|

市場調查報告書

商品編碼

1644873

中國汽車物流:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)China Automotive Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

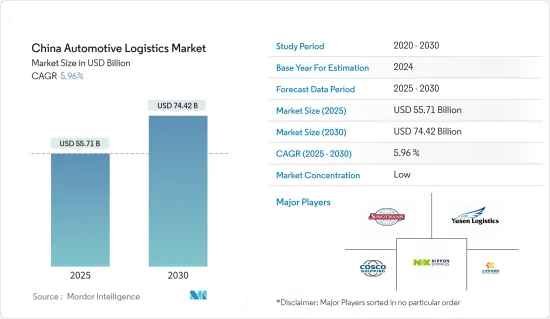

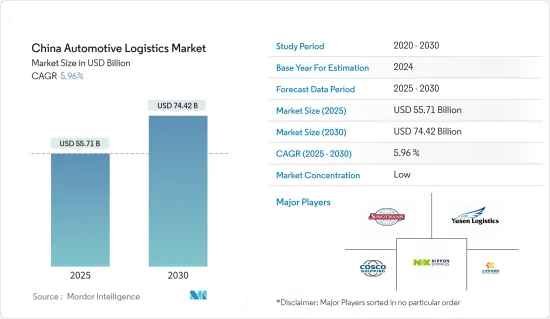

2025年中國汽車物流市場規模預估為557.1億美元,預估至2030年將達744.2億美元,預測期間(2025-2030年)複合年成長率為5.96%。

主要亮點

- 中國汽車產業正在經歷重大轉型,中國政府也推出措施刺激汽車消費。這些措施包括財稅支持、加速淘汰老舊柴油貨車、最佳化二手車交易管道等。此外,各國政府還推出了對新能源汽車的補貼,並投資基礎設施建設以支持汽車產業,這些都可能會促進汽車市場的發展。

- 中國仍然是世界上最大的汽車市場,年銷量和產量均排名第一。預計2025年國內產量將達3,500萬台。此外,由於全球對電動車的興趣日益濃厚,中國汽車在海外的銷售也顯著成長。 《環球時報》報道,10月中國製造業出現改善跡象,財新中國製造業採購經理人指數(PMI)上升1點至50.3。

- 電動車市場的快速成長在該產業的發展軌跡中發揮著舉足輕重的作用。在電動車領域佔據主導地位的中國,汽車出口量顯著成長。事實證明,加強物流基礎設施(例如建造倉庫設施和專用運輸路線)是有效的。政府的支持性政策,例如對電動車製造商的補貼和對充電基礎設施的投資,進一步推動了這一成長。

- 為了解決車輛運輸和零件處理的複雜性,公司擴大採用人工智慧和物聯網技術來最佳化物流並提高效率。例如,從 2024 年初開始,最大的汽車製造商之一上汽集團部署了整合物聯網感測器和人工智慧演算法的自動化倉庫系統。因此,人工智慧和物聯網的整合正在成為業界的標準實踐,推動進一步的進步並在效率和可靠性方面樹立新的標竿。

- 汽車產業的成長、汽車銷售的增加以及出口的增加預計將推動該國汽車物流市場的發展。

中國汽車物流市場趨勢

中國對新能源汽車的投資推動市場成長

2024 年 JD Power 中國新能源汽車-汽車性能、執行和佈局(NEV-APEAL)研究強調了汽車物流市場的一個關鍵趨勢:中國新能源汽車 (NEV) 的穩步崛起。中國新能源車的 NEV-APEAL 平均得分為 789 分(滿分 1,000 分),較 2023 年上升了 13 分。這種持續上升的趨勢顯示消費者對新能源汽車的接受度和滿意度不斷提高,這反過來又刺激了對精簡物流解決方案的需求。

新能源汽車產業的快速成長正在重塑相關產業鏈,其中電池產業尤為突出。動力電池在決定車輛的電池壽命、安全性和總成本方面起著至關重要的作用。中國製造商明顯偏好磷酸鋰鐵(LFP)電池,這與西方市場對鋰鎳錳鈷(NMC)電池的傾向不同。到2024年4月,新乘用車零售滲透率將超過50%。這項變化不僅凸顯了新能源汽車在市場上的快速成長,也凸顯了對促進新能源汽車分銷的專業物流服務的需求日益成長。

新能源汽車市場的快速成長,正在擴大汽車物流領域客製化運輸和處理服務的需求。這種激增的需求不僅擴大了供應鏈,而且還刺激了基礎設施發展並促進了永續的物流實踐。隨著物流公司不斷滿足這些不斷變化的需求,它們在開闢新的收益來源的同時,也正在改變中國汽車格局方面發揮關鍵作用。

綜上所述,中國新能源汽車的快速發展不僅正在再形成物流市場,也正在為汽車領域帶來重大變革。消費者接受度的不斷提高和向永續實踐的轉變給物流公司帶來了挑戰和機遇,最終促進了整個汽車生態系統的演變。

