|

市場調查報告書

商品編碼

1644658

亞太工業感測器:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Asia Pacific Industrial Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

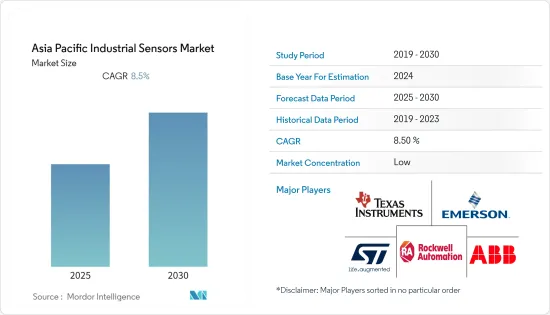

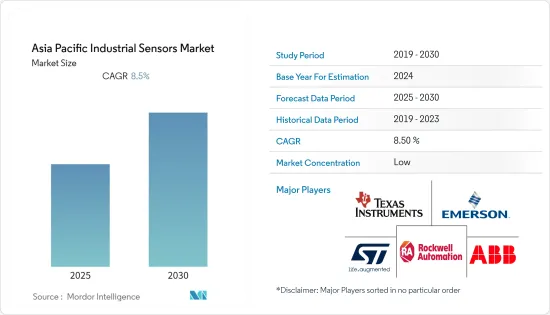

預計預測期內亞太工業感測器市場複合年成長率將達到 8.5%。

在食品飲料、製造、製藥等政府指定的重點行業中,由於勞動力短缺以及遠端監控和操作的需求,對自動化的需求不斷成長,從而刺激了對各種感測器的需求。

工業 4.0 正在挑戰流程工業和製造業中自動化和控制功能的傳統界限。工業 4.0 透過日本的社會 5.0 和中國製造 2025 等全球舉措和架構框架,實現更廣泛的能力和產業。

製造業中的智慧感測器正在提高設備的運作效率、有效性和可靠性。各種感測器,包括氣體感測器、影像感測器和接近感測器,與物聯網和人工智慧等技術相結合,正在將製造工廠轉變為互聯、可靠且經濟高效的設施。該地區製造業的擴張也可能推動對改善處理和資料通訊的感測器的需求。

推動工業感測器市場成長的主要因素包括物聯網和工業 4.0 的日益普及、工業自動化的不斷發展以及政府對工業感測器使用的有利監管。然而,感測器設備高昂的初始成本限制了工業感測器市場的成長。相反,各行業對智慧感測器的採用預計將為市場擴張提供潛在機會。

在亞太地區,成本、營運和維護問題是限制市場成長的因素。高昂的安裝成本可能成為採用感測器技術的障礙。感測器規格根據應用而有所不同,成本取決於所用原料的品質。例如,選擇高品質的原料對於生產良好的溫度感測器至關重要。

根據國家統計局的數據,2021年前11個月中國天然氣產量增加。 1-11月天然氣產量1860億立方米,與前一年同期比較增8.9%,年增19%。由於電感式接近感測器在石油和天然氣工業中的應用,該地區的工業發展正在推動對電感式接近感測器的需求。

在 COVID-19 期間,為了實現高效的工業營運,對工業感測器的需求強勁,預測性維護為市場參與企業提供了有利可圖的機會,汽車製造商對智慧感測器的需求也在增加,以提高安全性和舒適度。

亞太工業感測器市場趨勢

自動化技術採用率成長

亞太地區是汽車等各產業領域公司的製造地,對製造各種汽車和家用電子電器產品所使用的各種零件有需求。此外,消費者可支配收入的增加推動了對電子產品的需求,這有助於無電池感測器的發展。

在韓國,在政府市場友善政策的推動下,企業正在快速轉型以採用工業4.0的元素,向智慧和自動化工廠的轉變正在加速。過去幾十年來,韓國汽車業從一個政府控制的小型產業發展成為由大型跨國公司控制的產業。韓國是起亞汽車、現代汽車、雷諾等大公司的所在地,汽車需求預計將穩定成長。

亞太地區工業感測器環境趨勢溫和。世界各國政府正致力於制定有益的監管框架,以增加自動化解決方案的採用,這是推動亞太工業機器人市場成長的主要因素。工業機器人配備有各種感測器並以此為基礎發揮作用。因此,機器人應用對工業感測器的需求預計會增加。

幾家日本公司正在開發新產品。例如,2021 年 10 月,ROHM 半導體公司發布了一款新型、緊湊、高精度氣壓感測器 IC BM1390GLV(-Z)。具備IPX8防水性能,適用於家用電子電器產品、工業設備、小型物聯網設備等。為了應對壓力感測器在各種應用中日益普及的趨勢,該公司開發了一種新型微型壓力感測器。

預計汽車市場將在預測期內有所改善,並有望成為亞太地區感測器的主要終端用戶之一。

中國佔大部分佔有率

中國作為世界製造地,感測器銷售潛力巨大。中國是世界最大的汽車製造國,也是家用電子電器產品生產大國。該國快速的經濟發展正在刺激其感測器產業的成長。

該合資企業由中國國有第一汽車工廠、德國大眾汽車公司、奧迪汽車公司和大眾汽車(中國)投資公司組成。該合資企業名為一汽-大眾汽車集團,旨在高效生產大眾新款速騰和邁騰系列汽車等高品質汽車。

