|

市場調查報告書

商品編碼

1636631

電信業者OPEX分析(2016-23):網路OPEX居高不下,電信業者希望透過AI和自動化取得未來利潤Telco Opex Analyzer, 2016-23: Telcos Grapple with Stubbornly High Network Opex, Look to AI and Automation for Future Gains |

|||||||

本報告深入研究了2016年至2013年期間依類別的電信業者的OPEX趨勢,分析主要地區32家業者的資料。

視覺

OPEX 的智慧管理對於電信公司的發展和提高獲利能力非常重要。2023年全球電信業者收入預計將年減0.5%至17,781億美元。這是十年來的最低水準,原因在於貨幣波動和 5G 收益化機會有限(尤其是在日本)。除了收入停滯不前之外,電信業者還面臨高額的資本支出需求和激烈的競爭,凸顯了除了資產出售和外包等傳統方法之外,戰略成本最佳化的必要性。因此,管理 OPEX 非常重要。

主要調查結果:

2023年 OPEX 下降了 1.0%,不包括折舊和攤銷(D&A)的OPEX 下降了 0.5%,下降率與收入大致相同。差異在於 D&A,到2023年將急劇下降至 3%。

- 網路相關的OPEX(包括營運、租賃、公用事業和 D&A)佔總 OPEX 的50.8%,但不同公司之間存在很大差異。

- 網路營運成本將從2016年 OPEX 的16.5%增加到2023年的18.4%。由於新的會計規則(IFRS 16),網路租賃 OPEX 幾年前有所下降,目前穩定在 3.0-3.5% 的範圍內

- D&A 是最大的OPEX 類別,到2023年將成長到 OPEX 的23.4%

- 隨著電信公司爭奪數位人才並擁抱自動化,佔 OPEX 16%以上的勞動成本上升。勞動成本佔總OPEX的比例將從2016年的16.2%上升至2023年的17.4%。

接受調查的操作員:

|

|

目錄

- 1.報告重點

- 2.概述

- 3.調查結果:32個電信集團

- 4.調查結果:依公司

- 5.分類

- 6.關於我們

This report provides a deep dive into telco opex trends by category from 2016 to 2013, analyzing data from 32 companies across key regions.

VISUALS

Managing opex wisely is essential for telcos to thrive and grow profitability: in 2023, global telco revenues fell 0.5% YoY to $1,778.1B. That marks a decade-low, due to currency fluctuations, particularly in Japan, and limited 5G monetization opportunities. In addition to stagnant revenues, telcos face high capex demands and fierce competition, emphasizing the need for strategic cost optimization beyond traditional methods like asset sell-offs and outsourcing. Getting opex under control is key.

Key findings of our telco opex study include:

Total opex fell by 1.0% in 2023, but opex excluding depreciation and amortization (D&A) declined by 0.5%, or about the same rate of decline as revenues. The difference is D&A, which fell at the much steeper clip of 3% in 2023.

- Network-related opex, encompassing operations, leasing, utilities, and D&A, constitutes 50.8% of total opex, with significant company-specific variations.

- Network operations costs rose from 16.5% of opex in 2016 to 18.4% in 2023. Network leasing opex declined several years ago due to new accounting rules (IFRS 16) and are now steadily in the 3.0 to 3.5% range.

- Depreciation and amortization, the largest opex category, grew to 23.4% of opex in 2023.

- Labor costs, accounting for over 16% of opex, are rising as telcos compete for digital talent and embrace automation. As a percentage of total opex, labor costs increased from 16.2% in 2016 to 17.4% in 2023.

The report underscores the need for telcos to standardize opex tracking and implement transformative measures to enhance profitability. By benchmarking costs and uncovering inefficiencies, telcos and vendors can better navigate industry challenges and opportunities.

*Companies included: Advanced Info Service (AIS), Airtel, Batelco, BT, Charter Communications, China Mobile, Chunghwa Telecom, Du, Etisalat, Globe Telecom, KDDI, KPN, LG Uplus, Megafon, MTN Group, Oi, Ooredoo, Orange, PLDT, Proximus, Saudi Telecom (STC), Singtel, SK Telecom, Starhub, Swisscom, Tata Communications, Telecom Argentina, Telecom Italia, Telkom Indonesia, Telus, Turk Telekom, and Veon.

Operator coverage:

|

|

Table of Contents

- 1. Report Highlights

- 2. Abstract

- 3. Results for Group of 32 Telcos

- 4. Results by Company

- 5. Taxonomy

- 6. About

List of Figures and Charts:

- 1. Capex and Opex as % of Revenues - Group of 32

- 2. Network-related capex and opex in 2016-23: Group of 32 (% revenues)

- 3. Opex by category, 2016-23 average

- 4. Network-related opex categories as % of total opex, 2016-23

- 5. All network-related opex, % total

- 6. Profit margins for group of 32 telcos, 2016-23 average

- 7. Labor costs as a % of total opex

- 8. Labor costs per employee (US$K)

- 9. Opex items by company, % total opex: 2023

- 10. Profitability margins by company, 2023

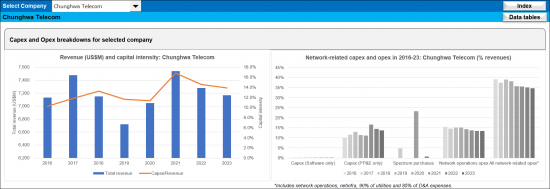

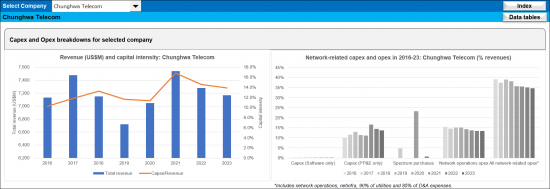

- 11. Company-level revenue (US$M) and capital intensity

- 12. Company-level network-related capex and opex in 2016-23

- 13. Company-level opex by category, 2016-23 average

- 14. Company-level network-related opex categories, as % of total opex, 2016-23

- 15. Company-level all network-related opex as % of total opex

- 16. Labor costs per employee (US$K): company vs. global telco average

- 17. Labor costs as a % of total opex: company vs. global telco average

- 18. Average profit margins, 2016-23: company vs. global telco average

- 19. Company-level profitability trends, 2016-23