|

市場調查報告書

商品編碼

1644793

中國即時付款市場:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)China Real Time Payments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

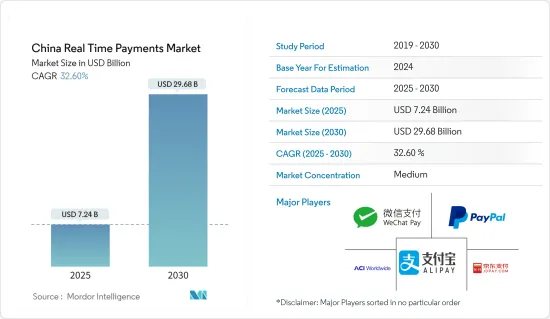

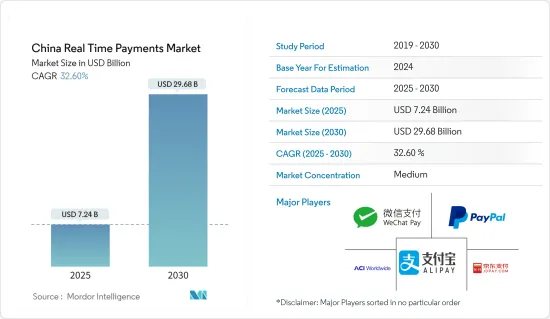

預計2025年中國即時付款市場規模為72.4億美元,到2030年預計將達到296.8億美元,預測期內(2025-2030年)的複合年成長率為32.6%。

由於網路和行動用戶數量的增加、銀行帳戶數量的增加以及即時付款需求的不斷成長,市場正在不斷擴大。

關鍵亮點

- 中國是一個人口大國,數位科技的普及率正在迅速提高,因此數位錢包的普及也正在迅速增加。此外,由於中國行動錢包(主要由支付寶和微信支付提供)的普及率很高,該地區的即時付款具有巨大的成長空間。

- 根據國家圖書館委員會目錄,到2023年,中國13億人口中約有60%將使用行動付款進行購物。該地區即時付款交易數量的大幅增加預計將進一步提振該地區即時付款市場。

- 此外,過去十年來,中國對先買後付服務的興趣飆升。推動 BNPL 發展的因素包括與 BNPL付款相關的前所未有的低利率、透過支付寶和微信支付的線上付款的成長,以及希望吸引新客戶的資金充足的金融科技新興企業。該地區的各個電子商務平台都向客戶提供 BNPL 服務。

- 隨著中國5G基礎設施的快速發展,低延遲網路的出現有望為中國即時付款市場創造新的機會。

- 然而,該地區對金融科技公司也制定了一套嚴格的規章制度,這可能會阻礙該地區即時付款市場的成長。

- 此外,新冠疫情進一步刺激了金融包容性,在中國正規金融服務擴張的同時,也推動了數位付款的大幅成長。新冠肺炎疫情爆發後,中國推出了數位貨幣——數位人民幣,以透過非接觸式付款實現無現金社會。預計這些趨勢將對 COVID-19 後所調查市場的成長產生正面影響。

中國即時付款市場趨勢

中國智慧型手機的普及推動了即時付款市場的成長

- 中國智慧型手機的高普及率支持了該國即時付款的日益普及。智慧型手機普及率的提高為中國即時付款的興起提供了必要的推動力,支付寶和微信支付等主要即時付款提供商都透過其行動應用程式提供即時付款。

- 根據GSMA預測,到2030年,中國的5G用戶數將佔全球整體的近三分之一。此外,預計到 2030 年,該技術將為中國經濟增加 2,900 億美元,使整個產業受益。

- 此外,隨著中國當地消費者擴大從現金轉向基於行動的即時付款並放棄付款卡,預計預測期內即時付款將會成長。此外,過去幾年來,擁有銀行帳戶的人口數量龐大以及網路普及率的提高進一步推動了市場的成長。

- 高網路普及率也決定了中國即時付款的成功與成長。例如,根據中國網際網路絡資訊中心(CNNIC)的數據,2023年6月中國網路使用者數量與2022年12月相比增加了1,100萬人。全國已有超過10億人可以上網。預計所有這些因素結合起來將在預測期內推動該地區的即時付款市場的發展。

P2B 市場可望成長

- 中國的即時付款已經被商家、餐廳和各類電商平台廣泛採用。智慧型手機和網路的高普及率也支持了這一點。此外,由於付款可以在幾秒鐘內快速完成,該地區的企業和個人因其即時和便利性而被透過即時付款進行的P2B交易所吸引。

