|

市場調查報告書

商品編碼

1639480

印刷標籤:市場佔有率分析、產業趨勢、統計、成長預測(2025-2030)Print Label - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

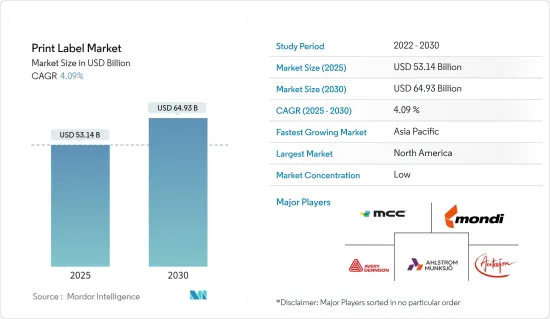

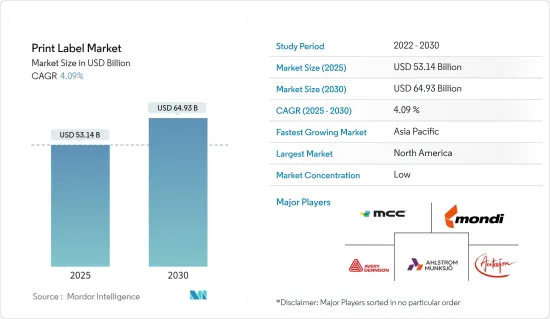

印刷標籤市場規模預計到 2025 年為 531.4 億美元,預計到 2030 年將達到 649.3 億美元,預測期內(2025-2030 年)複合年成長率為 4.09%。

印刷標籤市場對更具吸引力的品牌的需求正在激增。這背後有幾個因素,包括 SKU 增加、產品生命週期縮短以及標籤監管要求增加。此外,隨著製成品需求的成長和可支配收入的增加,印刷標籤市場有望進一步擴大。

包括Nilpeter、Xeikon和Bobst Firenze在內的幾家主要企業聲稱,數位標籤不僅滿足市場需求,而且優於傳統印刷方法。

事實證明,數位技術擅長創造有吸引力的標籤設計,吸引消費者並滿足不同行業的需求。將數位技術與現有印刷方法相結合有望徹底改變各種規模的行業,但嚴格的環境標籤法規是一個挑戰。

標籤挑戰主要是由於溫度和濕度等環境因素造成的,需要小心處理。標籤在乾燥、室溫條件下使用時最為有效,但在極端環境下(尤其是冬季或夏季或冷藏條件下)很難使用。

市場相關人員正在加倍投入銷售和分銷管道。例如,Xecon 位於上海的研發中心滿足中國不斷成長的需求,並提供測試應用程式和開發新收益的平台。同時,達美樂正在加強其數位印刷部門,最近在北美採用該服務就證明了這一點。

此次疫情凸顯了標籤公司面臨的兩大障礙:提高生產力和提供遠端客戶支援。隨著疫情後需求激增,企業面臨產能壓力,凸顯了整個產品生命週期自動化的迫切性。

印刷標籤市場趨勢

食品工業在預測期內將產生大量需求

- 食品業將在未來幾年主導印刷標籤市場。今天的消費者越來越了解食物中的成分。這導致人們更加關注產品標籤上列出的材料,製造商傾向於更突出的品牌。

- 此外,對品質、安全和延長保存期限的包裝食品的需求激增也是推動印刷標籤市場的關鍵因素。印度工商聯合會(FICCI)的資料顯示,由於人均收入增加、都市化和女性工作時間增加等因素,包裝食品的支出正在增加。

- 隨著全球經濟的發展,包括超級市場和便利商店在內的現代零售商店大幅增加。這些商店,尤其是新興市場的商店,擴大儲備冷凍食品。經濟合作暨發展組織(OECD) 強調冷凍食品和包裝食品的受歡迎程度顯著上升。尤其是德國,個人化包裝食品的銷售量顯著成長了 56%。

- Label Insight 和食品行銷研究所的見解顯示,86% 的消費者在購買雜貨時優先考慮透明度。他們對提供全面且易於理解的成分資訊的食品製造商和零售商表示更大的信任。

