|

市場調查報告書

商品編碼

1644849

美國汽車物流:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)United States Automotive Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

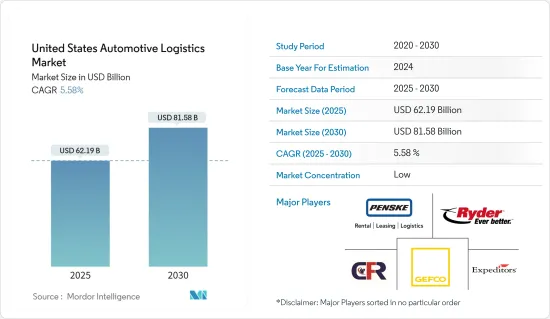

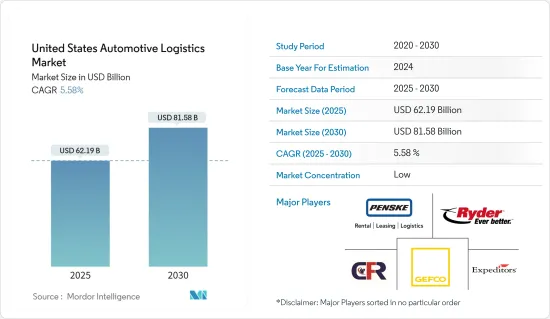

2025年美國汽車物流市場規模預估為621.9億美元,預計2030年將達815.8億美元,預測期間(2025-2030年)的複合年成長率為5.58%。

美國汽車市場受到電動車產業的推動,輕型汽車佔據美國市場主導地位。

去年3月新冠疫情爆發後,美國汽車產業需求急遽下降。這對整個汽車供應鏈物流行業產生了影響。美國汽車銷量與前一年同期比較下降了38%。

在解除封鎖限制、開放市場後,輕型車產業反彈,本會計年度的銷售量達到約 1,384 萬輛。光是輕型車就佔了美國汽車銷量的約 97%。隨著市場在疫情後復甦,美國汽車物流行業的進出口預計將大幅成長。

美國是世界第二大汽車市場和產業,中國緊隨其後,位居第一。該部分在美國進出口中發揮重要作用。美國是世界第二大汽車生產國,生產汽車超過150萬輛,商用車超過760萬輛。美國是該地區最有前景、成長最快的汽車市場之一。美國汽車產業受到多種因素的支撐,包括研發力度、勞動力可用性、政府支持和地理優勢。

美國汽車物流市場趨勢

美國電動車產業蓬勃發展

該產業組織表示,到 2022 年,美國汽車銷量中將有約 5.7% 是純電動車,高於 2021 年的 3.2%。該地區的純電動車銷量佔全球插電式電動車總銷量的 8% 多一點。特斯拉繼續主導美國電動車市場,美國電動車銷量預計為 302,000 輛。但競爭開始愈演愈烈,通用汽車等製造商不斷在其汽車產品中增加新的電動車車型。雪佛蘭 Bolt 已躋身最暢銷電動車榜。當年的銷量略低於該車型上市時的銷量,則位居第二。通用汽車計劃在 2035 年只銷售零排放汽車,並且已經在全球插電式電動車市場中處於領先地位。

特斯拉在該地區插電式電動車市場佔據主導地位,大眾集團緊隨其後。整體而言,製造商都希望增加研發支出,其中電動車領域是投資的重中之重。部分原因是美國政府承諾在 2030 年實現一半汽車銷售實現零排放。

輕型汽車佔據美國市場主導地位

2022年,美國汽車業銷售了約1,384萬輛輕型汽車。這一數字包括約 290 萬輛汽車零售和近 1,090 萬輛輕型卡車零售額。小型車佔據美國市場的主導地位,因為它們實用且省油,很受歡迎,是消費者的經濟選擇。由於對輕型商用車的需求不斷成長,墨西哥和美國之間的短途海運量增加,而《美國-墨西哥-加拿大協議》(USMCA)的簽署預計將促進汽車物流行業的發展。該行業組織表示,當被問及對微型車的滿意度時,美國消費者對本田、Lexus和寶馬的車型最為滿意。根據每 100 輛車報告的問題數量,Lexus是最值得信賴的品牌之一。

美國汽車物流產業概況

美國汽車物流市場高度分散且競爭激烈,擁有大量國內外參與者。華盛頓國際參與企業(Expeditors International of Washington Inc.)、DHL、GEFCO 和日本通運 (Nippon Express) 等國際公司與 CFR Rinkens、Ryder System Inc. 和 Penske Logistics 等國內巨頭展開競爭。由於國內外對電動車的需求不斷增加、對輕型車輛的需求不斷成長以及其他影響市場的因素,預計市場將會成長。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

第2章調查方法

第3章執行摘要

第4章 市場動態與洞察

- 市場概況

- 市場動態

- 驅動程式

- 電子商務和網上銷售的成長

- 輕型汽車生產的需求

- 限制因素

- 燃油價格波動

- 技術純熟勞工短缺

- 機會

- 積層製造

- 對聯網汽車和自動駕駛汽車的需求不斷增加

- 驅動程式

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 政府法規和舉措

- COVID-19 市場影響

第5章 市場區隔

- 按類型

- 整車

- 汽車零件

- 其他

- 按服務

- 運輸

- 倉儲業

- 經銷和庫存管理

- 其他

第6章 競爭格局

- 公司簡介

- Expeditors International of Washington Inc.

- CFR Rinkens

- Ryder System Inc.

