|

市場調查報告書

商品編碼

1644991

中東和非洲鑽鋌:市場佔有率分析、產業趨勢和成長預測(2025-2030 年)Middle East And Africa Drill Collar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

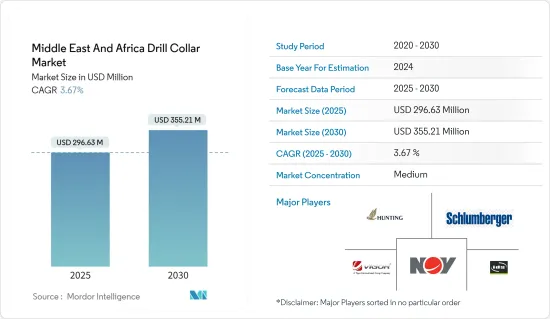

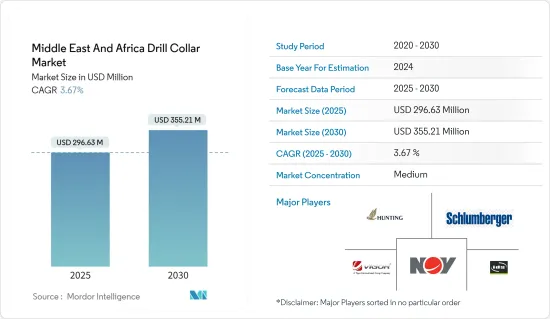

中東和非洲鑽鋌市場規模預計在 2025 年為 2.9663 億美元,預計到 2030 年將達到 3.5521 億美元,預測期內(2025-2030 年)的複合年成長率為 3.67%。

關鍵亮點

- 從中期來看,預計預測期內,上游產業投資增加(旨在提高生產能力,從而在當前高價環境下實現利潤最大化)將推動市場發展。

- 另一方面,預計全球整體和這些地區可再生能源的採用將抑制該地區對碳氫化合物的需求,從而在預測期內抑制市場發展。

- 地中海和紅海仍存在規模較小、更為複雜的海上天然氣田開發項目,這意味著預測期內市場將面臨巨大的成長機會。

- 沙烏地阿拉伯佔據市場主導地位,並可能在預測期內實現最高的複合年成長率。這是由於預測期內石油和天然氣產量的增加。

中東和非洲鑽頭顏色市場趨勢

海上業務實現顯著成長

- 新冠疫情爆發後,全球需求復甦,對碳氫化合物的需求增加,再加上俄烏衝突造成的經濟影響,導致全球市場上碳氫化合物價格大幅上漲。這導致許多國家加快開發海上計劃,否則這些項目在低成本環境下在經濟上是不可行的。

- 此外,為了從更高的價格中獲益,這些國家正在大力投資擴大生產能力,以獲取更高的石油收入。反過來,預計這將推動對探勘與生產領域的投資,從而在預測期內推動海上領域的發展。

- 根據貝克休斯國際鑽井平台數量統計,截至 2023 年 10 月,累積海上鑽機數量為 44 個,較兩年前疫情影響開始在該地區加劇的 2020 年 10 月(20 個)成長了近 115%。

- 因此,該地區一些國家正在大力投資開發其海上蘊藏量。例如,2022年8月,ADNOC Offshore向ADNOC Drilling授予了兩份大型海上鑽井契約,總額超過34億美元,用於建造八座海上自升式鑽機。同樣,2022年6月,阿布達比國家石油公司鑽井公司獲得了兩份價值20億美元的契約,為Hail Gasha天然氣開發計劃(全球最大的海上酸性天然氣計劃)提供綜合鑽井服務,其中13億美元為綜合鑽井服務和流體,7.11億美元為提供四個島嶼鑽井裝置。

- 該領域的如此大規模投資表明該地區大多數國家都希望從全球高價環境中獲益,預計這將加速對海上計劃的投資以擴大產能並在預測期內推動市場發展。

沙烏地阿拉伯主導市場

- 沙烏地阿拉伯是中東和北非地區最大的原油生產國,並且在全球上游技術領域處於領先地位。根據沙烏地阿拉伯能源部統計,該國去年原油產量為9124720桶/日,是第三大原油生產國。去年天然氣產量1,204.6億立方米,位居世界第八。

- 該國是中東和北非地區最大的原油生產國,擁有世界第二大已探明原油蘊藏量。沙烏地阿拉伯的探勘與生產領域由國營碳氫化合物公司沙烏地阿美主導,該公司是全球最大的原油出口商。

