|

市場調查報告書

商品編碼

1632095

印度的即時付款-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)India Real Time Payments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

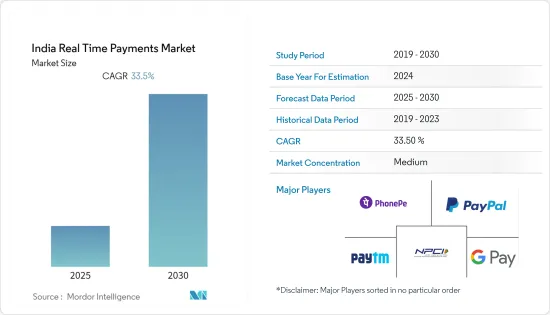

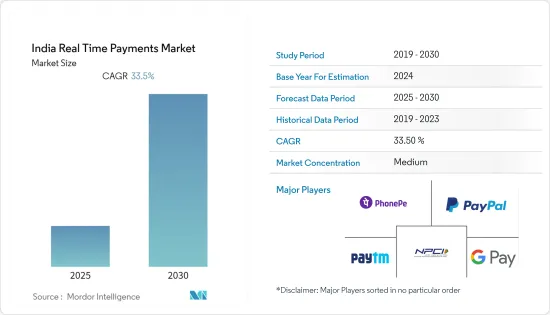

印度即時付款市場預計在預測期內複合年成長率為33.5%

主要亮點

- 在印度,連網設備的使用呈指數級成長。例如,政府計劃在 BharatNet 計劃下於 2025 年對每個村莊進行光纖最佳化,透過引入透過行動電話獲取金融服務的數位方式,我們能夠對系統帶來決定性的變化,從而使印度的銀行業受益。憑藉即時付款系統,印度頂級銀行推出了創新的互動式行動銀行應用程式,該應用程式不僅直覺,而且注重客戶滿意度。

- 從2010年到2020年的10年可以稱為印度付款進化的十年。過去三十年來,印度一直在改變其付款系統。傳統銀行的彈性下降以及透過數位轉型實現的即時付款系統的崛起是印度從以物易物系統到統一付款介面(UPI)付款系統取得長足進步的關鍵原因。

- 印度中央銀行(RBI)發揮了關鍵作用並監督了所有這些變化。例如,2022 年 3 月,印度儲備銀行 (RBI) 宣布了 2022-23 年數位化重點計畫。央行公佈了數位平台貸款標準,推出了央行數位貨幣,推動成立了75家數位銀行,並實施了POS終端地理標記框架。央行提案了多項措施,以實現數位付款和金融科技領域的結構性改革,這對該國即時付款的成長產生了積極影響。

- 引入快速付款系統,例如允許消費者每天 24 小時轉帳的 IMPS 和 UPI、Bharat付款支付系統 (BBPS)、使付款申請和購買商品和服務變得更容易的 PPI 以及電子通行費的引入。 ,印度已採取措施採用創新的付款系統,為受益人提供即時信貸。

- 這些付款系統的便利性很快就得到了認可,因為它們為消費者提供了現金和紙本付款的替代方案。付款生態系統中擴大使用非銀行金融科技公司作為 PPI 發行人、BBPOU 和 UPI 平台上的第三方應用程式供應商,進一步加速了數位付款在該國的採用。

- COVID-19 的疫情對印度的即時付款系統產生了各種影響。由於封鎖,電子錢包在申請付款、P2P 匯款和基本服務 P2B付款的使用增加。隨著交易轉移到網上,並與銷售必需品的小商店合作,這些商店現在正試圖在網上建立業務,付款閘道的交易量有所增加。

- 網路詐騙,包括資料庫濫用、身分盜竊、網路釣魚攻擊和卡片付款相關詐騙,在印度很常見,而且在疫情期間此類欺詐數量有所增加。根據微軟 2021 年全球技術支援詐騙調查報告,印度消費者遭受的線上詐騙程度明顯較高。 31%的印度人因詐騙而損失過錢,過去一年的詐騙率為69%,為全球最高。低網路頻寬電子商務需要複雜的步驟才能完成交易,即使是最輕微的故障也會擾亂整個過程。

