|

市場調查報告書

商品編碼

1643177

歐洲柴油發電機組:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Diesel Generator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

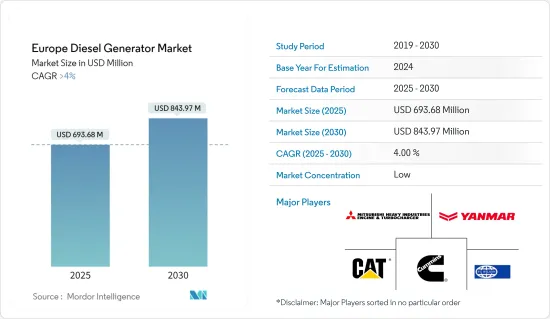

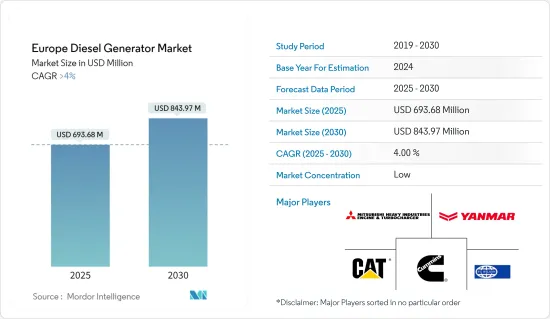

預計 2025 年歐洲柴油發電機市場規模為 6.9368 億美元,到 2030 年將達到 8.4397 億美元,預測期內(2025-2030 年)的複合年成長率將超過 4%。

關鍵亮點

- 從中期來看,備用柴油發電機的需求預計將推動市場發展。這些發電機適用於許多領域,包括工業、建築、醫療和離網應用。

- 由於可再生能源作為替代電源(無論是在併網還是離網)的使用越來越多,未來幾年市場成長可能會放緩。

- 隨著向再生能源來源的轉變不斷進行,歐洲消費者正在尋找高效、環保的選擇,例如結合了太陽能等再生能源來源的混合柴油發電機。預計這將在不久的將來為市場參與企業創造巨大的商機。

歐洲柴油發電機市場趨勢

工業領域預計將主導市場

- 包括採礦業、製造業、農業和建設業在內的工業領域將在未來幾年消耗一半以上的能源。

- 最大的能源使用者是工業部門,包括採礦業、製造業、農業和建設業。這可能會推動對柴油發電機的需求,因為這些產業,尤其是醫療、製藥和製造設施,越來越需要運作、可靠的電力。

- 因此,製藥和製造設施等行業對持續可靠電力供應的需求不斷增加,預計將推動對柴油發電機的需求。在停電期間(以避免停機)以及電網接入有限的地區,工業運作主要依賴柴油發電機產生的電力。

- 截至 2023 年,歐洲是僅次於亞太地區的世界第二大鋼鐵生產國。根據世界鋼鐵協會預測,2023年歐盟鋼鐵產量將達1.263億噸。鋼鐵業是電力消耗大戶,鋼鐵生產需要大量可靠的能源。德國等許多國家仍在其鋼鐵業使用柴油發電機,以支持該國的發展工作。

- 預計未來幾年英國和俄羅斯的工業部門都將成長。這是由於這兩個國家的製造業蓬勃發展,這可能會刺激工業領域對柴油發電機的需求。

- 此外,預計在預測期內,政府(尤其是英國和土耳其)擴大工業部門的措施將推動對柴油發電機的需求。

英國可望主導市場

- 英國是世界上最發達的國家之一,也是歐洲工業化程度最高的國家之一。隨著能源需求的不斷成長,經濟的各個領域也需要不間斷的電力供應。

- 英國電網在尖峰時段需要備用電源。為了滿足這一峰值需求,國家電網輸電公司(NGET)一直使用柴油發電機(DG)組為變電站的冷卻風扇、泵浦和照明等關鍵活動提供備用電源。

- 英格蘭和威爾斯的 250 多個 NGET 站點均使用備用發電機,其中大多數由柴油發電。這些系統為 NGET 在停電時提供恢復能力。

- 生活水準的提高推動了對電力備用設備的需求,國家也從柴油發電機的成本和效益中受益。在英國,發電機廣泛用於農業、通訊和建築等各個領域。

- 近幾個月來,該國的建設活動一直在增加。英國政府預計,2023年新建住宅存量訂單量將達175.5億,較2018年持續增加。預計預測期內建設活動的增加將產生對柴油發電機的需求。

- 英國農業規模龐大,農業覆蓋了英國國土面積的60%以上。隨著國家電網越來越依賴可再生能源,農業產業熱衷於開發備用電源系統。對柴油發電系統的依賴日益增加正在推動市場的發展。

- 超過40%的歐洲資料中心位於英國,消耗大量電力。資料中心使用柴油發電機來滿足停電期間的電力需求。截至 2023 年,英國共有 513 個資料中心運作。

- 預計未來幾年該國將建立更多的資料中心,從而增加對柴油發電機的需求。

歐洲柴油發電機產業概況

歐洲柴油發電機市場適度細分。市場的主要參與企業包括Caterpillar、三菱重工引擎與渦輪增壓器有限公司、FG Wilson Engineering(都柏林)有限公司、康明斯公司和洋馬控股。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2029 年市場規模與需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 備用應用中需要柴油發電機

- 在多個終端用戶行業中的使用日益廣泛

- 限制因素

- 增加使用可再生能源作為替代電力來源

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 容量

- 75kVA以下

- 75 至 350 kVA 或更低

- 350kVA以上

- 最終用戶

- 住宅

- 商業的

- 工業的

- 地區

- 德國

- 俄羅斯

- 英國

- 挪威

- 北歐的

- 法國

- 義大利

- 歐洲其他地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Caterpillar Inc.

