|

市場調查報告書

商品編碼

1644951

重整單位-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Reformer Unit - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

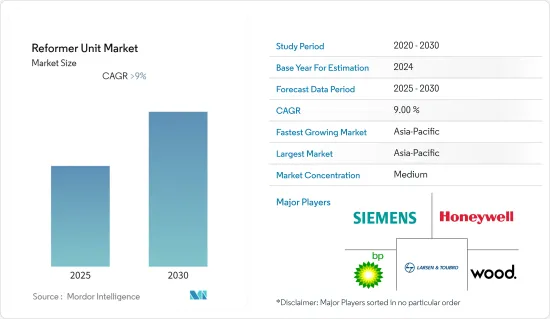

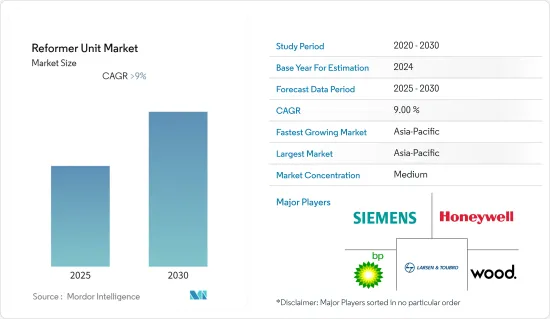

預測期內,重整裝置市場預計將以超過 9% 的複合年成長率成長。

2020 年,新冠疫情對市場產生了負面影響。目前市場已恢復至疫情前的水準。

關鍵亮點

- 從中期來看,為滿足對更高品質石油產品日益成長的需求,對擴大下游活動的投資不斷增加,正在推動重整器市場的需求。

- 另一方面,由於難以以極高的運轉率運行,預計設備故障會導致停工,市場分散度也會增加,這將阻礙市場成長。

- 政府關於限制車輛有害排放氣體的法規不斷增多,預計將為重整裝置市場創造重大機會。

- 由於亞太地區(尤其是印度和中國等國家)的石油精製計劃數量不斷增加,預計預測期內亞太地區將佔據市場主導地位。

改革單位市場趨勢

石油業可望主導市場

- 近年來,汽油和柴油的需求一直穩定成長,預計中期內不會放緩。這些產品主要用於汽車和重型機械等各種地方。

- 此外,許多國家都致力於減少環境排放。此外,很少有國家設立減少或消除排放的目標。這些透過重整器生產的高辛烷值燃料有助於生產比傳統燃料排放量少得多的更清潔的燃料。

- 例如,2022年7月,一群美國參議員提出了一項法案,透過提案含有20%至30%乙醇的高消費量認證測試燃料來增加乙醇的消費量,並要求汽車製造商從2026年開始生產和保固使用這種燃料的汽車。

- 此外,世界各地的石油消費量正在大幅增加。例如,2021年的石油消費量量比2020年增加了6.1%。 2021年石油消費量為每天9,690.8萬桶,而2020年約為每天9,136萬桶。

- 此外,世界各地也提案了多個石化計劃。例如,中國計劃在2021年至2025年間建成512座石化工廠並投入營運。根據國際能源總署(IEA)的石化評估,到2050年,除歐洲以外幾乎所有地區的初級化學品產量都將增加。

- 因此,由於對清潔燃料的需求不斷增加以及政府的支持措施,預計石油業將佔據預測領域的主導地位。

亞太地區佔市場主導地位

- 預計亞太地區將在預測期內出現顯著成長,這得益於石油消費量的增加、下游活動的投資增加、政府對使用高辛烷值燃料的推動力加大、以及該地區利用以柴油為主要燃料的重型機械的開發活動增加。

- 截至 2021 年,亞太地區的精製能力約為每天 36,478,000 桶 (tbpd)。中國和印度是該地區的主要企業,精製能力分別為 16,990 噸桶/天和 5,018 噸桶/天。

- 預計未來幾年印度的精製能力將擴大。 2021年,全國原油精製能力將達到2.4987億噸/年。印度最大的精製印度石油公司(IOC)宣布,計劃在 2030 年將其精製能力從每年 8,070 萬噸提高到每年 1.5 億噸。

- 此外,該地區的許多國家都要求使用更清潔的燃料,以減少運輸部門的環境排放。例如,2022年8月,澳洲阿爾巴尼斯工黨政府提出立法,將澳洲低硫汽油的銷售期限延後到2024-2027年。到 2024 年 12 月 15 日,澳洲零售店銷售的所有汽油的最大含硫量將為 10ppm。這適用於 91 RON、95 RON、98 RON 和 E85 無鉛汽油。

- 因此,基於上述事實,預計亞太地區將憑藉石化產業投資的增加和政府的支持措施在重整器市場中佔據主導地位。

重整裝置產業概況

全球重整裝置市場適度細分。該市場的主要企業(不分先後順序)包括霍尼韋爾國際公司、伍德集團、英國石油公司、拉森-特布羅有限公司和西門子股份公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2028 年市場規模及需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅產品/服務

- 競爭對手之間的競爭

第5章 市場區隔

- 應用

- 石油工業

- 化工

- 其他

- 過程

- 熱重整

- 催化重整

- 2028 年市場規模與需求預測(按地區)

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 澳洲

- 馬來西亞

- 其他亞太地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 奈及利亞

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Chevron Corporation

- Honeywell International

- Chiyoda Corporation

- BP PLC

- KBR Inc.

