|

市場調查報告書

商品編碼

1643008

網版印刷標籤:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Screen Print Label - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

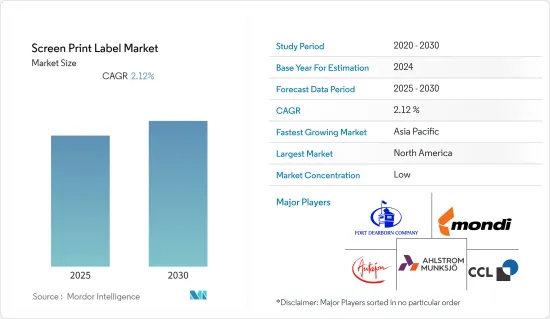

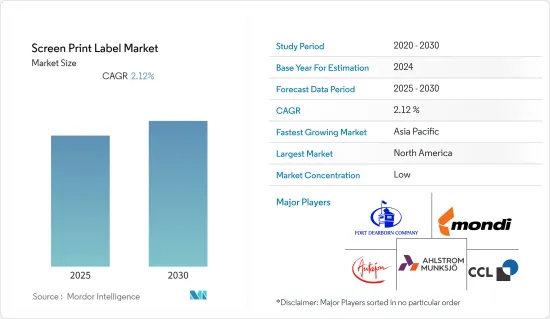

預計預測期內網版印刷標籤市場複合年成長率為 2.12%。

主要亮點

- 它的耐磨性、防潮性和光滑的油墨塗層比其他印刷過程更能推動市場的發展。油墨厚度非常一致,使得此製程非常適合需要耐候(戶外)、防潮、耐磨和耐化學品等特性的應用。這一特性使其非常適合用於飲料標籤。

- 此外,網版印刷相對於所有其他生產印刷製程的最大優勢是可在基材上沉積的油墨量。 UV凸版可印製厚度為2~3.5微米的油墨,UV膠印可印製厚度為1.5~2.5微米的油墨,凹印可印製厚度為2~5微米的油墨,UV柔印可印製厚度為3~8微米的油墨。但UV絲網的墨層厚度一般在4微米至30微米以上。這種油墨厚度使網版印刷油墨比其他標籤印刷製程具有更高的不透明度。

- 此外,矽膠油墨在網版印刷的應用也推動了市場的發展。隨著新型布料不斷湧入市場,油墨供應商也在加緊推出新的和性能增強的產品,以使裝飾者能夠充分發揮他們的技能。矽膠油墨主要以尖端矽膠聚合物為基礎,為現代性能布料提供極致的彈性和手感。這些油墨經過創新設計,將矽膠化學的優點和好處引入印染網印刷作業。未來,對於服裝以外的應用,用於3D熱壓轉印標籤的高密度矽膠油墨的趨勢將備受關注。

- 昂貴的多色印刷解決方案對市場成長是一項挑戰。為了降低成本,適合多色印刷的數位印刷是有效的選擇。此外,由於油墨厚度的原因,小文字的網版印刷可能會很困難,而數位印刷和柔版印刷則非常適合印刷精細的圖像。

- 疫情為印刷標籤企業帶來的兩個最大問題是提高生產效率和遠端客戶服務。疫情初期的持續需求給標籤公司的製造能力帶來了巨大壓力,凸顯了產品生命週期各個階段對自動化的需求。此外,俄羅斯-烏克蘭戰爭也對整個市場產生影響。

網版印刷標籤市場趨勢

時尚服飾佔很大市場佔有率

- 隨著全球服裝市場價值的不斷上升,對網版印刷標籤技術的需求也隨之增加。標籤製造商不斷為服飾標籤提出創新理念、新材料、新飾面和其他設計方法。服飾標籤對於品牌來說非常重要,消費者保護機構也在推行嚴格的服飾護理標籤要求。此外,國際標準化組織 (ISO) 等獨立組織也有標籤要求,想要獲得認證的公司必須遵守。

- 服裝業的網版印刷織物標籤為客自訂的複雜設計提供了卓越的細節。它適合嬰兒服裝、T 恤和女用貼身內衣。本公司採用輪轉印刷和網版印刷技術生產印刷緞面標籤。然而,RFID 和基於織物的標籤已成為市場上的嚴峻挑戰,因為它們可以為行業帶來進一步的優勢,並為未來的機會帶來挑戰。