亞太地區預計將佔據較大佔有率

- 在不斷成長的商業興趣的推動下,中國已成為亞太地區的主導經濟體。隨著人口迅速成長、生活水準提高和人均收入增加,經濟蓬勃發展,該國所有最終用戶行業都在成長。

- 以阿里巴巴為首的電子商務巨頭的崛起將在未來幾年推動中國印刷標籤市場的發展。舉例來說,阿里巴巴雙11購物狂歡期間,中國消費者被約19億個包裹淹沒。

- 尤其是在印度,電子商務的激增正在推動印刷標籤的採用。印度投資局預測,印度電子商務的複合年成長率將達到30%,目標是到2026年商品總價值達到2,000億美元,市場滲透率目標為12%,較目前的2%大幅躍升。

- 澳洲的電子商務場景凸顯了這一趨勢。根據澳洲郵政電子商務產業報告顯示,消費者零售金額3,102.9億美元,與前一年同期比較去年同期成長9.7%。網路購物額與前一年同期比較增57%至504.6億美元,佔社會消費品零售總額的16.3%,反映了消費者購買意願的增強。這是日本明年的目標。

- 去年 3 月,大型標籤公司 Multi-Color Corporation 對 Herrods 的收購引起了波動,這進一步證明了該行業的繁榮。 Herrods 總部位於澳洲墨爾本,專注於套模標籤 (IML) 解決方案,服務於澳洲和紐西蘭市場。 Herrods 已經步入成長軌道,並正在擴大業務以滿足不斷成長的需求。 Multi-Color Corporation 的此舉是一項策略性舉措,旨在利用這項額外產能來增強向該地區新舊客戶提供的服務。

印刷標籤行業概況

印刷標籤市場競爭非常激烈,由幾家大公司組成,例如 Multi-Color Corporation、Mondi Group、Avery Dennison Corporation、Ahlstrom-Munksjo Oyj 和 Autajon Group。市場高度細分。許多公司正在透過新產品推出、策略聯盟和收購來擴大其市場佔有率。

- 2024 年 1 月,艾利丹尼森在 2023 年歐洲標籤展上推出了其創新的 AD LinrSave 技術,標誌著壓敏優質標籤領域變革策略的第一步。

- 2023 年 9 月,特種紙製造商 Sappi 宣布擴大其濕膠標籤紙產品陣容。新增的“Parade Label Pro WS”增強了濕強度和耐鹼性。該產品在奧地利 Sappi 的 Glatkorn 工廠生產。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 數位印刷技術的演變

- 增強新興經濟體的製造業導向

- 市場問題

- 缺乏能夠承受惡劣氣候條件的產品

第6章 市場細分

- 按印刷過程

- 平張膠印

- 凹版印刷

- 柔版印刷

- 螢幕

- 凸版印刷

- 電子攝影

- 噴墨

- 按標籤格式

- 濕膠標籤

- 感壓標籤

- 無底紙標籤

- 多部分追蹤標籤

- 套模標籤

- 收縮和拉伸套

- 按最終用戶產業

- 食物

- 飲料

- 醫療保健

- 化妝品

- 家庭使用

- 工業(汽車、工業化學品、耐用消費品/非耐用消費品)

- 後勤

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 波蘭

- 荷蘭

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Multi-Color Corporation

- Mondi Group

- Avery Dennison Corporation

- Ahlstrom-Munksjo Oyj

- Autajon Group

- Fort Dearborn Company

- CCL Industries

- Multi Packaging Solutions(WestRock Company)

- Clondalkin Group

- Cenveo Corporation

- Brady Corporation

- Fuji Seal International Inc.

- Constantia Flexibles Group GmbH

- RR Donnelley & Sons Company

- 3M Company

- Taylor Corporation

- Huhtamaki OYJ

- Taghleef Industries Inc.

- Ravenwood Packaging

- Sato America

- Coveris

- Fedrigoni Self-Adhesives(Fedrigoni Group)

- ePac Holdings LLC

- Neenah Inc.