- 沙烏地阿拉伯是石油輸出國組織 (OPEC) 中最具影響力的成員國之一,自新冠疫情重創全球能源需求以來,該國一直在逐步提高產量配額,以維持全球油價穩定。

- 該國上游石油部門專注於開發該國大型陸上和海上石灰岩油藏,包括世界上最大的傳統型陸上油田(Ghawar 油田)和最大的傳統型海上油田(Safaniyah 油田)。這些巨型油田已經生產了很長時間,仍蘊藏大量蘊藏量。沙烏地阿拉伯也開始開發該國最大的傳統型岩層賈富拉頁岩,估計蘊藏量近 200 兆立方英尺的頁岩氣。

- 鑽探和完井需要大量投資,但沙烏地阿拉伯的鑽探成本是世界上最低的。據沙烏地阿美稱,2021 年和 2020 年上游平均開採成本均為每桶 3 美元。

- 根據貝克休斯國際鑽井數量統計,截至 2023 年 10 月,沙烏地阿拉伯的累積鑽機數量為 86 個,較去年同期的 2022 年 10 月增加近 8.9%。

- 沙烏地阿美公司透露,計劃今年將資本支出(capex)增加至 400 億至 500 億美元,較去年成長近 50%,預計到 2025 年還將進一步增加。該公司計劃在 2027 年之前增加 1,300 萬桶/日的原油產能,並計劃在 2030 年將天然氣產量提高近 50%。

- 此類雄心勃勃的擴張計劃,加上永續性和遵守環境標準的新時代目標,預計將吸引大量投資,並需要該領域的重大技術創新,預計這將在預測期內推動上游市場和該國對鑽鋌的需求。

中東和非洲鑽色產業概況

中東和非洲的鑽色市場正在變得半固體。主要參與企業包括(不分先後順序)Hunting PLC、National Oilwell Varco Inc. (NOV)、Schlumberger Limited、中國維格鑽井石油工具和設備有限公司、International Drilling Services Ltd (IDS)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 類型

- 標準鋼鑽鋌

- 無磁鑽鋌

- 按位置

- 陸上

- 海上

- 按地區

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 伊朗

- 南非

- 阿爾及利亞

- 其他

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- Companies Profiles

- Hunting PLC

- National Oilwell Varco Inc.(NOV)

- Schlumberger Limited

- China Vigor Drilling Oil Tools and Equipment Co. Ltd

- International Drilling Services Ltd(IDS)

- Schoeller-Bleckmann Oilfield Equipment AG

- American Oilfield Tools Inc.

- Challenger International Inc.

- Zhong Yuan Special Steel Co. Ltd

第7章 市場機會與未來趨勢

The Middle East And Africa Drill Collar Market size is estimated at USD 296.63 million in 2025, and is expected to reach USD 355.21 million by 2030, at a CAGR of 3.67% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, rising investments in the upstream sector aimed at increasing production capacity to maximize profits during the current high-price environment are expected to drive the market during the forecast period.

- On the other hand, the rising adoption of renewable energy across the globe and these regions is expected to curtail the demand for hydrocarbons in the region, restraining the market during the forecast period.

- Nevertheless, the development of smaller complex offshore gas fields remains in the Mediterranean, and the Red Sea remains a significant growth opportunity for the market during the forecast period.

- Saudi Arabia dominates the market and will likely register the highest CAGR during the forecast period. With the growing oil and gas production during the forecast period.

Middle East And Africa Drill Collar Market Trends

Offshore Segment to Witness Significant Growth

- In the aftermath of the COVID-19 pandemic, as demand for hydrocarbons rose due to a recovery in global demand, combined with the economic fallout of the Russia-Ukraine conflict, the price of hydrocarbons rose significantly in global markets. This has prompted many countries to accelerate the development of offshore projects, which were deemed economically unfeasible in the low-price environment.

- Additionally, to profit from the high prices, these countries are investing heavily in expanding production capacity to rake in higher oil revenues. This is expected to result in higher investments in the E&P sector, driving the offshore segment during the forecast period.

- According to Baker Hughes International Rig Count, as of October 2023, the cumulative offshore rig count stood at 44, which was nearly 115% higher than two years ago in October 2020 (20) when the effects of the pandemic started to intensify in the region.

