|

市場調查報告書

商品編碼

1644477

印度工業感測器和變送器:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)India Industrial Sensors and Transmitters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

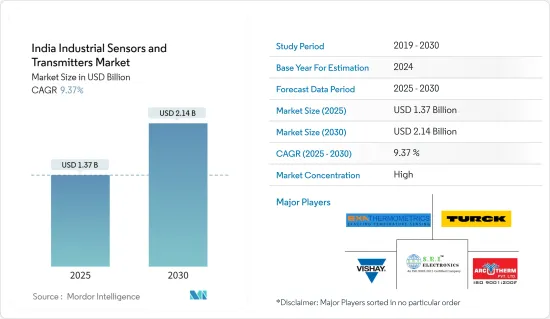

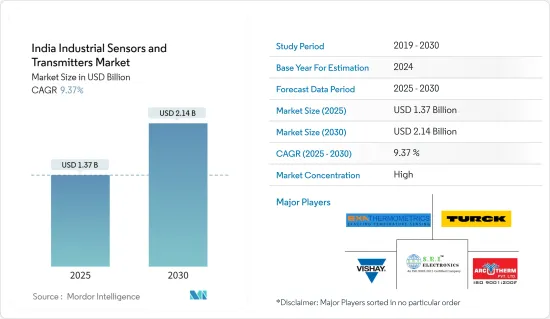

印度工業感測器和變送器市場規模預計在 2025 年為 13.7 億美元,預計到 2030 年將達到 21.4 億美元,預測期內(2025-2030 年)的複合年成長率為 9.37%。

主要亮點

- 工廠自動化和工業 4.0 嚴重依賴工業感測器。動作感測器用於監測設備的健康狀況,從線性和角度定位到傾斜檢測、水平以及衝擊和跌落檢測。印度工業在經濟和人口方面具有良好的條件擴大經營,同時支持預計很快就會增加的國內利益和出口機會。

- 作為“印度製造”計劃的一部分,印度政府擬優先發展汽車製造。根據2016-26汽車使命計畫(AMP),到2026年乘用車市場預計將成長兩倍,達到940萬輛,從而推動該地區感測器使用量的增加。此外,各公司正在擴大其業務範圍,以鞏固其在企業發展市場中的地位。例如,總部位於古爾岡的汽車零件供應商 Minda Industries 已與美國Sensata 的兩家中國子公司合作,購買車輪轉速感測器,以增強其產品組合。

- 此外,在食品飲料、製造、製藥等政府指定的核心產業中,由於勞動力短缺以及遠端監控和操作的需求,對自動化的需求不斷擴大,從而帶動了各種感測器的需求。

- 成本和營運問題是印度市場成長的一些障礙。高昂的安裝成本可能使人們不願意採用感測器技術。感測器規格根據應用而有所不同,價格取決於所用原料的品質。例如,製造優質溫度感測器的關鍵因素是生產商選擇優質的原料。

- 新冠肺炎疫情對許多行業產生了負面影響。 2020 年第一季,汽車和加工工業出現停產或減產。這對這些行業對各種感測器的需求產生了重大影響。由於印度政府的安全法規越來越嚴格,越來越多的製程工業開始投資自動化監控設備,壓力感測器在工業和物聯網設備中的應用也得到了擴展。

印度工業感測器和變送器市場趨勢

流量感測器的需求預計將增加

- 隨著物聯網技術在工業領域的部署,工業IoT已成為發展方向和趨勢。氣體流量感測器廣泛應用於工業自動化、天然氣、冶金、礦場、石油、航空、工業包裝、工業清洗等領域。此外,由於有關控制發電廠有害氣體排放的嚴格規定,對石油和天然氣流量測量的需求也推動了該地區流量感測器的採用。

- 流量感測器是一種可以測量流體(例如氣體或液體)流量的組件。這些感測器利用機械和電氣子系統來測量流體物理屬性的變化並計算其流速。在印度,流量感測器廣泛應用於各個終端用戶產業,包括製藥、汽車、石油和天然氣、化學、水和用水和污水、製造業、發電和化學工業。

