|

市場調查報告書

商品編碼

1635344

德國即時付款:市場佔有率分析、行業趨勢和成長預測(2025-2030)Germany Real Time Payments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

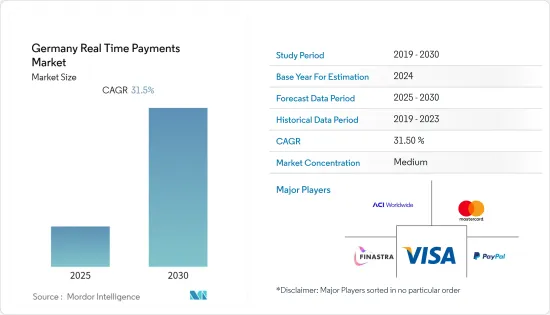

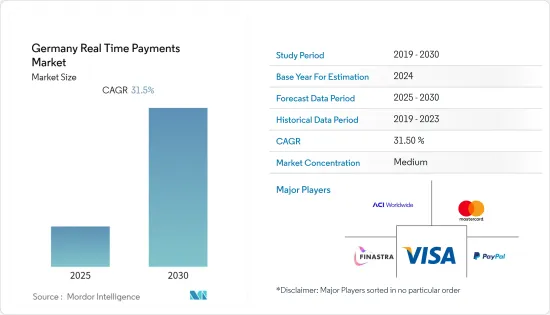

德國即時付款市場預計在預測期內複合年成長率為31.5%

主要亮點

- 非銀行付款服務供應商(PSP) 和銀行開發的新型付款技術的興起為企業和消費者提供了多種付款方式。隨著技術的進步,這些設施正在利用先進的 API、人工智慧和行動銀行解決方案的力量來重塑金融科技世界。

- 即時付款被譽為遊戲規則的改變者,它將把喜愛現金的德國人轉向數位付款。 SCT Inst 消除了與信用卡相關的負面文化形象。 FSI資料顯示,許多中小型銀行正在選擇透過付款技術服務供應商為消費者提供即時付款模式的交易服務和解決方案。預計到 2027 年,德國的即時付款將佔所有零售付款交易的 37%。

- 隨著歐元區最近的監管改革,德國正經歷重大變革。許多領先的公司都希望利用這個機會將自己打造成商業和金融科技解決方案提供者。例如,單一歐元付款區(SEPA)的建立、付款服務指令(PSD2)以及歐洲零售付款委員會(ERPB)的建立正在推動市場成長。

- COVID-19大流行引發了數位轉型,並成為經濟「創新加速器」。市場已經在經歷重大轉型,市場參與企業將注意力轉向電子商務,更多地在線上購物。疫情的加劇以及封鎖和非接觸式付款等監管變化使該行業受益。同時,諸如保險作為附加服務的功能,特別是買家保護(例如 PayPal 和信用卡提供者提供的功能)也出現了。福利和特別優惠的現金回饋積分對一些參與者有吸引力。

- 即時付款解決方案為消費者和企業提供了即時獲取資金的便利性以及一鍵轉移資金的便利,但它們也增加了實施新付款基礎設施、與付款相關的金融犯罪、還有該行業自誕生以來一直面臨的與技術故障、網路攻擊等相關的挑戰。

德國即時付款市場趨勢

P2B 細分市場佔據主要市場佔有率

- 根據 ACI Worldwide 發布的一份報告,浮動付款是存入銀行帳戶但尚未付款的存款。德國的企業和消費者目前即時付款更為普遍,預計由於付款浮動時間的減少,到 2021 年將實現 3.13 億美元的效率提升。即時支付的引入將縮短德國的浮動時間,並在 2021 年將每天的總交易量減少 48.23 億美元。這項營運資金全年為公司生產帶來了約 1.14 億美元的收入。

- 最近,EPC(歐洲付款委員會)於 2022 年 6 月宣布了 P2B 交易 QR 碼(行動主導(SEPA)付款)標準化的最終版本,規範了即時信用轉帳(SCT)付款和匯款的需求。

- 根據德意志聯邦銀行的研究,截至年終,德國四分之三的簽帳金融卡付款(73%)是使用 NFC 技術進行非接觸式支付。德國有超過 1 億張卡片在流通。該系統由德國銀行業營運,獨立於Visa和Mastercard等國際信用卡公司,預計這將在不久的將來讓德國在即時付款方面佔據優勢。

- 即時付款市場正在發生重大變化,新參與企業的採用成為推動德國即時支付市場的關鍵因素。 N26 銀行是該地區最早提供即時付款解決方案的組織之一,這些系統的關鍵在於新的數位銀行應用程式介面 (API)。

