|

市場調查報告書

商品編碼

1644607

通用類比IC:全球市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Global General Purpose Analog IC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

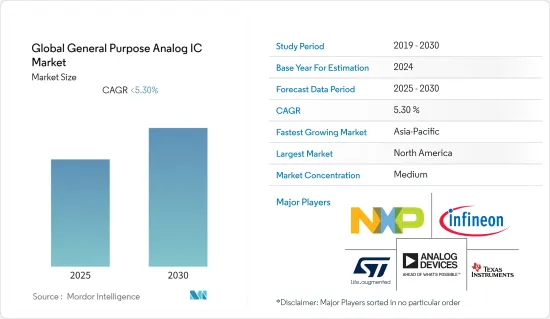

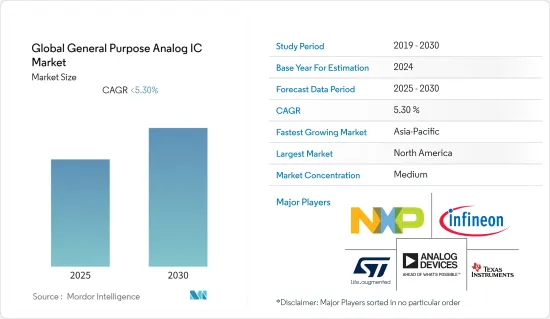

預計預測期內全球通用類比IC市場複合年成長率將略低於 5.3%。

日益增強的環保意識也推動了該行業的發展,從而導致了具有創新內置網格系統的城市的建立。這導致對處理有線和無線連接的電源管理類比IC系統的需求增加。此外,汽車產業自動化程度的提高也推動了市場成長。汽車製造商使用電源管理類比IC系統來調節過度的電池電壓波動、延長電池壽命並運行安全系統。

在預測期內,通用類比IC市場預計將受到物聯網 (IoT) 日益成長的使用所推動。類比IC使最終用戶能夠感知、理解和傳輸智慧資料。物聯網預計將推動產業成長,因為在各種即時連接的設備和應用中使用這些積體電路有很多優勢。此外,通用類比IC具有低功耗和高效的訊號處理能力,使其成為建立自動化設備生態系統的理想選擇。

此外,各個終端用戶產業擴大生產能力的需求也推動了所研究市場的成長。例如,2021年1月,日本政府透露,正在敦促台灣當局向代工晶片製造商施壓,要求增加產量。 2021 年 1 月,日本半導體供應商瑞薩電子宣布,計劃將部分製造產能藉給國內競爭對手旭化成設計的汽車半導體。此舉緩解了人們對旭化成半導體供應的擔憂。瑞薩電子生產用於晶體振盪器的類比積體電路 (IC),該晶體振盪器用作防撞系統等汽車應用中的計時裝置。

另一方面,2020 年初全球新冠疫情嚴重擾亂了研究市場供應鏈和生產。對於電路和晶片製造商來說,影響更加嚴重。亞太地區許多封裝測試工廠因人手不足而縮減甚至停止運作。這種趨勢為依賴半導體的最終產品公司帶來了瓶頸。

不過,據半導體行業協會稱,自2020年第一季以來,半導體產業已經開始復甦。儘管面臨與冠狀病毒相關的物流挑戰,亞太地區的半導體設施仍繼續正常且高產能運作。此外,韓國等國大部分半導體業務仍在持續營運,2020年晶片出口成長9.4%。預計預測期內全球半導體市場也將強勁復甦。

通用類比IC市場趨勢

工廠自動化程度的提高可望推動市場成長

自動化產業正在透過結合數位和實體製造方面來實現最佳性能,從而實現革命性的變化。此外,注重精實生產和縮短時間正在加速市場成長。

汽車產業是全球自動化製造設施中佔有重要地位的突出產業之一。據觀察,各汽車製造商的生產設施都已自動化,以保持精度和效率。此外,以電動車取代傳統汽車的趨勢日益成長,預計將增加汽車產業的需求。汽車業主要關注的問題之一是計劃工期。具有快速回報期的計劃以及低成本的自動化和創新可以幫助提高效率和增強競爭力。