- Due to this, several countries in the region are investing heavily in the development of offshore reserves. For instance, in August 2022, ADNOC Offshore awarded two major offshore drilling contracts totaling over USD 3.4 billion to ADNOC Drilling for the hire of 8 offshore jack-up rigs. Similarly, in June 2022, ADNOC Drilling was awarded two contracts worth USD 2 billion for the integrated drilling services at its Hail and Ghasha Gas Development Project (the world's largest offshore sour gas project), of which USD 1.3 billion was for integrated drilling services and fluids, while USD 711 million was for the provision of 4 Island Drilling Units.

- Such large investments in the sector demonstrate the fact that most countries in the region are trying to benefit from the global high-price environment, which is expected to accelerate investments in offshore projects to expand production capacity, driving the market during the forecast period.

Saudi Arabia to Dominate the Market

- Saudi Arabia is the largest crude oil producer in the MENA region, and the country has been a global leader in upstream technology. According to the Saudi Ministry of Energy, the country produced 9124.72 thousand barrels/day of crude last year, making it the 3rd largest producer of crude oil. Last year, the country produced 120.46 billion cubic meters of gas, making it the 8th largest producer globally.

- The country is the largest producer of crude oil in the MENA region and has the second-largest proven crude oil reserves globally. The country's E&P sector is dominated by the state-owned hydrocarbon utility Saudi Aramco, the world's largest exporter of crude oil.

- Saudi Arabia is one of the most influential members of the OPEC cartel, and since the COVID-19 pandemic decimated energy demand globally, the country has been slowly raising production quotas to keep oil prices stable globally.

- The country's upstream sector is focused on the development of massive limestone reservoirs in the country's onshore and offshore areas, such as the world's largest conventional onshore oil field (Ghawar) and the largest conventional offshore field (Safaniyah). These colossal fields have been producing for a long time and still have significant recoverable reserves. Additionally, Saudi Arabia has also started the development of the Jafurah Shale play, the country's largest unconventional shale play, estimated to hold nearly 200 Trillion cubic feet of shale gas.

- Drilling and completion of new wells is a significant investment; however, Saudi Arabia has one of the lowest costs of drilling globally. According to Saudi Aramco, the average upstream lifting cost was USD 3 per barrel produced in both 2021 and 2020.

- According to Baker Hughes International Rig Count, as of October 2023, Saudi Arabia's cumulative rig count stood at 86, which was nearly 8.9% higher than one years ago in October 2022.

- Saudi Aramco disclosed plans to boost its capital expenditure (CAPEX) to USD 40-50 billion this year, up by nearly 50% from last year, with further growth expected until 2025. The company plans to increase its crude production capacity to 13 million barrels/day by 2027 and aims to increase gas production by nearly 50% by 2030.

- Such ambitious expansion plans, coupled with new-age goals of complying with sustainability and environmental standards, are expected to attract significant investments and require major innovation in the sector, factors which are expected to drive the upstream market in the country and the demand for drill collars in the country during the forecast period.

Middle East And Africa Drill Collar Industry Overview

The Middle-East and African drill collar market is semi-consolidated. Some of the major players, in no particular order, include Hunting PLC, National Oilwell Varco Inc. (NOV), Schlumberger Limited, China Vigor Drilling Oil Tools and Equipment Co. Ltd, and International Drilling Services Ltd (IDS).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGEMENTATION

- 5.1 Type

- 5.1.1 Standard Steel Drill Collar

- 5.1.2 Non-magnetic Drill Collar

- 5.2 By Location of Deployment

- 5.2.1 Onshore

- 5.2.2 Offshore

- 5.3 By Geography

- 5.3.1 Saudi Arabia

- 5.3.2 United Arab Emirates

- 5.3.3 Iran

- 5.3.4 South Africa

- 5.3.5 Algeria

- 5.3.6 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Companies Profiles

- 6.3.1 Hunting PLC

- 6.3.2 National Oilwell Varco Inc. (NOV)

- 6.3.3 Schlumberger Limited

- 6.3.4 China Vigor Drilling Oil Tools and Equipment Co. Ltd

- 6.3.5 International Drilling Services Ltd (IDS)

- 6.3.6 Schoeller-Bleckmann Oilfield Equipment AG

- 6.3.7 American Oilfield Tools Inc.

- 6.3.8 Challenger International Inc.

- 6.3.9 Zhong Yuan Special Steel Co. Ltd