倉儲業推動市場成長

各個服務領域正在推動市場成長。隨著中國汽車產業的擴張,倉儲產業對整個供應鏈至關重要。為了容納不斷成長的貨物量,公司正在大力投資擴大倉庫容量。

此外,隨著電子商務的興起和汽車產量的增加,汽車製造商正在尋求強大的倉儲解決方案來管理波動的存量基準。例如,日物流於 2024 年擴大了在中國的倉儲業務,並整合了自動化儲存和搜尋系統,以加強庫存管理並最大限度地縮短處理時間。

此外,也正在引進利用物聯網技術進行即時庫存監控的先進庫存管理系統。例如,中遠航運實施了智慧庫存管理解決方案,以實現整個網路中汽車零件的準確追蹤。

總之,中國汽車產業的成長很大程度上得益於運輸、倉儲和庫存管理服務的進步。這些技術創新對於滿足日益成長的市場對效率和可靠性的需求至關重要。

中國汽車物流產業概況

中國汽車物流市場高度分散,競爭激烈,除了國際公司外,還有多家國內汽車物流公司。 DHL、日本通運等國際企業與上汽安吉物流、日物流等本土公司競爭。此外還有許多其他參與者,例如中國遠洋運輸(集團)有限公司(COSCO)、HYCX集團和中國外運股份有限公司。

汽車行業的參與者正在透過整合最尖端科技來客製化多樣化產品。例如,最近深圳將在2024年建成一座人工智慧整合工廠,這將為供應鏈帶來重大轉變,而供應鏈則是任何製造業的支柱。借助先進的分析技術,這些工廠現在可以準確預測原料需求、最佳化存量基準並確保及時採購。這不僅可以最大限度地降低您的持有成本,還可以減少浪費。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 當前市場狀況

- 市場促進因素

- 新能源汽車銷售成長

- 政府措施和支持

- 市場限制

- 美國貿易戰

- 供應鏈中斷

- 市場機會

- 數位轉型

- 拓展新興市場

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者和消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- 政府法規和舉措

- 中國汽車產業概況(概況、發展趨勢、統計等)

- 地緣政治與疫情將如何影響市場

第5章 市場區隔

- 按類型

- 整車

- 汽車零件

- 按服務

- 運輸

- 倉儲、配送和庫存管理

- 其他服務

第6章 競爭格局

- 市場集中度概覽

- 公司簡介

- China Ocean Shipping(Group)Company

- SAIC Anji Logistics

- BLG Logistics

- HYCX Group

- Yusen Logistics Co. Ltd

- DHL

- Nippon Express

- GEODIS

- Sinotrans Co. Ltd

- DHL Supply Chain

- Apex Group*

- 其他公司

第7章:市場的未來

第 8 章 附錄

- 宏觀經濟指標(按活動分類的 GDP 分佈、運輸和倉儲業對經濟的貢獻等)

- 貿易統計 出口與進口統計

- 汽車業相關外貿統計數據

The China Automotive Logistics Market size is estimated at USD 55.71 billion in 2025, and is expected to reach USD 74.42 billion by 2030, at a CAGR of 5.96% during the forecast period (2025-2030).

Key Highlights

- China's automotive industry underwent substantial shifts which in response, the Chinese government has implemented measures to rejuvenate automobile consumption. These measures include providing fiscal and taxation support, accelerating the elimination of obsolete diesel trucks, and optimizing second-hand vehicle trading channels. Additionally, the government has introduced subsidies for new energy vehicles and invested in infrastructure development to support the automotive sector, such initiatives will keep the market afloat.

- China remains the world's largest vehicle market, leading in both annual sales and manufacturing output. Projections indicate that domestic production will hit 35 million vehicles by 2025. Furthermore, bolstered by a global surge in interest for electric vehicles, Chinese automobile sales overseas have seen notable growth. In October, signs of improvement emerged in China's manufacturing sector, highlighted by a 1 percentage point uptick in the Caixin China General Manufacturing Purchasing Managers' Index (PMI), reaching 50.3, as reported by Global Times.

- The swift growth of the electric vehicle market plays a pivotal role in this industry's trajectory. With its dominant stance in the electric vehicle arena, China has recorded a pronounced uptick in vehicle exports. Enhancements in logistics infrastructure, marked by upgraded warehouse facilities and specialized transport corridors, have been instrumental. The government's supportive policies, which include subsidies for electric vehicle manufacturers and investments in charging infrastructure, have further fueled this growth.

- To navigate the complexities of vehicle transportation and parts handling, companies are increasingly turning to AI and IoT technologies, aiming to optimize logistics and boost efficiency. For instance, from the begining of 2024, SAIC Motor Corporation, one of the largest automotive manufacturers, has rolled out an automated warehousing system integrated with IoT sensors and AI algorithms. As a result, the integration of AI and IoT is becoming a standard practice in the industry, driving further advancements and setting new benchmarks for efficiency and reliability.

- This growing automotive sector, increasing vehicle sales, and exports are expected to drive the country's automotive logistics market.