在工業4.0的推動下,美國在智慧工廠自動化和工業控制系統產業不斷創新,加強在全球市場的地位。所研究市場採用智慧技術也對國民經濟產生了直接的正面影響。美國是智慧工廠解決方案供應商的關鍵市場,由於較早採用工廠自動化,預計預測期內將顯著成長。此外,該國完善的自動化基礎設施也吸引了對智慧工廠解決方案的投資。

例如,2021年7月,Peak Performance與田納西州商會/田納西州製造商協會和德國漢諾威展覽技術學院合作推出了美國首個智慧工廠研究所。智慧工廠研究所是一個美國組織,為製造商提供創新製造技術,提供聯繫、合作和認證,以幫助改善他們的製造流程。這些發展預計將提高工廠自動化的滲透率,並推動通用類比IC市場的成長。

此外,澳洲和新加坡的工業部門在過去五年中均出現衰退。例如,根據澳洲統計局的數據,2021年澳洲製造業的總增加價值(GVA)大幅下降至510億澳元。數位經濟和工業4.0受到越來越多的關注,如新加坡的“智慧國家”和“未來經濟委員會”,印尼的“2020數位化願景”,“泰國4.0”計劃,以及越南政府的“工業4.0”計劃。

此外,「中國製造2025」計畫等中國政府項目正在刺激工廠自動化和技術方面的研發和投資。由於大多數自動化設備都是從德國和日本進口的,「中國製造」舉措旨在擴大自動化硬體和設備的國內生產。此外,在2020年全國人民代表大會上,中國共產黨宣布將「中國製造2025」和「中國標準2035」計畫擴大一倍,並投資約1.4兆美元用於數位基礎設施公共支出計畫。中國的新基礎設施計畫為全球企業提供了令人興奮的機會。

降低製造成本的需求不斷成長以及物聯網和機器對機器 (M2M) 技術的應用正在刺激多個地區的市場成長。

亞太地區市場預計將實現高成長

亞太地區對家電的需求及製造能力強勁。例如,根據中國國家統計局的數據,2020年中國將生產約15億支行動電話。 2022年1-2月,行動電話產量2.1271億支。中國是全球領先的行動電話製造國之一,預計未來仍將繼續穩定發展。中國除了是行動電話製造大國之外,國內行動電話行動電話也是全球最大的手機市場之一。

此外,根據中國國家統計局數據顯示,2021年1-2月,全國電腦整機產量6,387萬台,2022年1-2月,全國電腦整機產量6,185萬台。 2022年4月,中國電腦整機產量約3,266萬台。該地區龐大的電子製造能力為通用類比積類比IC市場的成長提供了豐厚的機會。

此外,日本在採用最新技術方面處於領先地位。例如,日本政府響應德國政府的“工業4.0”計劃,宣布實施“互聯工業”,為新製造業革命注入新動力。數位化、先進生產技術和機器人等技術進步正在加速推動智慧工廠的發展,從而提高製造業的效率。

智慧工廠是一種旨在透過使用機器人收集和分析工廠內各種資料、利用物聯網實現數位化和自動化等措施,最佳化製造業務並提高整個工廠的效率和生產率的概念。例如,2021年4月1日,日本JGC株式會社推出了Next Factory Solutions部門。

此外,韓國、日本和印度等經濟體在電子、汽車和製造業方面正在經歷顯著成長,為這些區域市場提供了巨大的成長潛力。政府加大基礎設施投資,加上「印度製造」計劃,預計將推動其中使用的各種感測器的需求,從而推動研究市場的需求。印度政府的目標是到2022年將製造業佔國內生產總值(GDP)的比重從2018年的17%提高到25%。因此,製造商正在尋求採用工業 4.0 和其他數位技術來實現這一目標。自動化技術、物聯網和人工智慧的採用將有助於所調查市場的成長。

通用類比IC產業概況

全球通用類比IC市場是一個中等分散的市場,主要企業包括德州儀器公司、美國微晶片科技公司、恩智浦半導體公司和美國類比裝置公司等。企業需要不斷適應最新的技術,創新且全面的產品和工藝,並有效控制生產成本。