印度即時付款市場趨勢

P2B 細分市場佔據主要市場佔有率

- 印度 P2B 交易的即時付款解決方案主要由印度國家付款公司 (NPCI) 管理。零售付款領域已經發展並成熟,由 NPCI 營運和實施各種系統。為了與每個印度人的生活緊密相連,NPCI 支持 RuPay 卡計畫、IMPS、UPI、國家自動清算所 (NACH)、支援 Aadhaar 的支付系統 (AePS)、Aadhaar 支付橋系統 (APBS)、國家電子收費系統(NETC)、巴拉特帳單支付系統(BBPS)以及各種創新零售付款產品。此外,NPCI 還與國際網路合作夥伴(日本信用局、Discover Financial Services、中國銀聯)合作,為印度作為全球解決方案提供商的即時付款系統鋪平了道路。

- Aadhaar 是一個獨特的印度身分證號碼,自 2009 年在印度推出以來,已向超過 1.27 億人發放。支援 Aadhaar 的 e-KYC(電子客戶資訊)帶動了印度即時付款的指數級成長。 Aadhaar 也用於驗證和處理向商家 (P2B) 的付款以及透過商業通訊方 (BC) (B2B) 進行的交易。

- 印度UPI付款系統已成為印度最全面的付款工具。根據 RBI資料,UPI 平台已註冊超過 2.6 億不重複訪客和 5,000 萬商家。 2022 年 5 月,透過 UPI 處理了約 594.6.3 千萬盧比的交易(1,004,000 印度盧比),包括 (P2B) 和 (P2C) 交易。 UPI 透過用戶的簽帳金融卡連接儲蓄和活期帳戶來促進交易,是印度開發即時付款解決方案的關鍵因素之一。

- 此外,印度儲備銀行於 2021 年 1 月宣布,獎勵在付款部各邦和三級至六級中心部署付款基礎設施,如 mPoS(行動 POS)、實體 POS、2D碼等。 PIDF)計劃。該計劃旨在三年內(到 2023年終)部署 90,000 個 POS(銷售點)終端和快速回應(QR)碼,以適應 P2B 交易的成長,目的是為商家提供便利的付款方式。

- 根據 ACI Worldwide 發布的報告,2021 年印度即時付款交易量全球領先,交易量達 486 億筆,佔全球貿易額的 40% 以上。印度的即時付款交易筆數約為中國的2.6倍,約為美國、法國、英國、加拿大和德國即時付款交易筆數總合的7倍。

技術進步將進一步促進即時付款

- 由於智慧型手機用戶數量的增加和備受期待的 5G 技術,印度在即時行動付款市場處於領先地位。例如,印度國家付款公司(NPCI)為UPI Lite服務推出了設備錢包,以實現離線付款。 2022 年 2 月,UPI 處理了 45.2749 億筆線上交易,價值 8526843 盧比。提供離線服務的UPI Lite預計將進一步提振印度的即時付款市場。

- 為了升級印度的付款系統,印度儲備銀行為金融和銀行部門提供了一個通訊主幹網,稱為基於衛星的印度金融網路 (INFINITE),由 VSAT 技術提供支援。 IDRBT 的任務是設計和開發此通訊網路。封閉式用戶群組 (CUG) 網路使用 VSAT 技術。分時多工址 (TDMA)/分時多工(TDM) 網路具有用於資料的星形拓撲和用於視訊和語音流量的 DAMASCPC(按需分配多址-每載波單通道)網路。

- 印度金融系統使用非接觸式技術。非接觸式技術是卡片付款生態系統的創新之一,允許持卡人「一觸即走」。這些卡片正變得越來越受歡迎。為了方便此類卡的使用,RBI 對使用支援近距離場通訊(NFC) 的 EMV 晶片和 PIN 卡進行持卡 (CP) 交易收取少量費用(2,000 印度盧比)。自 2021 年 1 月 1 日起,該限額已修訂為 5,000 印度盧比。

- IMPS是2010年推出的24/7「快速付款」系統,作為P2P模式之間的付款方式被廣泛接受。印度是繼英國、韓國和南非之後第四個引入此類付款系統的國家。該系統提供收款人和發款人之間的即時資金轉賬,銀行間淨付款是延期的。該系統促進推播交易,單筆交易限額為 2,000 印度盧比。

- UPI(統一支付介面)促進即時推拉匯款、公用事業收費付款、基於2D碼(掃描和支付)的付款、商家付款等。在交易過程中,UPI PIN 使用公開金鑰基礎建設(PKI) 技術進行加密。 UPI 框架由作為網路和付款服務供應商的 NPCI、作為付款系統提供者 (PSP) 的銀行、發卡銀行和受益銀行以及 Google Pay 和 WhatsApp 等 TPAP 組成。在印度市場,非銀行 PPI 發行人也提供這種便利。

