|

市場調查報告書

商品編碼

1644946

歐洲單軸太陽能追蹤器:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Single-axis Solar Tracker - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

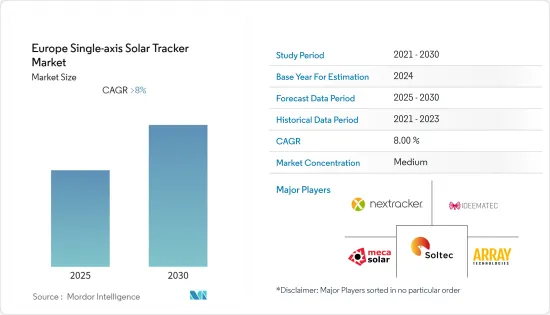

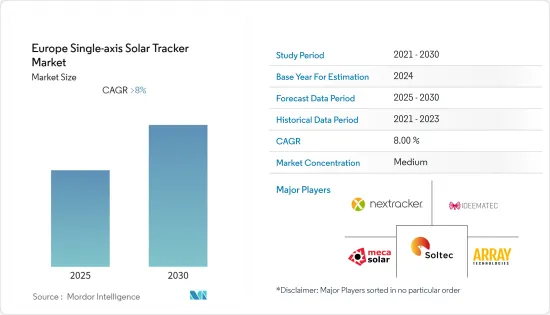

預計預測期內歐洲單軸太陽能追蹤器市場複合年成長率將超過 8%。

2020 年,市場受到了 COVID-19 疫情的負面影響。目前市場已恢復至疫情前的水準。

關鍵亮點

- 從中期來看,預計太陽能需求的上升將推動市場成長。此外,預計增加的投資和雄心勃勃的太陽能目標將推動市場成長。

- 另一方面,預測期內串式逆變器的技術缺陷預計將阻礙歐洲單軸太陽能追蹤器市場的成長。

- 單軸太陽能追蹤器的產品創新和最新技術的採用可能會在預測期內為歐洲單軸太陽能追蹤器市場提供有利的成長機會。

- 德國佔據市場主導地位,並可能在預測期內實現最高的複合年成長率。這一成長得益於投資增加和政府支持措施。

歐洲單軸太陽能追蹤器市場趨勢

增加投資和雄心勃勃的太陽能目標

- 歐洲的太陽能產業正經歷重大發展。 2021年,約有25.9吉瓦新增太陽能發電容量接入歐洲電網,比2020年的19.3吉瓦成長34%。此外,還有幾個太陽能發電工程正在規劃或建設階段。

- 截至 2021 年,歐盟累積太陽能光電裝置容量為 1.589 億千瓦,同年新增裝置容量超過 2,280 萬千瓦。德國是歐盟27國中累積太陽能光電裝置容量最大的國家。

- 例如,2021年4月,德國藍象能源公司與Umweltgerechte Kraftanlagen(UKA)簽署了一份開發框架協議,在德國開發500兆瓦的太陽能光電專案組合。該專案由11個處於不同開發階段的太陽能發電工程成,發電容量從20MW到130MW不等。德國也計劃在2030年實現太陽能發電量達到100吉瓦,再生能源佔其總電力消耗量的65%。

- 此外,其他幾個歐洲國家也制定並正在努力實現雄心勃勃的可再生能源目標。 2021年11月,歐洲新成立的太陽能產業協會Solar Power Europe呼籲歐盟到2030年將可再生能源目標提高到45%,預計將導致裝置容量增加210GW。

- 2022年2月,法國新能源戰略提出,到2050年,太陽能發電裝置容量將超過100吉瓦。

- 因此,由於這些因素,預計未來幾年太陽能將大幅成長,從而在預測期內對單軸太陽能追蹤器產生大量需求。

德國佔據市場主導地位

- 以裝置容量容量計算,德國是歐洲最大的太陽能光電市場,並確立了其作為全球能源和氣候安全領跑者之一的地位。這是因為它將自給自足與具有吸引力的上網電價結合在一起,特別適用於 40kW 至 750kW 的中型到大型商業系統。