2022 年 5 月 - 高價值類比半導體解決方案的著名代工廠 Tower Semiconductor 宣布擴展其電源管理平台,發布其第二代尖端 65nm BCD,將操作電壓延長至 24V 並將 Rdson 降低 20%。它還為其 180nm BCD 平台增加了深溝槽隔離功能,使高達 125V 的電壓下晶粒尺寸減少高達 40%。新產品滿足了對更高電壓和功率效率電源 IC 日益成長的需求,進一步加強了 Tower 在支援電源 IC 市場的市場主導地位。

2021 年 9 月 - ADI 公司推出了新型 MAX77659 單電感多輸出 (SIMO) 電源管理 IC (PMIC),它整合開關模式降壓充電器,可快速為穿戴式裝置、可聽裝置和物聯網 (IoT) 裝置充電。 MAX77659 SIMO PMIC 只需 10 分鐘快速充電即可提供超過 4 小時的播放時間,並透過單一電感器為多個電源軌供電,從而將材料清單(BOM) 減少 60%,並將整體解決方案尺寸縮小 50%。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

- 研究框架

- 二次調查

- 初步調查

- 主要研究方法及主要受訪者

- 資料三角測量與洞察生成

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 價值鏈分析

- COVID-19 市場影響評估

- 技術簡介

第5章 市場動態

- 市場促進因素

- 製造技術的進步

- 增加最終用戶應用

- 物聯網和人工智慧的進步

- 市場限制

- 複雜且昂貴的設計

- 擴大專用類比IC的使用範圍

第6章 市場細分

- 按應用

- 介面

- 電源管理

- 訊號轉換

- 放大器/比較器

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 中國

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

第7章 競爭格局

- 公司簡介

- Texas Instruments Incorporated

- STMicroelectronics

- NXP Semiconductors

- Microchip Technology Inc.

- Onsemi

- Renesas Electronics Corporation

- Skywork Solutions Inc.

- Maxim Integrated Products Inc.

- Analog Devices

- Taiwan Semiconductor

- Infenion Technologies

第8章投資分析

第9章:未來展望

The Global General Purpose Analog IC Market is expected to register a CAGR of less than 5.3% during the forecast period.

Growing environmental awareness is also driving the industry, creating cities with innovative grid systems as an inherent feature. As a result, the demand for Power management analog IC systems to handle wired and non-wired connections is growing. Furthermore, increasing automation in the automotive industry is helping to drive market growth. Car manufacturers use Power management analog IC systems to regulate excessive battery voltage fluctuations, improve battery life, and run security systems.

During the projected period, the market for General Purpose Analog ICs is expected to be driven by the growing internet of things (IoT) usage. End users can sense, understand, and transfer intelligent data due to analog ICs. Because of the numerous advantages of using these ICs across a wide range of real-time connected devices and applications, the internet of things is predicted to promote the industry's growth. Further, general-purpose analog ICs have low power consumption and efficient signal processing capabilities, making them ideal for setting up an automated device ecosystem.

Additionally, the need to expand the production capabilities of various end-user industries is aiding the growth of the studied market. For instance, in January 2021, the Japanese government revealed that they have been asking Taiwanese authorities to press contract chipmakers to increase output. In January 2021, Japan-based semiconductor vendor Renesas Electronics announced plans to lend part of its capacity to manufacture automotive semiconductors designed by domestic rival Asahi Kasei. The move eases concerns about semiconductor supplies from Asahi Kasei. Under an arrangement, Renesas will produce analog integrated circuits (ICs) for crystal oscillators, used as timing devices in automotive applications like collision avoidance systems.

On the flip side, the outbreak of COVID-19 across the globe has significantly disrupted the supply chain and production of the studied market in the initial phase of 2020. For circuits and chipmakers, the impact was more severe. Due to labor shortages, many packages and testing plants in the Asia-Pacific region reduced or even suspended operations. This trend created a bottleneck for end-product companies that depend on semiconductors.

