|

市場調查報告書

商品編碼

1644293

地理行銷:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Geomarketing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

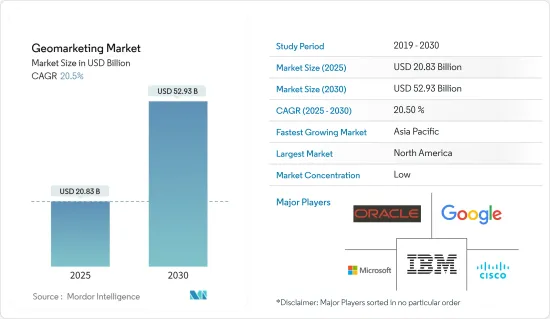

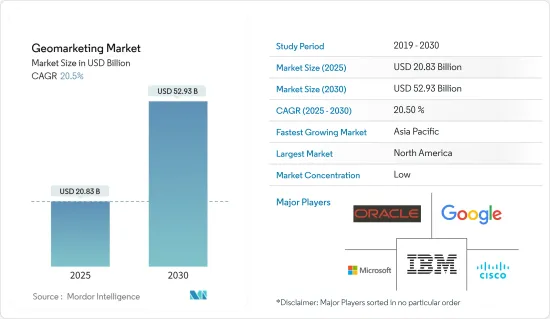

地理行銷市場規模預計在 2025 年將達到 208.3 億美元,預計到 2030 年將達到 529.3 億美元,預測期內(2025-2030 年)的複合年成長率為 20.5%。

越來越多的企業採用數位地圖,基於位置的分析技術不斷進步,以及對大量業務資料進行分析以獲得空間參考見解以便在正確的時間向正確的消費者提供正確的產品的需求不斷增加,這些都是推動地理行銷市場發展的主要因素,可以使公司的收益猛增。

關鍵亮點

- 跨國公司擴大在不同地理位置建立分支機構,這些公司擁有不同的文化、人口統計、食物和語言偏好,這迫使企業選擇地理行銷軟體,該軟體為他們提供一組資料和訊息,可用於識別潛在客戶並透過行銷策略將其轉化為實際客戶。地理行銷描述了它如何解決通訊服務供應商面臨的挑戰。

- 推動地理行銷市場發展的因素是對先進數位行銷技術的需求不斷增加、巨量資料平台的採用以及商業智慧解決方案的不斷創新。隨著先進技術(物聯網、進階分析、邊緣運算、區塊鏈)的採用,設備的互聯程度越來越高。隨著數位轉型的興起,企業開始從傳統工具轉向結合目標客戶智慧定位的數位行銷工具。

- 例如,丹麥家居裝飾零售商 Danisches Bettenlager 目前正在使用 WIGeoGIS 地理行銷解決方案來規劃和最佳化其宣傳冊廣告。新的最佳化銷售結構也旨在減少銷售經理的每日行程時間。

- 定位服務是利用設備地理位置向使用者提供資訊的解決方案。基於位置的智慧解決方案提供的眾多好處,包括商店搜尋、近距離行銷、即時資訊、天氣預報、行動勞動力管理、路邊援助、交通資訊、詐騙預防等,使得這項技術對組織越來越重要且不可或缺。農業、物流、汽車等領域 GPS 精準應用的興起,推動了對定位解決方案的需求,以提高企業收益

- 許多國家缺乏統一的監管標準,引發了人們對客戶資料隱私的擔憂。此外,由於應用程式和網路面臨惡意程式碼和拒絕服務等持續的安全威脅,安全性問題可能會導致資料遺失或洩漏,這可能會阻礙未來的市場成長。

- 新冠疫情導致銷售大量從實體店轉向數位商店,進而導致各消費者群體大規模使用資料。在全球出現恐慌性搶購和居家隔離措施的背景下,各公司不斷投資和改進技術以吸引顧客。此外,透過採用數位媒體的廣告和行銷策略,公司為客戶提供了所有必要的基礎設施和技術支持,從而減少了生產力的下降。這些因素促使企業採用更多的地理行銷解決方案,進而促進市場的成長。數位地理行銷技術和先進的行銷分析工具的快速採用正在推動後疫情時代的市場成長。

