|

市場調查報告書

商品編碼

1636617

亞太地區即時付款:市場佔有率分析、產業趨勢與成長預測(2025-2030)Asia Pacific Real Time Payment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

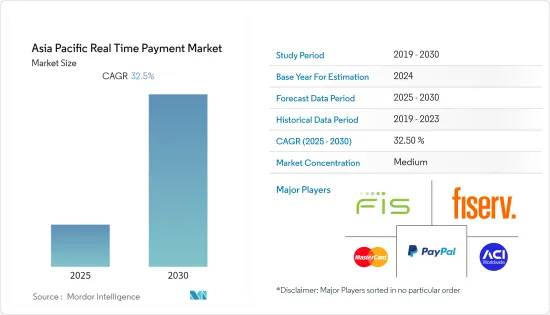

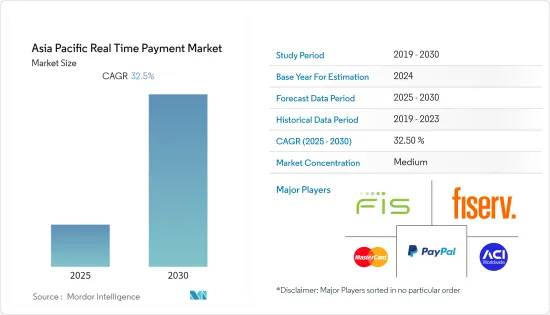

亞太地區即時付款市場預計在預測期內複合年成長率為32.5%。

主要亮點

- 印度、中國、泰國和越南等新興國家的消費者、企業和政府正在採用更快的付款,以提高便利性和財務安全性,對解決方案的需求不斷增加。

- 全球行動電話的普及以及供應商和買家之間快速清算和結算金融交易的日益成長的需求支撐了這個市場。此外,由於網路商家和零售店主對即時付款解決方案的接受程度不斷提高,市場預計將會發展。這些系統具有優於其他電子方法的優勢,例如更快的交易速度、即時通訊、廣泛的資料交易以及對供應商和企業組織的 24/7 存取。

- 此外,無現金交易的增加以及消費者對線上和行動銀行等系統的日益偏好也將刺激行業擴張。由於 Samsung Pay、Google Pay 和 Apple Pay 等金融科技的普及,該行業可能會大幅成長。此外,隨著這些服務/服務機構和當地銀行擴大聯合努力並推出諸如提供快速預付款和無貨幣付款等先進舉措,該行業預計將進一步加速。

- 根據 ACI 全球與經濟與商業研究中心的研究「Globaldata 的 2022 年即時黃金時段」(Cebr),泰國是世界第四大國家。泰國是全球即時交易第四大國家,交易量達 97 億筆。 2021年,採用即時付款預計將為企業和消費者節省13億美元,帶來60億美元的額外經濟產出,相當於該國GDP的1.12%。

- COVID-19 造成的封鎖增強了電子商務和食品應用程式的實力,也推動了即時付款業務的發展。例如,根據ACI的數據,2021年即時付款佔印度付款交易總額的31.3%。這是由於商家接受基於 UPI 的行動付款應用程式和2D碼付款,以及在 COVID-19 大流行期間數位付款的使用增加。

亞太即時付款市場趨勢

印度在貿易量和經濟成長方面處於領先地位

- ACI研究顯示,預計2026年即時付款將帶動印度GDP成長459億美元,屆時即時付款交易量將超過2,060億筆。

- ACI 預計,2021 年印度即時付款交易量將達到 486 億筆,是中國(180 億筆)的三倍多,是美國、加拿大、英國、法國和德國(75 億筆)的近七倍。

- 由於基於UPI的行動付款應用程式和2D碼付款的推出,以及在COVID-19大流行期間數位付款的使用增加,即時付款佔去年付款交易總額的比例達到了31.3%。隨著消費者迅速從現金支付轉向基於行動的即時付款並且不再使用支付卡,預計到 2026 年,即時付款在付款交易總量中的佔有率將上升至 70% 以上。

- 根據為全球零售商、銀行和資本市場組織提供技術解決方案的知名供應商 FIS 的最新民意調查,COVID-19 大流行導致印度每天的即時交易量增加了一倍。

- 根據ACI Worldwide提供的報告,與美國、英國、加拿大和澳洲等其他市場相比,印度的即時付款市場非常發達。題為《2022年即時支付黃金時代》的報告顯示,印度的即時付款包括即時付款服務(IMPS)和通用支付介面(UPI),近年來使用量不斷增加。這些也被認為是印度即時付款的關鍵驅動力。

