|

市場調查報告書

商品編碼

1644390

電信營運管理-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Telecom Operations Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

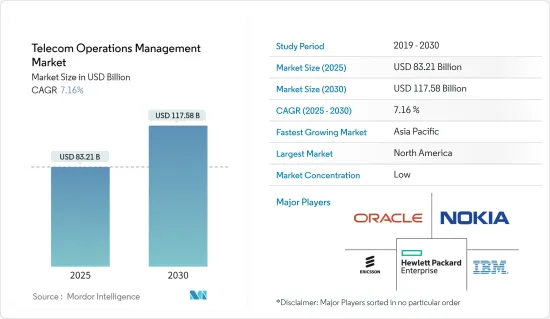

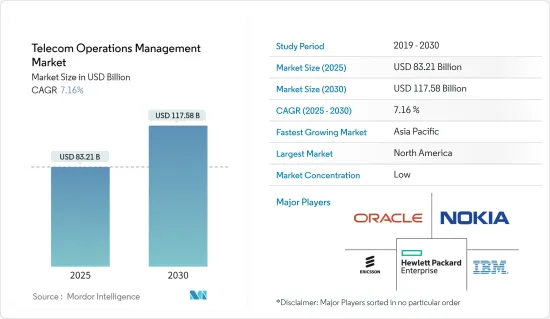

預計 2025 年電信營運管理市場規模為 832.1 億美元,到 2030 年將達到 1,175.8 億美元,預測期內(2025-2030 年)的複合年成長率為 7.16%。

由於數百萬員工和學生待在家中,COVID-19 疫情的爆發應確保電信業者做好充分準備來應對業務,因為其網路頻寬需求將增加 30% 至 40%。據 FieceTelecom 稱,冠狀病毒疫情正在促使各種規模的企業加快其數位轉型計畫。那些已經致力於數位轉型並採用雲端策略的公司能夠更好地度過疫情爆發的最初幾週。 Verizon Business 調查結果強調了幾個要點,其中包括 43% 的受訪者計劃透過數位和相關技術擴展業務。 30% 的企業已經增加了以數位化方式交付產品或服務的新方式。

關鍵亮點

- 通訊業是數位轉型的關鍵驅動力之一,同時也是全球數位化的推動力,該產業的市場環境正在發生重大變化。

- 通訊產業在互通性和技術方面的投資正在加強全球經濟中資本流動和資訊的模式轉移,同時為跨產業全新經營模式的出現提供了基礎。隨著頻寬需求的飆升和行動網路用戶的增加,通訊服務供應商正在不斷發展以提供先進和創新的解決方案。

- 此外,傳統網路加上 5G 網路日益成長的基礎設施要求,形成了一個複雜的環境,對通訊服務供應商(CSP) 提出了挑戰。因此,在通訊採用技術先進的營運支援系統的需求日益增加。

- 對低成本資料和語音服務的不斷成長的需求正在推動市場成長。這導致了服務供應商的崛起,他們以批發價從 MNO 購買網路服務,然後以低於 MNO 服務的價格將其作為配套服務出售。

- 大多數企業組織都在採用多供應商、多重雲端配置,導致網路架構日益複雜,這也促進了市場的擴張。此外,由於這些企業希望以有限的資源滿足需求並簡化變更流程,因此他們需要更靈活、更具適應性的網路架構。

- 此外,預測期內雲端、機器對機器 (M2M) 交易和行動貨幣等服務的興起預計將進一步推動對通訊營運管理的需求。

- 此外,隨著企業行動化程度越來越高,並採用 BYOD 等新概念來改善員工互動和易用性,提供快速、高品質的網路至關重要。企業正在積極採用 BYOD,這將推動預測期內的市場成長。

通訊營運管理市場趨勢

雲端運算可望強勁成長

- 世界各地的通訊業者正在踏上以雲端為中心的轉型之旅,以推動新服務、商機和體驗。通訊業者可以透過將我們的雲端原生、開放和模組化解決方案與完全託管的高效能雲端平台結合來加速他們的進程。雲端提供者正重點關注幾個戰略區域來支援通訊業者。這包括幫助電信業者將 5G 作為商業服務平台收益、透過資料主導的體驗增強客戶參與度、以及幫助提高核心通訊系統的營運效率。

- 2021年10月,戴爾科技宣布推出新的通訊軟體、解決方案和服務,幫助通訊服務供應商(CSP)加速部署開放、雲端原生網路並創造新的商機。 Open RAN(ORAN)等新技術為 CSP 提供了更多部署網路基礎架構的選擇,以支援其未來發展。