- 印在棉質床單織物上的標籤的外觀和感覺與棉麻床單相似。這些通常用於較大尺寸的徽標,例如 2.75" x 2.5"。邊緣會因洗滌而磨損,從而呈現出復古的外觀。透過在有機棉上進行網版印刷,可以使用多種顏色創建帶有複雜徽標的標籤。

北美可望引領創新

- 美國的網版印刷標籤製造商發現其大部分需求來自食品、飲料和服裝業。在該地區,國內外各類參與者都在透過技術創新和合作促進市場成長。

- 此外,自訂網版印刷的需求也不斷增加。這種網版印刷過程允許客戶將任何所需的圖形、公司徽標、圖例標示、標籤等直接印刷到成品上。

- 網版印刷可用於在任何尺寸、形狀和厚度的基材上進行印刷。網版印刷允許在基材上施加更厚的油墨,從而產生其他印刷技術通常無法實現的效果,例如點字、閃光、刮擦和凸起字體。這也是影響網版印刷標籤市場成長的關鍵因素。

- 總部位於加州的 Fabri-Tech 提供自訂網版印刷,其印刷功能可實現多種顏色、各種字體或客戶設計所需的任何其他內容。 Fabri-Tech 採用網版標籤印刷方法,可在多種基材上印刷,包括紙張、PET、PC、PMMA、PP、PS、ABS、PU 塑膠、橡膠和各種金屬。

網版印刷標籤產業概況

網版印刷標籤市場由多家大型參與者組成,競爭激烈且本質上分散。此外,參與者正在投資新機器,以透過獨特的增值來佔領市場佔有率。主要企業有 Fort Dearborn Company、Mondi PLC 等。

2022 年 8 月,行銷、包裝、印刷和供應鏈解決方案提供商 RR Donnelley & Sons Company (RRD) 宣布,為直接回應客戶需求,其直接熱感無底紙標籤生產能力已提高一倍約 40%。 RRD 位於威斯康辛州門羅的工廠最近增加了第二台無底紙印刷機,使該公司能夠提供尖端、易於使用的標籤解決方案,滿足不斷成長的生產和永續性需求。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 耐磨、防潮、光滑的油墨塗層

- 採用矽膠油墨進行網版印刷

- 市場限制

- 多色印刷的昂貴解決方案

- 價值鏈分析

- 產業吸引力-波特五力模型

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按類型

- 收縮套筒標籤

- 無底紙標籤

- 濕膠標籤

- 其他類型

- 按最終用戶

- 時尚與服飾

- 食物

- 飲料

- 化妝品和個人護理

- 其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- Fort Dearborn Company

- Mondi PLC

- Ahlstrom-Munksjo Oyj

- Autajon Group

- CCL Industries Inc.

- Coveris Inc.

- Constantia Flexibles Group GmbH

- 3M Company

- Gallus Ferd. Ruesch AG

第7章 市場機會與未來趨勢

The Screen Print Label Market is expected to register a CAGR of 2.12% during the forecast period.

Key Highlights

- Abrasion and moisture-resistant properties and smooth ink coating drive the market over other printing process. The ink film thickness is so appropriate that this process excels in applications where properties such as resistance to weather (outdoors), moisture, abrasion, and chemicals, are needed. This property makes a natural fit for beverage labels.

- Additionally, the single greatest advantage that screen printing has over all other production printing processes is in the volume of ink that can be laid onto a substrate. UV letterpress can deposit ink as thick as 2 to 3.5 microns; UV offset is 1.5 to 2.5 microns; gravure is 2 to 5 microns; and UV flexo can lay down from 3 to 8 microns. However, the UV screen has an ink thickness ranging from 4 to 30 microns and beyond. The thickness of the ink provides screen-printed inks with opaque properties than in other printing process for labeling.

- Moreover, the adoption of screen-printing silicon ink is driving the market. With new fabric availability in the market, ink suppliers are stepping up to the plate to offer new, enhanced products that enable decorators to use their skills fully. Silicone inks are highly based on cutting-edge silicone polymers for delivering the ultimate stretch and feel on the latest performance fabrics. The inks have been innovatively designed, which brings out the strengths and benefits of silicone chemistry to the textile screen printing operation. In the future, the trend will focus on its usage of high-density silicone ink for 3D heating press transfer labels in applications other than apparel.

