|

市場調查報告書

商品編碼

1645030

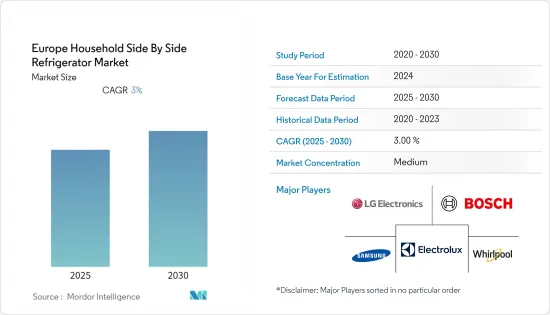

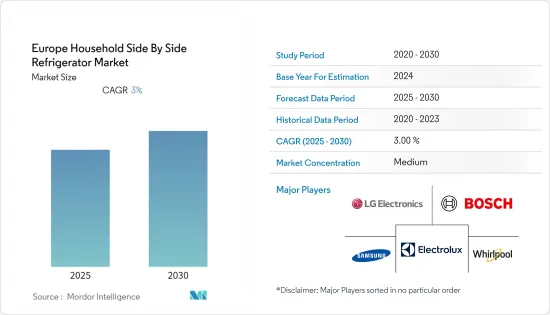

歐洲家用對開式冰箱:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Europe Household Side By Side Refrigerator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計預測期內歐洲家用對開式冰箱市場的複合年成長率將達到 3%。

歐洲是全球冰箱市場第二大地區。該市場的成長是由消費者對家用智慧家電(包括冰箱)的日益成長的偏好所推動的。此外,消費者可支配收入較高、智慧型手機的廣泛應用以及高速網際網路的普及也推動了該全部區域先進冰箱市場的成長。在報告期間,透過電子和家電零售商以及家居和花園零售商等專業分銷模式銷售的家用冰箱銷售量趨於下降。電子商務正迅速奪取冷凍設備市場的零售單位佔有率。消費者可以輕鬆輕鬆地在線上和展示室中瀏覽模型,然後透過電子商務進行購買。製冷電器市場的成長是由消費者對包括冰箱在內的智慧電器日益成長的偏好所推動的。消費者可支配收入較高、智慧型手機普及以及高速網路的普及也將推動該地區冰箱市場的成長。

在大多數歐洲國家,本地供應商生產的產品比其他公司生產的產品更受歡迎。如果當地製造商的產品品質不高且價格實惠,那麼他們將永遠無法獲得良好的市場佔有率。換句話說,可以解釋歐洲人喜歡靈活、多功能、便利、環保、能耗低、價格低廉的產品。

自新冠疫情以來,冷凍設備零售較上年略有加速。在疫情初期,由於一些家庭面臨糧食短缺的風險,試圖儲存糧食,因此對此類設備的需求增加。此外,市場上公司推出的新產品可能會推動市場成長。許多市場參與企業正投入綠色創新產品的研發。此外,歐洲製造商正專注於推出和引進新產品,以多樣化產品系列併擴大該地區的製造和分銷。

歐洲家用對開門冰箱市場趨勢

智慧廚房的日益普及將對市場產生正面影響

智慧廚房的趨勢直接影響家用對開門冰箱市場的成長。這導致消費者廚房購買模式的改變。住宅市場的快速成長也推動了市場的成長。許多已開發國家由於來自各國的移民增加而經歷人口成長。雙收入家庭、核心家庭、離開父母去工作以及工作變動的增加導致了家電購買量的增加。這導致家庭消費增加,從而刺激了對開式冰箱市場的需求。

線上細分市場領先市場

由於網路和智慧型手機普及率高、技術進步、數位化導致的購物行為變化、各種產品的供應以及網路購物網站上的各種折扣和優惠,預計預測期內線上市場將快速成長。此外,售後服務的完善也為冰箱市場的成長提供了動力。製造商與多家其他公司合作,以確保在線上銷售後及時交貨和安裝。

歐洲家用對開門冰箱產業概況

歐洲家用對開門冰箱市場本質上是分散的,有大量製造商從事該行業。知名製造商包括博世集團、伊萊克斯公司、三星電子、惠而浦公司、LG、通用電氣公司和海爾集團公司。各大製造商正在採用併購和新產品開發策略來加強其影響力和分銷管道,從而佔據更高的市場佔有率。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態與洞察

- 市場概況

- 市場促進因素

- 冷凍食品消費量的增加推動了市場

- 市場限制

- 環保意識的增強阻礙了市場成長

- 市場機會

- 環保節能冰箱

- 智慧科技公司推出新產品

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者和消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 洞察技術對市場的影響

- COVID-19 市場影響

第5章 市場區隔

- 按應用

- 少於 15 立方英尺

- 15至20立方英尺

- 20-25立方英尺

- 超過 25 立方英尺

- 按分佈

- 專賣店

- 超級市場/大賣場

- 網路商店

- 其他分銷管道

- 按國家

- 英國

- 法國

- 義大利

- 德國

- 西班牙

- 其他歐洲國家

第6章 競爭格局

- 市場集中度概覽

- 公司簡介

- Bosch Group

- Electrolux AB

- LG

- Whirlpool

- Samsung

- General Electric Co

- Haier Group

- Liebherr-Hausger te Ochsenhausen GmbH

- Midea

- Miele

- Brandt

第7章:市場的未來

第 8 章 免責聲明與發布者

The Europe Household Side By Side Refrigerator Market is expected to register a CAGR of 3% during the forecast period.

