|

市場調查報告書

商品編碼

1651023

中東和非洲 AMH 和儲存系統 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)MEA AMH and Storage Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

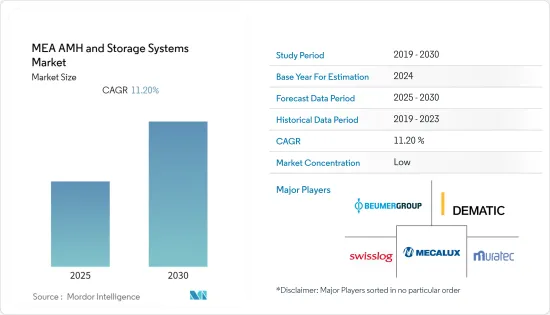

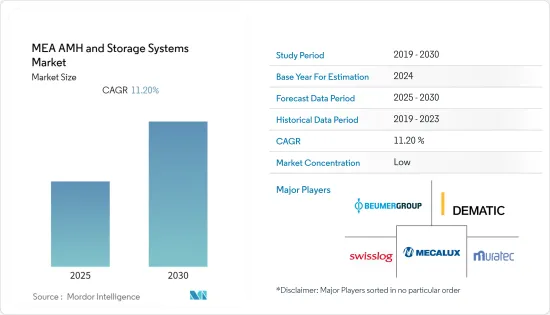

中東和非洲 AMH 和儲存系統市場預計在預測期內實現 11.2% 的複合年成長率

關鍵亮點

- 採用技術 4.0 和物聯網的國家所推動的趨勢正在推動市場的發展。由機器人技術推動的工業 4.0 正在徹底改變物料輸送。機器人技術在倉庫和配送設施中變得越來越普遍。除了挑選和包裝訂單外,機器人還可以用於裝卸卡車和清潔倉庫地板。機器人的引入提高了工作準確性和生產效率。機器人還可以透過減少所需的人工勞動量來幫助公司節省成本。工業 4.0 也利用人工智慧來影響物料輸送。人工智慧機器人可以比人類更快、更準確地挑選物品。此外,機器學習可用於在倉庫內有效地安排訂單。

- 物聯網顯著減少了 AGV/AMR 維護所需的成本和時間。 AGV 由維護人員遠端監控,只有出現問題時才會派人前來,因此無需定期維護。此外,AGV/AMR 由複雜的軟體操作,並可透過雲端基礎的應用程式進行無線控制。可以遠端發送指令並輕鬆解決技術問題。因此,維護既簡單又經濟實惠。

- 過去幾年,電子商務發展迅速。為了更好地滿足消費者的需求,許多企業正在從實體零售轉向網路零售。該地區的主要企業已投資技術以提供可靠的消費者服務。

- COVID-19 疫情使得不同領域採用自動化的情況變得複雜。 COVID-19 疫情帶來了保持社交距離和非接觸式操作的獨特挑戰,改變了標準操作程序。組織被迫限制勞動力以應對日益成長的需求。後疫情時代,公共場所的清潔是一項挑戰。事實證明,使用 UV-C 光是解決該問題的非侵入性解決方案。然而,紫外線會損害人體皮膚。 AMR 配備 UV-C 燈,可在規定區域內獨立移動。機器人可以使用行動應用程式中創建的地圖上的航點進行導航。然後機器人將按照路徑點繼續清潔。當電池電量不足時,機器人還可以無需人工幫助尋找充電站。預計此類使用案例將為所研究市場的成長提供有利可圖的機會。

- 用於物料輸送(例如機械臂)和儲存系統的設備非常昂貴。在受調查的市場中,自動儲存和搜尋系統 (ASRS) 被發現比一般物料輸送設備更高成本。自動化起重機也需要大量的基礎設施來維護產品。

中東和非洲的 AMH 和儲存系統市場趨勢

中東和非洲電子商務的成長預計將推動市場

- 中東是全球成長最快的電子商務市場之一,也是人口最年輕的地區之一。中東地區總人口為1.08億,其中15歲至29歲的人口占總人口的28%以上。

- 這一趨勢在某些國家尤其明顯,包括埃及、伊拉克、黎巴嫩、摩洛哥、阿曼、突尼斯、約旦、阿爾及利亞和沙烏地阿拉伯,這些國家約有 20% 的人口年齡在 15 至 24 歲之間。許多年輕一代正在轉向電子商務和智慧型手機的使用,預計電子商務將呈現上升趨勢。

- 隨著網路購物購者越來越喜歡客製化、個人化的產品訂單,電子商務公司發現完成複雜的手動訂單變得越來越困難。客戶還希望以更低的價格獲得客製化產品,並與常規訂單同時交付。客製化訂單的日益普及迫使製造商和倉庫業者提高其揀選和分類流程的效率和速度,以實現經濟成功。

