|

市場調查報告書

商品編碼

1690722

北美汽車物流:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)North America Automotive Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

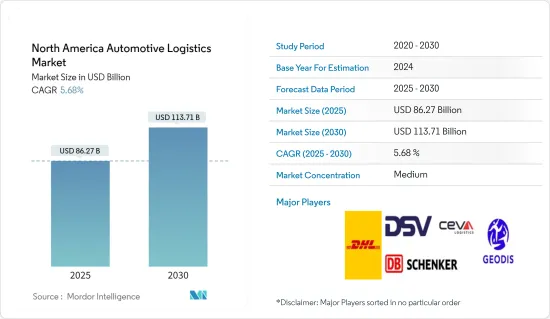

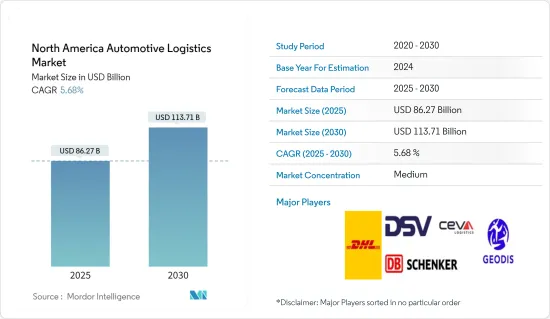

北美汽車物流市場規模預計在 2025 年為 862.7 億美元,預計到 2030 年將達到 1,137.1 億美元,預測期內(2025-2030 年)的複合年成長率為 5.68%。

北美汽車物流從未像現在這樣準備好迎接巨大的變革和機會。然而,與整個汽車產業一樣,汽車物流的經濟和貿易風險、新法規、消費行為和投資回報率幾乎沒有不不確定性。

憑藉前所未有的可視性和靈活性,汽車物流行業必須在競爭中保持領先。OEM、物流和技術提供者必須合作共用資料、制定計劃和升級技術,以保持供應鏈高效流動。

汽車供應鏈的未來物流服務提供者以及從宏觀層面來說整個經濟都至關重要。汽車供應鏈結構的變化可能會影響全球貿易的性質和各國經濟的動態。

全球汽車生產設施數量的不斷增加正在推動汽車物流市場的成長。此外,隨著汽車製造商為物流供應商創造巨大的商機,預計未來幾年市場成長將會加速。自經濟衰退以來,新興經濟體一直保持穩定成長,消費者的可支配收入增加。

北美汽車物流市場趨勢

小型車生產需求

- 在北美,消費者的偏好正在轉向運動型多功能車和卡車,汽車製造商正在增加產量以滿足不斷成長的需求。例如福特探險者 (Ford Explorer) 和雪佛蘭 Silverado 等車款的受歡迎程度。

- 電動車產量的成長是由於人們對混合動力汽車和電動車的興趣日益濃厚。例如,特斯拉的超級工廠於2023年12月在德克薩斯建成,旨在滿足北美日益成長的電動車需求。

- 北美汽車產業正在調整和投資技術以滿足更嚴格的排放法規,從而影響輕型車輛的設計和生產。 2022年8月,美國政府將簽署具有歷史意義的《通膨控制法案》,這可能是美國史上最重要的經濟和氣候相關法案。 《通膨削減法案》協助推動了美國製造業產能的復甦,為清潔能源技術的開發和生產提供了廣泛的獎勵。

- 隨著小型車生產需求的增加,汽車物流公司的運輸量將會增加。更多的車輛和零件必須從製造廠運送到配送中心和經銷店。

美國電動車發展

- 聯邦和州級的獎勵對於電動車的廣泛應用至關重要。聯邦政府為購買符合條件的電動車提供稅額扣抵。例如,合格插電式電動車信貸額度最高可達 7,500 美元。

- 各大汽車廠商也都在積極佈置電動車。通用汽車和福特等公司已宣布投資電動車研發和生產的計畫。 2024 年 1 月,福特馬達與這家總部位於明尼蘇達州的公司簽署協議,購買 1,000 輛全電動汽車,具體為 F-150 Lightning 和 Mustang Mach-E。

- 2023 年前 11 個月,電動車註冊量預計將超過 100 萬輛,約佔整個市場的 7.4%(高於 2022 年同期的 5.4%)。專家也表示,2023 年電池電動車 (BEV) 的銷量將達到約 110 萬輛。特斯拉在 2023 年銷售了 1,739,707 輛 Model 3/Y。

- 此外,鑑於聯邦政府和國家相關人員正在就取消 2025 年燃油經濟性標準和《清潔空氣法》規定的州政府權力進行討論,持續的市場成長將取決於監管發展。

北美汽車物流行業概況

北美汽車物流市場比較分散。預計未來幾年電動車需求的不斷成長、輕型汽車數量的增加以及其他一些因素將推動市場成長。競爭格局以以下主要企業為特徵:DHL Supply Chain、Ryder System 和 CH Robinson。這些公司利用其全球網路和先進技術,提供全面的物流和供應鏈解決方案。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提條件

- 研究範圍

第2章調查方法

- 分析方法

- 研究階段

第3章執行摘要

第4章 市場洞察

- 市場概況

- 政府法規和舉措

- 價值鏈/供應鏈分析

- 產業技術趨勢

- 聚焦:電子商務對傳統汽車物流供應鏈的影響

- 深入了解汽車售後市場及其物流活動

第5章 市場動態

- 市場促進因素

- 環境問題和法規

- 汽車技術的進步

- 市場限制

- 經濟不確定性

- 市場機會

- 電動車的普及

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第6章 市場細分

- 按服務

- 運輸

- 倉儲、配送和庫存管理

- 其他服務

- 按類型

- 整車

- 汽車零件

- 其他

- 按國家

- 美國

- 加拿大

- 墨西哥

第7章 競爭格局

- 市場集中度概覽

- 公司簡介

- CEVA Logistics AG

- DB Schenker

- DHL

- DSV

- GEODIS

- KUEHNE+NAGEL International AG

- Nippon Express Co. Ltd

- Ryder System Inc.

