|

市場調查報告書

商品編碼

1644480

北美和歐洲的聊天機器人:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)North America and Europe Chatbot - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

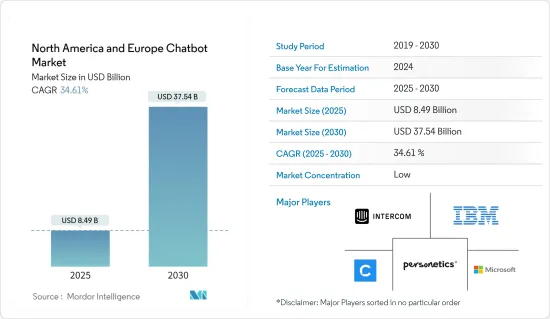

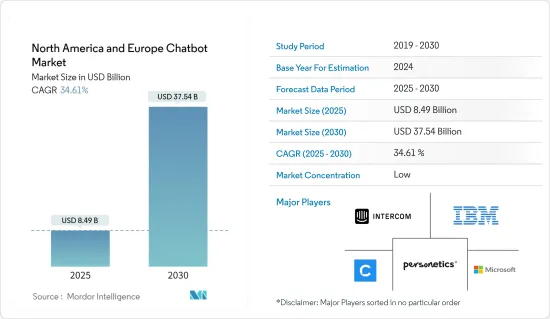

北美和歐洲聊天機器人市場規模預計在 2025 年為 84.9 億美元,預計到 2030 年將達到 375.4 億美元,預測期內(2025-2030 年)的複合年成長率為 34.61%。

企業總是在尋找機會與客戶建立聯繫並確保積極的溝通。隨著開發更出色的通訊平台的需求日益增加,對話式聊天機器人正成為企業的首要任務。在疫情期間,許多企業選擇採用聊天機器人來實現客戶服務的自動化。

主要亮點

- 投資聊天機器人等自動化解決方案可以幫助企業增強客戶服務。隨著通訊應用程式的使用越來越廣泛,將聊天機器人整合到通訊應用程式中可以透過客戶喜歡的應用程式與客戶聯繫,從而提供更好的用戶體驗,從而提供高投資收益。

- 聊天機器人還可以進行消費者分析。透過了解客戶行為,公司可以改變其銷售、行銷和產品開發策略,以促進客戶獲取、提高客戶滿意度並持續發展業務。聊天機器人可以輕鬆地與社交媒體平台和網站整合,適用於任何規模的企業和行業,包括 BFSI、零售、醫療保健、酒店等。

- 隨著通訊應用程式的使用越來越多,將聊天機器人整合到通訊應用程式中可以改善用戶體驗,並透過客戶喜歡的應用程式與客戶聯繫,從而提供更高的投資收益。此外,通訊應用程式可以儲存用戶的聊天記錄以供將來使用,使聊天機器人能夠個性化用戶體驗並獲得有關用戶的可操作見解。

- 許多企業在理解需求和如何使用聊天機器人方面仍然面臨問題。這是因為人們對所提供的好處以及使用聊天機器人來提高客戶滿意度和實現消費者分析的必要性認知不足。

- 在 COVID-19 疫情期間,各個組織擴大部署聊天機器人來回應客戶的查詢和其他相關資訊。由於各州/國家實施的封鎖,各種組織都採用了遠端工作,由於客戶服務員工數量極少,該公司嚴重依賴聊天機器人來減輕客戶查詢的負擔。

北美和歐洲的聊天機器人市場趨勢

通訊應用的流行正在推動市場

- 通訊應用程式上的聊天機器人使組織和品牌能夠在人們已經花費大量時間的平台上與人們進行大規模的個人互動。此外,聊天機器人可以透過 API 連接到各種資料來源,以按需提供資訊和服務。鑑於聊天機器人具有改善客戶體驗的潛力,企業正在投資它們作為與消費者互動的新方式。

