|

市場調查報告書

商品編碼

1645107

離岸風力發電施工船-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Offshore Wind Construction Vessel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

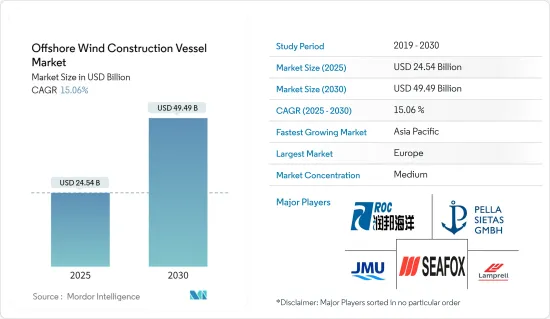

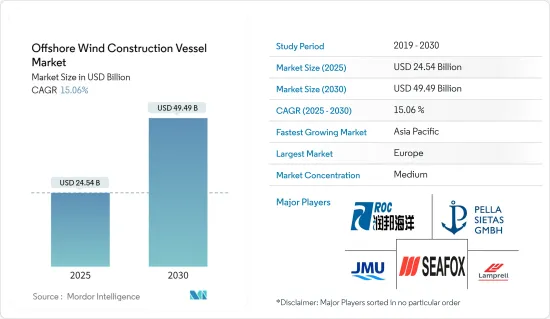

2025年離岸風力發電建造船市場規模預估為245.4億美元,預計2030年將達到494.9億美元,預測期間(2025-2030年)複合年成長率為15.06%。

關鍵亮點

- 從中期來看,離岸風力發電裝置數量增加和全球可再生能源需求等因素預計將成為預測期間離岸風力發電施工船市場最重要的促進因素之一。

- 另一方面,離岸風力發電施工船的高建造和營運成本預計將在預測期內對市場構成威脅。

- 然而,船舶設計、推進系統和自動化方面的不斷進步正在使風電施工船舶變得更有效率。預計這一因素將在未來為市場創造許多機會。

- 亞太地區佔據市場主導地位,並可能在預測期內實現最高的複合年成長率。由於中國、越南和日本等國家的海上風力發電安裝計劃數量不斷增加,這些國家正在推動市場的發展。

離岸風力發電施工船市場趨勢

傳統自升式船舶預計將成長

- 典型的自升式船舶是設計用於在惡劣的海洋環境條件下作業的裝置。它們有一個船體和多個圓柱形或格子狀的支柱,可以延伸到海床,從而可以將船舶頂起,為安裝、維護和水線以上各種其他活動提供穩定的平台。其設計和操作相對簡單,非常適合離岸風力發電的建造和維護工作。

- 自升式船舶的主要優勢之一是能夠在海上提供穩定的高空作業平台。這種穩定性對於塔筒部分、機艙、渦輪機和葉片等風電部件的精確定位和安裝至關重要。即使在惡劣的天氣條件下,高空作業平台也能讓使用者安全、有效率地進入渦輪機進行維護和修理工作。

- 隨著離岸風力發電設施的增加,傳統自升式船的需求預計將大幅增加。各國都在探索部署離岸風力發電,但與傳統自升式船相比,離岸風電場的操作和維護簡單得多,運作成本相對較低。

- 根據國際可再生能源機構(2023年)的數據,預計2023年全球離岸風力發電累積裝置容量將達到72.66吉瓦,而2022年為61.96吉瓦,複合年成長率超過17%。

- 為了滿足這一市場需求,自升式船舶營運商和造船廠正在大力投資設計和建造新的最先進的船舶。這些船舶配備了動態定位系統、運動補償起重機和綜合控制系統等先進技術,以提高營運效率和安全性。

- 例如,2023 年 5 月,丹麥安裝公司 Cadeler 宣布已著手研發一系列新型傳統升降式離岸風電安裝船。該公司與 MAN Energy Solutions 合作開發小型引擎,旨在將這些船舶的重量減輕 50%。這將在不增加船舶重量的情況下為更先進的推進系統騰出空間,從而能夠以與傳統船舶相似的價格建造先進船舶。

- 因此,由於技術進步和海上風力發電探勘的不斷增加,預計預測期內傳統自升式船舶將大幅成長。

亞太地區佔市場主導地位

- 亞太地區預計將在離岸風力發電建造船市場佔據主導地位,各國都為可再生能源和海上風力發電製定了雄心勃勃的目標。該地區的國家,包括中國、越南、印度、日本和韓國,由於快速的經濟成長和都市化,能源需求正在激增。海上風力發電已成為滿足日益成長的能源需求、同時抑制碳排放和解決空間限制的理想解決方案。