地理行銷市場趨勢

服務部件市場預計將佔據主要市場佔有率

- 智慧型手機、智慧型穿戴裝置、筆記型電腦、無線連接、物聯網和雲端運算等智慧型裝置的技術進步正在推動流量並增加對分析服務的需求,因為它們能夠分析和提供即時資料。

- 根據思科系統公司預測,到 2023 年全球行動用戶數量將成長到 57 億。 2018-2023年整個期間的年平均成長率為2%。數位化的興起推動了定位服務的需求,這些服務有可能提供量身定做的行銷策略服務,為採用此類服務的服務供應商創造新的成長機會。

- 此外,品牌越來越依賴定位服務提供者來衡量客戶要求,確定客戶需求,並確保他們提供的服務處於同一水平,以保持領先於競爭對手,從而推動了市場成長。公司還利用定位技術、進階分析和自動化來創造高度個人化的客戶體驗,建立品牌忠誠度並減少因持續競爭而導致的解約率。

- 此外,定位服務正在引起各個行業的廣泛關注,包括政府部門、通訊、交通和零售。定位服務使得根據客戶的生活方式和接近性提供促銷服務成為可能。

- 例如,美國叫車服務公司 Uber 透過智慧型手機使用顧客和司機的位置資訊。基於位置的功能可協助公司改善其服務,包括取貨、導航、客戶支援和促銷服務。這樣,預計未來許多公司將透過定位服務獲得寶貴的見解並引領市場。

預計北美將佔據較大的市場佔有率

- 預計北美將在預測期內佔據研究市場的主導地位,這主要歸因於 IT 支出的增加、對創新和先進技術的接受度以及該地區許多重要的市場供應商。此外,物聯網技術的高採用率對該地區市場的成長做出了巨大貢獻。預計美國將主導北美各國市場。

- 最新的 5G 智慧型手機具有較高的資料速度和定位精度,很可能成為推動地理行銷需求的主要因素。地理行銷有望成長,因為它使企業能夠透過即時發送客製化通知和廣告來瞄準個人客戶。

- 該地區是 IBM、Oracle 和 Microsoft 等多家主要企業的所在地,對地理行銷軟體工具開發的投資正在增加,這些工具利用位置資訊幫助公司開展行銷宣傳活動和策略,從而推動了地理行銷的需求。它還幫助最終用戶企業組織和查看資料,並使用數位地圖按特定實體位置分析資料。例如,CAPcargo 使用 PTV xServers 的開發元件實現地理、物流和行銷功能。路線可以在地圖上直覺顯示,並且可以計算距離、駕駛時間和通行費。

- 此外,技術、法規和客戶期望的變化正在改變金融服務,迫使金融機構提供更靈活和開放的服務,同時保持嚴格的安全和資料隱私。根據思科系統公司預測,2023年終,北美行動用戶數量將達3.29億。該地區約有 88% 的人口擁有智慧型手機,金融機構透過向客戶提供基於位置的客製化產品和服務,將獲得巨大的利益,促使許多 BFSI 組織與 IT 供應商進行合作。

- 例如,萬事達卡與軟體公司 Carto 合作開發了一套地圖解決方案—萬事達卡零售位置洞察 (Mastercard Retail Location Insights)。該解決方案是一個多部門且高度靈活的解決方案,可以分析關鍵變量,以便做出與評估對業務成功至關重要的領土、財產和其他地理位置相關的準確決策。

地理行銷產業概覽

地理行銷市場高度細分,主要參與者包括微軟公司、IBM 公司、甲骨文公司、Google有限責任公司和思科系統公司。該市場的參與企業正在採用合作、創新和收購等策略來增強其服務產品並獲得永續的競爭優勢。

2023年8月,IBM宣布將啟動有史以來首次廣告宣傳,正式推出公司下一代企業人工智慧資料平台Watsonx。全球商業領袖仍不清楚人工智慧的真正變革力量以及如何利用它。此次宣傳活動旨在將 Watsonx 定義並區分為一種力量倍增器,能夠為尋求以新穎和創新的方式應用 AI 解決方案的全球商業領袖加速產生影響。

2022 年 10 月,Microsoft Advertising 在 Google Import 中推出了一項解決方案,使得在利用 Google AdWords Performance Max宣傳活動時更輕鬆地跨平台複製工作。該功能現已正式推出,用戶可以將他們的 Performance Max宣傳活動作為智慧購物宣傳活動和本地庫存廣告匯入 Microsoft。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 行銷領域擴大採用新技術

- 對基於位置的智慧的需求不斷增加,以提高業務收益

- 市場限制

- 企業中日益成長的安全和隱私問題

第6章 市場細分

- 按組件

- 軟體

- 按服務

- 按部署

- 雲

- 本地

- 按位置

- 室內的

- 戶外的

- 按最終用戶產業

- BFSI

- 資訊科技/通訊

- 零售與電子商務

- 媒體娛樂

- 旅遊與飯店

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Microsoft Corporation

- IBM Corporation

- Oracle Corporation

- Google LLC

- Cisco Systems, Inc.