- 憑藉其在合理程度上模仿人類的能力,聊天機器人可以幫助品牌更有效地在這些不斷發展的通訊平台上吸引消費者。

- 隨著通訊應用程式的使用越來越多,將聊天機器人整合到通訊應用程式中可以改善用戶體驗,並透過客戶喜歡的應用程式與客戶聯繫,從而提供更高的投資收益。聊天機器人上提出的大多數查詢都是常規查詢,可以使用人工智慧聊天機器人來回答,例如退貨政策、訂單歷史記錄等。在某些情況下,品牌還可以使用通訊來共用有關產品的訊息,以幫助客戶發現過程。

- 此外,通訊應用程式可以儲存用戶的聊天記錄以供將來使用,使聊天機器人能夠個性化用戶體驗並獲得有關用戶的可操作見解。因此,由於易於整合和高回報,預計預測期內聊天機器人在通訊應用程式上的使用量將會增加。

預計義大利的聊天機器人將快速成長

- 在義大利,零售、醫療保健、銀行、通訊和公共產業等面向客戶的眾多行業擴大使用聊天機器人來降低成本並提高業務效率,從而刺激了大量創新和資金籌措活動。

- 中國對醫療保健和酒店業的需求正在增加,考慮到疫情後的旅遊形勢,市場上的聊天機器人創新將進一步增加。例如,2021 年 2 月,Hotelway 為義大利客戶推出了一款飯店聊天機器人。一旦義大利恢復旅遊,該公司就準備利用 Hotelway 聊天機器人來滿足客人的需求,從而抓住市場機會。

- 市場供應商正積極在各個平台上為義大利客戶推出聊天機器人。例如,2021 年 2 月,Read It 宣布發布其聊天機器人的義大利語版本。這個聊天機器人會詢問五個不同的提示問題,可以透過網頁瀏覽器和 Telegram 通訊服務應用程式存取。這款聊天機器人是由日本開放大學 (KMi) 的 Alessio Antonini 博士與英語與創新寫作系 (OU) 的同事合作創建的。

- 同樣,2021年3月,一款名為AIDA的新聊天機器人在義大利推出,針對1型和2型糖尿病患者及其家人。 H-Novo Pharm Nordisk 聊天機器人旨在提供具體的治療和訊息,但不會取代轉診醫生。

- 在預測期內,該國醫療保健和博物館領域採用聊天機器人的情況將會增加。此外,市場供應商正在為 iOS 和 Android 設計聊天機器人。例如,2021 年 2 月,義大利數位健康科技Start-UpsPatchAi 和醫療保健提供者羅氏推出了一款虛擬助手,以與癌症患者互動並改善他們的照護。 PatchAi 智慧健康伴侶 (SHC) 是一款適用於 iOS 和 Android 的行動應用程式。它包括一個聊天機器人,鼓勵適當的自我護理並收集相關醫療記錄,供醫生在繼續治療癌症患者時參考。

- 該國對人工智慧聊天機器人的需求日益成長;這些自動化客戶服務聊天機器人可以發起對話並提供提案。因此,客戶請求將變得越來越個人化,而人工智慧聊天機器人將能夠挖掘有關個人客戶的資料,以創造更真實的客戶體驗,從而有可能提高客戶維繫。

北美和歐洲聊天機器人產業概況

北美和歐洲的聊天機器人市場高度分散且競爭激烈。該行業由人工智慧市場上幾家大型老字型大小企業以及針對較小客戶營運的小型、中型和本地公司組成。

- 2021 年 2 月—Personetics 從華平投資獲得 7,500 萬美元投資,以加速向全球金融機構推出其由人工智慧主導的個人化和參與解決方案。

- 2021 年 1 月—微軟提交了一項專利,提出了將人類以數位方式重新想像為聊天機器人的有趣可能性。 Ubergizmo 發現的一項微軟專利提出了根據特定人的輸出創建聊天機器人的可能性,而不是使用傳統方法透過廣泛用戶的對話和材料來訓練聊天機器人。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 聊天機器人的歷史與演變