- 據國際可再生能源機構稱,近年來亞太地區海上能源產能大幅成長。其規模在世界上名列前茅。 2023年該地區離岸風力發電裝置容量將達到40.25吉瓦,佔全球裝置容量的55%以上。這意味著該地區海上風力發電的採用將不斷增加,從而促進市場成長。

- 亞太各國政府正在實施雄心勃勃的可再生能源目標和支持政策,為離岸風力發電的發展創造了良好的環境。例如,中國已設定目標,到2030年安裝40吉瓦(GW)的離岸風力發電容量,日本的目標是10GW,韓國的目標是820GW。這些都進一步推動了該地區離岸風力發電建造船市場的發展。

- 此外,該地區在造船、鋼鐵生產和重型機械等領域成熟的製造能力為發展強大的離岸風電供應鏈提供了堅實的基礎,包括生產風力發電機組件、船舶和支援基礎設施。

- 因此,預計亞太地區將在預測期內佔據市場主導地位。

離岸風力發電施工船舶產業概況

全球離岸風力發電施工船市場正走向半固體。該市場的一些主要企業包括 Lamprell Energy Ltd、Pella Sietas GmbH、Japan Marine United Corporation、Seafox 和南通彩虹海洋工程設備有限公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 至2029年的市場規模及需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 離岸風力發電的採用日益增多

- 人們對可再生能源的興趣日益濃厚

- 限制因素

- 初期資本投入高

- 驅動程式

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅產品/服務

- 競爭對手之間的競爭

第5章 市場區隔

- 船舶類型

- 自航自升船舶

- 常規自升式船舶

- 重裝運船隻

- 2029 年市場規模與需求預測(按地區)

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 北歐的

- 俄羅斯

- 土耳其

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 澳洲

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 卡達

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Lamprell Energy Ltd

- Xiamen Shipbuilding Industry Co. Ltd

- Pella Sietas GmbH

- Japan Marine United Corporation

- Shanghai Zhenhua Heavy Industries Co. Ltd

- Nantong Rainbow Offshore & Engineering Equipments Co. Ltd

- COSCO SHIPPING Heavy Transport Inc.

- Fred. Olsen Windcarrier

- Deme Group

- Seafox

- 市場排名/佔有率分析

第7章 市場機會與未來趨勢

- 技術創新的進步

簡介目錄

Product Code: 50002218

The Offshore Wind Construction Vessel Market size is estimated at USD 24.54 billion in 2025, and is expected to reach USD 49.49 billion by 2030, at a CAGR of 15.06% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as increasing offshore wind energy installations and the global renewable energy imperative are expected to be among the most significant drivers for the offshore wind construction vessel market during the forecast period.

- On the other hand, the cost of building and operating offshore wind construction vessels is high, which will pose a threat to the market during the forecast period.

- However, continued advancements in vessel design, propulsion systems, and automation led to more efficient wind construction vessels. This factor is expected to create several opportunities for the market in the future.

- The Asia-Pacific region dominates the market and will likely register the highest CAGR during the forecast period. China, Vietnam, Japan, and others drive it due to the growing number of offshore wind energy installation projects in these countries.

Offshore Wind Construction Vessel Market Trends

Normal Jack-Up Vessels Expected to Witness Growth

- Normal jack-up vessels are units designed to operate in harsh offshore environmental conditions. They have hulls and several cylindrical or lattice legs that can be extended to the seabeds, allowing the vessel to be jacked up and providing a stabilized platform for performing installation, maintenance, or various other activities from above the water surface. Due to their relatively more straightforward designs and operations, they are ideal for offshore wind farm construction and maintenance activities.

- One of the primary advantages of jack-up vessels is their ability to provide a stable and elevated working platform in offshore locations. This stability is critical for accurately positioning and installing wind energy components, such as tower sections, nacelles, turbines, and blades. The elevated platform also facilitates safe and efficient access to the turbines for maintenance and repair work, even in challenging weather conditions.

- As the number of offshore wind installations rises, the demand for normal jack-up vessels is expected to increase significantly. Various countries are exploring offshore wind energy installations, and compared to their counterparts, normal jack-up type vessels offer far less complexity in terms of operating and maintaining while also being relatively cheaper.

- According to the International Renewable Energy Agency 2023, the cumulative offshore wind energy installation globally was 72.66 GW in 2023 compared to 61.96 GW in 2022, registering a CAGR of over 17%, signifying the growing traction of offshore wind energy installation, which, in turn, drives the demand for normal jack-up vessels.

