|

市場調查報告書

商品編碼

1644820

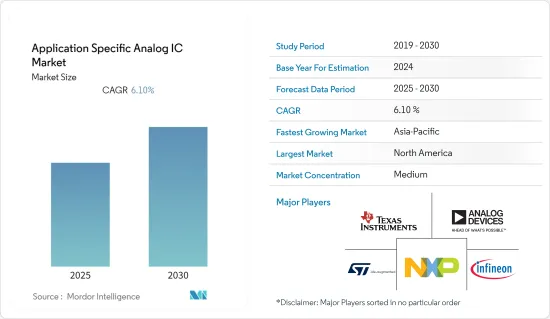

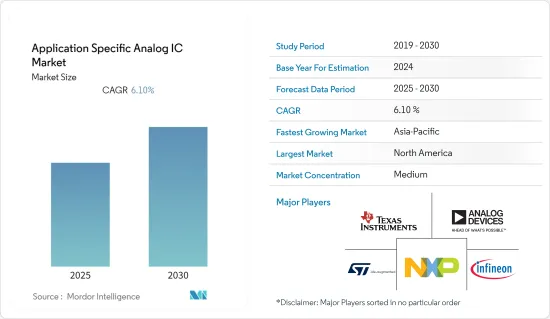

專用類比IC:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Application Specific Analog IC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計特定應用類比IC市場在預測期內的複合年成長率將達到 6.1%。

主要亮點

- 類比積體電路涉及使用雙極和場效電晶體整合技術的調變解調器類比電路的設計和分析。類比積體電路 (IC) 在整個連續訊號幅度值範圍內工作,用於射頻和音訊放大器中需要可變輸出訊號的各種功能。

- 類比IC在家用電子電器、汽車駕駛輔助系統 (ADAS) 和工業領域等各種應用領域的使用日益增加,促進了類比IC市場的成長。電動車中類比IC的採用日益增多是推動其需求的主要因素之一。類比IC對於汽車自動化至關重要,因為它們為內建人工智慧 (AI) 提供準確的資訊。

- 類比IC在汽車自動化中發揮關鍵作用,尤其是在網路通訊和自動駕駛方面,這是無人駕駛/自動駕駛汽車的關鍵要求。據納斯達克稱,無人駕駛汽車很可能在 2030 年佔領市場主導地位。

- 新冠肺炎疫情擾亂了全球供應鏈和製造業。新冠疫情及隨之而來的供應鏈不確定性對2020年和2021年的全球經濟產生了重大影響。這擾亂了金融市場,對全球供應鏈產生了不利影響,並增加了材料和營運成本,尤其是在全球汽車行業。

- 隨著物聯網在各個行業中的應用越來越廣泛,類比IC在大量即時連接設備和應用中所提供的優勢預計將推動市場成長。類比IC提供為自動化設備生態系統供電所需的動態功耗特性和訊號處理能力。

專用類比IC的市場趨勢

消費性電子產品的普及推動市場成長

- 家用電子電器中類比IC的使用日益增多,推動了需求的成長。智慧型手機和智慧型設備的日益普及正在推動對類比IC的需求。從智慧揚聲器和穿戴式裝置到語音控制電視遙控器,消費者更喜歡使用語音來與始終線上智慧電子產品互動。

- 智慧型手機佔據了很大的市場佔有率,隨著5G智慧型手機的出現,需求預計將進一步增加。三星等全球公司正在加大對半導體業務的投資,以成為 5G 智慧型手機領域的知名智慧型手機供應商。

- 根據中國資訊通訊研究院(CAICT)的報告,2022年1月,由於價格下跌提振了需求,中國支援5G網路的智慧型手機出貨量較2021年成長63.5%,達到2.66億部。報告也稱,5G智慧型手機出貨量佔中國出貨量的75.9%,高於全球40.7%的平均水準。

- 智慧型手錶和健身帶等智慧穿戴裝置的日益普及和功能的不斷增強也推動了消費性電子產品領域的成長。例如,2021 年 4 月,Fitbit 宣布推出一款名為 Luxe 的新型無按鈕健身追蹤器。相容於 Android 和 iOS 裝置。它還支援 Google Fast Pair,可以更快地與 Android 裝置配對,並支援在與行動電話配對時連接 GPS。

亞太地區將迎來顯著成長

- 智慧型手機、穿戴式裝置和汽車自動化的日益普及是推動亞太地區成長的關鍵因素。智慧型手機普及率的不斷上升使得亞太地區成為全球最大的行動市場之一。其背景是人口成長和都市化。

- 根據 GSM 協會預測,到 2025 年,五分之四以上的連線將是智慧型手機。預計這一趨勢將增加該地區智慧型手機對類比積體電路 (AIC) 的使用。

- 對物聯網平台的日益關注正在推動該地區類比IC的成長前景。隨著中國、印度和韓國等國家積極致力於加強其物聯網平台,並且這些新興國家的政府正致力於開展各種公私合作,以利用物聯網的進步來實現智慧城市、自動化和其他工業應用,亞太地區市場的發展得到了加強。