- Expensive solution for printing with many colors challenges the market growth. The alternative to lower the cost is a digital printing solution, which provides a better option when printing with many colors. Moreover, fine text may be difficult to screen print due to the thickness of the ink, whereas digital or flexographic printing is a good option for fine imagery.

- The two biggest problems the epidemic created for print label companies were productivity growth and remote customer service. The consistent demand throughout the epidemic's early stages put enormous pressure on the manufacturing capacity of the labeling companies, stressing the necessity for automation throughout the different stages of the product life cycle. Furthermore, the Russia-Ukrain war has an impact on the overall market.

Screen Print Label Market Trends

Fashion and Apparels to Hold Significant Market Share

- With the increasing value of the apparel market worldwide, the demand for screen print label technology is increasing. Label manufacturers are continuously thinking of innovative ideas for clothing labels and novel materials, finishes, and other methods of designing. Clothes labeling is considered critical for the brands promoting consumer protection agencies to have stringent apparel care labeling requirements. Additionally, independent organizations such as the International Organization for Standardization (ISO) have their labeling requirements that the companies must follow if they wish to receive certification.

- Screen-printed fabric labels for the apparel industry achieve excellent detail on custom complex designs. It is comfortable for baby clothes, t-shirts, and lingerie apparel. Firms manufacture printed satin labels using rotary printing and screen printing techniques. However, RFID and fabric-based labels have emerged as a serious challenge for the market as they offer additional industry advantages and may create challenges for future opportunities.

- Printed labels on cotton sheet fabric look and feel like a cotton linen sheet. These are typically used for logos with larger sizes, e.g., 2.75" x 2.5". With washing, edges fray to give a vintage appearance. A label with numerous colors and a difficult logo can be achieved with a silkscreen print on organic cotton.

North America is Expected to Drive Technology Innovation

- The screen print label manufacturers in the United States experience most of the demand from the food, beverage, and apparel segments. Various players, locally and globally in the region contribute to the market's growth through innovations, partnerships, etc.

- Furthermore, the demand for custom silkscreen printing is increasing. This silkscreen printing process allows printing any graphics, company logos, legends, or labels the customers would like directly onto their finished products.

- Screen printing enables printing on substrates of any size, shape, and thickness. The greater thickness of the ink that can be applied to the substrate with screen printing, which is generally not possible with other printing techniques, enables the creation of effects like braille, glitter, scratch-offs, and raised text. This is another significant factor influencing the growth of the market for screen-printed labels.

- California-based Fabri-Tech offers custom silkscreen printing where their printing capabilities allow for multiple colors, varying fonts, or anything else that customer requires in design. Fabri-Tech uses its silkscreen label printing methods on various substrates, such as paper, PET, PC, PMMA, PP, PS, ABS and PU plastics, rubber, and different metals.

Screen Print Label Industry Overview

The screen print label market is fragmented in nature, as the market is highly competitive and consists of several major players. Furthermore, players invest in new machinery to gain market share through their unique addition. Key players are Fort Dearborn Company, Mondi PLC, etc.

In August 2022, in direct response to customer demand, R.R. Donnelley & Sons Company (RRD), a marketing, packaging, print, and supply chain solutions provider, said that it had doubled its capacity for direct thermal linerless label production by almost 40%. At its facility in Monroe, Wisconsin, RRD recently added a second linerless press, positioning it to offer a cutting-edge and easily accessible labeling solution that satisfies increased production and sustainability demands.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Abrasion and Moisture Resistant Properties, Along with Smooth Ink Coating

- 4.2.2 Adoption of Screen Printing Silicon Ink

- 4.3 Market Restraints

- 4.3.1 Expensive Solution for Printing with Many Colors

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Shrink Sleeves Label

- 5.1.2 Linerless Label

- 5.1.3 Wet-Glued Label

- 5.1.4 Other Types

- 5.2 End User

- 5.2.1 Fashion and Apparels

- 5.2.2 Food

- 5.2.3 Beverages

- 5.2.4 Cosmetics and Personal Care

- 5.2.5 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Fort Dearborn Company

- 6.1.2 Mondi PLC

- 6.1.3 Ahlstrom-Munksjo Oyj

- 6.1.4 Autajon Group

- 6.1.5 CCL Industries Inc.

- 6.1.6 Coveris Inc.

- 6.1.7 Constantia Flexibles Group GmbH

- 6.1.8 3M Company

- 6.1.9 Gallus Ferd. Ruesch AG