- 截至 2022 年 4 月,印度通用支付介面 (UPI) 交易額預計將超過 9.8 兆印度盧比。雖然比上個月略有成長,但與 2018 年 8 月相比大幅成長,當時 UPI 交易額不到 5,500 億印度盧比。 UPI 是印度國家付款公司 (NPCI) 於 2016 年推出的平台。它允許 PhonePe 和 Google Pay 等付款服務供應商的用戶將其銀行與 NPCI 作為交換機連接並匯款。它比之前的 IMPS 等交易方法更容易使用。

智慧型手機和網路的普及正在推動市場。

- 由於需要不斷連接到網際網路,智慧型手機已成為印度乃至全球最受歡迎的設備。人們,尤其是那些生活在都市區、生活方式忙碌的人們,習慣在旅途中進行溝通。由於可支配收入的增加和便捷的融資選擇(如 EMI),擁有智慧型手機不再是奢侈品。對於像印度這樣擁有龐大勞動人口的新興國家來說,這是現實。此外,行動電話製造商之間的激烈競爭和技術進步繼續壓低智慧型手機的價格,提高購買力和銷售量。

- 亞太地區通訊業者正在利用行動網路和服務的規模和效用,幫助企業和小型企業採用符合工業 4.0 目標的新數位解決方案,其中包括: 5G 和物聯網將發揮重要作用。該地區第二波 5G 網路部署已經開始,印度、印尼和馬來西亞正在進行多項 5G 相關活動。

- 在其中一些市場引入 5G 將有助於為低收入用戶大規模製造更實惠的 5G 設備,並可能促進新興市場消費者和企業新型 5G 應用的開發。根據GSMA《2021年行動經濟報告》,到2025年終,5G的行動連線總數將超過2G和3G,佔總連線數的14%。

- 互聯互通對於幫助亞太地區應對並最終擺脫疫情、重組經濟並增強其抵禦未來衝擊的能力至關重要。我們相信,5G網路、雲端服務、邊緣運算、人工智慧、巨量資料和物聯網都將在釋放疫情後數位經濟的全部潛力和推動即時付款市場方面發揮關鍵作用。

- 使用行動電話匯款現在不僅在亞太地區被接受,而且已成為新常態。市場領導者包括中國的支付寶和微信支付、印度的PayTM、印尼的OVO、ShopeePay、LinkAja和GoPay、日本和台灣的LINE Pay、韓國的Kakao Pay、馬來西亞和新加坡的GrabPay以及印度的Gpay和Paytm 。是。

亞太地區即時付款產業概況

由於不同地區的參與企業的存在,亞太地區的即時支付市場競爭非常激烈。快速變化的客戶偏好使市場更具吸引力並吸引大量投資。由於市場發展潛力大,市場被新參與企業分割。服務供應商正在組建聯盟以鼓勵產品創新。

- 2022 年 1 月 - 印度國家付款公司 (NPCI) 的國際支付部門 NPCI International 付款 Limited (NIPL) 與總部位於荷蘭的全球付款基礎設施公司 TerraPay 簽署合作備忘錄,以提供有效的 UPI ID印度人現在可以透過TerraPay的安全付款技術可在銀行帳戶中即時接收國際付款。

- 2022 年 1 月 - 數位 P2P付款成長的全球領導者 MoneyGram International, Inc. 宣布與 Digital Wallet Corporation 建立策略合作夥伴關係。這家全球金融科技公司擁有日本最大的行動匯款服務和數位錢包 Smiles Mobile Remittance (Smiles)。日本消費者現在可以使用 Smiles 行動應用程式向全球 200 多個國家和地區匯款,該應用程式由 MoneyGram 的全球付款通道和近乎即時的功能提供支援。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 國內付款環境的演變

- 與該地區無現金交易擴展相關的主要市場趨勢

- COVID-19 對國家付款市場的影響

第5章市場動態

- 市場促進因素

- 智慧型手機普及率提高

- 減少對傳統銀行業務的依賴

- 提高便利性

- 市場問題

- 付款詐騙

- 對現金的依賴

- 市場機會

- 政府鼓勵數位付款成長的措施預計將導致一般民眾即時付款的成長

- 數位付款產業的關鍵法規和標準

- 世界各國的監管狀況

- 可能造成監管障礙的經營模式

- 經營狀況變化帶來的發展空間

- 關鍵案例和使用案例分析

第6章 市場細分

- 按付款類型

- P2P

- P2B

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

第7章 競爭格局

- 公司簡介

- Fiserv Inc.