- 這些感測器根據測量流量所採用的技術類型進行區分。這些技術包括科氏技術、差流技術、超音波以及渦流技術。超音波等能在惡劣環境下準確運作的技術取得了重大進展。

- 從燃料氣體到火炬到酸性氣體,甚至在加工、運輸和儲存過程中監測液化天然氣 (LNG),選擇正確的流量感測器至關重要。此外,由於對設備操作效率和精度的需求不斷增加,整個石油和天然氣價值鏈採用自動化,對流量感測器的採用產生了重大影響。

- 在石油和天然氣工業中,流量測量至關重要。油井測試、提高採收率、分餾、完井、分離以及原油和天然氣的回收和製備等上游工程都需要它。

化工和化肥產業預計將出現強勁成長

- 壓力感測器是工業自動控制中應用最廣泛的測量設備之一。大型化工計劃幾乎採用所有壓力感測器應用,包括差壓、絕壓、表壓、高壓、差壓、高溫、低溫、遠傳法蘭壓力感測器等各種材質和特殊加工而成。化工產業對壓力感測器的需求集中在測量精度、反應快速性、溫度特性、靜壓特性、長期穩定性等。

- 液位感測器用於石化和化工廠,以檢測高腐蝕性或酸性化學物質並確保一切順利運作。石化產業採用超音波液位感測器。這是因為它是一種非接觸式設備,可在檢測化學品品質的同時提供安全性。

- 裂解爐和硫磺回收爐的溫度範圍從低溫(遠低於零度)到800°C以上。如此高的溫度需要各種各樣的材料和感測器技術。對於低於 600°C 的應用,RTD 感測器提供更準確的讀數,並且可以重複使用。

- 油漆和易燃化學品等化學工業處理碳氫化合物和酒精,因此需要防爆或本質安全的感測器組件。可靠且可重複的液位、流量、壓力和溫度測量對於安全、準確的連續製程控制至關重要。通常使用熱電偶、帶有溫度計套管的 RTD 感測器、紅外線溫度感測器和紅外線熱成像來監測此類過程。

- 壓力變送器是化學工業最常用的自動控制控制設備之一。涵蓋了大型化工計劃中幾乎所有壓力變送器的應用,包括差壓、絕壓、表壓、差壓、高溫、低溫、各種材質及特殊加工的遠傳法蘭壓力變送器。

印度工業感測器和變送器產業概況

印度工業感測器和變送器市場集中在少數參與者手中。為了在競爭中生存,每個參與者可能透過各種策略併購、技術創新和增加研發投入來尋求市場擴張。

- 2021 年 7 月 - 喀拉拉邦數位大學 (DUK) 與電子技術材料中心 (C-MET) 合作,同意在科欽附近建立該國首個智慧物聯網 (IIoT) 感測器卓越中心。印度電子和資訊技術部 (MeitY) 和各州 IT 部門聯合計劃建立卓越中心 (CoE)。

- 2021 年 7 月-WIKA Instruments India Pvt. Ltd. 推出了用於工業應用的壓力感測器模組。型號 MTF-1 壓力感測器模組是一種簡單且適應性強的選擇,可將壓力測量納入許多應用。壓力值在模組內部進行數位化處理,並以標準化數位或類比訊號輸出。因此,MTF-1 模組旨在為高達 1,000 bar 的壓力應用提供準確的資料,並實現節能運作。該模組旨在以節能的方式運行,其數位 I2C 訊號由於其低基本消費量和短開啟時間而允許極其高效的資料傳輸。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 技術簡介

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 不同終端用戶之間的競爭日益激烈。

- 消費者對優質產品的需求不斷增加,並擔心人為干預

- 市場限制

- 成本和營運問題

第6章 市場細分

- 依感測器類型

- 流動

- 溫度

- 壓力

- 等級

- 變送器和其他感測器

- 按最終用戶

- 力量

- 石化、化工、化肥

- 飲食

- 用水和污水

- 生命科學

- 石油和天然氣

- 其他最終用戶

第7章 競爭格局

- 公司簡介

- EXA Thermometrics India Pvt. Ltd

- Vishay Intertechnology, Inc.