- McDermott International, Ltd

- Siemens AG

- Wood PLC

- Linde AG

- Larsen & Toubro Limited

- Ventech Engineers

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 93647

The Reformer Unit Market is expected to register a CAGR of greater than 9% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the increasing investments in the expansion of downstream activities to meet the increasing demand for higher quality petroleum products, thus increasing the demand for a reformer unit market.

- On the other hand, the difficulty in operations at extremely high operations leads to increased shutdown or breakdown times due to equipment malfunction, which is expected to hinder market growth.

- Nevertheless, the increasing government regulations on controlling harmful emissions from vehicles are expected to create huge opportunities for the reforming unit market.

- Asia-Pacific is expected to dominate the market during the forecasted period due to the increasing oil refinery projects in the region, especially in countries like India and China.

Reformer Unit Market Trends

The Oil Industry Is Expected To Dominate The Market

- The demand for gasoline and diesel has been on a constant rise in recent years, and the demand will likely maintain its momentum over the medium term. These products are predominantly used in various places, such as for vehicles, heavy machinery, and other sectors.

- Moreover, many countries are focusing on reducing their environmental emissions. Furthermore, few countries have even set targets to reduce or eliminate emissions. These high-octane fuels produced through reformer units help produce cleaner fuels that emit significantly less emission than conventional fuels.

- For instance, in July 2022, a group of senators in the United States proposed legislation to increase ethanol consumption by introducing high-octane certification test fuels containing 20% to 30% ethanol and requiring automakers to build and warranty their vehicles to utilize the fuels beginning in 2026.

- Furthermore, the consumption of oil has increased significantly around the world. For instance, in 2021, oil consumption increased by 6.1% compared to 2020. In 2021 the oil consumption was 96908 thousand barrels per day, and in 2020 the consumption was around 91360 thousand barrels per day.

- Additionally, several petrochemical projects are being proposed around the world. For instance, 512 petrochemical plants will begin operations in China between 2021 and 2025. According to an International Energy Agency (IEA) petrochemicals assessment, practically all areas, except Europe, will grow primary chemical production by 2050.

- Hence, the oil industry is expected to dominate the forecast segment due to increased demands for cleaner fuels and supportive government policies.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region is expected to witness significant growth during the forecasted period due to the increasing consumption of oil, increasing investment in the expansion of downstream activities, increasing push from the government to use high-octane fuel, and increasing development activities in the region that utilizes heavy machinery which uses diesel as the primary source of fuel.

- As of 2021, Asia-Pacific had a refining capacity of roughly 36,478 thousand barrels per day (tbpd). China and India were the region's major players, with oil refining capacities of 16,990 tbpd and 5,018 tbpd, respectively.

- In the future years, India's refining capacity is expected to expand. The country's crude oil refining capacity reached 249.87 million metric tonnes per year in 2021. In addition, Indian Oil Corporation (IOC), India's largest refining firm, announced intentions to boost its refining capacity from 80.7 million metric tonnes per year to 150 million metric tonnes per year by 2030.

- Moreover, many countries in the region are mandating the usage of cleaner fuel in order to curb the environmental emissions from the transportation sector. For instance, in August 2022, the Albanese Labor Government in Australia presented legislation to move the sale of lower-sulfur gasoline in Australia from 2024 to 2027. All petrol in retail outlets in Australia will have a maximum sulfur level of 10 parts per million by December 15, 2024. This applies to unleaded petrol with 91 RON, 95 RON, 98 RON, and E85.

- Therefore, due to the abovementioned facts, the Asia-Pacific region is expected to dominate the reformer market due to increasing investment in the petrochemical sector and supportive government policies.

Reformer Unit Industry Overview

The Global Reformer Unit Market is moderately fragmented. Some key players in this market (in no particular order) are Honeywell International, Wood plc, BP plc, Larsen and Toubro Limited, and Siemens AG., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Oil Industry

- 5.1.2 Chemical Industry

- 5.1.3 Others

- 5.2 Process

- 5.2.1 Thermal Reforming

- 5.2.2 Catalytic Reforming

- 5.3 Geography [Market Size and Demand Forecast till 2028 (for regions only)]

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Russia

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Australia

- 5.3.3.4 Malaysia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 UAE

- 5.3.4.3 Nigeria

- 5.3.4.4 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Columbia

- 5.3.5.4 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Chevron Corporation

- 6.3.2 Honeywell International

- 6.3.3 Chiyoda Corporation

- 6.3.4 BP PLC

- 6.3.5 KBR Inc.

- 6.3.6 McDermott International, Ltd

- 6.3.7 Siemens AG

- 6.3.8 Wood PLC

- 6.3.9 Linde AG

- 6.3.10 Larsen & Toubro Limited

- 6.3.11 Ventech Engineers

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219