, and waste management. Based on the increasing complexity of projects in Delhi, Hyderabad, and other cities, FM firms have determined that high-level cleaning services represent a growth opportunity for their business.

- Internet of Things (IoT) adoption quickly emerges as a major driver in FM soft services. IoT enables improved decision-making and work process optimization across various industry sectors by providing a continuous, real-time data stream. The demand for outsourcing services is growing, and businesses are emphasizing individualized services with added value, such as risk management that is reliable and efficient and manages local labor laws and HSE.

- Additionally, the consistent rise in commercial real estate in emerging cities like Kolkata is anticipated to offer growth prospects for the incumbents battling challenges like congestion in mature markets. With the impact of regional variables like the development of new branch offices and the outsourcing of soft FM, the demand is predicted to experience a continual rise even though the country's current market penetration is still (relatively) limited.

- The COVID-19 outbreak has sparked changes in how facilities and services are run. The future of organizations will demand careful thought and tailored plans. Therefore the role of FM service providers may also change to one that is more strategic and long-term in character.

North of the Country is Expected to hold Dominant Market Share

- To serve a broad spectrum of customers and increase their market share, the businesses in the area are diversifying their product lines. For instance, Delhi NCR-based MASCOP Facilities Services provides comprehensive facility management services for trouble-free office space maintenance and operation. The company's clientele includes corporate entities, industries, government agencies, manufacturing firms, shopping centers, hotels, institutional settings, guesthouses, hospitals, multiplexes, and substantial office complexes.

- Most newly formed markets are expected to keep an organized structure in light of smart city developments and eliminate the unorganized sectors, making it easy for FM vendors to deploy their services. The IT boom in the country paired it with e-commerce investments, and companies like Shopify, and Amazon, among others, announced overall infrastructural development that drives the demand for FM services.

- For various suppliers, integrated facilities management has streamlined and effectively managed work and tasks. One integrated perspective of all management-related duties and fewer contracts, teams, and resources to manage are the main effects of the approach. IFM delivers better visibility that results in effective management of teams, decreased operating expenses, quicker replies to requests, less downtime for employees, and a stronger focus on the big picture instead of managing each separate stakeholder and each activity multiple times. Using an IFM service provider also makes it much simpler to implement significant modifications across numerous sites and services.

- Coworking spaces have been crucial to India's growing gig economy and startup culture. In recent years, "coworking spaces in India" have grown exponentially. By renting out individual office spaces, these hubs have spared startups and corporations the immense burden of setting up new offices. Large Indian cities like Delhi, Bangalore, and Mumbai are no longer the only ones where there is a demand for coworking spaces. Additionally, it has reached other Tier 2 Indian cities.

India Facility Management Industry Overview

The Indian Facility Management Market is fragmented. The major companies include Sodexo Facilities Management Services India Private Limited, ISS Facility ManagementBVG India Limite, G4S India, and Mortice Group PLC (TenonFM).

In March 2023, Sodexo Facilities Management Services India Private Limited launched its expertise to AHPI-affiliate healthcare providers and diagnostic centers in Ranchi for the repair, maintenance, and upkeep of clinical equipment to enable quality patient care. The warehouse comprises a state-of-the-art repair laboratory housing vital spare parts and accessories for equipment crucial to patient care.

In June 2022, the FacilityCobot interdisciplinary innovation project was a partnership between the University of Southern Denmark (SDU), consulting firm K-Jacobsen, Signal Architects, and ISS, as well as the technology firms Ubiqisense and Enabled Robotics. The project's goal is to create a novel mobile robot that combines a smart building sensing system with a human-robot interface and frees cleaning employees from laborious or repetitive chores. The robot will be able to operate effectively with cleaning personnel with the integration of the aforementioned technologies, particularly in spaces with a lot of open space, like offices and canteens.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Introduction to Market Drivers

- 5.2 Market Drivers

- 5.2.1 Growing Emphasis on Outsourcing of Non-core Operations

- 5.2.2 Steady Growth in Commercial Real Estate Sector

- 5.2.3 Strong Emphasis on Green Practices and Safety Awareness

- 5.3 Market Restraints

- 5.3.1 Skilled Manpower Shortage and Macro Level Fluctuations

6 MARKET SEGMENTATION

- 6.1 By Facility Management Type

- 6.1.1 Hard Services

- 6.1.2 Soft Services

- 6.2 By Sector Type

- 6.2.1 Unorganized

- 6.2.2 Organized

- 6.3 By End-User

- 6.3.1 Commercial

- 6.3.2 Industrial

- 6.3.3 Infrastructure

- 6.4 By Geography

- 6.4.1 North

- 6.4.2 West

- 6.4.3 South

- 6.4.4 East

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Sodexo Facilities Management Services India Private Limited

- 7.1.2 BVG India Limited

- 7.1.3 ISS Facility Management

- 7.1.4 G4S India

- 7.1.5 Mortice Group PLC (TenonFM)

- 7.1.6 Quess Corporation

- 7.1.7 Dusters Total Solutions Limited

- 7.1.8 ServiceMax Facility Management Private Limited

- 7.1.9 EFS Facilities Services

- 7.1.10 Updater Services Private Limited