- 谷歌宣布與 Amdocs 建立合作夥伴關係,使通訊服務供應商能夠在 Google Cloud 上運行 Amdocs 市場領先的產品組合,為其企業客戶提供新的資料分析、站點可靠性工程和 5G 邊緣解決方案。 Amdocs 宣布,Altice USA 已在 Google Cloud 上運作Amdocs 的資料和智慧系統,這是 Amdocs 和 Google Cloud 聯合上市舉措的一部分。此外,透過與 Netcracker 建立新的夥伴關係關係,該公司可以在 Google Cloud 上部署其整個數位 BSS/OSS 和編配堆疊。服務供應商現在可以根據需要擴展和購買關鍵任務 IT 應用程式、存取無限的 Google Cloud 資源、降低擁有成本並加快新服務的可用性。

- 2021年6月,AT&T與微軟合作,將其5G行動核心網路遷移到Microsoft Azure的混合雲端。微軟正在收購 AT&T 的網路雲端平台技術,該技術為 AT&T 的 5G 核心提供支援。該公司還將收購 AT&T 的工程和生命週期管理軟體,用於運行容器化或虛擬網路服務。

- 此外,ZENIC ONE(UME)系統首次將人工智慧與巨量資料融合,透過工具和應用程式增加管理和控制。因此,透過即時擷取設備上報的營運相關訊息,結合AI智慧巨量資料分析,可以監控網路的運作狀態,快速辨識問題、恢復業務,大大提高維運效率。預計此類案例將成為市場成長的強勁推動力。

- 愛立信預計,2021年全球智慧型手機用戶數將超過60億,未來幾年將成長數億。預計預測期內用戶數量的增加將推動市場成長。此外,「數位印度」計畫等舉措有望推動通訊業雲端平台和雲端基礎的模型的整合,這將成為市場成長的驅動力。

預計北美將佔很大佔有率

- 由於對業務營運解決方案的支出較高,北美預計將佔據通訊業務營運管理市場的大部分佔有率。此外,隨著通訊高度發展以及通訊業者之間的競爭激烈,該地區的通訊分析市場預計將變得更加活躍。用於客戶支援的IT基礎設施和技術的不斷進步、大量的市場供應商以及輕鬆獲取熟練的技術專業知識以管理日常業務和幫助台軟體,正在促進通訊業務管理市場的成長。

- 市場上出現了幾個新參與企業,進一步推動了市場的成長。例如,2022 年 7 月,阿達尼集團確認進軍蜂窩通訊領域,並計劃於 2022 年推出。作為其市場擴張計劃的一部分,該公司計劃在澳洲推出三家新的無線服務供應商,成為首批進入該領域的印度公司之一。該集團還提案向北美市場投資10億美元。

- 此外,消費行為,包括行動網際網路和智慧型手機普及率的提高、價格的下降和更多在地化內容,正在推動電子商務、金融服務、視訊和社交媒體等領域的行動服務的繁榮。因此,北美對電訊業務管理的需求不斷上升。

- 連網型設備和行動裝置的大量增加刺激了對增強網路服務的需求。北美一直處於技術採用的前沿,該地區的連網型設備採用率最高。

- 例如,根據思科系統公司的數據,2018年北美人均設備和連接數量為8.2個,預計2023年將達到13.4個。這些趨勢預計將成為區域市場成長的主要驅動力。

- 此外,物聯網、多重雲端環境和人工智慧等技術進步的部署增加了網路架構的複雜性。根據 GSMA 預測,到 2025 年,北美的物聯網連接數量將從 2019 年的 28 億增加到 54 億。因此,這些技術的採用正在刺激對靈活和適應性網路架構的需求,從而推動該地區的市場成長。

電信營運管理產業概況

電信營運管理市場競爭激烈且細分化。這是因為有 IBM 公司、Oracle 公司、Telefonaktiebolaget LM Ericsson、Hewlett Packard Enterprise Development LP 和諾基亞公司等大公司的存在。領先的公司正在合作提出創新的解決方案來增加市場佔有率。

- 2022 年 2 月-埃及電信和 Grid Telecom 就希臘和埃及之間的新海底電纜選擇簽署了戰略合作備忘錄。兩家公司將探索希臘和埃及之間的連通選擇,並透過與鄰國的互連利用埃及電信和 Grid Telecom 的網路和國際影響力。

- 2021 年 9 月—阿曼沃達豐與愛立信簽署協議,部署、營運和維護新的 4G 和 5G 核心和無線存取 (RAN)待開發區網路。愛立信介紹了其完整的核心網路解決方案,包括愛立信雲端核心、雲端 VoLTE 和 NFVI,以及端到端傳輸網路解決方案。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查假設和市場預測

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- COVID-19 市場影響評估

- 行業使用案例

第5章 市場動態

- 市場促進因素

- 增加營運成本和複雜性

- 市場問題

- 缺乏高效率的系統整合商

第6章 市場細分

- 按部署

- 本地

- 雲

- 按類型

- 軟體

- 網管

- 客戶和產品管理

- 收益管理

- 庫存管理及其他

- 按服務

- 軟體

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- IBM Corporation

- Telefonaktiebolaget LM Ericsson

- Oracle Corporation

- Hewlett Packard Enterprise Development LP

- Nokia Corporation

- Amdocs Inc.

