|

市場調查報告書

商品編碼

1645029

法國國內對開式冰箱:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)France Household Side By Side Refrigerator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

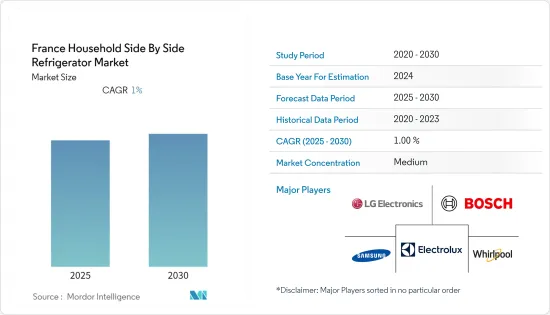

預測期內,法國國內對開式冰箱市場預計將以 1% 的複合年成長率成長。

對許多家庭來說,並排式冰箱是熱門的選擇。很多人說對開式冰箱比其他冰箱效果更好。對開式冰箱高效、實用、靈活,適合各種類型的家庭及其不同需求。並排式冰箱非常適合空間有限的廚房,因為它們需要較少的空間來打開門。對於擁有全尺寸冰箱但廚房空間有點緊張的家庭來說,這是一個不錯的選擇。

電子商務是冷凍設備市場成長最快的零售單位佔有率。消費者可以輕鬆方便地在網路上或在展示室選擇型號,然後透過電子商務購買。消費者可支配收入高、智慧型手機的廣泛使用以及高速網際網路的普及也有望促進該地區先進冰箱市場的成長。在報告期間內,透過大眾量販店以及家居和花園零售商等專業分銷管道的家用冰箱銷售呈下降趨勢。冰箱市場的成長得益於消費者對包括冰箱在內的智慧家電的日益偏好。消費者可支配收入較高、智慧型手機的廣泛使用以及高速網際網路的普及也有望推動該地區冰箱市場的成長。

法國家用對開冰箱市場趨勢

電子商務對市場產生正面影響

法國是歐洲電子商務市場的主要企業,僅次於德國和英國,位居第三。預計到2023年,全國電子商務網站數量將超過5,100萬個。在過去十年中,法國電子商務市場的規模幾乎加倍,展示了數位領域業務不斷成長的規模和盈利。到2024年,法國電商平台的用戶滲透率預計將達到77.8%。此外,由於網際網路和行動裝置的廣泛應用、技術進步、數位化導致的購物習慣的改變、可供選擇的產品種類繁多、網路購物平台上提供各種折扣和優惠等,預計電子商務行業在不久的將來會受到熱烈追捧。此外,售後服務的改善也推動了冰箱市場的發展,製造商與多家公司合作,以確保在線上銷售後及時交貨和安裝。

都市化和可支配所得的增加推動市場

預計 2023 年至 2024 年期間法國的就業率將會成長。 2024年就業人數預計為2,834萬人。近年來,員工數量一直穩定增加。隨著大多數城市人口選擇智慧廚房電器,預計未來幾年市場將會成長。技術進步使得廚房用具更加節能,從而增加了需求。此外,都市化導致可支配收入增加,進一步增加了對高檔和豪華公寓的需求。由於可支配收入的增加,人們的生活方式發生了改變,進一步促進了市場的成長。產品創新和都市化是預計有助於市場擴張的兩個主要因素。隨著城市社會勞動人口的增加,對高階廚房電器的需求預計將會增加。

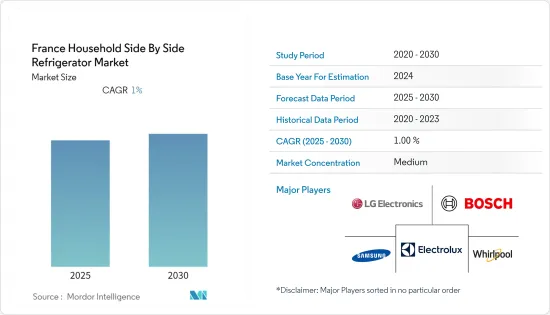

法國國內對開門冰箱產業概況

法國國內對開門冰箱市場本質上較為分散,有大量製造商參與此產業。主要參與者包括博世集團、伊萊克斯公司、三星電子、惠而浦公司、LG、通用電氣公司和海爾集團公司。各大製造商正在採用併購和新產品開發策略來加強其影響力和分銷管道,從而佔據更高的市場佔有率。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態與洞察

- 市場概況

- 市場促進因素

- 冷凍食品消費量增加

- 市場限制

- 環保意識的增強阻礙了市場成長

- 市場機會

- 環保節能冰箱

- 智慧科技公司推出新產品

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者和消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 洞察技術對市場的影響

- COVID-19 市場影響

第5章 市場區隔

- 按應用

- 少於 15 立方英尺

- 15至20立方英尺

- 20-25立方英尺

- 超過 25 立方英尺

- 按分佈

- 超級市場/大賣場

- 專賣店

- 網路商店

- 其他分銷管道

第6章 競爭格局

- 市場集中度概覽

- 公司簡介

- Bosch Group

- Electrolux AB

- LG

- Whirlpool

- Samsung

- General Electric Co.