- 最近,德國儲蓄銀行推出了一項新功能,允許客戶以即時付款方式進行交易。不過,這項新功能僅在收款銀行也支援即時付款的情況下才有效。隨著技術的進步和即時付款模式在該地區的適應速度,德國越來越多的金融機構已經加入了該技術的早期採用者行列,這已成為推動德國即時付款市場的關鍵因素。

電子商務是推動市場的關鍵

- 自大流行以來,德國的電子商務業務成長迅速,即使在冠狀病毒爆發期間,整個全部區域的銷售額也在成長。例如,Postnord發布的2021年電子商務業務報告發現,約94%的人口使用網路購物,相當於6,210萬消費者。該報告還表明,在德國,大多數 B2C 公司更喜歡透過 Paypal、Apple Pay 和 Google Pay 等供應商進行即時付款。

- Postnord 最近的一項研究還將德國列為歐洲人網上購物第四受歡迎的國家(按每個國家(中國、美國、英國)都有數百萬人購物)。這約佔所有歐洲消費者的 26%。調查還表明,該地區首選的付款閘道是 PayPal 或類似的支付方式,佔 50%,其次是申請,佔 21%,簽帳金融卡或信用卡佔 17%。

- 根據已發布的報告(2021年歐洲電子商務報告),德國96%的總人口可以上網,其中88%的人在網路上購買商品和服務。

- 全球大流行改變了整個營商環境。對即時交易日益成長的需求推動了各行業對增強型數位付款解決方案的需求。情境商務正在興起,使工人、商人、客戶和供應商能夠採用適合他們 24/7 生活方式的更快的經營方式。

- 德國的新技術改革和監管發展使即時付款系統市場變得異質。其主要原因是數位化的提高、客戶行為的變化以及 PSD2 法規的出現,該法規引入了 NFC 和 QR 碼等技術。

德國即時付款產業概況

快速變化的消費者偏好使這個市場成為利潤豐厚的選擇,因此吸引了大量投資。具有巨大的成長潛力,但由於新進入者,市場正走向分散化。服務供應商正在夥伴關係推動產品創新。

- 2022 年 6 月 - 德國數位付款處理公司 ePay 和 Euronet Worldwide 宣布推出更多產品。 ePay 提供一系列付款解決方案,包括商業獎勵、禮品卡、全通路商務電子商務、卡受理和行動。這些服務包括 POS、端對端 ATM、卡片外包解決方案、發卡、商家收單服務等。

- 2022 年 5 月 - 跨國匯款產業主要企業Euronet Worldwide, Inc. 的子公司 Ria Money Transfer 宣布與總部位於瑞典的國際電話服務供應商Rebtel 建立新的合作夥伴關係。此次合作將 Ria 的國際匯款服務直接整合到 Rebtel 的數位平台中,讓 Rebtel 客戶能夠輕鬆便捷地向世界各地的親人匯款。 Ria 為 170 個國家和地區的銀行帳戶、行動錢包和現金提供付款,並由 Euronet 的 Dandelion 服務(全球最大的即時國際付款網路)提供支援。對於希望進入金融科技領域的通訊業者來說,納入匯款功能代表著獨特的成長機會。

- 2021 年 6 月-德意志銀行與 Fiserv 成立合資企業,為商家提供付款解決方案。該合資企業將 Clover 的付款受理解決方案與德意志銀行的綜合銀行服務結合。該合資企業將為中小企業(SME)提供服務,總部位於美因河畔法蘭克福,尚待監管部門核准。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 國內付款環境的演變

- 與日本無現金交易擴張相關的主要市場趨勢

- COVID-19 對國家付款市場的影響

第5章市場動態

- 市場促進因素

- 智慧型手機的普及

- 減少對傳統銀行業務的依賴

- 提高便利性

- 市場問題

- 付款詐騙

- 對現金的依賴

- 市場機會

- 政府鼓勵數位付款成長的措施預計將導致一般民眾即時付款的成長

- 數位付款產業的關鍵法規和標準

- 世界各國的監管狀況

- 可能造成監管障礙的經營模式

- 經營狀況變化帶來的發展空間

- 關鍵案例和使用案例分析

- 主要國家真實支付交易在所有交易中的佔比以及交易量和交易金額的區域分析

- 主要國家依地區真實支付交易與非現金交易比例及交易量分析

第6章 市場細分

- 按付款類型

- P2P

- P2B

第7章 競爭格局

- 公司簡介

- ACI Worldwide, Inc.