- GEFCO

- Penske Logistics

- US Auto Logistics

- DHL

- Nippon Express

- JB Hunt Transport Services Inc.

- CH Robinson Worldwide*

第7章:市場的未來

第 8 章 附錄

- 宏觀經濟指標(按活動分類的 GDP 分佈、運輸和倉儲業對經濟的貢獻等)

- 貿易統計 出口與進口統計

- 汽車業相關外貿統計數據

The United States Automotive Logistics Market size is estimated at USD 62.19 billion in 2025, and is expected to reach USD 81.58 billion by 2030, at a CAGR of 5.58% during the forecast period (2025-2030).

The US automotive market is driven by the electric vehicle sector, and light vehicles dominate the US market.

The automotive industry in the United States experienced a sharp decline in demand because of the COVID-19 outbreak last year in March 2020. This impacted the entire automotive supply chain logistics industry. The US vehicle sales were down by 38% year-on-year.

After the lockdown restrictions were lifted and the market was opened, the light vehicle segment sector bounced back to reach some 13.84 million units of sales in the current year. Light vehicles alone accounted for about 97% of the motor vehicles that were sold in the United States. Post-pandemic and with the market bouncing back, the United States automotive logistics industry is anticipated to see huge growth in both imports and exports.

The United States is the world's second-biggest auto market and automotive industry, the first being China. This sector plays an important role in US imports and exports. The country is the second-largest automaker in the world, manufacturing more than 1.5 million cars and 7.6 million commercial vehicles. The United States is one of the most promising and fastest-growing automobile markets in the region. The United States automobile industry is supported by multiple factors such as R&D efforts, labor availability, government support, and geographic advantages.

U.S. Automotive Logistics Market Trends

Electric Vehicle Sector growing in the United States

According to an industry association, approximately 5.7% of US car sales were fully electric in 2022, up from 3.2% in 2021. The battery electric vehicle sales in the region made up just over eight percent of the total plug-in electric vehicle sales worldwide. Tesla continues to dominate the US EV market, with an estimated 302,000 electric vehicles sold in the United States. However, competition is beginning to gain momentum, and manufacturers such as General Motors are continuing to add new EV models into their range of vehicles offered. Chevrolet's Bolt made it into the list of best-selling electric vehicle models. The model recorded its second-largest sales volume that year, just under its sales-the year the model launched. General Motors intends to sell only zero-emission vehicles by 2035 and was already one of the global plug-in EV market leaders.

While Tesla dominated the plug-in electric vehicle market in the region, it was also followed closely by the Volkswagen Group, whose worldwide electric vehicle sales soared that same year. Overall, manufacturers were looking to increase their research and development expenditure, with electric mobility at the forefront of their investments. This was in part motivated by the US Government's commitment to zero-emission for half of all vehicle sales by 2030.

Light Vehicles dominating the US Market

In 2022, the auto industry in the United States sold approximately 13.84 million light vehicle units. This figure includes retail sales of about 2.9 million autos and just under 10.9 million light truck units. Light-duty vehicles dominate the US market because they are popular for their utility and better fuel economy, which makes them an economical choice for consumers. With the increase in demand for light commercial vehicles, growth in short-sea volumes between Mexico and the US is being observed, which is forecasted to grow the automotive logistics sector with the signing of the US-Mexico-Canada Agreement (USMCA). According to an industry association, when asked about light vehicle satisfaction, consumers in the United States were most satisfied with Honda, Lexus, and BMW models. Lexus was among the most dependable brands based on the number of problems reported per 100 vehicles.

U.S. Automotive Logistics Industry Overview

The US automotive logistics market is highly fragmented and competitive, with the presence of big international and domestic firms in the country. International players like Expeditors International of Washington Inc., DHL, GEFCO, and Nippon Express compete with local giants like CFR Rinkens, Ryder System Inc., and Penske Logistics. The market is expected to grow because of the growing demand for electric vehicles at the domestic and international levels, an increase in the demand for lightweight vehicles, and other factors influencing the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Growth of E-commerce and Online Sales

- 4.2.1.2 Demand from Light Vehicle Production

- 4.2.2 Restraints

- 4.2.2.1 Fluctuating fuel prices

- 4.2.2.2 Shortage of skilled workforce

- 4.2.3 Opportunities

- 4.2.3.1 Additive Manufacturing

- 4.2.3.2 Rising demand for Connected and Autonomous vehicles

- 4.2.1 Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Government Regulations and Initiatives

- 4.5 Impact of COVID-19 on the market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Finished Vehicle

- 5.1.2 Auto Component

- 5.1.3 Other Types

- 5.2 By Service

- 5.2.1 Transportation

- 5.2.2 Warehousing

- 5.2.3 Distribution and Inventory Management

- 5.2.4 Other Services

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration Analysis and Major Player)

- 6.2 Company Profiles

- 6.2.1 Expeditors International of Washington Inc.

- 6.2.2 CFR Rinkens

- 6.2.3 Ryder System Inc.

- 6.2.4 GEFCO

- 6.2.5 Penske Logistics

- 6.2.6 US Auto Logistics

- 6.2.7 DHL

- 6.2.8 Nippon Express

- 6.2.9 J.B. Hunt Transport Services Inc.

- 6.2.10 C.H Robinson Worldwide*

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution by Activity, Transport and Storage Sector-contribution to Economy, etc.)

- 8.2 Trade Statistics: Imports and Exports

- 8.3 External Trade Statistics related to the Automotive Sector