- Turck India Automation Private Limited

- Arcotherm Pvt Ltd

- SRI Electronics

- WIKA Instruments India Pvt. Ltd.

- SENSOREX, Inc

第8章投資分析

第9章:市場的未來

簡介目錄

Product Code: 72337

The India Industrial Sensors and Transmitters Market size is estimated at USD 1.37 billion in 2025, and is expected to reach USD 2.14 billion by 2030, at a CAGR of 9.37% during the forecast period (2025-2030).

Key Highlights

- Factory automation and Industry 4.0 rely heavily on industrial sensors. Sensors such as motion, environmental, and vibration sensors are used to monitor the health of equipment, ranging from linear or angular positioning to tilt sensing, leveling, shock, or fall detection. India's industries are well-positioned to expand their operations economically and demographically while supporting domestic interests and export opportunities that are expected to increase soon.

- As part of the 'Make in India' initiative, the Indian government intends to prioritize automobile manufacturing. According to the Auto Mission Plan (AMP) 2016-26, the passenger car market would triple to 9.4 million units by 2026, which is predicted to increase sensor usage in the region. Companies are also expanding their activities to strengthen their positions in the markets in which they operate. For example, Gurgaon-based auto component supplier Minda Industries partnered with two Chinese subsidiaries of US-based Sensata to purchase the wheel speed sensors required to enhance their portfolio.

- Furthermore, the demand for automation is expanding in government-designated essential industries such as food and beverage, manufacturing, and pharmaceutical, due to a lack of labor and the need for remote monitoring and working, which has driven the demand for various sensors.

- Cost and operational concerns are some of India's barriers to market growth. High installation costs may cause disinclination in the adoption of sensor technology. The sensor's specifications vary depending on the application, and the price of the sensors is determined by the quality of raw materials used. For example, as an important part of producing a superior temperature sensor, the producer's high-quality raw materials choice is vital.

- COVID-19 had a negative impact on many industrial sectors. The automotive and process industries were on hold or reduced production during the first quarter of 2020. As a result, the demand for all types of sensors in these industries was significantly impacted. Expansion of industrial and IoT devices for pressure sensors was observed as more and more process industries started investing in automation monitoring devices, owing to safety and stringent government regulations in India.

India Industrial Sensors & Transmitters Market Trends

Flow Sensors are Expected to be Higher in Demand

- The deployment of Internet of Things technology in the industrial field has resulted in the Industrial IoT becoming the development direction and trend. Gas flow sensors are widely utilized in industrial automation, natural gas, metallurgy, mining, petroleum, aviation, industrial packaging, and industrial cleaning, among other fields. In addition, the requirement for flow measurement in oil and gas in response to rigorous rules related to controlling harmful gas emissions from power plants is driving the region's adoption of flow sensors.

- Flow Sensors are components that can measure the flow of a fluid, such as a gas or liquid. These sensors utilize both mechanical and electrical subsystems to measure changes in the fluid's physical attributes and calculate its flow. In India, the adoption of flow sensors is widely seen in various end-user industries, including pharmaceutical, automotive, oil and gas, chemical, water and wastewater, manufacturing, power generation, chemical, and others.

- These sensors are distinguished by the type of technologies that are used to measure flow. The technologies include Coriolis, Differential Flow, Ultrasonic, Vortex, and others. There has been significant development in technologies, such as ultrasonic, to operate in harsh environments with precision.

- The selection of an appropriate flow sensor for monitoring fuel gas to flare and acid gas, as well as monitoring liquefied natural gas (LNG) during processing, transportation, and storage, is crucial. Furthermore, because of the increased need for efficiency and accuracy in equipment operation, the adoption of automation across the oil and gas value chain had a major impact on the adoption of flow sensors.

- In the oil & gas sector, flow measurement is crucial. It is required in upstream operations that include well testing, enhanced oil recovery, fractionation, completion, and separation, as well as the recovery and preparation of crude oil and natural gas.