- Mastercard Inc.

- Finastra International GmbH

- PayPal Holdings, Inc.

- Fiserv, Inc.

- Fidelity National Information Services, Inc.(FIS Inc.)

- Wirecard AG

- Worldpay, Inc.

- Temenos AG

- Visa Inc.

第8章投資分析

第9章 市場未來展望

簡介目錄

Product Code: 91459

The Germany Real Time Payments Market is expected to register a CAGR of 31.5% during the forecast period.

Key Highlights

- With the rise of new payment technologies developed by non-bank payment service providers (PSPs) and banks, businesses and consumers now have a wide range of payment instruments. With the rise of technological advancement, these facilities are reshaping the fintech world, leveraging the power of advanced API, AI, and mobile banking solutions.

- Real-time payments are being touted as a game-changer for moving cash-loving Germans into digital payments. SCT Inst solves the negative cultural association of credit cards. As per the data by FSI Many smaller banks have opted to use payments via a technical service provider to deliver real-time payment mode transactional services and solutions for consumers. Real-time payments in Germany are expected to make up 37 percent of all retail payment transactions by 2027.

- Germany has been experiencing a major transformation with the recent regulatory reforms in the Euro region. Many major players are trying to take advantage of the opportunity to establish themselves as a business and Fintech solution provider. For instance, the establishment of the Single Euro Payments Area (SEPA), Payment Services Directive (PSD2), and the establishment of the Euro Retail Payments Board (ERPB) have aided the growth of the market.

- The COVID-19 pandemic has turned out to be a catalyst for digital transformation and thus an 'innovation accelerator' for the economy. The market has already been going through a major transformation, with participants shifting focus toward e-commerce to do more shopping online. Pandemic intensification and changes in regulation like lockdown and touchless payments benefitted the industry. Along came features like Insurance as an added service, particularly in buyer protection (e.g., as provided by PayPal and credit card providers). Cashback points for rewards and special offers appeal to some participants.

- The real-time payment solution has easily given consumers and businesses the luxury of ready access to funds and the convenience of transferring them with a single button; however, there are also challenges related to the cost of adopting a new payment infrastructure, financial crimes related to payments, technological failure, and cyberattacks, which the industry has faced since its inception.

Germany Real Time Payments Market Trends

P2B Segment Will hold The Major Share of the Market

- According to a report published by ACI Worldwide, a payment float is a deposit into a bank account that has not yet been cleared. With its current share of real-time adoption, German businesses and consumers will gain an estimated net efficiency saving of USD 313 million in 2021, driven by a reduction in the payment float. Instant payments unlocked a total transaction value of USD 4,823 million daily in 2021 through a reduced float time in Germany. This working capital facilitated an estimated USD 114 million of firm output in the same year.

- Recently in June 2022 EPC (European payment council) publishes the final version of the standardization of QR codes ( mobile-initiated ( SEPA) payment) involving the P2B mode of transaction addressing the need for a regulatory body for Instant credit transfer (SCT) payment and transfers, which seems to make real-time payment more secured in upcoming future. looking forward to these regulatory reforms Germany is expected to double its real-time payments volume by 2026.

- As per the study by Deutsche Bundesbank at the end of 2021, three out of four (73%)payments of the debit card in Germany were contactless using NFC Technology. In Germany, there are more than 100 million cards in circulation. The system is operated by the German banking sector and is independent of international credit card companies like Visa and Mastercard which is expected to favor Germany in real-time payment settlement in the near future.

- Real-time payment market has been experiencing tremendous changes with the introduction of new players which has been a key factor to drive the market for instant germany N26 bank one of the first organizations to provide real-time payment solutions in the region key to these sytems lies in the new digital banking application programming interfaces - APIs.

- Recently, Germany's savings banks introduced a new feature allowing customers to make a transaction as an instant payment. But it only works if the receiving bank also supports instant payments. With technological advancement and the adaptation rate of the real-time payment mode in the region, an increasing number of lenders in Germany have already joined the group of early adopters of the technology, which has been a key factor in driving the real-time payment market in Germany.

Ecommerce will be the Key to Drive The Market

- Germany's e-commerce business has proliferated since the pandemic, and sales have increased across the region during the coronavirus pandemic. For Instance, the report posted on eCommerce business 2021 by Postnord reflects approximately 94 % of the population is shopping online, which is 62.1 million consumers. The report also suggested that most B2C companies prefer real-time payment settlement with vendors like Paypal, Apple Pay, and Google pay in Germany.