- 隨著中國行動網際網路普及率高以及即時付款等快速付款結帳解決方案的出現,網路購物日益流行,這也增加了該地區的網購者數量。例如,根據CNNIC報告,截至2023年6月,中國約有8.84億人在網路上購買商品,高於2018年的6.1011億人。預計這將在預測期內進一步促進該地區的 P2B 即時交易。

- 由於這種成長預計將持續下去,預計預測期內市場將見證電子商務領域的成長趨勢。

- 此外,支付寶、微信支付等主要參與者正快速成長為電子商務平台的首選付款解決方案。這些平台為網路購物購物者提供創新的即時付款解決方案,增加了該地區的 P2B 即時交易。因此,所有這些因素的結合可能會在預測期內促進中國的P2B貿易。

中國即時付款產業概況

目前,中國的即時付款市場似乎還比較固體,只有少數參與企業能夠佔據較大的市場佔有率。主要市場參與企業正在推行各種策略,包括產品創新、收購和合作,以提供創新的付款解決方案並提高其競爭地位。主要市場參與企業包括 Paypal Holdings Inc.

- 2024 年 1 月,PayPal Holdings, Inc. 推出了重新構想的結帳和訪客結帳體驗、面向現金回饋的全新高級優惠平台以及一款新的消費者應用程式,讓客戶有更多理由賺取現金返還並使用 PayPal 購物。

- 2023年4月,江蘇省常熟市宣布計畫於5月啟動新的付款流程。一旦推出,中國東部某城市的公務員將以電子人民幣形式領取全薪。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 中國付款環境的演變

- 與中國無現金交易擴張相關的主要市場趨勢

- 新冠肺炎疫情對中國付款市場的影響

第5章 市場動態

- 市場促進因素

- 智慧型手機的普及可望推動即時付款市場

- 對更快付款和減少對傳統銀行依賴的需求日益增加

- 市場問題

- 付款詐騙和安全問題

- 嚴格金融科技監理的挑戰

- 市場機會

- 政府鼓勵數位付款成長的措施預計將推動一般民眾即時付款的成長。

- 數位付款產業的關鍵法規和標準

- 中國整體監管狀況

- 可能成為監管障礙的經營模式

- 隨著商業環境的變化而有發展空間

- 關鍵用案例和使用案例分析

- 現實世界付款交易佔比及主要國家交易量及金額區域分析

- 主要國家地區實際付款交易與非現金交易比例及交易量分析

第6章 市場細分

- 依付款類型

- P2P

- P2B

第7章 競爭格局

- 公司簡介

- AliPay(Alibaba Group)

- WeChat Pay(Tencent Holdings Ltd.)

- Paypal Holdings Inc.

- ACI Worldwide Inc.

- JDPay.com(JD.com)

- FIS Global

- Mastercard Inc.

- VISA Inc.

- Fiserv Inc.

- Apple Inc.

第8章投資分析

第9章:未來市場展望

The China Real Time Payments Market size is estimated at USD 7.24 billion in 2025, and is expected to reach USD 29.68 billion by 2030, at a CAGR of 32.6% during the forecast period (2025-2030).

In view of the increasing number of Internet and mobile users, the growing number of bank accounts, and the increasing need for instant payments, the market is growing.

Key Highlights

- China has a one of large population with booming access to digital technology, and the country has quickly adopted digital wallets, which are now a dominant force in the china payments market. In addition, there is a lot of room for realtime payments to grow in the region, given the high level of mobile wallet adoption in China, mainly offered by AliPay and WeChat Pay.

- According to National Library Board Catalogue, around 60 percent of China's 1.3 billion population will have purchased via mobile payment by 2023. The significant increase in the number of transactions of real-time payments in the region is further expected to boost the real-time payments market in the region.

- Furthermore, there's been a surge of interest in Buy now pay later services in China over the last decade. A few factors driving BNPL are unprecedentedly low-interest rates associated with BNPL payments, the growth of online payments through Alipay and WeChat Pay, as well as highly funded fintech startups that are looking to attract new clients. The BNPL services are provided by various ECommerce Platforms in the region to their customers.

- With the country's rapid development of 5G infrastructure, new opportunities are anticipated to emerge in the Chines real-time payments market owing to the availability of a low latency network.

- However, a series of stringent rules and regulations on fintech companies has also been implemented in the region, which may hamper the growth of the real-time payments market in the region.

- Moreover, the COVID-19 pandemic has further spurred financial inclusion, driving a large surge in digital payments amid the expansion of formal financial services in China. After the COVID-19 pandemic, China launched its digital currency, the digital Yuan or RMB, to become a cashless society using contactless payments. Such trends are anticipated to positively influence the studied market's growth post-COVID-19.