However, according to the Semiconductor Industry Association, after Q1 of 2020, the semiconductor industry started the recovery. Despite logistical challenges related to the coronavirus, semiconductor facilities in Asia-Pacific continued to function normally with high-capacity rates. Moreover, most semiconductor operations in various countries, such as South Korea, continued uninterrupted, and chip exports grew by 9.4% in 2020. The global semiconductor market is also expected to recover robustly during the forecast period.

General Purpose Analog IC Market Trends

Increasing Factory Automation is Expected to Drive the Market's Growth

The automation industry has been revolutionized by combining digital and physical manufacturing aspects to deliver optimum performance. Further, the focus on achieving zero waste production and a shorter time to reach the market has augmented the market's growth.

The automotive industry is one of the prominent sectors that hold a significant in the worldwide automated manufacturing facilities. It is observed that the production facilities of various automakers are automated to maintain accuracy and efficiency. Further, the growing trend of replacing conventional vehicles with EVs is expected to augment the automotive industry's demand. One of the automotive industry's primary concerns is the project's duration. Quick return-on-investment projects, along with low-cost automation and cost innovation, may help the manufacturers improve competitiveness through efficiency improvement.

Fuelled by Industry 4.0, the United States continues to innovate and consolidate its position in the global market in the smart factory automation and industrial control systems industry. The embracing of smart technologies in the studied market has also positively imparted a direct impact on the national economy. The United States is a substantial market for vendors offering solutions for Smart Factories and is expected to grow significantly over the forecast period, owing to the early adoption of factory automation. Further, the developed infrastructure for automation in the country is also attracting players to invest in smart factory solutions.

For instance, in July 2021, Peak Performance Inc., in collaboration with the Tennessee Chamber/Tennessee Manufacturers Association and the Deutsche Messe Technology Academy, launched the first Smart Factory Institute in the United States. The Smart Factory Institute is a US-based organization that will provide manufacturers with connections, collaborative ties, and certifications to help them improve their manufacturing processes by giving them access to innovative manufacturing technology. Such developments would increase the penetration rate of factory automation, thereby facilitating the growth of the general purpose analog IC market.

Additionally, Australia and Singapore have witnessed a decline in the industrial sector over the past five years. For instance, According to the Australian Bureau of Statistics, the Gross value added (GVA) by the manufacturing industry in Australia decreased significantly by AUD 51 billion in 2021. Significant initiatives have resulted in increased attention being given to the digital economy and Industry 4.0 in the region, such as Singapore's Smart Nation and Committee for the Future Economy initiatives, Indonesia's "2020 Go Digital Vision", the "Thailand 4.0" initiative, the Vietnamese government's Industry 4.0 initiatives, amongst others, which is bringing increased scope for smart factory automation.

Further, the Chinese government's programs, such as the Made in China 2025 plan, promote the use of R&D in factory automation and technologies and its investments. Also, as most of the automation equipment is imported from Germany and Japan, the 'Made in China' initiative aims to expand the country's domestic production of automation hardware and equipment. Moreover, at the 2020 National People's Congress, the CCP announced that in addition to doubling down on its Made in China 2025 and China Standards 2035 initiatives, it announced to spend approximately USD 1.4 trillion on a digital infrastructure public spending program. China's New Infrastructure initiative presents exciting opportunities for global companies.

The increase in the need to reduce manufacturing costs and applications of the Internet of Things and machine-to-machine (M2M) technologies are fueling the market's growth in several regions.

The Asia Pacific Region is Expected to Witness a High Market Growth

The Asia Pacific region has a robust demand and manufacturing capabilities for consumer electronics. For instance, according to the National Bureau of Statistics of China, almost 1.5 billion cell phones will be produced in China in 2020. The nation produced 212.71 million units of cell phones in January/February 2022. China has been one of the leading global cell phone manufacturing countries and may continue to develop steadily soon. In addition to its established status as a manufacturing country for mobiles, China's domestic mobile phone market has become one of the largest cell phone markets in the world.