- 該地區完善的物流網路使南非成為電子商務行業的強大平台。此外,根據世界經濟論壇的報導,南非意識到貿易的潛在未來是數位化,電子商務是其中的重要組成部分,它有可能改變非洲企業的生產、銷售和消費方式。預計這也將推動電子商務和物流領域的發展。預計這些因素將推動市場成長。

- 此外,阿拉伯聯合大公國是電子商務產業的強大平台。例如,2022 年 1 月,總部位於阿拉伯聯合大公國的電子商務履約新興企業Shortages 在種子資金籌措中籌集了 70 萬美元,以幫助國際電子商務公司進入阿拉伯聯合大公國和海灣合作理事會市場。該資金將用於擴張和人才招聘,這是該公司增加阿拉伯聯合大公國倉儲設施策略的一部分。

- 據杜拜經濟發展部稱,今年銷售額預測將達到 270 億美元左右。預計 2018 年至 2022 年期間,阿拉伯聯合大公國的電子商務銷售額將以 23% 的複合年成長率成長。

沙烏地阿拉伯有望佔據主要市場佔有率

- 與許多中東國家一樣,沙烏地阿拉伯的經濟依賴石油和石化工業。據估計,如果該國石油產量下降5%,國內生產總值(GDP)成長速度將放緩80%以上。

- 就連國際貨幣基金組織(IMF)在其最新的《世界經濟展望》中也大幅下調了沙烏地阿拉伯的GDP預測。修改的主要原因是歐佩克協議達成後石油減產的前景。

- 近年來,由於沙烏地阿拉伯推出「2030願景」計畫以減少該國對石油的依賴,該國在電子商務和物流領域的需求大幅成長。該計畫包含九點策略,包括簡化流程、自由化市場、私有化、加強基礎設施、建立新的自由經濟區、實施治理和監管改革,以最大限度地發揮其發展成為中東地區物流樞紐的戰略優勢。

- 隨著眾多製藥公司預計進入沙烏地阿拉伯市場,該國有望成為製藥業的熱點。這可能會增加對包裝解決方案的需求。預計這將自然導致輸送機和堆垛機的更廣泛採用。

- 此外,沙烏地阿拉伯是世界主要旅遊目的地之一,吸引了許多外國遊客。該國平均空中交通量的增加正在推動機場終端用戶領域對 AMH 設備的需求。全球石油市場放緩和生產限制可能會減少對航空領域的投資,但預計未來幾年將出現明顯復甦。根據沙烏地阿拉伯民航局估計,旅遊業對沙烏地阿拉伯GDP的貢獻今年預計將達到2,230億沙烏地里亞爾(約593.8億美元),到2032年將持續成長至6,350億沙烏地里亞爾(約1,688.9億美元)。

中東和非洲 AMH 和儲存系統產業概況

中東和非洲 AMH 和儲存系統市場高度分散,主要參與者包括 Swisslog Holdings AG、Murata Machinery USA, Inc.、Beumer Group、Dematic Group 和 Mecalux SA。市場參與企業正在採取聯盟、合作、併購和收購等策略來增強其產品供應並獲得永續的競爭優勢。

2022年3月,SSI Schaefer與Nahdi醫療公司合作,宣布啟動沙烏地阿拉伯首個自動化製藥廠。該設施佔地平方公尺,配備溫控物流、靈活的配送中心和自動化訂單處理功能,其技術和系統支援 Nahdi 確保醫療安全,符合最新的國際標準和 SFDA 最佳實踐法規。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 電子商務產業成熟

- 市場限制

- 高成本

- 技術簡介

第6章 市場細分

- 設施

- 自動導引運輸車系統(AGV系統)

- 單元貨載運輸車

- 牽引車

- 托盤車

- 組裝車輛

- 堆高機

- 夾車

- 其他 AGV 系統

- 自動儲存和搜尋系統 (AS/RS)

- 單元貨載自動倉儲系統

- 迷你公路自動倉儲系統

- 旋轉式 AS/RS

- 機器人自動倉儲系統

- 隧道式系統

- 其他自動化立體倉庫

- 輸送機/分類系統

- 腰帶

- 調色盤

- 擰緊

- 開賣

- 新月

- 滾筒

- 其他輸送機和分類系統

- 機器人系統

- 碼垛

- 拾取和放置服務

- 裝箱

- 其他機器人系統

- 自動導引運輸車系統(AGV系統)

- 最終用戶應用程式

- 車

- 零售

- 運輸和物流

- 醫療與生命科學

- 製造業

- 能源

- 其他

- 業務類型

- 包裝

- 組裝

- 儲存和處理

- 分配

- 運輸

- 其他業務

- 國家

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 土耳其

- 以色列

- 其他國家

第7章 競爭格局

- 公司簡介

- Swisslog Holdings AG

- Murata Machinery USA, Inc.