- Mitsubishi Heavy Industries Engine & Turbocharger Ltd

- FG Wilson

- Cummins Inc.

- Yanmar Holdings Co. Ltd

- Generac Power Systems

- Kohler Co.

- Doosan Corporation

- 其他知名公司名單

- 市場排名分析

第7章 市場機會與未來趨勢

- 混合柴油發電機的需求不斷增加

簡介目錄

Product Code: 70158

The Europe Diesel Generator Market size is estimated at USD 693.68 million in 2025, and is expected to reach USD 843.97 million by 2030, at a CAGR of greater than 4% during the forecast period (2025-2030).

Key Highlights

- In the medium period, the market is expected to be driven by the need for diesel generators in standby applications. These generators are needed in many fields, including industrial, construction, medical, and off-grid applications.

- The growing use of renewables as an alternative power source, both on-grid and off-grid, is likely to slow the market's growth over the next few years.

- Nevertheless, with the increasing shift toward renewable energy sources, European consumers are looking for efficient and environmentally safe options, such as hybrid diesel generators that incorporate renewable sources like solar. This, in turn, is expected to create significant opportunities for the market players in the near future.

Europe Diesel Generator Market Trends

The Industrial Segment is Expected to Dominate the Market

- The industrial segment, which includes mining, manufacturing, agriculture, and construction, uses more than half of the energy that will be used over the next few years.

- The largest amount of energy is used by the industrial sector, which includes mining, manufacturing, agriculture, and construction. Because of this, the demand for diesel generators is likely to go up as these industries, especially healthcare, pharmaceutical, and manufacturing facilities, need more and more power that is always on and reliable.

- Therefore, the increasing demand for continuous and reliable power supply in industries like pharmaceuticals and manufacturing facilities is expected to escalate the demand for diesel generators. Industrial operations mainly depend on electricity generated from diesel generators during power outages (to avoid operation downtime) and in regions with limited grid access.

- As of 2023, Europe was the second-largest producer of steel in the world after Asia-Pacific. According to the World Steel Association, in 2023, the European Union produced 126.3 million tonnes of steel. The steel industry is a major consumer of power and requires a large amount of reliable energy for steel manufacturing. Many countries like Germany still use diesel generators for the steel industry, which are the backbone of the country's development work.

- In the next few years, both the United Kingdom and Russia are likely to see growth in their industrial sectors. This is because the manufacturing sectors in both countries are growing quickly, which is likely to increase the demand for diesel generators in the industrial sector.

- Furthermore, government initiatives to expand the industrial sector, especially in the United Kingdom and Turkey, are expected to propel the demand for diesel generators during the forecast period.

The United Kingdom is Expected to Dominate the Market

- The United Kingdom is one of the most developed countries in the world and one of the most industrialized countries in Europe. With an ever-increasing demand for energy, various sectors of the economy also need an uninterrupted power supply.

- The United Kingdom's national grid requires a backup power source when there is a peak demand. The National Grid Electricity Transmission (NGET) has been using diesel generators (DG) sets to accommodate this peak demand and provide backup power to substations for key activities such as cooling fans, pumps, and lighting, enabling it to continue to perform its crucial role in the electricity transmission system.

- Backup generators are used at over 250 NGET sites across England and Wales, the majority of which are diesel-powered. These systems provide NGET with the resilience to recover from a loss of power supply event.

- The country benefits from the cost and effectiveness of diesel generators, with improved living standards increasing the demand for power backup devices. Various sectors, such as agriculture, telecommunication, and construction, within the United Kingdom regularly utilize generators.

- Construction activity around the country has been increasing in the past few months. According to the government of the United Kingdom, in 2023, 175.5 orders were placed for new housing public, which has been continuously increasing since 2018. The rise in construction activities is expected to create demand for diesel generators during the forecast period.

- The UK agriculture sector is large and covers more than 60% of the country's total land area. Although the country's power grid is increasingly dependent on renewable sources, the agriculture industry is more interested in the power backup system. It is becoming more dependent on diesel generator systems, which is driving the market.

- More than 40% of the data centers in Europe are present in the United Kingdom and consume a significant amount of power. The data center uses a diesel generator to meet the demand for electricity during a power cut. As of 2023, there were 513 data centers active in the United Kingdom.

- The country is expected to witness more data centers in the coming years, increasing the demand for diesel generators.

Europe Diesel Generator Industry Overview

The European diesel generator market is moderately fragmented. Some of the major players in the market are Caterpillar Inc., Mitsubishi Heavy Industries Engine & Turbocharger Ltd, FG Wilson Engineering (Dublin) Ltd, Cummins Inc., and Yanmar Holdings Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Need for Diesel Generators in Standby Applications

- 4.5.1.2 Increasing Use in Several End-user Industries

- 4.5.2 Restraints

- 4.5.2.1 Growing Use of Renewables as an Alternative Power Source

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Capacity

- 5.1.1 Below 75 kVA

- 5.1.2 75-350 kVA

- 5.1.3 Above 350 kVA

- 5.2 End User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 Russia

- 5.3.3 United Kingdom

- 5.3.4 Norway

- 5.3.5 NORDIC

- 5.3.6 France

- 5.3.7 Italy

- 5.3.8 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Caterpillar Inc.

- 6.3.2 Mitsubishi Heavy Industries Engine & Turbocharger Ltd

- 6.3.3 F G Wilson

- 6.3.4 Cummins Inc.

- 6.3.5 Yanmar Holdings Co. Ltd

- 6.3.6 Generac Power Systems

- 6.3.7 Kohler Co.

- 6.3.8 Doosan Corporation

- 6.4 List of Other Prominent Players

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Hybrid Diesel Generators

02-2729-4219

+886-2-2729-4219