|

市場調查報告書

商品編碼

1651030

柴油發電機 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Diesel Generator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

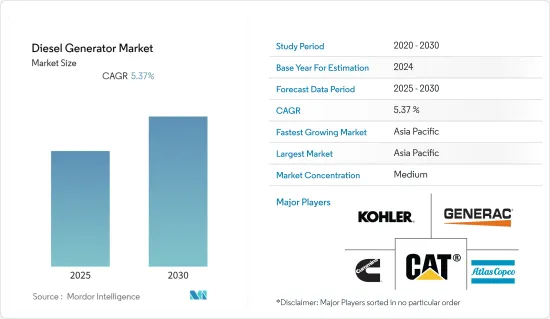

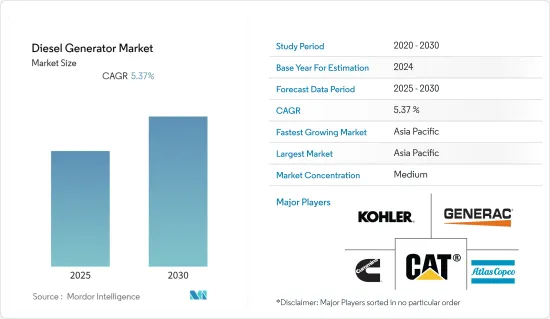

預測期內,柴油發電機市場預計複合年成長率為 5.37%

關鍵亮點

- 從中期來看,對不間斷可靠電力供應的需求不斷增加,以及包括醫療保健產業在內的商業部門的需求不斷成長,預計將推動柴油發電機市場的發展。

- 另一方面,基於天然氣和生質燃料等替代燃料的發電機的需求不斷成長,預計將抑制柴油發電機市場的成長。

- 新興經濟體商業和工業領域、新興經濟體住宅領域以及國防活動對電力的需求日益成長,預計在不久的將來為市場參與企業創造巨大的商機。

- 由於能源需求不斷增加,亞太地區是預測期內成長最快的市場,其中大部分需求來自中國和印度等國家。

柴油發電機市場趨勢

工業領域主導市場

- 工業領域佔據柴油發電機市場的最大佔有率。在停電期間(以避免生產風險)以及電網接入有限的地區,工業運作主要依賴柴油發電機產生的電力。

- 工業部門包括採礦業、製造業、農業和建設業,佔所有終端用戶能源消耗的最大佔有率。因此,這些產業,特別是醫療保健機構、製藥業和製造機構對持續可靠電力供應的需求不斷增加,預計將增加對柴油發電機的需求。

- 許多不同的行業,包括建築業,都需要可靠的電力源。這些行業是備用發電機的大用戶。隨著全球此類細分市場的成長,預計預測期內對備用發電機的需求將進一步增加。

- 由於製造業的激增,預計未來幾年中國和印度的工業將強勁成長,預計將推動工業領域對柴油發電機的需求。

- 從全球鋼鐵產量來看,中國粗鋼產量居世界首位,2022年12月產量較去年與前一年同期比較下降10%至7,790萬噸。印度、日本、美國和俄羅斯則遠遠落後,鋼鐵業是柴油發電機的龐大密集型,因為該產業能源密集度高,其營運在停電期間嚴重依賴柴油發電機產生的電力。

- 此外,預計在預測期內,政府(尤其是中國和印度)擴大工業部門的措施將推動對柴油發電機的需求。

亞太地區佔市場主導地位

- 2022 年,亞太地區在全球柴油發電機市場佔據主導地位,預計在預測期內仍將保持主導地位。

- 由於基礎設施計劃不斷增加、電力供需缺口不斷擴大、全國範圍內製造設施的擴張以及商業辦公空間的增加,中國引領亞太柴油發電機市場。國家正受益於柴油發電機的成本和效益,而生活水準的提高也推動了對電力備用設備的需求。