- Paypal Holdings Inc.

- Mastercard Inc.

- FIS Global

- VISA Inc.

- Apple Inc.

- Alipay(Ant Financials)

- SIA SpA

- Finastra

- ACI Worldwide Inc.

第8章投資分析

第9章 市場未來展望

簡介目錄

Product Code: 91181

The Asia Pacific Real Time Payment Market is expected to register a CAGR of 32.5% during the forecast period.

Key Highlights

- Consumers, businesses, and governments in emerging nations such as India, China, Thailand, Vietnam, etc., are adopting quick payments to gain greater ease and financial security, driving up demand for the solutions.

- The market is primarily supported by the growing use of cell phones worldwide and the ever-increasing desire for quick clearing and reimbursement of money transactions between vendors and purchasers. Furthermore, the market is predicted to develop due to the growing acceptance of real-time payment solutions by web-based business sellers and retail location owners. These systems offer advantages such as faster transaction speeds than other electronic techniques, real-time communications, extensive data transactions, and vendor and corporate organization accessibility 24 hours a day, seven days a week.

- Additionally, rising volumes of cashless transactions and a growing shopper preference for systems like net and mobile banking will add to industry expansion. Due to the increasing popularity of FinTech administrations such as Samsung Pay, Google Pay, and Apple Pay, the industry is likely to grow significantly. Furthermore, expanding the combined efforts of these services/service organizations and regional banks to launch advancements, such as the provision of speedy advances and money-less payments, would accelerate the industry even further.

- According to ACI Worldwide and the Centre for Economics and Business Research's research, Globaldata's Prime-Time for Real-Time 2022, (Cebr). Thailand was the fourth-largest country in the world regarding real-time transactions, with 9.7 billion. In 2021, widespread adoption of real-time payments was expected to save businesses and consumers USD 1.3 billion, resulting in USD 6 billion in additional economic production, representing 1.12% of the country's GDP.

- Lockdowns imposed as a result of COVID-19 enhanced e-commerce and food apps, driving the real-time payments business as well. Real-time payments, for example, accounted for 31.3 percent of overall payments transaction volume in India in 2021, according to ACI, owing to merchant acceptance of UPI-based mobile payment apps and QR code payments, as well as increasing use of digital payments during the Covid-19 outbreak.

APAC Real Time Payment Market Trends

India to lead in terms of Volume of Transactions and economic growth

- According to a survey by ACI, real-time payments are expected to enhance India's GDP by USD 45.9 billion in 2026, with real-time payments transaction volumes expected to top 206 billion by then.

- According to an ACI estimate, India accounted for 48.6 billion real-time transactions in 2021, over three times that of China (18 billion transactions) and nearly seven times that of the United States, Canada, the United Kingdom, France, and Germany (7.5 billion).

- Real-time payments accounted for 31.3% of overall payments transaction volume last year, thanks to merchant adoption of UPI-based mobile payment apps and QR code payments and increased use of digital payments during the Covid-19 outbreak. Real-time payments' proportion of overall payments volume is expected to climb to over 70% in 2026, as consumers rapidly transition from cash to mobile-based real-time payments, skipping payment cards.

- According to the latest FIS poll, a prominent provider of technology solutions for retailers, banks, and capital markets organizations globally, India's daily real-time transactions have doubled to 41 million due to the COVID-19 pandemic.

- According to a report provided by ACI Worldwide, the Indian real-time payments market is well developed compared to other markets such as the United States, the United Kingdom, Canada, and Australia. The Immediate Payment Service (IMPS) and Unified Payments Interface (UPI), both of which have witnessed considerable usage in recent years, are among India's real-time payments, according to the paper titled "Prime Time For Real-Time 2022." These are also considered to be India's primary drivers of real-time payments.

- The universal payment interface (UPI) transactions in India were estimated to be worth over 9.8 trillion Indian rupees as of April 2022. Although this was a little rise from the previous month, the value of UPI transactions had climbed significantly from August 2018, when it was less than 550 billion Indian rupees. UPI was a National Payments Corporation of India (NPCI) platform introduced in 2016. It allows users of payment service providers like PhonePe or GooglePay to connect with banks and transfer money using NPCI as a switch. It's easier to utilize than earlier transaction methods like IMPS.