- Netcracker Technology Corp

- Cisco Systems Inc.

- Accenture PLC

- SAP SE

- NEC Corporation

- Comarch SA

- ZTE Corporation

- ServiceNow Inc.

- TATA Consultancy Services Limited

第8章投資分析

第9章 市場機會與未來趨勢

The Telecom Operations Management Market size is estimated at USD 83.21 billion in 2025, and is expected to reach USD 117.58 billion by 2030, at a CAGR of 7.16% during the forecast period (2025-2030).

With the outbreak of COVID-19, telecom companies should be well equipped to handle the operations for meeting the 30% to 40% increase in bandwidth demand on their networks as millions of employees and students became homebound. According to FieceTelecom, the coronavirus pandemic has pushed companies of all sizes to accelerate their digital transformation plans. The companies that had already engaged in the adoption of digital transformation and cloud strategies were better able to sustain in the first few weeks of the pandemic. Verizon Business' survey results echoed some of the points, including 43% of the respondents now planning to expand their businesses through digital and related technologies. Also, 30% have already added new methods for delivering their products and services digitally.

Key Highlights

- The telecommunications industry is regarded as one of the significant adopters of digital transformation, both as a key driver of worldwide digitization and as an industry witnessing a large-scale change in its market environment.

- Investment by the telecommunications industry in interoperability and technology has reinforced a paradigm shift in capital flows and information through the global economy while providing the building blocks for the emergence of entirely new business models across industries. With the rapidly growing demand for bandwidth and the increasing number of mobile Internet users, communication service providers are evolving to offer advanced and innovative solutions.

- Also, legacy networks, combined with the growing infrastructure requirements for 5G networks, have created a complex environment, making it challenging for communication service providers (CSPs). Hence, the need for the adoption of technologically advanced operations support systems in telecommunications is increasing.

- The continuously growing need for low-cost data and voice services is boosting the market growth. This is encouraging the service providers, who purchase the network services from the MNOs at wholesale rates and sell these as bundled services at lower rates than those of MNOs.

- The market studied is augmented by the increasing complexity in network architectures, as most enterprise organizations have multi-vendor, multi-cloud configurations. Furthermore, as these organizations aim to meet the demand with limited resources and streamline their change processes, they require more flexible and adaptable network architectures.

- In addition, the increasing number of services such as cloud, Machine to Machine (M2M) transactions, and mobile money are further expected to augment demand for telecom operations management over the forecast period.

- Furthermore, with businesses going mobile and adopting new concepts like BYOD to increase employee interaction and ease of use, it has become essential to provide a high speed and quality network. The organizations are looking forward to adopting BYOD aggressively in their operations, thereby fueling the market growth over the forecast period.

Telecom Operations Management Market Trends

Cloud is Expected to Witness Significant Growth

- Telecom companies worldwide are embarking on transformation journeys centered on the cloud to drive new services, revenue opportunities, and experiences. The telecom operators can accelerate the journey by combining their cloud-native, open and modular solutions with the fully managed, high-performing Cloud platform. Cloud providers are focusing on some strategic regions to support telecommunications companies. These include helping telecommunications companies monetize 5G as a business services platform, empowering them to engage their customers through data-driven experiences better, and assisting them in improving operational efficiencies across core telecom systems.

- In Oct 2021, Dell Technologies introduced new telecom software, solutions, and services to help communications service providers (CSPs) accelerate their open, cloud-native network deployments and create new revenue opportunities. New technologies like Open RAN (ORAN) give CSPs a broader set of options for deploying network infrastructure to support future growth.

- Google announced a partnership with Amdocs to enable communications service providers to run Amdocs' market-leading portfolio on Google Cloud and to deliver new data analytics, site reliability engineering, and 5G edge solutions to enterprise customers. Amdocs announced that Altice USA had gone live with Amdocs data and intelligence systems on the Google Cloud as part of the Amdocs and Google Cloud joint go-to-market initiative. Also, a new partnership with Netcracker to deploy its entire Digital BSS/OSS and Orchestration stack on Google Cloud. Service providers can now scale and purchase their mission-critical IT applications on-demand, access unlimited Google Cloud resources, reduce ownership costs, and accelerate new services' availability.

- In June 2021, AT&T partnered with Microsoft to shift its 5G mobile core network to Microsoft Azure's hybrid cloud. Microsoft is acquiring AT&T's Network Cloud platform technology that runs AT&T's 5G core. The deal also involves buying AT&T engineering and lifecycle management software that runs containerized or virtualized network services.