第8章投資分析

第9章 市場未來展望

The Print Label Market size is estimated at USD 53.14 billion in 2025, and is expected to reach USD 64.93 billion by 2030, at a CAGR of 4.09% during the forecast period (2025-2030).

The print label market is witnessing a surge in demand for more appealing brands. This is fueled by several factors, such as a rise in SKUs, shorter product life cycles, and heightened regulatory requirements on labels. Additionally, as the demand for manufactured goods grows and disposable incomes rise, the print label market is poised for further expansion.

Several key players, including Nilpeter, Xeikon, and Bobst Firenze, assert that digital labels not only meet market demands but also outperform traditional printing methods.

Digital technology has proven adept at meeting diverse industry needs, crafting appealing label designs that entice consumers. While integrating digital tech with existing printing methods promises to revolutionize sectors of all sizes, stringent environmental labeling regulations pose a challenge.

Label application challenges, largely stemming from environmental factors like temperature and humidity, demand careful handling. Labels fare best when applied in dry, room-temperature conditions, although navigating extremes, especially in winter, summer, or cold storage, can be tricky.

Market players are doubling down on sales and distribution channels. For instance, Xeikon's innovation center in Shanghai caters to China's growing needs, offering a platform for testing applications and exploring new revenue streams. Meanwhile, Domino is bolstering its digital printing arm, which is evident in its recent North American service hires.

The pandemic underscored two major hurdles for label companies, i.e., enhancing productivity and providing remote customer support. As demand surged post-pandemic, companies faced capacity strains, emphasizing the urgency of automation across product life cycles.

Print Label Market Trends

The Food Industry to Create Significant Demand During Forecast Period

- The food industry is poised to dominate the print label market in the coming years. Consumers today exhibit heightened awareness regarding the contents of their food. This has led to a pronounced focus on the materials listed on product labels, prompting manufacturers to lean toward more prominent branding.

- Furthermore, the surging demand for packaged foods, driven by their assurance of quality, safety, and extended shelf life, is a key factor propelling the print label market. Data from the Federation of Indian Chambers of Commerce & Industry (FICCI) highlights that the expenditure on packaged foods is on the rise, attributed to factors like escalating per capita incomes, urbanization, and the increasing working hours for women.

- With the advancement of global economies, there is a notable uptick in the presence of modern retail outlets, including supermarkets and convenience stores. These outlets, particularly in emerging markets, are increasingly stocking a wider array of frozen food products. The Organisation for Economic Co-operation and Development (OECD) underscores a significant rise in the popularity of frozen and packaged foods. Notably, Germany saw a remarkable 56% surge in sales of personalized packaged foods.

- Insights from Label Insight and the Food Marketing Institute revealed that a staggering 86% of shoppers prioritize transparency when grocery shopping. They express a higher level of trust in food manufacturers and retailers who offer comprehensive and easily understandable ingredient information.

Asia-Pacific is Expected to Hold a Major Share

- China, driven by heightened corporate interest, stands as the dominant economy in Asia-Pacific. All end-user industries in the country are witnessing growth, with a rapidly growing economy bolstered by a surging population, rising living standards, and increasing per capita income.

- The ascent of e-commerce powerhouses, exemplified by Alibaba, is poised to propel the print labels market in China over the coming years. As a testament to this, during Alibaba's Double 11 shopping extravaganza, Chinese consumers were inundated with nearly 1.9 billion packages.

- Not to be outdone, the e-commerce surge in India is primed to drive the adoption of print labels. Projections from Invest India suggest that the Indian e-commerce landscape is on track to achieve a 30% CAGR, aiming for a USD 200 billion gross merchandise value by 2026, with a market penetration target of 12%, a significant leap from the current 2%.

- Highlighting the trend, Australia's e-commerce scene saw a notable surge. As per the Australia Post's e-commerce industry report, consumers spent a hefty USD 310.29 billion on retail sales, marking a 9.7% increase from the previous year. Online purchases, reflecting heightened consumer engagement, soared by 57% year-on-year, with a record USD 50.46 billion spent online, constituting 16.3% of total retail sales. This is a milestone the nation is eyeing for the upcoming year.