- 國家和地方的政策是該國太陽能成長的最大貢獻者。 2020年,柏林通過了“太陽能城總體規劃”,擴大太陽能電池板在全市屋頂的部署,目標是到2050年利用太陽能滿足全市約25%的電力需求。該計畫包含 27 項建議,旨在推動柏林太陽能發電的擴張,其中包括向業主提供獎勵和教育,以及消除太陽能發電系統的監管障礙。

- 2022年4月,德國經濟和氣候變遷部宣布了清潔能源目標,即到2030年,該國80%的能源結構來自再生能源。目前,德國電力結構的40.9%由清潔能源組成。

- 此外,政府也設定了2030年將太陽能發電能力提高到200GW的目標,而為實現這一目標,政府計劃將太陽能發電競標提高到20GW。

- 截至年終,全國累積太陽能光電裝置容量5,873萬千瓦,較2020年成長9.32%。

- 2022年5月,德國聯邦網路局(Bundesnetzagentur)舉行了第三次屋頂太陽能光電競標,平均價格為0.091美元/kWh。該機構審查了 171 個競標(總發電容量為 212 兆瓦),並選定了 163 個計劃(總發電容量為 204 兆瓦)。最終價格從 0.075 美元/千瓦時到 0.095 美元/千瓦時不等。第二輪屋頂太陽能光電競標於 2022 年 1 月舉行,該部門審查了 209 份競標(總容量為 233 兆瓦),並選出了 136 個計劃(總合容量為 154 兆瓦)。最終價格從 0.061 美元/千瓦時到 0.088 美元/千瓦時不等。最終平均價格為0.079美元。

- 此外,2022 年 4 月,德國聯邦網路局宣布,在太陽能光電競標中已授予 201 份提案,總合容量為 108.4 吉瓦,高於 2021 年 7 月的 510.34 兆瓦。競標價格範圍為每千瓦時 0.043 美元至 0.059 美元。數量加權平均價格為每千瓦時 0.057 美元,高於之前的每千瓦時 0.053 美元。

- 總體而言,預計德國將在預測期內主導歐洲單軸太陽能追蹤器市場。

歐洲單軸太陽能追蹤器產業概況

歐洲單軸太陽能追蹤器市場本質上是適度細分的。市場的主要企業(不分先後順序)包括 Soltec Power Holdings SA、MecaSolar、Ideatec Deutschland GmbH、Nextracker Inc. 和 Array Technologies Inc.

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2027 年市場規模及需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 按地區分類的市場區隔

第6章英國

第7章 挪威

第 8 章 荷蘭

第9章 德國

第10章 歐洲其他地區

第11章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Soltec Power Holdings SA

- Arctech Solar Holding Co. Ltd

- MecaSolar

- Ideematec Deutschland GmbH

- Nextracker Inc.

- DCE Solar

- Valmont Industries Inc.

- PV Hardware

- Solar Flexrack

- Array Technologies Inc.

第12章 市場機會與未來趨勢

The Europe Single-axis Solar Tracker Market is expected to register a CAGR of greater than 8% during the forecast period.

The market was negatively impacted by the COVID-19 pandemic in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the growing demand for solar power is expected to stimulate market growth. Furthermore, increasing investments and ambitious solar energy targets are expected to drive the market's growth.

- On the other hand, technical drawbacks of string inverters are expected to hamper the growth of Europe's single-axis solar tracker market during the forecast period.

- Nevertheless, product innovation and adoption of the latest technologies in single-axis solar trackers will likely create lucrative growth opportunities for the European single-axis solar tracker market during the forecast period.

- Germany dominates the market and is likely to witness the highest CAGR during the forecast period. This growth is attributed to increasing investments and supportive government policies.

Europe Single-axis Solar Tracker Market Trends

Increasing Investments and Ambitious Solar Energy Targets

- The European region has been witnessing significant developments in the solar industry. In 2021, nearly 25.9 GW of new solar PV capacity was connected to the European grid, an increase of 34% compared to the 19.3 GW installed in 2020. Additionally, several solar projects are either in the planning or construction phase.

- The EU had a cumulative solar photovoltaic capacity of 158.9 GW as of 2021, adding over 22.8 GW that year. Germany is the leading member of the EU-27 in terms of the highest cumulative solar PV capacity.