- Moreover, the ZENIC ONE (UME) system integrates Artificial Intelligence and Big Data for the first time to add management and control with tools and applications. Therefore, the system can collect the information related to the operation reported by the device in real-time and combine AI intelligent big data analysis to monitor the network operation status, promptly pinpoint problems and recover services, thus significantly improving the O&M efficiency. Such instances are expected to provide a strong impetus for market growth.

- As per Ericsson, the number of smartphone subscriptions worldwide surpassed six billion in 2021 and is expected to grow further by several hundred million in the next few years. This increase in users will drive market growth over the forecasted period. Additionally, initiatives such as the Digital India initiative are expected to uplift the cloud platform integration or cloud-based model in telecom operation that will drive the market growth.

North America is Expected to Hold Significant Share

- North America is anticipated to occupy a significant share in the telecom operations management market studied, owing to the region's high expenditure on business operation solutions. Besides, telecommunications in the region is highly developed with intense competition among the communication providers, which is expected further to boost the market for telecom analytics in the region. The continuous advancements in IT infrastructure and technology used for customer support, a significant number of market vendors, and the accessibility of proficient technical expertise in managing the daily operations and helpdesk software contribute toward the telecom operations management market growth region.

- The market is witnessing several new players, further driving the market growth. For instance, in July 2022, Adani Group confirmed its entry into the cellular telecom space and will do so with a rollout in 2022. The company is expected to release three new wireless service providers in Australia as part of its planned expansion into the market, making it one of the first Indian firms to enter this area. The group has also proposed to invest USD 1 billion in the North American market.

- Furthermore, the shift in consumer behavior, along with rising mobile internet adoption and smartphone, improved affordability, and the increasing availability of locally relevant content, has led to a boom in mobile services across areas such as e-commerce, financial services, video, and social media. As a result, the demand for telecom operations management has been witnessing an upward trend in North America.

- Substantial growth in connected and mobile devices is spurring the demand for enhanced network services. Since North America has always remained at the forefront of technology adoption, the region witnessed the maximum adoption of connected devices.

- For instance, according to Cisco Systems, the average number of devices and connections per capita in North America stood at 8.2 in 2018 and is expected to reach 13.4 by 2023, which is the highest amongst any other region globally. Such trends are expected to act as major drivers for growth in the regional market.

- Further, deploying technological advancements, such as IoT, multi-cloud environments, or AI, increases network architectures' complexity. According to the GSMA, the number of IoT connections in North America is expected to reach 5.4 billion in 2025, compared to 2.8 billion in 2019. Hence, deploying these technologies is increasing the demand for flexible and adaptable network architectures, thereby fueling the market growth in the region.

Telecom Operations Management Industry Overview

The Telecom Operations Management Market is highly competitive and fragmented. This is due to the presence of significant players such as IBM Corporation, Oracle Corporation, Telefonaktiebolaget LM Ericsson, Hewlett Packard Enterprise Development LP, Nokia Corporation, etc. The prominent companies are entering into collaborations and are launching innovative solutions to increase their market share.

- February 2022 - Telecom Egypt and Grid Telecom have signed a strategic MoU for new subsea cable options between Greece and Egypt. The two companies will explore connectivity options between Greece and Egypt, as well as the use of Telecom Egypt's and Grid Telecom's networks and international footprint through interconnectivity to neighboring countries.

- September 2021 - Vodafone in Oman has signed an agreement with Ericsson to deploy, operate and maintain a new 4G and 5G core and radio access (RAN) greenfield network. Ericsson will supply a complete core network solution based on Ericsson Cloud Core, Cloud VoLTE, and NFVI, as well as an end-to-end transport network solution.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Denition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Assessment of Impact of COVID-19 on the Market

- 4.4 Industry Use Cases

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Operational Costs and Complexity

- 5.2 Market Challenges

- 5.2.1 Shortage of Efficient System Integrators

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Type

- 6.2.1 Software

- 6.2.1.1 Network Management

- 6.2.1.2 Customer and Product Management

- 6.2.1.3 Revenue Management

- 6.2.1.4 Inventory Management and Others

- 6.2.2 Services

- 6.2.1 Software

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Telefonaktiebolaget LM Ericsson

- 7.1.3 Oracle Corporation

- 7.1.4 Hewlett Packard Enterprise Development LP

- 7.1.5 Nokia Corporation

- 7.1.6 Amdocs Inc.

- 7.1.7 Netcracker Technology Corp

- 7.1.8 Cisco Systems Inc.

- 7.1.9 Accenture PLC

- 7.1.10 SAP SE

- 7.1.11 NEC Corporation

- 7.1.12 Comarch SA

- 7.1.13 ZTE Corporation

- 7.1.14 ServiceNow Inc.

- 7.1.15 TATA Consultancy Services Limited