一汽轎車將採用新材料、新技術,實現多種品牌、多種車型的集中生產。感測器技術用於工廠在自動化生產的各個階段(如壓制、噴漆、焊接和最終組裝)檢測工件的位置。

工業自動化和嚴格的食品品質法正在推動將感測器納入該國工業生產過程的需求。根據食品飲料創新論壇(FBIF)顯示,2021年上半年中國大部分食品相關領域實現了20%以上的成長。

工業 4.0 正在打破流程和製造中自動化和控制功能的傳統界限。工業4.0正在日本的社會5.0和中國的中國製造2025等全球舉措和架構的框架下實現更廣泛的功能和行業。

亞太地區工業感測器產業概況

亞太地區工業感測器市場競爭激烈,其中包括羅克韋爾自動化、霍尼韋爾國際、德州儀器、松下公司、意法半導體、泰科電子、西門子、安費諾公司、Dwyer Instruments 和博世感測器技術等多家公司。

- 2021 年 6 月 - 羅克韋爾自動化不斷發展其服務和解決方案能力,並在亞太區推出新品牌 LifecycleIQ Services,以幫助企業在數位化時代快速創新並提高效率。

- 2021 年 2 月-First Sensor AG 是一家服務於感測器技術市場新興市場的標準產品和客製化感測器解決方案的開發人員和製造商,現已推出其全新 MTE EFFICIENCY 模組化壓力變送器平台。 MTE EFFICIENCY 模組化平台可為要求嚴苛的應用提供高測量精度和穩定性,同時極具成本效益。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 物聯網的日益普及推動對感測元件的需求

- 需要在惡劣環境下進行穩健的設計和提高性能

- 市場問題

- 使用小部件帶來的技術挑戰

第6章 市場細分

- 依產品類型

- 壓力

- 溫度

- 等級

- 流動

- 磁場

- 加速度和偏航率

- 氣體

- 其他

- 按最終用戶產業

- 車

- 航太和軍事

- 化工和石化

- 醫療

- 電子和半導體

- 發電

- 石油和天然氣

- 飲食

- 用水和污水

- 其他

- 按國家

- 中國

- 日本

- 韓國

- 其他亞太地區

第7章 競爭格局

- 公司簡介

- Texas Instruments Incorporated

- STMicroelectronics NV

- Emerson Electric Co

- Rockwell Automation Inc.

- ABB Limited

- First Sensor AG

- Siemens AG

- Ericco International Limited

- Honeywell International Inc.

- Amphenol Advanced Sensors

- All Sensors Corporation

第8章投資分析

第9章:市場的未來

The Asia Pacific Industrial Sensors Market is expected to register a CAGR of 8.5% during the forecast period.

The demand for automation is increasing in government-designated critical industries such as food and beverage, manufacturing, and pharmaceutical, owing to a lack of workforce and the need for remote monitoring and working, which has fueled the demand for various sensors.

The traditional boundaries of automation and control functions in the process and manufacturing industries are being challenged by Industry 4.0. It is enabling a broader range of functions and industries through global initiatives and architectural frameworks such as Japan's Society 5.0 and Made-in-China 2025.

Smart sensors in the manufacturing industry improve device operational efficiency, effectiveness, and reliability. Various sensors, such as gas, image, and proximity sensors, in conjunction with technologies such as IoT and AI, transform manufacturing plants into connected, dependable, and cost-effective facilities. The region's expanding manufacturing sector may also drive demand for sensors to improve processing and data communication.

The prominent factors driving the growth of the industrial sensors market include an increase in Internet of Things and Industry 4.0 penetration, an increase in industrial automation, and favorable government regulations toward the use of industrial sensors. However, the high initial cost of the sensor device limits the growth of the industrial sensors market. Conversely, the increased adoption of smart sensors in a variety of industries is expected to provide potential opportunities for market expansion.

Cost, operations, and maintenance problems are some factors limiting market growth in the Asia-Pacific region. High installation costs may discourage the use of sensor technology. The sensor specification varies depending on the application, and the cost of the sensors is determined by the quality of raw materials used. For instance, selecting high-quality raw materials is crucial to producing a superior temperature sensor.

According to the National Bureau of Statistics (NBS) China registered an increase in its natural gas output in the first 11 months of 2021. The country's natural gas output totaled 186 billion cubic meters during the January-November period, growing 8.9% from a year ago and 19% from the 2019 level. The development of industries in the region is driving the demand for inductive proximity sensors, owing to their applications in the oil and gas industry.

In the midst of COVID-19, there was a strong demand for industrial sensors for efficient industrial operations, with predictive maintenance offering lucrative opportunities to market players and increasing demand from automobile manufacturers to deliver improved safety and comfort for smart sensors.