- For instance, in April 2021, the Germany-based Blue Elephant Energy made a development framework agreement with Umweltgerechte Kraftanlagen (UKA) to develop a 500 MW solar portfolio in Germany. It consists of 11 solar projects in an advanced development stage, with capacities ranging between 20 MW and 130 MW. Germany also aims to achieve 100 GW of solar power and a 65% share of renewables in the gross electricity consumption by 2030.

- Moreover, several other European countries have set ambitious renewable energy targets and are working toward them. In November 2021, the new European Photovoltaic Industry Association, SolarPower Europe, called on the EU to increase its renewable energy target to 45% by 2030, which is anticipated to result in an extra 210 GW of installed solar capacity.

- In February 2022, as part of a new energy strategy, France aimed to deliver more than 100 GW of installed solar PV capacity by 2050.

- Therefore, owing to these factors, solar PV is expected to grow significantly in the coming years, which is expected to create a massive demand for the single-axis solar tracker during the forecast period.

Germany to Dominate the Market

- Germany is the largest solar photovoltaic market in Europe in terms of installed capacity, which justifies it being one of the front runners in energy and climate security globally. The country has witnessed significant developments in the solar PV market and is likely to continue to do so due to a combination of self-consumption with attractive feed-in premiums, especially for medium to large-scale commercial systems ranging from 40 kW to 750 kW.

- National and regional policies have been one of the most prominent contributors to the growth of solar PV in the country. In 2020, Berlin adopted the 'Solarcity Master Plan' to expand the deployment of solar panels across the city's rooftops, with the target of supplying around 25% of the city's electricity needs with solar power by 2050. It included 27 recommendations to kickstart the solar expansion in Berlin, including incentives and education for property owners and the removal of regulatory barriers for photovoltaic systems.

- In April 2022, Germany's Economy and Climate Ministry announced the clean energy target of making up 80% of its power mix from renewables by 2030, a bump from its previous target of 65%. Currently, 40.9% of Germany's power mix consists of clean energy.

- Additionally, the country's government has also set a target of raising its solar power capacity to 200 GW by 2030, for which the country's government is planning to increase solar tenders to 20 GW.

- At the end of 2021, the country had a total cumulative photovoltaic capacity of 58.73 GW, a rise of 9.32% compared to 2020.

- In May 2022, Germany's Federal Network Agency, the Bundesnetzagentur, concluded the third rooftop PV tender with an average price of USD 0.091/kWh. The agency reviewed 171 bids with a total capacity of 212 MW and selected 163 projects totaling 204 MW. The final prices ranged between USD 0.075/kWh and USD 0.095/kWh. The second rooftop PV tender was concluded in January 2022, and the agency reviewed 209 bids with a total capacity of 233 MW, of which 136 projects were selected, totaling 154 MW. The final prices ranged between USD 0.061/kWh and USD 0.088/kWh. The final average price was USD 0.079.

- Additionally, in April 2022, Germany's Federal Network Agency announced that the agency had selected 201 proposals with a combined output of 1.084 GW under the solar auction, up from 510.34 MW in July 2021. The bids in the round ranged from USD 0.043 to USD 0.059 per kWh. The volume-weighted average price stood at USD 0.057 per kWh, up from USD 0.053 per kWh in the previous round.

- Therefore, owing to the above points, Germany is expected to dominate the European single-axis solar tracker market during the forecast period.

Europe Single-axis Solar Tracker Industry Overview

The European single-axis solar tracker market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include Soltec Power Holdings SA, MecaSolar, Ideematec Deutschland GmbH, Nextracker Inc., and Array Technologies Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION - BY GEOGRAPHY

6 United Kingdom

7 Norway

8 Netherlands

9 Germany

10 Rest of Europe

11 COMPETITIVE LANDSCAPE

- 11.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 11.2 Strategies Adopted by Leading Players

- 11.3 Company Profiles

- 11.3.1 Soltec Power Holdings SA

- 11.3.2 Arctech Solar Holding Co. Ltd

- 11.3.3 MecaSolar

- 11.3.4 Ideematec Deutschland GmbH

- 11.3.5 Nextracker Inc.

- 11.3.6 DCE Solar

- 11.3.7 Valmont Industries Inc.

- 11.3.8 P V Hardware

- 11.3.9 Solar Flexrack

- 11.3.10 Array Technologies Inc.