Increased Smartphone and Internet Penetration to drive the Market

- Smartphones have become the most popular device in India and globally due to the continual need to be connected. People, especially those who live in urban areas and have hectic lifestyles, have become accustomed to communicating on the go. Smartphone ownership is no longer a luxury, thanks to increased disposable income levels and simple financing options (such as EMI). This is a reality for a new country with a huge working population, such as India. Furthermore, tight rivalry among handset manufacturers and technological advancements continue to drive down smartphone prices, increasing affordability and sales growth.

- Operators around the Asia Pacific are leveraging the scale and utility of mobile networks and services to help large and small businesses implement new digital solutions in accordance with Industry 4.0 goals, in which 5G and IoT will play significant roles. In the area, the second wave of 5G network rollouts has commenced, with several 5G-related activities taking place in India, Indonesia, and Malaysia.

- The introduction of 5G in some of these markets could encourage the mass manufacture of more affordable 5G devices for lower-income users and the development of novel 5G applications for consumers and businesses in emerging markets. By the end of 2025, 5G will have surpassed 2G and 3G in total mobile connections, accounting for 14% of all connections, according to the GSMA Mobile Economy Report 2021.

- Connectivity will be critical in rebuilding economies and making them more resilient to future shocks as the Asia Pacific continues to deal with and eventually emerge from the pandemic. 5G networks, cloud services, edge computing, AI, big data, and the Internet of Things will all play a crucial part in realizing the full potential of a post-pandemic digital economy, boosting the real-time payments market.

- The usage of a mobile phone for money transfer is now not only acceptable but also the new normal throughout the Asia Pacific. AliPay and WeChat Pay in China, PayTM in India, OVO, ShopeePay, LinkAja, and GoPay in Indonesia, LINE Pay in Japan and Taiwan, Kakao Pay in South Korea, GrabPay in Malaysia and Singapore, and Gpay and Paytm in India are among the market leaders.

APAC Real Time Payment Industry Overview

The Asia-Pacific Real Payment Market is competitive owing to the presence of various regional players. With quickly changing customer preferences, the market has become a lucrative choice, attracting a large amount of investment. Because of the enormous development potential, the market is fragmenting due to new entrants. To encourage product innovation, service providers are forming alliances.

- In January 2022 - NPCI International Payments Limited (NIPL), the international payments arm of the National Payments Corporation of India (NPCI), has signed a memorandum of understanding with TerraPay, a Netherlands-based global payments infrastructure company, to enable Indians with an active UPI ID to receive real-time, international payments into their bank accounts via TerraPay's secure payments technology.

- January 2022 - MoneyGram International, Inc., a global leader in the growth of digital P2P payments, has announced a strategic relationship with Digital Wallet Corporation. This global fintech firm owns Smiles Mobile Remittance (Smiles), Japan's largest mobile money transfer service and digital wallet. Consumers in Japan may now send money to more than 200 countries and territories worldwide using the Smiles mobile app, which is backed by MoneyGram's global payment rails and near real-time capabilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Evolution of the payments landscape in the country

- 4.4 Key market trends pertaining to the growth of cashless transaction in the Region

- 4.5 Impact of COVID-19 on the payments market in the country

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Smartphone Penetration

- 5.1.2 Falling Reliance on Traditional Banking

- 5.1.3 Ease of Convenience

- 5.2 Market Challenges

- 5.2.1 Payment Fraud

- 5.2.2 Existing Dependence on Cash

- 5.3 Market Opportunities

- 5.3.1 Government Policies Encouraging the Growth of Digital Paymentis expected to aid the growth of Real Time Payment methods amongst commoners

- 5.4 Key Regulations and Standards in the Digital Payments Industry

- 5.4.1 Regulatory Landscape Across the World

- 5.4.2 Business Models with Potential Regulatory Roadblocks

- 5.4.3 Scope for Development in Lieu of Evolving Business Landscape

- 5.5 Analysis of major case studies and use-cases

6 MARKET SEGMENTATION

- 6.1 By Type of Payment

- 6.1.1 P2P

- 6.1.2 P2B

- 6.2 By Geography

- 6.2.1 Asia Pacific

- 6.2.2 China

- 6.2.3 India

- 6.2.4 Japan

- 6.2.5 South Korea

- 6.2.6 Rest of the Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Fiserv Inc.

- 7.1.2 Paypal Holdings Inc.

- 7.1.3 Mastercard Inc.

- 7.1.4 FIS Global

- 7.1.5 VISA Inc.

- 7.1.6 Apple Inc.

- 7.1.7 Alipay (Ant Financials)

- 7.1.8 SIA SpA

- 7.1.9 Finastra

- 7.1.10 ACI Worldwide Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219