- Beumer Group

- Dematic Group

- Mecalux SA

- Kardex AG

- Toyota Material Handling

- Coesia Middle East DMCC(Flexlink)

- SSI Schaefer

- PCM ME(FZC)

第8章投資分析

第9章:市場的未來

The MEA AMH and Storage Systems Market is expected to register a CAGR of 11.2% during the forecast period.

Key Highlights

- The market is driven by trends caused by countries adopting technology 4.0 and IoT. Using robotics, industry 4.0 is revolutionizing material handling. In warehouses and distribution facilities, robotics has become more prevalent. In addition to picking and packaging orders, robots can be employed for loading and unloading trucks, and even cleaning the warehouse floor. Workplace accuracy and productivity can both be enhanced by robotics. Robots can also help companies save money by reducing the amount of manual work necessary. Industry 4.0 also has an impact on material handling using artificial intelligence. AI-powered robots are faster and more precise at picking orders than people. Additionally, they can use machine learning to route orders efficiently through the warehouse.

- IoT significantly reduces the cost and time needed for AGV/AMR maintenance. AGVs can be remotely monitored by maintenance personnel, who are only called in when problems emerge, eliminating the need for routine maintenance visits. Additionally, because the devices are operated by sophisticated software, cloud-based apps can control them wirelessly. Instructions can be transmitted remotely, and technical problems are easily fixed. As a result, maintenance is simple and affordable.

- E-commerce has been growing rapidly over the last few years. Many companies have moved from physical retail to online to better cater to consumer requirements. Major companies in the region have invested in technology to provide reliable consumer service.

- The COVID-19 pandemic complicated the situation of automation adoption in various sectors. It changed the standard operating procedure by bringing in unique challenges of social distancing and contactless operation. Organizations were forced to limit their workforce and deal with the increasing demand. In the post-pandemic era, cleaning public spaces is a difficult problem. The usage of UV-C light has proven to be a non-intrusive solution to this problem. However, UV light can harm a person's skin. AMRs with UV-C lamps installed can move independently through a defined region. Robots can navigate maps made by mobile apps using waypoints. The robots then proceed to clean the area while following the waypoints. When the battery is low, the robots also find the charging station without human assistance. Such use cases are anticipated to offer lucrative opportunities for the growth of the studied market.

- The equipment used for material handling (such as robotic arms) and storage systems has been highly cost-intensive. Automated storage and retrieval systems (ASRS) have been found to cost higher than the typical material-handling equipment in the market studied. Automated cranes also need a high amount of infrastructure to sustain the product.

MEA Automated Material Handling and Storage Systems Market Trends

Growing E-commerce in Middle East and Africa is Expected to Drive the Market

- The Middle East is one of the fastest-growing e-commerce markets globally, with one of the youngest populations. Out of 108 million people, more than 28% of the population in the Middle East is between the ages of 15 and 29.

- This is more prominent in specific countries, including Egypt, Iraq, Lebanon, Morocco, Oman, Tunisia, Jordan, Algeria, and Saudi Arabia, where around 20% of the total population is between the ages of 15 and 24 years. Most younger generations are shifting towards e-commerce and smartphone usage, due to which the upward trend of e-commerce is expected.

- As online shoppers' preferences for customized and personalized product orders grow, e-commerce enterprises find it increasingly challenging to fulfil complex orders using manual processes. Customers also want these customized purchases delivered at low prices and simultaneously with standard orders. Because of the growing popularity of customized orders, manufacturers and warehouse operators have been compelled to improve the efficiency and speed of their picking and sorting processes to achieve economic success.

- With well-built logistics networks in the region, South Africa is an encouraging platform for the e-commerce industry. Moreover, according to the World Economic Forum, South Africa has realized that the potential future of trade is digital, and a large component of this is e-commerce, which has the potential to transform how businesses in Africa produce, sell, and consume goods. This is also expected to drive the e-commerce and logistics sector. Such factors are expected to drive the market's growth.

- Furthermore, United Arab Emirates is an encouraging platform for the e-commerce industry. For instance, in January 2022, the UAE-based e-commerce fulfillment start-up, Shortages, raised USD 700,000 in a seed funding round to allow international e-commerce companies access the UAE and GCC markets. The raised funds would be used for expansion and recruitment as part of the company's strategy to establish more warehouse facilities across the UAE.

- According to DED (Dubai), In the current year, the forecasted value of e-commerce sales in the United Arab Emirates (UAE) was approximately USD 27 billion. E-commerce sales in the UAE were estimated to grow by an average of 23% per year between 2018 and 2022.

Saudi Arabia is Expected to Hold Major Market Share

- Like most Middle Eastern countries, Saudi Arabia's economy also typically depends on the oil and petrochemical industry. It is estimated that even a 5% reduction in oil production in the country may decelerate the pace of gross domestic product (GDP) by over 80%.