- The recent survey from Postnord also reflects that Germany is at 4th position in countries where Europeans shop online (number of millions who shopped from each country (China, USA, and the UK). It's approximately 26 % of the total consumers in the European region. The study also suggested that the preferred payment gateway in the area be PayPal or a similar option at 50%, followed by invoices at 21%, debit or credit card at 17 %.

- As per the report (2021 European E-commerce Report) published, 96 % of the total population in Germany have access to the internet estimated growth rate of 1 %, and 88% of that internet user that bought goods or services online growth rate expected to be 2%from the previous year 2020.

- The global pandemic has changed the entire scenario of doing business; an increased need for immediate transactions and enhanced digital payment solutions across industries have become necessary. Contextual commerce is on the rise - allowing workers, merchants, customers, and suppliers to implement a quicker way to do business that fits into their 24/7/365 lifestyle.

- With the country's new technological reforms and regulations advancement, Germany has a heterogeneous market for real-time payment systems. The key reasons are the growing digitalization level, changes in customer behavior, and the advent of the PSD2 regulation by deploying technologies such as NFC or QR codes.

Germany Real Time Payments Industry Overview

With consumer preferences changing rapidly, the market has become a lucrative option and thus, has attracted a huge amount of investments. Due to the huge growth potential, the market is moving towards fragmentation due to the new entrants. The service providers are engaging in partnerships to promote product innovation.

- June 2022 - Germany-based digital payments processing company ePay and Euronet Worldwide announced additional product launches. ePay offers a portfolio of business incentives, gift cards, and payment solutions, such as eCommerce, card acceptance, and mobile for omnichannel commerce. These services include point-of-sale (POS), end-to-end ATM, card outsourcing solutions, card issuance, and merchant acquisition services.

- May 2022 - Ria Money Transfer, a business segment of Euronet Worldwide, Inc., a key player in the cross-border money transfer industry, announced a new partnership with Rebtel, an international calling service provider based in Sweden. The partnership embeds Ria's international money transfer service directly into Rebtel's digital platform, making it easy and convenient for Rebtel's customers to send money to loved ones worldwide. Ria offers payments to bank accounts, mobile wallets, and cash across 170 countries and territories and is powered by Euronet's Dandelion service, the world's largest real-time international payments network. Embedding a money transfer feature presents a unique growth opportunity for Telcos wanting to enter the fintech space.

- June 2021 - Deutsche Bank and Fiserv are entering into a Joint venture to provide a payment solution for merchants. The joint venture is to combine Clover's payment acceptance solution with Deutsche Bank's integrated banking services. The joint venture will serve small, medium-sized, and small, medium-sized enterprises (SMEs) and will be based in Frankfurt am Main, pending regulatory approval.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Evolution of the payments landscape in the country

- 4.4 Key market trends pertaining to the growth of cashless transaction in the country

- 4.5 Impact of COVID-19 on the payments market in the country

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Smartphone Penetration

- 5.1.2 Falling Reliance on Traditional Banking

- 5.1.3 Ease of Convenience

- 5.2 Market Challenges

- 5.2.1 Payment Fraud

- 5.2.2 Existing Dependence on Cash

- 5.3 Market Opportunities

- 5.3.1 Government Policies Encouraging the Growth of Digital Paymentis expected to aid the growth of Real Time Payment methods amongst commoners

- 5.4 Key Regulations and Standards in the Digital Payments Industry

- 5.4.1 Regulatory Landscape Across the World

- 5.4.2 Business Models with Potential Regulatory Roadblocks

- 5.4.3 Scope for Development in Lieu of Evolving Business Landscape

- 5.5 Analysis of major case studies and use-cases

- 5.6 Analysis of Real Payments Transactions as a share of all Transactions with a regional breakdown of key countries by volume and transacted value

- 5.7 Analysis of Real Payments Transactions as a share of Non-Cash Transactions with a regional breakdown of key countries by volumes

6 MARKET SEGMENTATION

- 6.1 By Type of Payment

- 6.1.1 P2P

- 6.1.2 P2B

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ACI Worldwide, Inc.

- 7.1.2 Mastercard Inc.

- 7.1.3 Finastra International GmbH

- 7.1.4 PayPal Holdings, Inc.

- 7.1.5 Fiserv, Inc.

- 7.1.6 Fidelity National Information Services, Inc. (FIS Inc.)

- 7.1.7 Wirecard AG

- 7.1.8 Worldpay, Inc.

- 7.1.9 Temenos AG

- 7.1.10 Visa Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219