- Further underlining the industry's vigor, in March of the previous year, Multi-Color Corporation, a leading label entity, made waves with its acquisition of Herrods. Based in Melbourne, Australia, Herrods specializes in in-mold label (IML) solutions, catering to markets in Australia and New Zealand. Herrods was already on a growth trajectory, expanding its operations to meet the escalating demand. Multi-Color Corporation's move was strategic, aiming to leverage this added capacity to enhance service offerings for both new and existing clientele in the region.

Print Label Industry Overview

The print label market is highly competitive and consists of several major players, such as Multi-Color Corporation, Mondi Group, Avery Dennison Corporation, Ahlstrom-Munksjo Oyj, and Autajon Group. The market is highly fragmented. Many companies are increasing their market presence by introducing new products or entering into strategic partnerships or acquisitions.

- January 2024: Avery Dennison debuted its innovative AD LinrSave technology at Labelexpo Europe 2023, marking the initial move in its strategy to revolutionize the pressure-sensitive prime label segment.

- September 2023: Sappi, a specialist paper manufacturer, announced the expansion of its wet-glue label paper range. The new addition, Parade Label Pro WS, boasts enhanced wet strength and alkali resistance. This product is being manufactured at Sappi's Gratkorn facility in Austria.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Evolution of Digital Print Technology

- 5.1.2 Increased Focus toward Manufacturing in the Developing Economies

- 5.2 Market Challenges

- 5.2.1 Lack of Products with Ability to Withstand Harsh Climatic Conditions

6 MARKET SEGMENTATION

- 6.1 By Print Process

- 6.1.1 Offset lithography

- 6.1.2 Gravure

- 6.1.3 Flexography

- 6.1.4 Screen

- 6.1.5 Letterpress

- 6.1.6 Electrophotography

- 6.1.7 Inkjet

- 6.2 By Label Format

- 6.2.1 Wet-glue labels

- 6.2.2 Pressure-sensitive labels

- 6.2.3 Linerless labels

- 6.2.4 Multi-part tracking labels

- 6.2.5 In-mold labels

- 6.2.6 Shrink and Stretch Sleeves

- 6.3 By End-user Industries

- 6.3.1 Food

- 6.3.2 Beverage

- 6.3.3 Healthcare

- 6.3.4 Cosmetics

- 6.3.5 Household

- 6.3.6 Industrial (Automotive, Industrial Chemicals, and Consumer and Non-consumer Durables)

- 6.3.7 Logistics

- 6.3.8 Other End-user Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Spain

- 6.4.2.5 Italy

- 6.4.2.6 Poland

- 6.4.2.7 Netherlands

- 6.4.2.8 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Australia

- 6.4.3.5 South Korea

- 6.4.3.6 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Multi-Color Corporation

- 7.1.2 Mondi Group

- 7.1.3 Avery Dennison Corporation

- 7.1.4 Ahlstrom-Munksjo Oyj

- 7.1.5 Autajon Group

- 7.1.6 Fort Dearborn Company

- 7.1.7 CCL Industries

- 7.1.8 Multi Packaging Solutions (WestRock Company)

- 7.1.9 Clondalkin Group

- 7.1.10 Cenveo Corporation

- 7.1.11 Brady Corporation

- 7.1.12 Fuji Seal International Inc.

- 7.1.13 Constantia Flexibles Group GmbH

- 7.1.14 R.R. Donnelley & Sons Company

- 7.1.15 3M Company

- 7.1.16 Taylor Corporation

- 7.1.17 Huhtamaki OYJ

- 7.1.18 Taghleef Industries Inc.

- 7.1.19 Ravenwood Packaging

- 7.1.20 Sato America

- 7.1.21 Coveris

- 7.1.22 Fedrigoni Self-Adhesives (Fedrigoni Group)

- 7.1.23 ePac Holdings LLC

- 7.1.24 Neenah Inc.