印度即時付款產業概況

隨著消費者偏好的快速變化,這個市場已成為利潤豐厚的選擇,並吸引巨額投資。由於新進入者的加入,市場正走向碎片化,因為存在巨大的成長潛力。服務供應商正在夥伴關係推動產品創新。

- 2022 年 6 月 - WhatsApp 向印度用戶提供 1.35 美元現金回饋,並獲得 NPCI 許可將其用戶群擴大到 1 億人。

- 2022 年 6 月—印度 Unicorn Pine Labs Fintech 以 7,000-7,500 萬美元收購 API 基礎設施供應商 Setu。收購完成後,Setu 的品牌形象、團隊、業務和客戶將保持完整。 Setu 是一家應用程式介面 (API) 基礎設施供應商,提供申請付款、儲蓄、信貸、付款和其他服務。

- 2022 年 3 月 - PhonePe 收購 GigIndia 以加強其企業服務。此次收購將使企業和企業能夠利用 GigIndia 的自由微型企業家網路接觸更多客戶並擴大其分銷管道。 PhonePe 計劃今年再進行兩到三項收購,以加強其技術和金融平台業務。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 國內付款環境的演變

- 與日本無現金交易擴張相關的主要市場趨勢

- COVID-19 對國家付款市場的影響

第5章市場動態

- 市場促進因素

- 智慧型手機的普及

- 減少對傳統銀行業務的依賴

- 提高便利性

- 市場問題

- 付款詐騙

- 對現金的依賴

- 市場機會

- 政府鼓勵數位付款成長的措施預計將導致一般民眾即時付款的成長

- 數位付款產業的關鍵法規和標準

- 世界各國的監管狀況

- 可能造成監管障礙的經營模式

- 經營狀況變化帶來的發展空間

- 關鍵案例和使用案例分析

- 主要國家真實支付交易在所有交易中的佔比以及交易量和交易金額的區域分析

- 主要國家依地區真實支付交易與非現金交易比例及交易量分析

第6章 市場細分

- 按付款類型

- P2P

- P2B

第7章 競爭格局

- 公司簡介

- Temenos AG

- ACI Worldwide

- Google LLC(Alphabet Inc.)

- Paypal Holdings Inc.

- Mastercard Inc.

- Paytm

- NPCI

- VISA Inc.

- Razorpay Technologies Private Limited

- Volante Technologies Inc.

- PhonePe Private Limited

第8章投資分析

第9章 市場未來展望

簡介目錄

Product Code: 91276

The India Real Time Payments Market is expected to register a CAGR of 33.5% during the forecast period.

Key Highlights

- India has made tremendous growth when it comes to access to Internet-enabled devices in the country. For instance, the government's plan to fiberize all villages by 2025 under the BharatNet program has benefitted the banking sector in India, which has been able to make crucial changes in banking mechanisms by introducing digital means of accessing financial services through mobile phones. With instant payment systems, top banks in India have launched not just intuitive but also innovative and interactive mobile banking applications with features revolving around customer satisfaction.

- The decade of 2010-2020 can be termed as the decade of payment evolution in India. India has been transforming its payment systems over the past three decades. From barter systems to Unified Payments Interface (UPI) payment systems, India has come a long way primarily because of the failing resilience of traditional banking and the rise of Real-time Payment systems through digital transformation.

- India's central bank (RBI) plays a key role and has been supervising all these transformations. For Instance, in March 2022, RBI rolled out a digital-heavy plan for 2022-23. The central bank announced lending norms for digital platforms, rolled out a central bank digital currency, facilitated the setting up of 75 digital banks, and implemented a geo-tagging framework for POS terminals. It has proposed several measures to bring about structural reforms in the digital payments and fintech space, which has positively influenced the real time payments growth in the country.

- India has worked around its policies towards the introduction of innovative payment systems that provide instant credit to the beneficiary, with the launch of fast payment systems such as IMPS and UPI that are available to consumers round the clock for undertaking fund transfers and the introduction of mobile-based payment systems such as Bharat Bill Payment System (BBPS), PPIs to facilitate payment of bills and purchase of goods and services and National Electronic Toll Collection (NETC) to facilitate electronic toll payments.