第5章 市場動態

- 市場促進因素

- 通訊應用的興起

- 消費者分析需求不斷成長

- 市場挑戰

- 缺乏意識和整合複雜性

- 主要趨勢和機遇

- 選擇聊天機器人平台的通用標準

- 成本分析

- COVID-19 對市場的影響

第6章 市場細分

- 按公司規模

- 中小型企業

- 大型企業

- 按最終用戶產業

- 零售

- BFSI

- 衛生保健

- 資訊科技/通訊

- 旅遊與飯店

- 其他最終用戶產業

- 按國家分類 - 北美

- 美國

- 加拿大

- 按國家 - 歐洲

- 英國

- 德國

- 義大利

- 法國

- 其他歐洲國家

第7章 競爭格局

- 公司簡介

- Amplify.ai

- Intercom

- Personetics

- Chatfuel

- Conversable

- Gubshup

- IBM Corporation

- ManyChat

- Microsoft Corporation

- Nuance Communications Inc

- Octane.ai

- Pandorabots

- Pypestream

- Creative Virtual LTD

- Reply.ai

- Mindmeld

- Ibenta

- Meya.ai

- CM.com

- FlowXO

- Rasa NLU

- Cognigy

第8章投資分析

第9章:市場的未來

The North America and Europe Chatbot Market size is estimated at USD 8.49 billion in 2025, and is expected to reach USD 37.54 billion by 2030, at a CAGR of 34.61% during the forecast period (2025-2030).

Businesses are constantly seeking opportunities to connect with customers and ensure positive communication. Conversational chatbots are becoming companies' priority with the increasing need to develop more prominent communication platforms. During the pandemic, many enterprises opted for chatbot implementation to automate customer service.

Key Highlights

- Investing in automation solutions such as chatbots enables organizations to enhance customer service. Due to the rising use of messenger applications, the integration of chatbots into them has yielded a higher return on investment as approaching the customers on their preferred application improves user experience.

- Chatbot also allows organizations with consumer analytics. Insight into customers' behaviors can help businesses make changes to their sales, marketing, and product development strategies to boost customer acquisition, improve customer satisfaction, and continue growing the business. Chatbots can easily be integrated with social media platforms and websites for various industries, like BFSI, retail, healthcare, hospitality, etc., irrespective of the size of the enterprise.

- Due to the rising use of messenger applications, integration of chatbots into them yield a higher return on investment as approaching the customers on their preferred application improves user experience. Moreover, messenger applications allow chatbots to save the user's chat history for future purposes that enable chatbots to personalize the user experience and gain actionable insights about the user.

- Many enterprises still face troubles in understanding the need and method to use a chatbot. Low awareness regarding the benefits provided and the need for chatbots to enhance customer satisfaction and achieve consumer analytics are the reason for the same.

- During the outbreak of the COVID-19 pandemic, the chatbot has been increasingly deployed by various organizations to respond to customer queries and other related information. As different organization has adopted remote working due to the lockdown imposed in states/countries, the company are heavily dependent on chatbots to reduce the burden of customer query due to the minimal availability of customer service employees.

North America and Europe Chatbot Market Trends

Increasing Domination of Messenger Application is Driving the Market

- Chatbots on messaging apps allow organizations and brands to personally engage at a high scale with people on the platforms where they're already spending a lot of time. Moreover, chatbots can be connected to a variety of data sources via APIs to deliver information and services on demand. The potential for chatbots to improve customer experiences has companies investing in them as a new way of interacting with consumers.

- Chatbots with the ability to reasonably mimic humans allow brands to engage consumers more efficiently on these growing messaging platforms.

- Due to the rising use of messenger applications, integration of chatbots into them yield a higher return on investment as approaching the customers on their preferred application improves user experience. Most inquiries conducted on chatbots are routine ones like return policy, order history, etc. that can be answered using A.I.-powered chatbots. In some cases, brands can also use messaging to share information about products and help customers with the discovery process.

- Moreover, messenger applications allow chatbots to save the user chat history for future purposes that enable chatbots to personalize the user experience and gain actionable insights about the user. Thus, due to easy integration and higher returns, usage of chatbots over messenger applications is expected to increase over the forecast period.

Italy is Anticipated to Have Rapid Growth of Chatbots

- In Italy, chatbots are increasingly being used to reduce costs and improve operational efficiencies in a wide range of customer-facing industries, including retail, healthcare, banking, telecommunications, and utilities, with various innovations and funding activities.

- The country is witnessing increased demand for Healthcare and Hospitality, and further, the market is innovating chatbots considering the after-pandemic travel situations. For instance, in February 2021, Hotelway announced a hospitality chatbot in Italy for Italian customers. The company is ready to capitalize market after travel resumes in Italy to cater to guests' needs with the Hotelway chatbot.

