|

市場調查報告書

商品編碼

1642943

智慧顯示器 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Smart Display - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

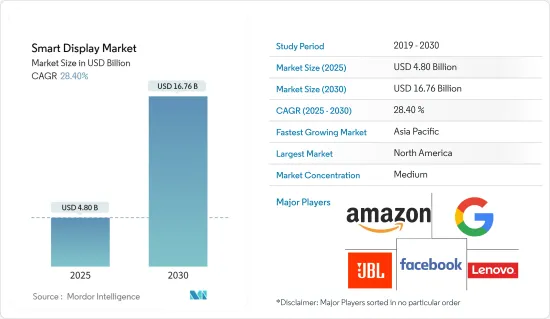

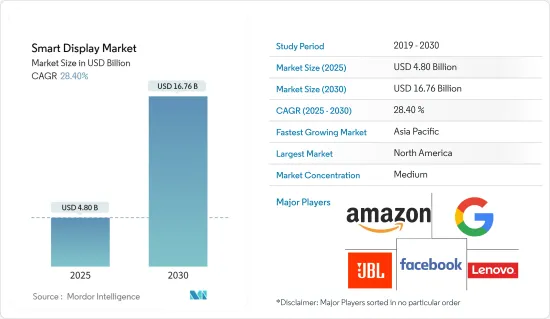

智慧顯示器市場規模在 2025 年估計為 48 億美元,預計到 2030 年將達到 167.6 億美元,預測期內(2025-2030 年)的複合年成長率為 28.4%。

智慧家庭和連網家庭產品的需求快速成長,推動該市場製造商為其產品添加新功能、更高的可靠性和更高的產品利用率。預計該因素將在預測期內推動市場成長。

關鍵亮點

- 智慧家居設備需求增加將推動市場成長 據馬來西亞投資發展局(MIDA)稱,預計未來八年全球整體智慧家居市場規模將達到約4000億美元。此時智慧家居設備銷售量將佔整體家居設備銷售量的40%。

- 此外,據 IBEF 稱,印度正在支持「全民住宅」和「智慧城市使命」等目標。印度政府已為 AMRUT 和智慧城市計畫撥款 1,375 億印度盧比(18.9 億美元)。

- 2022年4月,沃爾瑪宣布與Google建立合作關係。此合作夥伴關係將允許客戶透過手機、揚聲器或智慧顯示器使用 Alexa 語音控制將商品新增至購物車。此類智慧門市的發展可望進一步擴大智慧顯示的市場機會。因此,此類顯示器的用途和適應性不斷擴大,預計將在未來五年內推動市場需求。

- 此外,智慧城市概念在能源、廢棄物和基礎設施領域的物聯網應用中顯示出巨大的前景。根據亞洲開發銀行統計,東南亞國家聯盟(東協)國家約有50%的人口居住在都市區,預計2025年將有7,000萬人成為居住者。因此,東協永續都市化策略引用智慧城市計劃和智慧設備等技術進步作為應對這些都市化挑戰的解決方案。這些發展可能會進一步促進所研究市場的成長。

- 然而,在某些情況下,先進智慧顯示器的高成本和網路安全威脅預計將在預測期內阻礙市場的成長。

- 此外,COVID-19 疫情影響了對語音智慧顯示器的需求,由於消費者在電子產品和其他非必需品上的支出減少,導致銷售下降。此外,製造業因工廠暫時停工、減產而遭受嚴重損失,汽車、電子和半導體產業的成長暫時受到抑制。隨著經濟復甦和市場開始正常運轉,此類顯示器的需求預計將進一步增加。減少市場和公共場所的接觸點的趨勢仍在繼續,預計將為市場擴張提供重大成長機會。

智慧顯示市場趨勢

連網型設備推動市場成長

- 物聯網的普及是推動智慧家庭設備普及的關鍵因素之一,有助於住宅從傳統到智慧的轉變。因此,智慧家庭設備的採用預計將推動智慧家庭顯示器的需求。

- 為了適應市場的成長,參與企業正在不斷擴大其產品供應的地理範圍。例如,2022年6月,三星電子宣布全球推出SmartThings Home Life,為全球消費者提供更全面的智慧家庭體驗。該服務是SmartThings應用程式的新功能,提供對三星家用電子電器產品的集中和整合控制。

- 此外,根據消費科技協會的數據,智慧家庭設備的硬體銷售額預計將在 2022 年成長 3%,達到 238 億美元。隨著能源成本不斷上升,節能家用電子電器為消費者提供了照明、恆溫器和智慧插座等節省成本的解決方案。對智慧家庭設備的需求不斷增加是推動智慧顯示器市場成長的主要因素之一。

- 此外,包括智慧音箱的成功在內的多種因素也推動了智慧家庭設備的普及。各種語音助理的日益普及、人工智慧在多種智慧家庭設備中的應用以及對支援物聯網的智慧設備的需求激增,是預計推動智慧顯示器市場成長的一些因素。