- The convenience of these payment systems ensured rapid acceptance as they provided consumers with an alternative to using cash and paper for making payments. The facilitation of non-bank FinTech firms in the payment ecosystem as PPI issuers, BBPOUs, and third-party application providers in the UPI platform has furthered the adoption of digital payments in the country.

- The Covid-19 pandemic has had a mixed impact on the real-time payment system in India. The e-wallets saw increased traction for bill payments, P2P transfers, and P2B payments for essential services owing to the lockdown. Payment gateways saw an increase in volumes as transactions went online, tieing up with small stores selling essentials that are currently seeking to establish an online presence.

- Online frauds, including database exploits, ID thefts, phishing attacks, and card payment-related scams, are common in India, and the number has only increased during the pandemic. As per Microsoft's Global Tech Support Scam Research 2021 Report, consumers in India experienced a fairly high online fraud. 31% of Indians lost money through a scam making it the highest global encounter rate of 69% in the past year. Low internet bandwidth E-commerce entails a set of complex steps while completing a transaction, and even a minor glitch can terminate the task.

India Real-Time Payments Market Trends

P2B Segment Will Hold Significant Market Share

- The real-time payment solutions for P2B transactions in India are majorly governed by the National Payments Corporation of India (NPCI). The retail payments space developed and matured with various systems operated and introduced by NPCI. To touch the lives of every Indian, NPCI has rolled out a variety of innovative retail payment products such as RuPay card scheme, IMPS, UPI, National Automated Clearing House (NACH), Aadhaar-enabled Payments System (AePS), Aadhaar Payments Bridge System (APBS), National Electronic Toll Collection(NETC), and Bharat bill pay system(BBPS). In addition, NPCI's alliance with international network partners (Japan Credit Bureau, Discover Financial Services, and China Union Pay) has paved the way for a global solution provider for the Indian real-time payment system.

- Aadhaar, a unique identification number in India issued to over 127 crore individuals Since its launch in 2009 in the country. Aadhaar-enabled e-KYC (electronic-Know Your Customer) has resulted in exponential growth of real-time payments in India. The use of Aadhaar also has leveraged authentication and processing of payments to merchants (P2B) and transactions made through Business Correspondents (BCs) (B2B) segments.

- India's UPI payment system has become the most inclusive mode of payment in India. As per the RBI data, over 26 crore unique users and five crore merchants are onboarded on the UPI platform. In May 2022, approximately 594.63 crores of transactions (INR 10.40 lakh crore) were processed through UPI, which includes (P2B) and (P2C) transactions. UPI facilitates transactions by linking Savings / Current Accounts through Debit Cards of users and is one of the key factors for developing real-time payment solutions in India.

- Further, the Reserve Bank of India operationalized the Payments Infrastructure Development Fund (PIDF) Scheme in January 2021 to incentivize the deployment of payment acceptance infrastructures such as mPoS (mobile PoS), physical Point of Sale (PoS), Quick Response (QR) codes in the North Eastern States and Tier-3 to 6 centers. The Scheme had targeted 90 lakh Points of Sale (PoS) terminals and Quick Response (QR) codes to be deployed over three years (till end-2023) in response to the rise in number of P2B transactions, aiming to ease the payment mode for merchants.

- According to the report published by ACI Worldwide, India is leading the world in real-time payment transactions in the year 2021, with 48.6 billion transactions representing more than 40% of the global commerce emerging from the country. The number of real-time transactions in India was almost 2.6 times higher than that of China and approximately seven times higher than the combined real-time payments volume of the US, France, the UK, Canada, and Germany.

Technological advancement will Further Drive the Real Time Payment Transfer

- With the rise in smartphone users and much-awaited 5G technology, India has been driving the real-time mobile payment market. For instance, The National Payments Corporation of India (NPCI) launched the UPI Lite service on-device wallet to enable people to conduct offline payments. In February 2022, UPI processed 4,527.49 million online transactions worth Rs 8,26,843. UPI Lite providing offline services will further boost the instant payment market in India.

- To upgrade the country's payment systems, RBI provided a communication backbone in the form of the satellite-based Indian Financial Network( INFINITE) using VSAT technology to the financial and banking sectors. IDRBT was entrusted with the task of designing and developing the communication network. The Closed User Group (CUG) Network uses VSAT technology. It is Time-division multiple access (TDMA)/Time-division multiplexing (TDM) network with STAR topology for Data and with Demand Assigned Multiple Access-Single Channel Per Carrier (DAMASCPC) overlaying with mesh topology for video and voice traffic.