- Adobe Systems Inc.

- Xtremepush Limited

- Ericsson Inc.

- ESRI Business Information Solutions Inc

- Software AG

- Qualcomm Inc.

第8章投資分析

第9章 市場機會與未來趨勢

The Geomarketing Market size is estimated at USD 20.83 billion in 2025, and is expected to reach USD 52.93 billion by 2030, at a CAGR of 20.5% during the forecast period (2025-2030).

Increasing adoption of digital mapping by many businesses, technological advancement in location-based analytics, and the increasing need to analyze the considerable business data to draw spatial reference insights to supply the right product to the right consumer at the right time can surge a company's revenue are some of the primary factors boosting geomarketing market.

Key Highlights

- Increasing establishments of multinational companies in different geographical locations with various cultural, demographic, food, and linguistics preference have forced companies to opt for geomarketing software that would provide a series of data and information that can be employed to identify and convert potential customers to actual customers through marketing strategy. Geomarketing provides a way to meet the challenges faced by communication service providers.

- The factors driving the geomarketing market are the increased demand for advanced digital marketing technologies, the adoption of big data platforms, and ongoing innovation in business intelligence solutions. Adopting advanced technologies (IoT, advanced analytics, edge computing, and blockchain) has increased device connectivity. With the rise in digital transformations, organizations have started moving toward digital marketing tools by incorporating the location intelligence of the target customers rather than traditional tools, as these offer more affordability and customer engagement.

- For instance, Danisches Bettenlager, a Denmark-based home decor retailer, is currently utilizing the geomarketing solution of WIGeoGIS for planning and optimizing brochure advertising. It also aims to reduce the daily traveling time of sales managers through a new and optimized sales structure.

- Location-based intelligence services are a solution that utilizes the device's geographical location to provide information to the user. The technology has gained considerable significance and is becoming an integral part of organizations due to the numerous benefits offered by location-based Intelligence solutions, including store locators, proximity-based marketing, real-time information, weather reports, mobile workforce management, roadside assistance, traffic updates, and fraud prevention. The rise in GPS-enabled precision applications, such as farming, logistics, and automotive, has created a high demand for location-based solutions to enhance business revenue.

- Many countries' lack of uniform regulatory standards has raised customer data privacy concerns. Further, security concerns as applications and networks are under persistent security threats such as malicious code and service denial can lead to data loss and leakage, hampering the market's growth in the future.

- The outbreak of COVID-19 led to the large-scale transfer of sales from physical stores to digital stores, leading to large-scale data usage by consumers of various sectors. Organizations were keeping up with their technology enhancement and investment to engage customers in times of panic buying and stay-at-home guidelines at the global level. Organizations also reduced productivity declines, with businesses providing all the essential infrastructure and technology support to their customers by adopting advertising and marketing strategies through digital media. Such factors have led organizations to adopt more geomarketing solutions, leading to market growth. With the rapid adoption of digital geomarketing technology, advanced marketing analytics tools drive market growth in the post-pandemic scenario.

Geo Marketing Market Trends

Services Components Segment is Expected to Hold Significant Market Share

- Technological advancement in smart devices such as smartphones, smart wearables, laptops, wireless connectivity, the Internet of Things, and cloud computing has increased the traffic and driven the demand for analytical services due to their ability to analyze and deliver real-time geo-data.

- According to Cisco Systems, the number of mobile subscriptions globally will grow to 5.7 billion by 2023. The compound annual growth rate is 2% for the whole period from 2018 to 2023. Advancements in digitization fuel the need for location-based services owing to their potential to deliver tailored marketing strategy services, resulting in new growth opportunities for service providers adopting such services.

- Moreover, increasing brand dependence on location-based service providers to determine customers' requirements and verify customers' needs and that their offerings are on the same level to remain one step ahead of competitors has driven the market's growth. Companies also utilize location-based technology, advanced analytics, and automation to create a highly personalized customer experience and build brand loyalty to reduce churn rates due to ongoing competition.