- To meet these market demands, jack-up vessel operators and shipyards have invested heavily in designing and constructing new, state-of-the-art vessels. These vessels are equipped with advanced technologies, such as dynamic positioning systems, motion-compensated cranes, and integrated control systems, to enhance their operational efficiency and safety.

- For instance, in May 2023, Danish installation firm Cadeler announced that the company worked on a new series of normal jack-up offshore wind installation vessels. The company teamed up with MAN Energy Solutions to develop a small engine that would reduce the weight of these vessels by 50%. This is expected to create room for a more advanced propulsion system without increasing the vessel weight, which leads to advanced vessels at a similar price to traditional vessels.

- Hence, the normal jack-up vessels are expected to grow significantly during the forecast period due to increased technological advancements and exploration of offshore wind energy.

Asia-Pacific to Dominate the Market

- Asia-Pacific is poised to dominate the offshore wind construction vessel market, driven by various countries setting ambitious renewable and offshore wind energy targets. Countries in the region, such as China, Vietnam, India, Japan, and South Korea, are experiencing a surge in energy demand due to rapid economic growth and urbanization. Offshore wind energy has emerged as an ideal solution to meet the growing energy demand while controlling carbon emissions and tackling space constraints.

- According to the International Renewable Energy Agency, offshore energy capacity in Asia-Pacific has risen significantly in recent years. It is one of the largest in the world. In 2023, the region's installed offshore wind energy capacity was 40.25 GW, which was more than 55% of the global installed capacity. This signifies the increased adoption of offshore wind energy in the region, propelling the market growth.

- Governments across the Asia-Pacific have implemented ambitious renewable energy targets and supportive policies, creating a conducive environment for offshore wind farm development. For instance, China has set a target of installing 40 gigawatts (GW) of offshore wind capacity by 2030, while Japan aims for 10 GW, and South Korea targets 8.2 GW by the same year. They are further driving the offshore wind construction vessels market in the region.

- Additionally, the region's well-established manufacturing capabilities in sectors such as shipbuilding, steel production, and heavy machinery provide a solid foundation for developing a robust offshore wind supply chain, including producing wind turbine components, vessels, and support infrastructure.

- Thus, the Asia-Pacific region will dominate the market during the forecast period.

Offshore Wind Construction Vessel Industry Overview

The global offshore wind construction vessel market is semi-consolidated. Some of the key players in this market are Lamprell Energy Ltd, Pella Sietas GmbH, Japan Marine United Corporation, Seafox, and Nantong Rainbow Offshore & Engineering Equipments Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Offshore Wind Energy Installation

- 4.5.1.2 Growing Imperative Toward Renewable Energy

- 4.5.2 Restraints

- 4.5.2.1 High Initial Capital Investment

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Self-propelled Jack-up Vessel

- 5.1.2 Normal Jack-up Vessel

- 5.1.3 Heavy Lift Vessel

- 5.2 Geography [Market Size and Demand Forecast till 2029 (for regions only)]

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 NORDIC

- 5.2.2.7 Russia

- 5.2.2.8 Turkey

- 5.2.2.9 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Australia

- 5.2.3.4 Japan

- 5.2.3.5 South Korea

- 5.2.3.6 Malaysia

- 5.2.3.7 Thailand

- 5.2.3.8 Indonesia

- 5.2.3.9 Vietnam

- 5.2.3.10 Rest of Asia-Pacific

- 5.2.4 Middle East and Africa

- 5.2.4.1 Saudi Arabia

- 5.2.4.2 United Arab Emirates

- 5.2.4.3 Nigeria

- 5.2.4.4 Egypt

- 5.2.4.5 Qatar

- 5.2.4.6 South Africa

- 5.2.4.7 Rest of Middle East and Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Argentina

- 5.2.5.3 Colombia

- 5.2.5.4 Rest of South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Lamprell Energy Ltd

- 6.3.2 Xiamen Shipbuilding Industry Co. Ltd

- 6.3.3 Pella Sietas GmbH

- 6.3.4 Japan Marine United Corporation

- 6.3.5 Shanghai Zhenhua Heavy Industries Co. Ltd

- 6.3.6 Nantong Rainbow Offshore & Engineering Equipments Co. Ltd

- 6.3.7 COSCO SHIPPING Heavy Transport Inc.

- 6.3.8 Fred. Olsen Windcarrier

- 6.3.9 Deme Group

- 6.3.10 Seafox

- 6.4 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Technological Innovation

02-2729-4219

+886-2-2729-4219