- Indian Financial system uses contactless technology, one of the innovations in the card payments ecosystem which allows cardholders to "Tap and Go." These cards are becoming increasingly popular. To provide convenience in the use of such cards, RBI permitted relaxation in Additional Factor of Authentication (AFA) in case of Card Present (CP) transactions using Near Field Communication (NFC)-enabled EMV Chip and PIN cards for small values(INR 2,000). The limit was revised to INR 5,000, effective from January 01, 2021.

- IMPS is a 24*7 'fast payments' system introduced in 2010 and has become a widely accepted payment method between P2P modes. India was the fourth country after the UK, South Korea, and South Africa to introduce such a payment system. The system provides real-time funds transfer between the beneficiary and remitter with a deferred net settlement between banks. The system facilitates push transactions with a per-transaction limit of INR 2 lakhs.

- Unified Payments Interface (UPI) facilitates immediate money transfer through push and pull payments, utility bill payments, QR code (scan and pay) based payments, merchant payments, etc. While transacting, the UPI PIN is encrypted using Public Key Infrastructure (PKI) technology. UPI's framework comprises NPCI as network and settlement service provider, banks as Payment System Providers (PSPs), and issuer banks and beneficiary banks, apart from TPAPs such as Google Pay and WhatsApp. Non-bank PPI issuers have also provided this facility in the Indian market.

India Real-Time Payments Industry Overview

With consumer preferences changing rapidly, the market has become a lucrative option and thus, has attracted a huge amount of investments. Due to the huge growth potential, the market is moving towards fragmentation due to the new entrants. The service providers are engaging in partnerships to promote product innovation.

- June 2022 - WhatsApp has been offering Indian users USD 1.35 cashback and was allowed by the NPCI to expand its user base to 100 million, an incentive for the users to leverage WhatsApp Payments for sending money to family members, friends, and more.

- June 2022 - Unicorn Pine Labs Fintech from India Acquires API infrastructure provider Setu in a USD 70-75 Mn deal. After the deal completion, Setu will keep its brand identity, teams, business, and customers. Setu is an application programming interface (API) infrastructure provider that offers services across bill payments, savings, credit, and payments.

- March 2022 - PhonePe acquires GigIndia, to strengthen enterprise offerings. The acquisition will allow it to leverage GigIndia's network of freelance microentrepreneurs to help enterprises and corporates reach more customers and scale their distribution channels PhonePe is eyeing 2-3 more acquisitions this year to boost its tech and financial platform play. Individuals who are aware of the company's internal plans told ET on condition of anonymity.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Evolution of the payments landscape in the country

- 4.4 Key market trends pertaining to the growth of cashless transaction in the country

- 4.5 Impact of COVID-19 on the payments market in the country

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Smartphone Penetration

- 5.1.2 Falling Reliance on Traditional Banking

- 5.1.3 Ease of Convenience

- 5.2 Market Challenges

- 5.2.1 Payment Fraud

- 5.2.2 Existing Dependence on Cash

- 5.3 Market Opportunities

- 5.3.1 Government Policies Encouraging the Growth of Digital Payments is expected to aid the growth of Real Time Payment methods amongst commoners

- 5.4 Key Regulations and Standards in the Digital Payments Industry

- 5.4.1 Regulatory Landscape Across the World

- 5.4.2 Business Models with Potential Regulatory Roadblocks

- 5.4.3 Scope for Development in Lieu of Evolving Business Landscape

- 5.5 Analysis of major case studies and use-cases

- 5.6 Analysis of Real Payments Transactions as a share of all Transactions with a regional breakdown of key countries by volume and transacted value

- 5.7 Analysis of Real Payments Transactions as a share of Non-Cash Transactions with a regional breakdown of key countries by volumes

6 MARKET SEGMENTATION

- 6.1 By Type of Payment

- 6.1.1 P2P

- 6.1.2 P2B

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Temenos AG

- 7.1.2 ACI Worldwide

- 7.1.3 Google LLC (Alphabet Inc.)

- 7.1.4 Paypal Holdings Inc.

- 7.1.5 Mastercard Inc.

- 7.1.6 Paytm

- 7.1.7 NPCI

- 7.1.8 VISA Inc.

- 7.1.9 Razorpay Technologies Private Limited

- 7.1.10 Volante Technologies Inc.

- 7.1.11 PhonePe Private Limited

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219