- 此外,2022 年 6 月,聯想在印度推出了內建 Alexa 功能的 Smart Clock Essential,擴大了其創新家居解決方案範圍。聯想智慧時鐘具有創新的數位功能和透過 Alexa 實現的免持語音控制。

亞太地區佔較大市場佔有率

- 亞洲經濟體對各種家用電子電器產品的需求不斷成長,推動了電子和半導體製造業的成長,刺激了智慧顯示器的採用。此外,根據 IBEF 的數據,到 2025 年,消費性電子產業規模預計將達到 1.48 兆印度盧比(211.8 億美元)。

- 這些地區的公司正專注於產品創新和投資,推出產品以在智慧顯示市場中獲得競爭優勢。此外,Wozart Smart Devices 最近推出了智慧安全,提供具有語音控制的安全、節能的智慧家居,可使用手機、平板電腦、揚聲器、電視等透過語音和觸控網路家用電子電器和照明。

- 對技術進步的需求不斷增加等因素正在推動智慧顯示器的採用,從而推動亞太智慧顯示器市場的成長。此外,2022 年 9 月,中國科技巨頭阿里巴巴宣布將投資 10 億美元支持其在中國市場的國際雲端運算客戶和夥伴關係。除了投資之外,該公司還宣布了新產品和服務,作為其更廣泛策略藍圖的一部分。其中包括雲端企業網路2.0,它提供全球智慧網路,支援業務的國際擴張。

- 此外,為了滿足用戶群的需求,百度公司推出了小度智慧顯示器X8,該顯示器專為滿足中國家庭不斷變化的需求而客製化,具有先進的人工智慧互動功能和增強的兒童模式。

- 2022 年 10 月,Google發布了備受期待的 Pixel 7 和 Pixel 7 Pro。新設備配備了第二代 Tensor SoC、改進的攝影機和智慧顯示器。此外,它還配備了許多很酷的機器學習功能。除了Pixel 7系列之外,Google還推出了首款Wear OS智慧型手錶Pixel Watch。此類智慧型設備的發展預計將推動所研究市場的成長。

- 隨著新產品的推出、擴張和投資,該地區有望實現顯著的市場成長。

智慧顯示器產業概況

智慧顯示器市場相對集中,少數大型企業佔據相當大的市場佔有率。智慧顯示器高級功能的需求預計將為市場成長提供機會。這項因素也鼓勵新公司進入市場。每家公司都在透過推出新產品和與其他公司合作來擴大其影響力。主要參與企業包括 Amazon.com, Inc.、Google, LLC 等。有一些進展。

2022 年 5 月 Alphabet Inc. 旗下的 Google 繼續透過添加獨特功能來改進其智慧顯示器。谷歌已將「看與說」功能整合到其 Nest Hub Max 智慧顯示器中。透過與該功能交互,用戶可以看著機上攝影機並啟動麥克風進行訂購,而無需說出關鍵字「Hey Google」。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 智慧家庭設備需求不斷成長

- 市場限制

- 高成本且詞彙量有限

第6章 市場細分

- 按語音助理(智慧顯示器出貨量)(Google、Alexa、其他)

- 按地區(智慧顯示器出貨量)

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章 競爭格局

- 公司簡介

- Amazon.com Inc.

- Google LLC

- Facebook Inc.

- JBL(Harman International)

- Lenovo Group Limited

- Baidu Inc.

- LG Electronics Inc.

第8章投資分析

第9章:市場的未來

The Smart Display Market size is estimated at USD 4.80 billion in 2025, and is expected to reach USD 16.76 billion by 2030, at a CAGR of 28.4% during the forecast period (2025-2030).

The rapidly growing demand for smart and connected home products is encouraging the manufacturers in the market to add new functionality, greater reliability, and higher product utilization to their offerings. This factor is expected to drive the market's growth during the forecast period.

Key Highlights

- The increasing demand for smart home devices drives market growth. According to the Malaysian Investment Development Authority (MIDA), globally, the smart home market is anticipated to reach about USD 400 billion in 8 years. At this point, the sales of smart home devices will account for 40% of the total sales of all household devices.

- Further, according to IBEF, India support ambitions such as 'Housing for All' and 'Smart Cities Mission. The government allocated INR 13,750 crores (USD 1.89 billion) to AMRUT and Smart Cities Mission.

- In April 2022, Walmart announced its collaboration with Google. This partnership will allow customers to add things to their cart utilizing the Alexa voice control through a phone, speaker, or smart display. Such developments in smart stores will extend further opportunities in the smart display market. Therefore, the growing applications and adaptability of such displays will bolster the market demand over the next five years.

- Furthermore, the concept of smart cities has marked a significant prospect with the Internet of Things in the energy, waste, and infrastructure sectors. According to Asian Development Bank, around 50% of the population in the nations making up the Association of Southeast Asian Nations (ASEAN) live in urban areas, and 70 million more are anticipated to become urban dwellers by 2025. Hence, the ASEAN Sustainable Urbanization Strategy identifies technological advances such as smart city projects and Smart devices as a solution to tackle these urbanization challenges. Such developments may further drive the studied market growth.

- However, the high cost of advanced smart displays in some cases and the cybersecurity threat are the factors expected to hinder the market's growth during the forecast period.