Europe is the second largest region in the global refrigerator market. The growth of the market is driven by the growing preference of consumers for smart appliances in the home, including refrigerators. In addition, the high disposable income of the consumers, the penetration of smartphones, and the availability of high-speed Internet will also drive the market growth of advanced featured refrigerators across the region. Sales of household refrigerators through specialist distribution formats such as electronics & appliance specialist retailers but also home & garden specialist retailers have tended to decrease during the review period. E-commerce is rapidly gaining retail volume shares in the refrigeration appliances market. It is convenient and easy for consumers to browse models online or through showrooms and then purchase through e-commerce, especially in the case of freestanding appliances. The market growth of refrigeration appliances is driven by the increasing preference of consumers for smart appliances, including fridges, in the home. The high disposable income of consumers, the prevalence of smartphones, and the availability of high-speed Internet will also drive the growth of refrigerators in the region.

In most European countries, the products that a local vendor manufactures have comparatively better preference than that of the others, which clearly signifies their preference to encourage their domestic market. Local manufacturers can never get a good market share unless the products are qualitative are have affordable prices. This, in short, can be explained as the Europeans prefer to use products that have features like flexibility, multi-utilization/ multi-functional features, convenience to use, eco-friendly, less energy-utilization, and are of low/reasonable cost.

Post-COVID-19, the refrigeration appliances saw growth in retail volume sales sped up slightly from the previous year. The fact that some households sought to stockpile food during the early stages of the pandemic due to the perceived risk of shortages increased demand for these appliances. Furthermore, the introduction of new products by the market players will drive the market growth. Many market players are investing in research and development of eco-friendly and innovative products in the market. Moreover, manufacturers in Europe are focusing on launching and introducing new products to diversify their product portfolios and expand manufacturing & distribution in the region.

Europe Household Side-by-Side Refrigerator Market Trends

The Growing Trend of Smart Kitchens is Positively Influencing the Market

The growing trend of smart kitchens is directly influencing the growth of the household side by side refrigerator market. It is leading to a changing purchasing pattern of the consumer for their kitchen. A surge in the residential side of the market is also driving the market growth. The population is growing in many developed countries due to the increasing number of immigrants from different countries. An increase in the number of working individuals, nuclear families, single-person homes, and job migration has resulted in an increase in the purchase of home appliances. Therefore, the number of household consumption also increased, which is propelling the market demand for side by side refrigerator market.

Online Segment is Driving the Market

The online segment is expected to witness rapid growth during the forecast period owing to the high penetration of the Internet and smartphones, along with technological advancements, changes in shopping behavior due to digitalization, availability of a wide range of products, and a wide range of discounts and offers on online shopping sites. In addition, improvements in after-sales services have provided an impetus to the refrigerator market growth. Manufacturers are working with several other companies to ensure timely delivery and installation after the online sales of the product.

Europe Household Side-by-Side Refrigerator Industry Overview

Europe's household side by side refrigerator market is fragmented in nature as a large number of manufacturers are operating in this industry. Some prominent players are Bosch Group, Electrolux AB, Samsung Electronics Co. Ltd., Whirlpool Corp., LG, General Electric Co., and Haier Group Corp., among others. The key manufacturers have been adopting mergers and acquisitions and new product development strategies to strengthen their presence and distribution channels and, thereby, gain a higher market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Consumption of Frozen Food Products is Driving the Market

- 4.3 Market Restraints

- 4.3.1 Rising Awareness on Environmental Protection to Hinder the Market Growth

- 4.4 Market Opportunities

- 4.4.1 Eco-friendly and Energy Efficiency Refrigerators

- 4.4.2 Introduction of New Products by Companies with Smart Technology

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Impact of Technology in the Market

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Under 15 cu.ft.

- 5.1.2 15-20 cu.ft.

- 5.1.3 20-25 cu.ft.

- 5.1.4 Above 25 cu.ft.

- 5.2 By Distribution

- 5.2.1 Speciality Stores

- 5.2.2 Supermarkets/ Hypermarkets

- 5.2.3 Online Stores

- 5.2.4 Other Distribution Channels

- 5.3 By Country

- 5.3.1 United Kingdom

- 5.3.2 France

- 5.3.3 Italy

- 5.3.4 Germany

- 5.3.5 Spain

- 5.3.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Bosch Group

- 6.2.2 Electrolux AB

- 6.2.3 LG

- 6.2.4 Whirlpool

- 6.2.5 Samsung

- 6.2.6 General Electric Co

- 6.2.7 Haier Group

- 6.2.8 Liebherr-Hausger te Ochsenhausen GmbH

- 6.2.9 Midea

- 6.2.10 Miele

- 6.2.11 Brandt*