- XPO Logistics Inc.

- United Parcel Service Inc.*

- 其他公司

第8章 市場機會與未來趨勢

第 9 章 附錄

- 各活動國內生產毛額分佈

- 資本流動洞察

- 經濟統計-運輸和倉儲業對經濟的貢獻

The North America Automotive Logistics Market size is estimated at USD 86.27 billion in 2025, and is expected to reach USD 113.71 billion by 2030, at a CAGR of 5.68% during the forecast period (2025-2030).

North American automotive logistics has rarely been on the verge of much change and opportunity. Yet, as in the broader automotive industry, there are few uncertainties about economic and trade risks, new regulations, consumer behavior, or returns on investment faced by vehicle logistics.

With greater visibility and more flexibility than ever before, the vehicle logistics sector must be able to compete. OEMs, logistics, and technology providers must collaborate to share data, plan, and upgrade technology to keep the supply chain flowing efficiently.

The future of automotive supply chains is vital to logistics service providers in the automotive sector and, at the macro level, whole economies. The nature of global trade and the dynamics of different national economies can be affected by any change in the supply chain structure for vehicles.

An increasing number of vehicle production facilities worldwide compels the growth of the automotive logistics market. In addition, the market growth is expected to accelerate in the coming years due to automobile manufacturers' significant business opportunities for logistics providers. In the post-recession era, emerging economies have seen steady growth, leading to a rise in disposable income for consumers.

North America Automotive Logistics Market Trends

Demand for Light Vehicle Production

- In North America, consumer preferences have shifted to sport utility vehicles and trucks, driving auto manufacturers to adapt their production to meet rising demand. Instances include the popularity of models like Ford Explorer and Chevrolet Silverado.

- Increased production of electric vehicles results from the increasing interest in hybrids and EVs. For example, in December 2023, Tesla's Gigafactory in Texas aimed to meet North America's growing demand for electric vehicles.

- The automotive industry in North America has been adapting to and investing in technologies to meet stringent emission standards, influencing the design and production of light vehicles. In August 2022, the US government signed the historic Inflation Reduction Act into law, which could prove to be the most critical economic and climate legislation in American history. The Act to reduce inflation, which has driven a revival in US manufacturing capacity, offers broad incentives for developing and manufacturing clean energy technologies.

- As the demand for light vehicle production rises, automotive logistics companies experience increased shipping volumes. More vehicles and components must be transported from manufacturing facilities to distribution centers and dealerships.

EV Boost in United States

- Federal and state-level incentives have been crucial in promoting EV adoption. The federal government offers tax credits for the purchase of qualifying electric vehicles. For instance, the Qualified Plug-In Electric Drive Motor Vehicle Credit provides a credit of up to USD 7,500.

- Major automakers have made substantial commitments to electric vehicles. Companies like General Motors (GM), Ford, and others have announced plans to invest in developing and producing electric vehicles. In January 2024, Ford Motor Co. inked a deal with a Minnesota-based company to buy a fleet of 1,000 all-electric vehicles, specifically the F-150 Lightning and Mustang Mach-E.

- During the first 11 months of 2023, EV registrations exceeded 1 million units, which is about 7.4% of the total market (up from 5.4% at this same time in 2022). Experts also stated that around 1.1 million battery-electric vehicles (BEVs) were sold in 2023. Tesla sold 1,739,707 Model 3/Y cars in 2023.

- The market's sustainable growth also depends on regulatory developments, given ongoing discussions among federal and national parties regarding the rollback of 2025 fuel-economy standards and state authority under the Clean Air Act.

North America Automotive Logistics Industry Overview

The North American Automotive Logistics Market is fragmented. The increasing demand for EVs, an increase in lighter vehicles, and several other factors are likely to drive the market's growth over the coming years. The competitive landscape is marked by key players such as DHL Supply Chain, Ryder System, and C.H. Robinson. These companies offer a comprehensive range of logistics and supply chain solutions, leveraging their global networks and advanced technologies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Government Regulations and Initiatives

- 4.3 Value Chain/Supply Chain Analysis

- 4.4 Technological Trends in the Industry

- 4.5 Spotlight - Effect of E-commerce on Traditional Automotive Logistics Supply Chain

- 4.6 Insights into Automotive Aftermarket and its Logistics Activities

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Environmental Concerns and Regulations

- 5.1.2 Technological Advancements in Automotive Technology

- 5.2 Market Restraints

- 5.2.1 Economic Uncertainty

- 5.3 Market Opportunities

- 5.3.1 Electric Vehicle Adoption

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Transportation

- 6.1.2 Warehousing, Distribution and Inventory Management

- 6.1.3 Other Services

- 6.2 By Type

- 6.2.1 Finished Vehicle

- 6.2.2 Auto Components

- 6.2.3 Other types

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

- 6.3.3 Mexico

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 CEVA Logistics AG

- 7.2.2 DB Schenker

- 7.2.3 DHL

- 7.2.4 DSV

- 7.2.5 GEODIS

- 7.2.6 KUEHNE + NAGEL International AG

- 7.2.7 Nippon Express Co. Ltd

- 7.2.8 Ryder System Inc.

- 7.2.9 XPO Logistics Inc.

- 7.2.10 United Parcel Service Inc.*

- 7.3 Other Companies

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

9 APPENDIX

- 9.1 GDP Distribution, by Activity

- 9.2 Insights into Capital Flows

- 9.3 Economic Statistics-Transport and Storage Sector, Contribution to Economy