China Real Time Payments Market Trends

Increasing Penetration of Smartphone across China to Propel the Real Time Payments Market Growth

- The high smartphone penetration across the region supports the increasing adoption of real-time payments in China. As major real-time payment providers such as AliPay and WeChat Pay offers real-time payments through mobile applications, increased smartphone penetration is a much-needed push to flourish real-time payments in China.

- According to GSMA, 5G subscriptions in China will likely account for nearly a third of the global total by 2030. Furthermore, the technology is expected to add USD 290 billion to the Chinese economy in 2030, spreading benefits across industries.

- Further, with consumers in Mainland China increasingly shifting from cash to mobile-based real-time payments and skipping payment cards, real-time payments are expected to grow over the forecast period. Moreover, the high banked population and increasing internet penetration over the past few years further fuel the growth of the market.

- The country's high internet penetration also governs the success and growth of real-time payments in China. For instance, according to China Internet Network Information Center (CNNIC), China's internet population grew by 11 million in June 2023 compared to December 2022. Over one billion people had access to internet in the country. All of the factors combined are expected to boost the real-time payments market in the region over the forecast period.

P2B Segment is Expected to Witness the Growth

- China's real-time payments are adopted widely by shopkeepers, restaurants, and various E-commerce platforms. This is further supported by high smartphone and internet penetration. Additionally, fast and immediate payments in seconds are attracting businesses and individuals in the region to perform P2B transactions through real-time payments owing to the immediacy and ease of convenience.

- The growing popularity of online shopping increased the number of online shoppers in the region, supported by high mobile internet penetration and fast payment checkout solutions such as real-time payments in China. For instance, as reported by CNNIC, there were about As of June 2023, about 884 million people in China had purchased goods online, compared to 610.11 million in 2018. This is further expected to boost the P2B real-time transaction in the region over the forecast period.

- With this growth anticipated to sustain, the studied market is projected to witness an upward growth trend in the e-commerce segment during the forecast period.

- Moreover, major players such as Alipay and WeChat Pay rapidly grow as preferred payment solutions for E-commerce platforms. These platforms offer innovative real-time payment solutions to online shoppers, increasing the P2B real-time transactions in the region. Hence, all these factors combined will likely boost the P2B transactions in China over the forecast period.

China Real Time Payments Industry Overview

The China real-time payments market appears to be semi-consolidated, as few players currently hold significant market share. Major market players provide innovative payment solutions and are involved in various strategies, such as product innovations, acquisitions, and partnerships, among others, to gain a competitive edge. Some key market players include Paypal Holdings Inc.,

- In Januray 2024, PayPal Holdings, Inc introduces reimagined checkout and guest checkout experiences, new advanced offers platform for merchants, and new consumer app to earn cash back and give customers more reasons to shop with PayPal

- In April 2023, Changshu, located in the province of Jiangsu, announced its plans to start a new payment process in May, which is expected to be the biggest rollout of the currency, also known as the e-CNY, in China. After the launch, In a city in eastern China, government workers will receive full pay in the electronic yuan.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness- Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Evolution of the payments landscape in China

- 4.4 Key market trends pertaining to the growth of cashless transaction in China

- 4.5 Impact of COVID-19 on the payments market in China

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Penetration of Smartphone is Expected to Boost the Real Time Payments Market

- 5.1.2 Growing Need For Faster Payments and Falling Reliance on Traditional Banking

- 5.2 Market Challenges

- 5.2.1 Payment Fraud and Security Issues

- 5.2.2 Challenges Related to Strict FinTech Regulations

- 5.3 Market Opportunities

- 5.3.1 Government Policies Encouraging the Growth of Digital Paymentis expected to aid the growth of Real Time Payment methods amongst commoners

- 5.4 Key Regulations and Standards in the Digital Payments Industry

- 5.4.1 Regulatory Landscape Across China

- 5.4.2 Business Models with Potential Regulatory Roadblocks

- 5.4.3 Scope for Development in Lieu of Evolving Business Landscape

- 5.5 Analysis of major case studies and use-cases

- 5.6 Analysis of Real Payments Transactions as a share of all Transactions with a regional breakdown of key countries by volume and transacted value

- 5.7 Analysis of Real Payments Transactions as a share of Non-Cash Transactions with a regional breakdown of key countries by volumes

6 Market Segmentation

- 6.1 By Type of Payment

- 6.1.1 P2P

- 6.1.2 P2B

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 AliPay (Alibaba Group)

- 7.1.2 WeChat Pay (Tencent Holdings Ltd.)

- 7.1.3 Paypal Holdings Inc.

- 7.1.4 ACI Worldwide Inc.

- 7.1.5 JDPay.com (JD.com)

- 7.1.6 FIS Global

- 7.1.7 Mastercard Inc.

- 7.1.8 VISA Inc.

- 7.1.9 Fiserv Inc.

- 7.1.10 Apple Inc.