- The market vendors are actively launching chatbots for Italian customers on various platforms. For instance, in February 2021, The READ-IT announced the release of the chatbot's Italian version. The chatbot asks a series of five different prompt questions and can be accessed through a web browser and the Telegram messenger service app. The chatbot was created by Dr. Alessio Antonini (KMi) of The Open University in collaboration with colleagues in English and Creative Writing (OU).

- Similarly, in March 2021, AIDA, a new chatbot launched in Italy, aimed at people with type 1 and 2 diabetes and their families. H-Novo Farm's Nordisk chatbot seeks to provide a tangible hand in the treatment and information without replacing the referring physician.

- The country is witnessing increased adoption of chatbots for healthcare and museums during the forecasted period. Further, the market vendors are designing chatbots that are compatible with both iOS and Android. For instance, in February 2021, PatchAi, an Italian digital health tech startup, and Roche, a healthcare provider, launched a virtual assistant to engage with cancer patients and improve care. PatchAi for Smart Health Companion (SHC) is a mobile app available on iOS and Android. It includes a chatbot that encourages proper self-care and collects relevant medical records that doctors can consult as they continue to treat a cancer patient.

- There is an increasing demand for AI chatbots in the country, and these Automated customer service chatbots initiate a conversation and provide suggestions. As a result, the customer's request is increasingly personalized, and AI-powered chatbots may mine data about individual customers, create more authentic customer experiences, and increase customer retention rate.

North America and Europe Chatbot Industry Overview

North American and Europe Chatbot Market is highly fragmented and competitive. The industry comprises several large and established players from the AI market and the smaller, local companies operating with smaller clientele.

- February 2021 - Personetics secures a USD 75 million investment from Warburg Pincus to accelerate the global expansion of its AI-driven personalization and engagement solutions for financial institutions.

- January 2021 - Microsoft filed a patent that raises the intriguing possibility of digitally reincarnating people as a chatbot. Instead of using the conventional method of training chatbots using conversations and material from a wide sample of users, Microsoft's patent - as spotted by Ubergizmo - raises the possibility of creating a chatbot from the output of a specific person.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 History and Evolution of Chatbots

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Domination of Messenger Applications

- 5.1.2 Increasing Demand for Consumer Analytics

- 5.2 Market Challenges

- 5.2.1 Lack of Awareness and Integration Complexities

- 5.3 Key Trends and Opportunities

- 5.4 Common Criteria for Selecting a Chatbot Platform

- 5.5 Cost Analysis

- 5.6 Impact of COVID-19 on the Market

6 MARKET SEGMENTATION

- 6.1 By Enterprise Size

- 6.1.1 Small and Medium Enterprises

- 6.1.2 Large Enterprises

- 6.2 By End-user Vertical

- 6.2.1 Retail

- 6.2.2 BFSI

- 6.2.3 Healthcare

- 6.2.4 IT and Telecom

- 6.2.5 Travel and Hospitality

- 6.2.6 Other End-user Verticals

- 6.3 By Country - North America

- 6.3.1 United States

- 6.3.2 Canada

- 6.4 By Country - Europe

- 6.4.1 United Kingdom

- 6.4.2 Germany

- 6.4.3 Italy

- 6.4.4 France

- 6.4.5 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amplify.ai

- 7.1.2 Intercom

- 7.1.3 Personetics

- 7.1.4 Chatfuel

- 7.1.5 Conversable

- 7.1.6 Google

- 7.1.7 Gubshup

- 7.1.8 IBM Corporation

- 7.1.9 ManyChat

- 7.1.10 Microsoft Corporation

- 7.1.11 Nuance Communications Inc

- 7.1.12 Octane.ai

- 7.1.13 Pandorabots

- 7.1.14 Pypestream

- 7.1.15 Creative Virtual LTD

- 7.1.16 Reply.ai

- 7.1.17 Mindmeld

- 7.1.18 Ibenta

- 7.1.19 Meya.ai

- 7.1.20 CM.com

- 7.1.21 FlowXO

- 7.1.22 Rasa NLU

- 7.1.23 Cognigy