Further, according to the National Bureau of Statistics of China, the production of finished computers in China amounted to 63.87 million units in Jan/Feb 2021 and 61.85 million units in Jan/Feb 2022, respectively. In April 2022, around 32.66 million finished computers were produced in China. The massive electronics manufacturing capabilities of the region offer lucrative opportunities for the growth of the general purpose analog IC market.

Further, Japan has been at the forefront of the adoption of the latest technologies. For instance, the Japanese government announced Connected Industries in response to the German government's "Industry 4.0" program, and the momentum for a new manufacturing revolution is rising. The push toward smart factories is accelerating with technological advancements such as digitalization, production technology sophistication, and robotics to achieve higher efficiency in manufacturing.

The Smart Factory is a concept that attempts to optimize manufacturing operations and increase the efficiency and productivity of the entire factory, including digitalization and automation using robots and IoT to gather and analyze various data in the factory. For instance, as of April 1, 2021, JGC Japan Corporation launched its "Next Factory Solution Department.

Moreover, as electronics, automotive, and manufacturing sectors are evolving at a significant growth rate in economies like South Korea, Japan and India, there is a tremendous potential for growth in these regional markets. An upsurge in infrastructure investment by the government, coupled with the 'Make in India' initiative, is expected to drive the demand for various sensors used in them, thereby driving the demand for the studied market. The Government of India seeks to rise the manufacturing sector's share of the gross domestic product (GDP) to 25% by 2022, from 17% in 2018. Thus, manufacturers anticipate incorporating Industry 4.0 and other digital technologies to achieve this target. The adoption of automation technologies, IoT, and AI, aids the growth of the studied market.

General Purpose Analog IC Industry Overview

The Global General Purpose Analog IC Market is a moderately fragmented market with major players like Texas Instruments Incorporated, Microchip Technology Inc., NXP Semiconductors, Analog Devices, etc. Companies must constantly adapt to the latest technologies, innovate comprehensive products and processes, and efficiently manage production costs.

May 2022 - Tower Semiconductor, a prominent foundry of high-value analog semiconductor solutions, announced the expansion of its power management platforms with the release of the second generation of its state-of-the-art 65nm BCD, expanding the operation to 24V and decreasing Rdson by 20%. The company is also adding deep trench isolations to its 180nm BCD platform, allowing up to 40% die size reduction for voltages up to 125V. The new releases address the increasing demand for higher power ICs at higher voltages and power efficiency, further enhancing Tower's leading market position in support of the power IC market.

September 2021 - Analog Devices, Inc. launched a new MAX77659 single-inductor multiple-output (SIMO) power management IC (PMIC) with an integrated switch-mode buck-boost charger, which charges wearables, hearables, and Internet of Things (IoT) devices quickly. The MAX77659 SIMO PMIC delivers over four hours of playtime after a short, ten-minute charge and uses a single inductor to power multiple rails, reducing the bill of materials (BOM) by 60% and shrinking total solution size by 50%.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption And Market Defination

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research

- 2.4 Primary Research Approach And Key Respondents

- 2.5 Data Triangulation And Insight Generation

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitutes

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of the Impact of Covid-19 on the Market

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Advancements in fabrication techniques

- 5.1.2 Increasing end-user applications

- 5.1.3 Advancements in Internet of Things and Artificial Intelligence

- 5.2 Market Restraints

- 5.2.1 Design Complexity and high costs

- 5.2.2 Increasing popularity of application specific analog Ics

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Interface

- 6.1.2 Power Management

- 6.1.3 Signal Conversion

- 6.1.4 Amplifier/Comparator

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 South Korea

- 6.2.3.4 Rest of Asia-Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Texas Instruments Incorporated

- 7.1.2 STMicroelectronics

- 7.1.3 NXP Semiconductors

- 7.1.4 Microchip Technology Inc.

- 7.1.5 Onsemi

- 7.1.6 Renesas Electronics Corporation

- 7.1.7 Skywork Solutions Inc.

- 7.1.8 Maxim Integrated Products Inc.

- 7.1.9 Analog Devices

- 7.1.10 Taiwan Semiconductor

- 7.1.11 Infenion Technologies