- Furthermore, location-based services have gained significant attention across various industrial sectors such as government authorities, telecommunications, transportation, and retailers. They have empowered players to offer promotional services based on customers' lifestyles and proximity.

- For instance, Uber, an American ride-hailing company offering services, works on customers' and drivers' location information through smartphones. Location features help the company to improve its services, including pickups, navigation, customer support, and promotional services. Thus, it is expected that many businesses will gain good insights through location-based services and drive the market in the future.

North America is Expected to Hold Significant Market Share

- North America is expected to dominate the market studied over the forecast period, mainly due to the increasing IT spending, acceptance of innovative and advanced technologies, and many significant market vendors in the region. Moreover, the high adoption of IoT technologies significantly contributes to the regional market's growth. The US is expected to be the dominating country-level Market in North America.

- The latest 5G-enabled smartphones with high-speed data and location accuracy are likely to be the major factors fueling the demand for geomarketing. It is anticipated to grow as it allows businesses to target individual clients by customizing and distributing notifications and advertisements in real-time.

- An increase in Investments to develop geomarketing software tools that use location-based information to help companies devise their marketing campaigns and strategies helps drive the demand for the geomarketing market in this region as many prominent players, such as IBM, Oracle, Microsoft, etc., are present. It also helps end-user organizations organize and display data and use digital mapping to analyze this data by a particular physical location. For Instance, CAPcargo uses the PTV xServers developer components for geographical, logistical, and marketing functions. Routes can be visualized on geographic maps, and distance and driving times or toll costs can be calculated.

- Moreover, changing technology, regulations, and customer expectations are transforming financial services pushing financial institutions to be more agile and open while maintaining tight security and data privacy. According to Cisco Systems, By the end of 2023, North America will have 329 million mobile users. Around 88% of the regional population own a smartphone, so financial institutions have vast opportunities to capitalize by delivering products and services tailored to customers based on location, leading to the collaboration of many BFSI organizations with IT providers.

- For instance, Mastercard collaborated with Carto, a software company, to develop packaged mapping solution, Mastercard Retail Location Insights, which is a multi-sectoral and very flexible solution that allows the analysis of critical variables for accurate decision-making related to the assessment of territories, properties and other aspects of geolocation, which are essential for business success.

Geo Marketing Industry Overview

The geomarketing market is highly fragmented, with the presence of major players like Microsoft Corporation, IBM Corporation, Oracle Corporation, Google LLC, and Cisco Systems Inc. Players in the market are adopting strategies such as partnerships, innovations, and acquisitions to enhance their service offerings and gain sustainable competitive advantage.

In August 2023, IBM announced launching the first ad campaign to formally introduce Watsonx, the company's next-generation enterprise-focused artificial intelligence and data platform. Global business leaders remain unclear about AI's real, transformative power and how to leverage it. The campaign is designed to define and differentiate Watsonx as a force multiplier that can accelerate impact for global business leaders as they look to apply AI solutions in new and innovative ways.

In October 2022, Microsoft Advertising introduced a solution within Google Import to make it easier to duplicate efforts across platforms when utilizing Google AdWords' Performance Max campaigns. This is now generally accessible and lets users import their Performance Max campaigns into Microsoft as Smart Shopping Campaigns and Local Inventory Advertising.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Emerging Technologies in Marketing Sector

- 5.1.2 Increasing Demand for Location-Based Intelligence to Enhance the Business Revenue

- 5.2 Market Restraints

- 5.2.1 Increasing Security and Privacy Concerns Among Enterprises

6 MARKET SEGMENTATION

- 6.1 By Components

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By Deployment

- 6.2.1 Cloud

- 6.2.2 On-Premise

- 6.3 By Location

- 6.3.1 Indoor

- 6.3.2 Outdoor

- 6.4 By End-User Industry

- 6.4.1 BFSI

- 6.4.2 IT and Telecommunications

- 6.4.3 Retail and E-commerce

- 6.4.4 Media and Entertainment

- 6.4.5 Travel and Hospitality

- 6.4.6 Other End-user Industries

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Microsoft Corporation

- 7.1.2 IBM Corporation

- 7.1.3 Oracle Corporation

- 7.1.4 Google LLC

- 7.1.5 Cisco Systems, Inc.

- 7.1.6 Adobe Systems Inc.

- 7.1.7 Xtremepush Limited

- 7.1.8 Ericsson Inc.

- 7.1.9 ESRI Business Information Solutions Inc

- 7.1.10 Software AG

- 7.1.11 Qualcomm Inc.