- 為了應對空氣污染和對外國石油的依賴,中國還計劃在 2022 年銷售 700 萬輛電動車。中國政府正在製定自動駕駛汽車的技術標準和行業指南。北京成為中國第一個允許自動駕駛汽車在公共道路上測試的城市。

- 由於全球半導體晶片短缺,各國都在努力提高半導體產量。例如,2021年12月,印度宣布了Semicon India計劃,旨在將印度定位為半導體製造、設計和創新領域的全球領導者。該計劃向參與矽半導體製造廠、顯示器製造廠和半導體設計的公司提供補助。

- 在政府的支持下,區域供應商正在提高生產能力,尤其是中國、印度、日本、韓國和台灣等國家,以滿足全球對類比IC日益成長的需求。

專用類比IC產業概況

全球專用類比IC市場競爭激烈,企業間的競爭日益激烈。該市場由德克薩斯公司、意法半導體公司和恩智浦半導體公司等多家大型公司組成。從市場佔有率來看,這些大公司目前佔據著市場主導地位。然而,隨著技術創新的進步,許多公司透過贏得新契約和開拓新市場來增加其市場佔有率。

- 2022 年 6 月-東芝電子元件及儲存裝置株式會社和日本半導體公司開發了一種用於汽車應用的高度可靠且多功能的帶有嵌入式非揮發性記憶體 (eNVM) 的類比平台。 0.13微米代類比平台應用於類比積體電路,提供了製程與裝置的最優組合。

- 2021 年 9 月-西門子數位工業軟體推出用於類比、數位和混合訊號 IC 設計的 mPower 完整性解決方案。新軟體為類比、數位和混合訊號 IC 提供了無限可擴展的電源完整性檢驗解決方案,甚至可以對最大的 IC 設計進行全面的功率、電壓降 (IR) 和電遷移 (EM) 分析。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 價值鏈分析

- COVID-19 市場影響

第5章 市場動態

- 市場促進因素

- 工廠自動化的成長

- 電動車迅速普及

- 物聯網 (IoT) 和人工智慧 (AI) 的進步

- 市場挑戰/限制

- 隨著應用程式的成長,設計複雜性也隨之增加

第6章 市場細分

- 按應用

- 消費者

- 電腦

- 通訊

- 車

- 工業及其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 中國

- 韓國

- 日本

- 台灣

- 其他亞太地區

- 世界其他地區

第7章 競爭格局

- 公司簡介

- Texas Instruments Incorporated

- STMicroelectronics

- NXP Semiconductors

- Microchip Technology Inc.

- Onsemi

- Renesas Electronics Corporation

- Skywork Solutions Inc.

- Maxim Integrated Products Inc.

- Analog Devices, Inc.

- Infenion Technologies

- Taiwan Semiconductor Co., Ltd.

第8章投資分析

第9章:市場的未來

The Application Specific Analog IC Market is expected to register a CAGR of 6.1% during the forecast period.

Key Highlights

- Analog integrated circuits deal with the design and analysis of modem analog circuits using integrated bipolar and field-effect transistor technologies. The analog integrated circuit (IC) operates over an entire range of continuous signal amplitude values, which are used for various functions that require variable output signals for radio-frequency and audio-frequency amplifiers.

- The increasing usage of analog ICs in various applications, such as consumer electronics, automotive driver assistance systems (ADAS), and industrial sectors, has contributed to the growth of the analog IC market. The rising adoption of analog ICs in electric automotive is one of the major factors driving its demand. Analog ICs are essential for vehicle automation, as they provide accurate information for the inbuilt artificial intelligence (AI).

- Analog ICs play a key role in the automation of automobiles, especially in networked communications and driving automation, which are the primary requirements of driverless/autonomous cars. According to the NASDAQ, driverless vehicles will likely dominate the market by 2030.

- Due to the COVID-19 outbreak, the global supply chain and manufacturing sector have been disrupted. The COVID-19 pandemic and subsequent supply chain uncertainties significantly impacted the global economy in 2020 and 2021. This has disrupted the financial markets, negatively impacted the global supply chain, and increased the cost of materials and operations, particularly within the global automotive industry.

- The growing adoption of IoT in various industries is expected to propel the market's growth, owing to the benefits offered by analog ICs, across a considerable range of real-time connected devices and applications. Analog ICs have dynamic power consumption characteristics and signal-processing capabilities required to configure an ecosystem of automated devices.

Application Specific Analog IC Market Trends

Increased Consumer Electronics Penetration to Drive the Market Growth

- The increasing usage of analog ICs in consumer electronic devices fuels the demand. The growing penetration of smartphones and smart devices is augmenting the demand for analog integrated circuits. From smart speakers and wearables to voice-controlled TV remotes, consumers love using voice to interact with the always-on smart electronic products in their lives.