- Haier Group

- Liebherr-Hausger te Ochsenhausen GmbH

- Midea

- Miele

- Brandt*

第7章:市場的未來

第 8 章 免責聲明與發布者

The France Household Side By Side Refrigerator Market is expected to register a CAGR of 1% during the forecast period.

Side by side refrigerators are a popular choice for many households. Many people say that side by side refrigerator works better than other refrigerators. Side by side refrigerator is efficient, practical, and flexible for all types of households and their various needs. Side by side fridge is perfect for kitchens where space is limited as the doors need less space to be opened. It is a great option for households that have a full-size fridge but a slightly small kitchen space.

E-commerce is becoming the fastest-growing retail volume share in the market of refrigeration appliances. It is easy and convenient for consumers to choose a model online or through a showroom and then purchase it via e-commerce, especially for freestanding refrigerators. Consumers' high disposable income, penetration of smartphones, and availability of high-speed Internet will also contribute to the growth of the advanced featured refrigerator market in the region. During the review period, sales of household refrigerators via specialist distribution formats like electronics and appliance retailers and home and garden retailers tended to decrease. The market growth of refrigeration appliances is driven by the increasing preference of consumers for smart appliances, including fridges, in the home. The high disposable income of consumers, the prevalence of smartphones, and the availability of high-speed Internet will also drive the growth of refrigerators in the region.

France Household Side-by-Side Refrigerator Market Trends

E- Commerce has Positive Impact on the Market

France is a major player in the European e-commerce market, ranking third behind Germany and the UK. In 2023, it was estimated that there were more than 51 million active e-commerce sites in the country. Over the past decade, France's e-commerce market has almost doubled in size, demonstrating both the scale and profitability of its growing business in the digital space. By 2024, user penetration on France's e-commerce platform is projected to reach 77.8%. Furthermore, the e-commerce sector is projected to experience a surge in popularity in the near future due to the widespread use of the Internet and mobile devices, technological progress, alterations in shopping habits caused by digitalization, the availability of a broad selection of products, and the variety of discounts and offers available on online shopping platforms. Additionally, the refrigerator market has been driven by improvements in after-sale services, with manufacturers collaborating with multiple companies to guarantee timely delivery and installation of the product after it has been sold online.

Growing Urbanization and Disposable Income are Driving the Market

Employment in France is projected to grow between 2023 to 2024. The number of people employed is estimated to be 28.34 million in 2024. The number of people employed has been increasing steadily in recent years.The market is projected to experience the growth in the coming years, as the majority of the urban population opts for smart kitchen appliances. Technological progress has made kitchen appliances more energy efficient, thus increasing the demand for them. Urbanization has also resulted in an increase in disposable income, which has further increased the demand for premium and luxury apartments. The changing lifestyles of the population due to increased disposable income are further contributing to the growth of the market. Product innovation and urbanization are two of the main factors that are expected to contribute to the expansion of the market. As the working population increases in urban societies, the demand for high-end kitchen appliances is expected to increase.

France Household Side-by-Side Refrigerator Industry Overview

France's household side by side refrigerator market is fragmented in nature as a large number of manufacturers are operating in this industry. Some prominent players are Bosch Group, Electrolux AB, Samsung Electronics Co. Ltd., Whirlpool Corp., LG, General Electric Co., and Haier Group Corp., among others. The key manufacturers have been adopting mergers and acquisitions and new product development strategies to strengthen their presence and distribution channels and, thereby, gain a higher market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Consumption of Frozen Food Products

- 4.3 Market Restraints

- 4.3.1 Rising Awareness About Environmental Protection to Hinder the Market Growth

- 4.4 Market Opportunities

- 4.4.1 Eco-Friendly and Energy Efficiency Refrigerators

- 4.4.2 Introduction of New Products by Companies with Smart Technology

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Impact of Technology in the Market

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Under 15 cu.ft.

- 5.1.2 15-20 cu.ft.

- 5.1.3 20-25 cu.ft.

- 5.1.4 Above 25 cu.ft.

- 5.2 By Distribution

- 5.2.1 Supermarkets/ Hypermarkets

- 5.2.2 Specialty Stores

- 5.2.3 Online Stores

- 5.2.4 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Bosch Group

- 6.2.2 Electrolux AB

- 6.2.3 LG

- 6.2.4 Whirlpool

- 6.2.5 Samsung

- 6.2.6 General Electric Co.

- 6.2.7 Haier Group

- 6.2.8 Liebherr-Hausger te Ochsenhausen GmbH

- 6.2.9 Midea

- 6.2.10 Miele

- 6.2.11 Brandt*