- 此外,基礎設施、IT 和通訊、資訊技術 (IT) 和 IT 支援服務等各個終端使用領域的快速成長、全國各地現有的製造設施以及中央政府推出的「中國製造」舉措預計將推動該國的柴油發電機市場的發展。

- 印度政府正致力於改善經濟,主要透過增加公路、鐵路和地鐵等基礎建設的支出。隨著新地鐵計劃即將訂定以及印度所有主要城市都在考慮建造地鐵網路,柴油發電機在地鐵計劃中擁有巨大的成長機會。

- 同時,2022 年 2 月,政府空氣品質委員會的一個小組委員會即時解除了德里國家首都轄區對柴油發電機組的禁令。該小組委員會表示,近期空氣品質有所改善,預計還會進一步改善。

- 此外,在印度尼西亞,製造業因停電次數增加而受到嚴重打擊,因此,為了確保持續可靠的電力供應,柴油發電機的引入正在增加。由於南蘇門答臘和雅加達經常停電,因此成為印尼柴油發電機市場成長的主要貢獻者。

- 因此,由於上述因素,預計亞太地區將在預測期內主導全球柴油發電機市場。

柴油發電機產業概況

柴油發電機市場適度細分。市場上的主要企業(不分先後順序)包括Caterpillar公司 (Caterpillar Inc.)、Generac Holdings Inc.、科勒公司 (Kohler Co.)、康明斯公司 (Cummins Inc.) 和阿特拉斯·科普柯公司 (Atlas Copco AB)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2028 年市場規模及需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 不間斷可靠電源的需求不斷增加

- 醫療產業等商業領域的需求增加

- 限制因素

- 對替代燃料發電機的需求不斷增加

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 容量

- 75kVA以下

- 75 至 375 kVA 或更低

- 375kVA以上

- 最終用戶

- 住宅

- 商務用

- 工業的

- 應用

- 備用電源

- 原先的功率

- 抑低尖峰負載電力

- 市場分析:2028 年前各地區市場規模及需求預測(按地區)

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 挪威

- 義大利

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 伊朗

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Atlas Copco AB

- Caterpillar Inc.

- Cummins Inc.

- Doosan Corp.

- Generac Holdings Inc.

- Kirloskar Oil Engines Ltd

- Kohler Co.

- Mitsubishi Heavy Industries Ltd

- Rolls-Royce Holding PLC

第7章 市場機會與未來趨勢

- 商業、工業和國防活動對電力的需求不斷增加

簡介目錄

Product Code: 51767

The Diesel Generator Market is expected to register a CAGR of 5.37% during the forecast period.

Key Highlights

- Over the medium period, the increasing demand for uninterrupted and reliable power supply and increased demand from the commercial sector, including the healthcare industry, is expected to drive the diesel generator market.

- On the other hand, the growing demand for generators based on alternative fuels, such as natural gas and biofuels, is expected to restrain the diesel generator market growth.

- Nevertheless, the commercial and industrial sectors in emerging economies, the residential sector in developed economies, and the increasing need for power in defence operations are expected to create significant opportunities for market participants in the near future.

- Asia-Pacific is the fastest-growing market during the forecast period due to the rising energy demand, with a majority of the demand coming from countries such as China and India.

Diesel Generator Market Trends

The Industrial Sector to Dominate the Market

- The industrial sector accounted for the largest share of the diesel generator market. Industrial operations mainly depend on electricity generated from diesel generators during power outages (to avoid production risks) and in regions with limited grid access.

- The industrial sector, which includes mining, manufacturing, agriculture, and construction, accounts for any end user's largest share of energy consumption. Therefore, the increasing demand for continuous and reliable power supply from these industries, especially healthcare facilities, pharmaceutical industries, and manufacturing facilities, is expected to escalate the demand for diesel generators.

- Many different industries, like the construction industry, require a reliable source of electricity. Such industries make up a large user base for backup generators. With the growth of such sectors globally, the demand for backup generators is expected to increase further during the forecast period.

