|

市場調查報告書

商品編碼

1643197

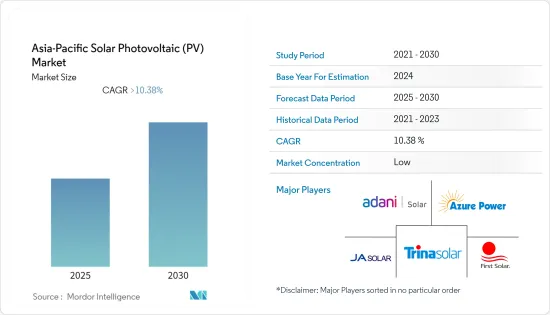

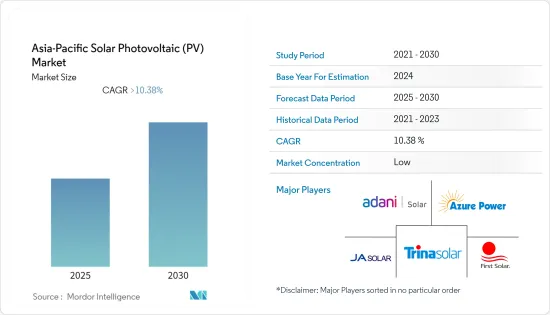

亞太光伏 (PV) -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Asia-Pacific Solar Photovoltaic (PV) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

預計預測期內亞太太陽能光伏 (PV) 市場的複合年成長率將超過 10.38%。

2020 年,市場受到了 COVID-19 的不利影響。目前市場已經恢復到疫情前的水準。

關鍵亮點

- 從長期來看,推動全球太陽能光電市場的主要因素是太陽能光電模組價格的下跌。預計這也將對該地區太陽能光伏(PV)市場的成長產生積極影響。

- 另一方面,高昂的安裝成本和糟糕的維護正在抑制太陽能市場的成長。此外,替代再生能源來源的日益普及也有望阻礙市場成長。

- 商業和工業部門擴大轉向分散式太陽能發電,以獲得各種經濟效益,並將其作為恆定的能源來源,以消除傳統電網電壓波動造成的停機和設備損壞。預計這將在不久的將來為該地區的分散式太陽能發電市場創造巨大的商機。

- 在日益成長的環境問題和國內太陽能發電的經濟效益的推動下,中國預計將主導市場。

亞太地區光電市場趨勢

地面安裝部分佔據市場主導地位

- 地面安裝太陽能電池板是安裝在地面上的太陽能電池陣列。這些系統通常比屋頂安裝更昂貴,但可以最大限度地提高能源產量。 2021年,地面光電市場佔有率達到裝置容量的50%以上。

- 由於規模經濟、大規模安裝以及營運和維護效率,用於商業和公共產業的地面安裝太陽能發電是經濟的。另一方面,屋頂太陽能光電用於1MW以下的小型住宅計劃。

- 大型公共產業計劃中競爭的加劇和技術的進步正在推動安裝成本和營運維護成本的下降。截至 2021 年,亞洲太陽能發電裝置容量已達 484.93 吉瓦,較 2020 年的 409.25 吉瓦成長 18.49%。

- 展望未來,2021 年 12 月,印度新可再生能源部 (MNRE) 邀請各方對併網屋頂太陽能發電計畫第二階段的評估提出意向書 (EOI)。該計劃是國家太陽能計劃 (NSM) 的一部分,旨在到 2022年終安裝 40 吉瓦的併網屋頂太陽能發電系統。

- 2022年1月,信實工業與古吉拉突邦政府簽署協議,在未來10-15年內在古吉拉突邦投資6,030億美元,建立10吉瓦的可再生能源發電發電廠和綠色氫能生態系統。可再生能源發電包括公用事業規模的太陽能發電廠。 RIL 計劃投資 6,000 億印度盧比,為其即將開展的可再生計劃建立太陽能光伏模組、電解槽、電池和燃料電池製造設施。

- 此外,2022 年 9 月,日立阿斯特莫在馬哈拉斯特拉邦的賈爾岡製造工廠建立了印度首座太陽能發電廠。該3兆瓦太陽能發電廠將建於佔地43,301平方公尺的土地上。該地面太陽能發電廠將由 7,128 塊地面太陽能板和 10 台逆變器組成,預計將於 2023 年投入運作。