Chemicals and Fertilizers Sector is Expected to Witness Higher Growth

- The pressure sensor is one of the most widely used measurement devices in the chemical industry's automatic control. In large-scale chemical projects, almost all pressure sensor applications, including differential pressure, absolute pressure, gauge pressure, high pressure, differential pressure, high temperature, low temperature, and remote transmission flange pressure sensors of various materials and special processing, are used. The chemical industry's demand for pressure sensors can be summarised as follows: measurement precision, fast response, temperature, and static pressure characteristics, and long-term stability.

- Liquid level sensors are employed in the Petrochemicals and Chemical factories to detect highly corrosive and acidic chemicals, ensuring that all operations run smoothly. In the petrochemical industry, ultrasonic liquid level sensors are employed because they are non-contact devices that provide safety while detecting chemical quality.

- Temperatures in cracking and Sulphur recovery furnaces can range from cryogenic (far below zero) to over 800°C. Temperatures this high necessitate a diverse set of materials and sensor technologies. In applications below 600°C, RTD sensors provide a more precise reading and can be used repeatedly.

- Sensor assemblies that are explosion-proof or intrinsically safe are necessary for the chemical industries, such as paints and flammable chemicals, because they deal with hydrocarbons and alcohols. Reliable and repeatable level, flow, pressure, and temperature measurements are essential for safe, precise, and continuous process control. Thermocouples, RTD sensors with thermo wells, infrared temperature sensors, and infrared thermal imaging are often used to monitor these processes.

- The pressure transmitter is one of the chemical industry's most commonly used automatic control devices. It covers almost all pressure transmitter applications in large chemical projects, such as differential pressure, absolute pressure, gauge pressure, pressure, differential pressure, high temperature, low temperature, and a variety of materials and special processing of remote flange Pressure Transmitters.

India Industrial Sensors & Transmitters Industry Overview

India Industrial Sensors and Transmitters Market is concentrated with only a few players in the market. The players are seen to be increasingly seeking market expansion through various strategic mergers and acquisitions, innovation, and increasing investments in research and development to stay ahead of the competition.

- July 2021 - The Digital University Kerala (DUK), in association with the Centre for Materials for Electronics Technology (C-MET), agreed to set up the country's first Centre of Excellence in Intelligent Internet of Things (IIoT) sensors near Kochi. The Union Ministry of Electronics and Information Technology (MeitY) and the state IT department planned to set up the Centre of Excellence (CoE) together.

- July 2021 - WIKA Instruments India Pvt. Ltd. has introduced a pressure sensor module for industrial applications. The model MTF-1 pressure sensor module is a simple and adaptable choice for incorporating pressure measurement into many applications. The pressure value is digitally processed in the module and output as a standardized digital or analog signal. Thus, the MTF-1 module provides exact data for applications with pressures of up to 1,000 bar and is designed for energy-saving operation. The module is intended to operate in an energy-efficient manner because of digital I2C signal transmits data extremely efficiently because of its low basic energy consumption and rapid switch-on periods.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Industry Attractiveness- Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.5 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Competition Among Various End-users To Stay Competitive By Introducing World- Class Manufacturing Facilities

- 5.1.2 Increasing Consumer Demand for Superior Quality Products and Concerns Over Human Intervention

- 5.2 Market Restraints

- 5.2.1 Cost and Operational Concerns

6 MARKET SEGMENTATION

- 6.1 Type of Sensor

- 6.1.1 Flow

- 6.1.2 Temperature

- 6.1.3 Pressure

- 6.1.4 Level

- 6.1.5 Transmitters and Other Sensors

- 6.2 End-User

- 6.2.1 Power

- 6.2.2 Petrochemicals, Chemicals and Fertilizers

- 6.2.3 Food and Beverage

- 6.2.4 Water and Wastewater

- 6.2.5 Life Sciences

- 6.2.6 Oil and Gas

- 6.2.7 Other End-Users

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 EXA Thermometrics India Pvt. Ltd

- 7.1.2 Vishay Intertechnology, Inc.

- 7.1.3 Turck India Automation Private Limited

- 7.1.4 Arcotherm Pvt Ltd

- 7.1.5 SRI Electronics

- 7.1.6 WIKA Instruments India Pvt. Ltd.

- 7.1.7 SENSOREX, Inc

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219