APAC Industrial Sensors Market Trends

Growth in the implementation of automated technology

The Asia-Pacific region is a hub for manufacturing units of numerous companies operating in various industrial verticals such as automotive, creating demand for various components used in the production of a wide range of automotive products and consumer electronics. Furthermore, rising consumer disposable income is fueling demand for electronic items, which is boosting the growth of battery-free sensors.

Migration to smart or automated factories has accelerated in South Korea as companies rapidly transform to implement Industry 4.0 elements due to the government's market-friendly policies. South Korea's automotive industry has grown from a small government-controlled sector to one controlled by large multinational corporations over the last few decades. The country is home to major players such as Kia, Hyundai, and Renault, and demand for automobiles is expected to grow steadily.

The Asia Pacific region's industrial sensor environment is trending toward moderation. Governments in various countries are focusing on developing a beneficial regularity framework to increase the adoption of automation solutions, which is a key factor contributing to the growth of the Asia Pacific industrial robot market. Industrial robots incorporate various sensors based on which they function. As such, the demand for industrial sensors is anticipated to rise for robotics applications.

Several Japanese companies have been developing new products. For instance, in October 2021, ROHM Semiconductor announced the release of a new BM1390GLV (-Z) compact, high-accuracy barometric pressure sensor IC. The new device has an IPX8 waterproof rating and is suitable for home appliances, industrial equipment, and small IoT devices. In response to the growing popularity of pressure sensors in a variety of applications, the company created the new compact pressure sensor.

The automotive market is expected to improve during the forecast period, and its is anticipated to be one of the key end users of sensors in the Asia Pacific region.

China to Hold a Majority Share

As a global manufacturing hub, China has enormous sensor sales potential. China is the world's largest automaker, as well as a major producer of consumer electronics. The country's rapidly developing economy is facilitating the sensor industry's growth.

A joint venture was established between the Chinese-government-owned First Automotive Works, Germany's Volkswagen AG, Audi AG, and Volkswagen Automobile (China) Investment Co. Ltd. This joint venture was called FAW-VW Automobile Co. Ltd, and it was formed to ensure efficient production of high-quality automobiles, like VW's new Sagitar or the Magotan vehicle lines.

FAW-VW would use new materials and technologies to facilitate the production of various vehicle types and models in a single location. Sensor technology is used in plants to detect workpiece positions during different stages of automated production, such as stamping, painting, welding, and final assembly.

The automation of industries and strict food quality laws are driving demand for the incorporation of sensors into the country's industrial production processes. According to the Food & Beverage Innovation Forum (FBIF), China achieved over 20% growth in most food-related sectors in the first half of 2021.

Industry 4.0 is breaking the traditional borders of automation and control functions in the process and manufacturing industry. It enables a wider domain of functions and industries under global initiatives and architectural frameworks, like Society 5.0 in Japan and Made-in-China 2025 in China.

APAC Industrial Sensors Industry Overview

The Asia-Pacific Industrial Sensors market is competitive with the presence of several companies, including Rockwell Automation, Honeywell International, Texas Instruments, Panasonic Corporation, STMicroelectronics, TE Connectivity, Siemens, Amphenol Corporation, Dwyer Instruments, and Bosch Sensortec.

- June 2021 - Rockwell Automation is evolving its service and solution capabilities and launching a new brand LifecycleIQ Services in Asia-Pacific to help companies innovate faster and improve efficiencies in the age of digitalization.

- February 2021- First Sensor AG, a developer and manufacturer of standard products and customized sensor solutions in the growing sensor technology market, has introduced its new MTE EFFICIENCY modular pressure transmitter platform. It would provide high measuring accuracy and stability for demanding applications while also being extremely cost-effective.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of IoT Leading to Demand for Sensing Components

- 5.1.2 Need for Robust Design and Enhanced Performance in Rugged Environment

- 5.2 Market Challenges

- 5.2.1 Technical Issues associated with the involvement of Smaller Components

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Pressure

- 6.1.2 Temperature

- 6.1.3 Level

- 6.1.4 Flow

- 6.1.5 Magnetic Field

- 6.1.6 Acceleration & Yaw Rate

- 6.1.7 Gas

- 6.1.8 Other Product Types

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Aerospace & Military

- 6.2.3 Chemical & Petrochemical

- 6.2.4 Medical

- 6.2.5 Electronics & Semiconductor

- 6.2.6 Power Generation

- 6.2.7 Oil & Gas

- 6.2.8 Food & Beverage

- 6.2.9 Water & Wastewater

- 6.2.10 Other End Users

- 6.3 By Country

- 6.3.1 China

- 6.3.2 Japan

- 6.3.3 South Korea

- 6.3.4 Rest of Asia-Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Texas Instruments Incorporated

- 7.1.2 STMicroelectronics N.V.

- 7.1.3 Emerson Electric Co

- 7.1.4 Rockwell Automation Inc.

- 7.1.5 ABB Limited

- 7.1.6 First Sensor AG

- 7.1.7 Siemens AG

- 7.1.8 Ericco International Limited

- 7.1.9 Honeywell International Inc.

- 7.1.10 Amphenol Advanced Sensors

- 7.1.11 All Sensors Corporation