- 因此,預計預測期內地面安裝太陽能板將主導亞太太陽能市場。

中國主導市場

- 中國是全球最大的太陽能光電市場,2021年累積設置容量佔全球市場的40%以上。截至年終,太陽能光電在中國可再生能源發電結構中的佔有率為 2.82 億千瓦。政府正在推出各種舉措,以在不久的將來增加太陽能的佔有率。

- 截至 2021 年,中國太陽能發電裝置容量達 306.403 吉瓦,較 2020 年安裝的 253.418 吉瓦成長 20.91%。中國也推出了針對太陽能和風能無補貼計劃的新政策。推出這項措施是為了利用建築成本的快速下降來應對付款積壓和計劃堵塞電網的問題。

- 2021年,中國向電網新增太陽能發電裝置容量54.9吉瓦,創歷史新高。根據中國國家能源局的數據,中國發電量與前一年同期比較增加了 14%,佔總發電量的 31%。根據國家能源局統計,截至2021年終,中國太陽能發電裝置容量達3.0656億千瓦,相當於德國全年發電量。

- 此外,2022年6月,協合新能源在中國將一座新的70MW太陽能發電廠併網。該計劃以池塘為基礎,也支持魚蝦養殖。天合光能為裝置提供了 670W 的太陽能板。

- 此外,2022 年 10 月,國家電力投資公司 (SPIC) 宣布已在中國四川省鄭州市附近建造一座試點太陽能發電廠。星川示範太陽能發電廠是國家電投在該地區建設的 600 兆瓦計劃的首座機組,耗資 4.442 億美元。

- 因此,預計預測期內中國將主導亞太太陽能市場。

亞太光伏產業概況

亞太地區太陽能光電市場較為分散。該市場的主要企業(不分先後順序)包括晶澳太陽能控股有限公司、天合光能有限公司、阿達尼綠色能源有限公司、Azure Power Global Limited 和 First Solar Inc.

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 裝置容量及至2027年預測(單位:GW)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 產品類型

- 薄膜

- 多晶

- 矽晶型

- 最終用戶

- 住宅

- 商業的

- 公共產業

- 擴張

- 地面安裝

- 屋頂太陽能

- 地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- JA Solar Holdings Co

- Trina Solar Ltd

- Adani Green Energy Ltd

- Azure Power Global Limited

- First Solar Inc

- ReneSola Ltd.

- Zhejiang Chint Electrics Co Ltd

- Yingli Green Energy Holding Co Ltd

- Hanwha Q CELLS Co. Ltd

- SMA Solar Technology AG

- JinkoSolar Holdings Co. Ltd

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 70219

The Asia-Pacific Solar Photovoltaic Market is expected to register a CAGR of greater than 10.38% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the long term, the major factor driving the global solar PV market is the declining cost of solar PV module prices. This, in turn, is likely to have a positive impact on the growth of the solar photovoltaic (PV) market in the region.

- On the other note, the high installation cost and poor maintenance practices are restraining factors for the growth of the solar photovoltaic market. Moreover, the increasing deployment of alternative renewable energy sources is expected to hinder the market's growth.

- Nevertheless, commercial and industrial sectors are showing a growing interest in distributed solar power generation due to various economic benefits and a constant source of energy to eliminate downtimes and equipment damage due to voltage fluctuations in conventional power grids. This is expected to create a huge opportunity for distributed solar PV market in the region in the near future.

- China is expected to dominate the market over rising environmental concerns and economic benefits of domestic solar power generation.

Asia-Pacific Solar Photovoltaic Market Trends

Ground Mounted Segment to Dominate the Market

- Ground-mounted solar panels are solar arrays that are installed at the ground level. These systems are usually more expensive than rooftop installations but could maximize energy production at a larger level. In 2021, the market share of ground-mounted solar PVs was more than 50% of the total installed solar PV capacity, as they are mainly deployed for commercial and utility purposes.

- Ground-mounted solar for commercial or utility projects is economical due to the economies of scale, large-scale installations, and operation and maintenance efficiencies. On the other hand, rooftop solar is used in small residential projects, less than 1 MW.

- Increasing competition and technical advancements in large-scale utility projects have led to cost reductions in both installation and operation & maintenance prices. As of 2021, Asia has reached 484.93 GW of solar PV installed capacity, which has grown 18.49% more compared to 409.25 GW installed in 2020.