China Automotive Logistics Market Trends

Chinese Investment in NEVs (New Energy Vehicles) Driving the Market Growth

The 2024 J.D. Power China New Energy Vehicle - Automotive Performance, Execution and Layout (NEV-APEAL) Study underscores a pivotal trend in the automotive logistics market: the steady ascent of New Energy Vehicles (NEVs) in China. Chinese NEVs have achieved an average NEV-APEAL score of 789 out of 1000, marking a notable 13-point rise from 2023. This consistent upward trend signals an increasing consumer acceptance and satisfaction with NEVs, subsequently fueling the demand for streamlined logistics solutions.

The swift growth of the NEV sector is reshaping associated industrial chains, with a pronounced focus on the battery sector. Power batteries play a pivotal role in influencing a vehicle's battery life, safety, and overall cost. Chinese manufacturers have shown a clear preference for lithium Iron Phosphate (LFP) batteries, setting themselves apart from the Western markets that lean towards Lithium Nickel Manganese Cobalt (NMC) batteries. By April 2024, new passenger cars achieved a retail penetration rate exceeding 50%, a milestone previously held by traditional petrol vehicles. This shift not only highlights the burgeoning dominance of NEVs in the market but also accentuates the escalating demand for specialized logistics services to facilitate their distribution.

The surging NEV market is amplifying the demand for customized transport and handling services within the automotive logistics domain. This burgeoning demand is not just expanding the supply chain but is also catalyzing infrastructure development and promoting sustainable logistics practices. As logistics firms pivot to address these evolving demands, they unlock fresh revenue streams, simultaneously playing a pivotal role in the transformation of China's automotive landscape.

In conclusion, the rapid advancement of NEVs in China is not only reshaping the logistics market but also driving significant changes in the automotive sector. The increasing consumer acceptance and the shift towards sustainable practices present both challenges and opportunities for logistics companies, ultimately contributing to the evolution of the entire automotive ecosystem.

Warehousing Segment Fuels Growth in the Market

Various service segments are fueling market growth. With the expansion of China's automotive industry, the warehouse segment has become pivotal in the overall supply chain. In response to increasing goods volumes, companies are significantly investing in expanding their warehouse capacities.

Moreover, with the rise of e-commerce and increased vehicle production, automotive manufacturers are seeking robust warehousing solutions to manage fluctuating inventory levels. For example, in 2024, Yusen Logistics expanded its warehousing operations in China, integrating automated storage and retrieval systems to enhance inventory management and minimize handling times.

Furthermore, there's a growing adoption of advanced inventory management systems leveraging IoT technology for real-time stock monitoring. For instance, COSCO Shipping has deployed smart inventory management solutions, enabling precise tracking of automotive components throughout its network.

In conclusion, the growth of China's automotive industry is significantly driven by advancements in transportation, warehousing, and inventory management services. These innovations are essential in meeting the increasing demands for efficiency and reliability in the market.

China Automotive Logistics Industry Overview

The Chinese automotive logistics market is highly fragmented and competitive, with the presence of several local automotive logistics companies in the country apart from international firms. International players like DHL and Nippon Express compete with local players like SAIC Anji Logistics and Yusen Logistics. And many other players including China Ocean Shipping (Group) Company (COSCO), HYCX Group, Sinotrans Limited, etc.

Players in the automotive sector are tailoring a diverse array of services by integrating cutting-edge technologies. For instance, Recently in 2024, Shenzhen's updtaed with AI-integrated factories, the supply chain - the backbone of any manufacturing setup - has undergone a significant transformation. With the help of advanced analytics, these factories can now accurately predict raw material needs, optimize inventory levels, and ensure timely procurement. This not only minimizes holding costs but also reduces wastage.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Drivers

- 4.2.1 Growing New Energy Vehicles Sales

- 4.2.2 Government Initiatives and Support

- 4.3 Market Restraints

- 4.3.1 Trade War between China and the United States

- 4.3.2 Supply Chain Disruptions

- 4.4 Market Opportunities

- 4.4.1 Digital Transformation

- 4.4.2 Expansion into Emerging Markets

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Industry Value Chain Analysis

- 4.7 Government Regulations and Initiatives

- 4.8 Overview of China's Automotive Industry (Overview, Development and Trends, Statistics, etc.)

- 4.9 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Finished Vehicle

- 5.1.2 Auto Component

- 5.2 By Service

- 5.2.1 Transportation

- 5.2.2 Warehousing, Distribution, and Inventory Management

- 5.2.3 Other Services

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 China Ocean Shipping (Group) Company

- 6.2.2 SAIC Anji Logistics

- 6.2.3 BLG Logistics

- 6.2.4 HYCX Group

- 6.2.5 Yusen Logistics Co. Ltd

- 6.2.6 DHL

- 6.2.7 Nippon Express

- 6.2.8 GEODIS

- 6.2.9 Sinotrans Co. Ltd

- 6.2.10 DHL Supply Chain

- 6.2.11 Apex Group*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution by Activity, Transport and Storage Sector-contribution to Economy, etc.)

- 8.2 Trade Statistics: Imports and Exports

- 8.3 External Trade Statistics related to the Automotive Sector