- China and India are expected to witness robust industrial growth in the coming years because of the sharp increase in the manufacturing sectors, which is expected to drive the demand for diesel generators in the industrial sector.

- According to global steel production, China is the world leader in crude steel production, with 77.9 million metric tonnes produced in December 2022, a 10% decrease from the previous year. India, Japan, the United States, and Russia trail far behind, which makes it a massive market for diesel generators, as the steel industry is extremely energy-intensive, and its operations are highly dependent on power generated from diesel generators during power outages.

- Furthermore, government initiatives to expand the industrial sector, especially in China and India, are expected to propel the demand for diesel generators over the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific dominated the global diesel generator market in 2022 and is expected to continue its dominance during the forecast period.

- China is the leading diesel generator market in the Asia-Pacific region, owing to increasing infrastructure projects, widening power demand-supply gap, expansion of manufacturing facilities across the country, and rising commercial office spaces. The country benefits from the cost and effectiveness of diesel generators, with improved living standards increasing the demand for power backup devices.

- Moreover, the rapid growth in various end-use sectors, such as infrastructure, telecommunication, and information technology (IT) and IT-enabled services, existing manufacturing units across the country, and the dedicated 'Made in China' initiative launched by the Chinese central government, are expected to drive the diesel generator market in the country.

- The Indian government focuses on improving the economy through increased infrastructure spending, mainly on roads, railways, and metro rail. With a new metro rail policy on the anvil and every large city in India looking to construct a metro rail network, diesel generators have immense growth opportunities in metro rail projects.

- On the other hand, in February 2022, A subcommittee of the government's air quality council removed the ban on diesel generator sets in Delhi-NCR today, effective immediately. The panel reported that air quality has improved recently and is anticipated to improve further in the coming days.

- Also, in Indonesia, the increasing power blackouts have significantly hampered the manufacturing sectors, which has increased the adoption of diesel generators in the country to ensure a continuous and reliable power supply. Due to frequent blackouts in these areas, South Sumatra and Jakarta are the key contributing areas for the growth of the diesel generator market in Indonesia.

- Therefore, based on the above-mentioned factors, Asia-Pacific is expected to dominate the global diesel generator market during the forecast period.

Diesel Generator Industry Overview

The diesel generator market is moderately fragmented. Some of the major players in the market (in no particular order) include Caterpillar Inc., Generac Holdings Inc., Kohler Co., Cummins Inc., and Atlas Copco AB, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Increasing Demand for Uninterrupted and Reliable Power Supply

- 4.5.1.2 Increased Demand from the Commercial Sector, Including the Healthcare Industry

- 4.5.2 Restraints

- 4.5.2.1 The Growing Demand for Generators Based on Alternative Fuels

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Capacity

- 5.1.1 Less Than 75 kVA

- 5.1.2 Between 75 and 375 kVA

- 5.1.3 More Than 375 kVA

- 5.2 End User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial

- 5.3 Application

- 5.3.1 Standby Backup Power

- 5.3.2 Prime Power

- 5.3.3 Peak Shaving Power

- 5.4 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2028 (for regions only)})

- 5.4.1 North America

- 5.4.1.1 United States of America

- 5.4.1.2 Canada

- 5.4.1.3 Rest of the North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Norway

- 5.4.2.4 Italy

- 5.4.2.5 France

- 5.4.2.6 Rest of the Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 South Korea

- 5.4.3.4 Rest of the Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of the South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Iran

- 5.4.5.4 Rest of the Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Atlas Copco AB

- 6.3.2 Caterpillar Inc.

- 6.3.3 Cummins Inc.

- 6.3.4 Doosan Corp.

- 6.3.5 Generac Holdings Inc.

- 6.3.6 Kirloskar Oil Engines Ltd

- 6.3.7 Kohler Co.

- 6.3.8 Mitsubishi Heavy Industries Ltd

- 6.3.9 Rolls-Royce Holding PLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Increasing Need For Power in Defence Operations as Well as In Commercial and Industrial Sector

02-2729-4219

+886-2-2729-4219