- Going forward, in December 2021, the Indian Ministry of New and Renewable Energy (MNRE) invited applications for the Expression of Interest (EOI) to evaluate Phase II of the Grid Connected Rooftop Solar Program. The program is a part of the National Solar Mission (NSM), which aims at installing 40 GW capacity of grid-connected solar rooftop installation systems by the end of 2022.

- In January 2022, Reliance Industries signed an agreement with the Gujarat government to invest USD 603 billion in Gujarat over 10-15 years to set up 100 GW renewable energy power plants and a green hydrogen ecosystem. Renewable energy power plants include solar power plants at a utility-scale. RIL is expected to invest INR 60,000 crore in setting up manufacturing facilities for solar PV modules, electrolyzers, batteries, and fuel cells for the upcoming renewable projects.

- Moreover, in September 2022, Hitachi Astemo installed India's first solar PV plant at the Jalgaon manufacturing plant in Maharashtra. The 3 MW solar power plant will be built in an area of 43301 sqm. The ground-mounted solar power plant will consist of 7128 ground-mounted solar panels and ten inverters and is expected to get commissioned by 2023.

- Owing to the above points, the ground-mounted segment is expected to dominate the Asia-Pacific Solar Photovoltaic (PV) Market during the forecast period.

China to Dominate the Market

- China is the largest market for solar PV across the globe, with a cumulative installed capacity that accounted for more than 40% of the global market in 2021. The solar power share in China's renewable power generation mix was recorded as 282 million kilowatts at the end of 2021. The government has envisaged various initiatives to increase this share of solar energy in the near future.

- As of 2021, China recorded a solar PV capacity of 306.403 GW, which has grown 20.91% higher than the 253.418 GW installed in 2020. Also, China revealed new solar and wind policies for subsidy-free projects. The policy was introduced to take advantage of a rapid fall in construction costs and to resolve payment backlog issues and grid logjam projects.

- In the year 2021, the country hit a breaking record of solar power capacity with 54.9 gigawatts to its grid. According to China's energy authority (CEA), the country managed to increase its capacity by 14 per cent compared to the capacity made by the previous year while gaining 31 percent of its total capacity additions over the year. By the end of the year 2021, China obtained a total solar capacity of 306.56 GW, which can cover the power generation of Germany, based on the National Energy Administration.

- Moreover, in June 2022, Concord New Energy connected a new 70 MW solar plant to the grid in China. The project, which is situated on a pond, also supports fish and shrimp aquaculture. Trina Solar supplied 670 W solar panels for the installation.

- Furthermore, in October 2022, State Power Investment Corp. (SPIC) announced that it had completed the pilot solar power plant near the town of Zhengdou in China's Sichuan province. The Xingchuan Demonstration Photovoltaic Power Station is the first unit of a 600 MW project that SPIC is building in the area at a planned cost of USD 444.2 million.

- Owing to the above points, China is expected to dominate the Asia-Pacific Solar Photovoltaic (PV) market during the forecast period.

Asia-Pacific Solar Photovoltaic Industry Overview

The Asia-Pacific Solar Photovoltaic (PV) Market is fragmented. Some of the key players in this market (not in a particular order) include JA Solar Holdings Co., Trina Solar Ltd, Adani Green Energy Ltd., Azure Power Global Limited, and First Solar Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Solar PV Installed Capacity and Forecast in GW, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Thin Film

- 5.1.2 Multicrystalline Silicon

- 5.1.3 Monocrystalline Silicon

- 5.2 End-User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Utility

- 5.3 Deployment

- 5.3.1 Ground Mounted

- 5.3.2 Rooftop Solar

- 5.4 Geography

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 South Korea

- 5.4.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 JA Solar Holdings Co

- 6.3.2 Trina Solar Ltd

- 6.3.3 Adani Green Energy Ltd

- 6.3.4 Azure Power Global Limited

- 6.3.5 First Solar Inc

- 6.3.6 ReneSola Ltd.

- 6.3.7 Zhejiang Chint Electrics Co Ltd

- 6.3.8 Yingli Green Energy Holding Co Ltd

- 6.3.9 Hanwha Q CELLS Co. Ltd

- 6.3.10 SMA Solar Technology AG

- 6.3.11 JinkoSolar Holdings Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219