- Smartphones command a significant market share, and with the advent of 5G smartphones, the demand is expected to increase even further. Global companies, like Samsung, are increasingly investing in the semiconductor business to become prominent smartphone vendors in the 5G smartphone space.

- In January 2022, China's shipments of smartphones compatible with 5G networks increased by 63.5% to 266 million in 2021 as falling prices boosted demand, according to the report by the China Academy of Information and Communications (CAICT). The report also stated that 5G smartphone shipments accounted for 75.9% of Chinese shipments, higher than a global average of 40.7%.

- The increasing adoption of smart wearables, like smartwatches and fitness bands, and their increasing functionality are also expanding the growth of the consumer electronics segment. For instance, in April 2021, Fitbit announced its new Luxe fitness tracker, a buttonless tracker. It is supported for Android and iOS devices. It also supports Google Fast Pair for pairing more quickly to Android devices and supports connected GPS while paired to the phone.

Asia-Pacific is Expected to Witness Significant Growth

- The increased adoptions of smartphones, wearables, and vehicle automation are the prime factors driving the growth of the Asia-Pacific segment. Rising smartphone adoption rates have made Asia-Pacific one of the largest mobile markets in the world. This is due to the increasing population growth and urbanization.

- As per the GSM Association, more than 4 out of 5 connections will be smartphones by 2025. This trend is expected to increase the analog integrated circuit (Analog IC) usage for smartphones in this region.

- The increasing focus on IoT platforms is boosting this region's growth prospects for analog ICs. With countries such as China, India, and South Korea, actively trying to strengthen the IoT platforms, governments of these developing countries are focusing on entering various public and private collaborations on leveraging IoT advancements for smart cities, automation, and other industrial applications, thus reinforcing the development of the Asia-Pacific segment.

- Also, China is targeting sales of 7 million EVs by 2022 to battle air pollution and dependence on foreign oil. The Chinese government has been formulating technology standards and industry guidelines for autonomous vehicles. Beijing became the country's first city to allow open road tests for autonomous cars.

- Due to the global semiconductor chip shortage, various countries are taking initiatives to boost semiconductor production. For instance, in December 2021, India announced the Semicon India Program intending to make India a global leader in semiconductor manufacturing, design, and innovation. The program will provide incentive support to companies engaged in silicon semiconductor fabs, display fabs, and semiconductor design.

- With governmental support, the regional vendors have been increasing their production capacities, especially in countries including China, India, Japan, South Korea, and Taiwan, to meet the increasing global demand for Analog ICs.

Application Specific Analog IC Industry Overview

The global application-specific analog IC market is significantly competitive and is witnessing a rise in competitiveness among companies. The market consists of various major players, such as Texas Instruments Incorporated, STMicroelectronics, and NXP Semiconductors. In terms of market share, these significant players currently dominate the market. However, with increasing technology innovations, many companies are increasing their market presence by securing new contracts and tapping new markets.

- June 2022 - Toshiba Electronic Devices and Storage Corporation and Japan Semiconductor Corporation developed a highly reliable and versatile analog platform with an embedded non-volatile memory (eNVM) for automotive applications. The 0.13-micron generation analog platform, applied to analog integrated circuits, offers an optimized combination of processes and devices.

- September 2021 - Siemens Digital Industries Software introduced the mPower integrity solution for analog, digital, and mixed-signal IC designs. The new software will provide a power integrity verification solution for unlimited scalability for analog, digital, and mixed-signal ICs, enabling ample power, voltage drop (IR), and electromigration (EM) analysis for even the largest IC designs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption And Market Definition

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitutes

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Impact Of Covid-19 On The Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Factory Automation

- 5.1.2 Rapid adoption of Electric Automobiles

- 5.1.3 Advancements in Internet of Things (IoT) and Artificial Intelligence (AI)

- 5.2 Market Challenges/Restraints

- 5.2.1 Growing Design Complexity with Increasing Applications

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Consumer

- 6.1.2 Computer

- 6.1.3 Communications

- 6.1.4 Automotive

- 6.1.5 Industrial and Others

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 South Korea

- 6.2.3.3 Japan

- 6.2.3.4 Taiwan

- 6.2.3.5 Rest of Asia-Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Texas Instruments Incorporated

- 7.1.2 STMicroelectronics

- 7.1.3 NXP Semiconductors

- 7.1.4 Microchip Technology Inc.

- 7.1.5 Onsemi

- 7.1.6 Renesas Electronics Corporation

- 7.1.7 Skywork Solutions Inc.

- 7.1.8 Maxim Integrated Products Inc.

- 7.1.9 Analog Devices, Inc.

- 7.1.10 Infenion Technologies

- 7.1.11 Taiwan Semiconductor Co., Ltd.