- Besides, the Covid-19 pandemic impacted the demand for voice-enabled smart displays and reduced sales, owing to reduced customer spending on electronics and other non-essential goods. In addition, the manufacturing sector noticed severe losses due to temporary plant shutdowns and low production volumes, temporarily hampering the growth of the automotive, electronics & semiconductor sectors. As economies recover and markets start to function normally, the demand for such displays is expected to boost further. The trend towards reducing the touchpoints in the marketplace and public areas is still ongoing, which is anticipated to provide significant growth opportunities for market expansion.

Smart Display Market Trends

Connected Device to Drive the Market Growth

- The increasing adoption of the Internet of Things is one of the significant factors driving the adoption of smart house devices and contributing to the transition of houses (from traditional to smart ones). Thus, adopting smart home devices is expected to fuel the demand for smart home displays.

- Players are increasingly expanding their products geographically, which caters to market growth. For instance, in June 2022, Samsung Electronics announced the global launch of SmartThings Home Life, offering consumers a more holistic smart home experience worldwide. The service is a new addition to the SmartThings app, providing centralized and integrated control over Samsung appliances.

- Further, according to the Consumer Technology Association, Hardware revenue for smart home devices rose by 3% growth in 2022, accounted USD 23.8 billion. As energy costs continue to increase, energy-efficient appliances offer consumers cost-saving solutions for lighting, thermostats, and smart outlets. The increased demand for smart home devices is one of the major factors contributing to the growth of the smart display market.

- Moreover, multiple factors, such as the success of smart speakers, contributed to the increased adoption of smart home gadgets. The increasing availability of various voice assistants, the implementation of AI in multiple smart home devices, and the rapidly growing demand for IoT-enabled smart devices are the factors that are expected to propel the growth of the smart display market.

- Furthermore, in June 2022, Lenovo expanded its innovative home solution range with the launch of its Smart Clock Essential in India, which comes with built-in Alexa functionality. The Lenovo smart clock has innovative digital features and hands-free voice control with Alexa.

Asia Pacific to Hold Significant Market Share

- The rising demand for different consumer electronics in the Asian economy is boosting the growth of electronics and semiconductor manufacturing, stimulating the adoption of smart displays. Further, According to IBEF, the Consumer Electronics industry is expected to reach INR 1.48 lakh crore (USD 21.18 billion) by 2025.

- The companies in these regions focus on product innovation and investment and are launching their products to achieve a competitive advantage in the smart display market. Further, Wozart Smart devices recently launched smart security that offers a voice-controlled, secure, and energy-efficient smart home and enables control of connected appliances and lights through voice and touch using phones, tablets, speakers, televisions, and more.

- Factors such as the rising need for technological advancement broaden the adoption of smart displays, which fuels the smart display market growth in Asia Pacific. Further, in September 2022, Chinese tech giant Alibaba announced to spend a USD 1 billion investment to support its international cloud computing customers and partnerships in the chines market. In addition to the investment, the company also announced new products and services as part of its more extensive strategic roadmap. These include Cloud Enterprise Network 2.0, which provides global intelligent networking to support enterprises' international expansion.

- Moreover, in recognition of its user base, Baidu, Inc. unveiled the Xiaodu Smart Display X8, customized for the evolving needs of China's households with advanced AI-powered interaction capabilities and an enhanced Children's Mode.

- In October 2022, Google launched the highly-anticipated Pixel 7 and Pixel 7 Pro. The new devices pack the second-gen Tensor SoC, improved cameras, and smart displays. In addition, the company comes with a host of cool machine-learning features. Along with the Pixel 7 series, Google established its first Wear OS smartwatch, the Pixel Watch. Such development in smart devices will drive the studied market growth.

- With the launch of the new product, expansion, and investment, the region caters to significant market growth.

Smart Display Industry Overview

The smart display market is relatively concentrated, as some major players hold a substantial market share. The demand for advanced features in smart displays is expected to offer opportunities for market growth. This factor is also encouraging new companies to enter the market. The companies are launching new products and collaborating with other companies to expand their presence. Key players are Amazon.com, Inc, Google, LLC, etc. A few developments are:

In May 2022, the Division of Alphabet Inc., Google continually improves its smart displays by adding unique capabilities. Google integrated a "Look and Talk" feature into the Nest Hub Max smart display. Users can operate this feature to activate the microphone for orders without utilizing the "Hey Google" keyword by looking at the onboard camera.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand of Smart Home Devices

- 5.2 Market Restraints

- 5.2.1 High Cost and Limited Set of Vocabulary

6 MARKET SEGMENTATION

- 6.1 By Voice Assistant (Smart Display Shipments) (Google, Alexa, others)

- 6.2 By Geography (Smart Display Shipments)

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon.com Inc.

- 7.1.2 Google LLC

- 7.1.3 Facebook Inc.

- 7.1.4 JBL ( Harman International)

- 7.1.5 Lenovo Group Limited

- 7.1.6 Baidu Inc.

- 7.1.7 LG Electronics Inc.