- In its World Economic Outlook update, even the International Monitory Fund (IMF) has drastically slashed its forecast for Saudi Arabia's GDP. The main argument behind that revision is the anticipated prolongation of the expurgated oil production following OPEC's agreement.

- In recent years, owing to Saudi Vision 2030, the plan launched recently to reduce the country's dependence on oil, the e-commerce and logistics sectors have witnessed a significant rise in demand. The plan encompasses a nine-point strategy of process streamlining, market liberalization, privatization, infrastructure enhancement, the establishment of new free economic zones, and governance and regulatory reforms to maximize its strategic advantage to evolve into the logistics hub of the Middle Eastern region.

- The country is expected to be a hotspot for pharmaceutical industries, as many players are expected to enter the Saudi Arabian market. This, in turn, will likely increase the need for packaging solutions. This is expected to automatically contribute toward the adoption of conveyors and palletizers.

- Moreover, the country is one of the major tourist destinations in the world and is attracting many foreign tourists. This increase in the average air traffic in the country is propelling the demand for AMH equipment in the airport end-user segment. Although the slowdown of the global oil market and restrictions on production are likely to reduce investments in the aviation sector, considerable recovery is expected in the next few years. According to the General Authority of Civil Aviation, tourism's contribution to Saudi Arabia's GDP was expected to reach SAR 223 billion (~USD 59.38 billion) by this year, and it anticipated that the contribution of the tourism industry to the Saudi economy would continue to increase to reach about SAR 635 billion (~USD 168.89 billion) by 2032.

MEA Automated Material Handling and Storage Systems Industry Overview

The Middle East and Africa Automated Material Handling and Storage Systems Market is highly fragmented with the presence of major players like Swisslog Holdings AG, Murata Machinery USA, Inc., Beumer Group, Dematic Group, and Mecalux S.A. Players in the market are adopting strategies such as partnerships, collaborations, mergers, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In March 2022, SSI Schaefer, in cooperation with Nahdi Medical Company, announced the implementation of Saudi Arabia's first automated pharmaceutical facility. Built on an area of 250,000 sqm, the facility features temperature-controlled logistics, a flexible distribution center, and automated order fulfilment using technology and systems to support Nahdi to guarantee medical security following the latest international standards & SFDA best practice regulations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Industry Value Chain Analysis

- 4.5 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Established e-commerce Industry

- 5.2 Market Restraints

- 5.2.1 High Cost of Infrastructure set up

- 5.3 Technology Snapshot

6 MARKET SEGMENTATION

- 6.1 Equipment

- 6.1.1 Automated Guided Vehicle Systems (AGV Systems)

- 6.1.1.1 Unit Load Carriers

- 6.1.1.2 Tow Vehicles

- 6.1.1.3 Pallet Trucks

- 6.1.1.4 Assembly Line Vehicles

- 6.1.1.5 Fork Lift Vehicles

- 6.1.1.6 Clamp Vehicles

- 6.1.1.7 Other AGV Systems

- 6.1.2 Automated Storage & Retrieval Systems (AS/RS)

- 6.1.2.1 Unit Load AS/RS

- 6.1.2.2 Mini Load AS/RS

- 6.1.2.3 Carousel Type AS/RS

- 6.1.2.4 Robotic AS/RS

- 6.1.2.5 Tunnel Style Systems

- 6.1.2.6 Other AS/RS

- 6.1.3 Conveyor and Sortation Systems

- 6.1.3.1 Belt

- 6.1.3.2 Pallet

- 6.1.3.3 Screw

- 6.1.3.4 Overhead

- 6.1.3.5 Crescent

- 6.1.3.6 Roller

- 6.1.3.7 Other Conveyor and Sortation Systems

- 6.1.4 Robotic Systems

- 6.1.4.1 Palletizing

- 6.1.4.2 Pick & Place Service

- 6.1.4.3 Case Packing

- 6.1.4.4 Other Robotic Systems

- 6.1.1 Automated Guided Vehicle Systems (AGV Systems)

- 6.2 End-user Application

- 6.2.1 Automotive

- 6.2.2 Retail

- 6.2.3 Transportation & Logistics

- 6.2.4 Healthcare & Lifesciences

- 6.2.5 Manufacturing

- 6.2.6 Energy

- 6.2.7 Other End-user Applications

- 6.3 Type of Operation

- 6.3.1 Packaging

- 6.3.2 Assembly

- 6.3.3 Storage & Handling

- 6.3.4 Distribution

- 6.3.5 Transportation

- 6.3.6 Other Types of Operation

- 6.4 Country

- 6.4.1 UAE

- 6.4.2 Saudi Arabia

- 6.4.3 South Africa

- 6.4.4 Turkey

- 6.4.5 Israel

- 6.4.6 Other Countries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Swisslog Holdings AG

- 7.1.2 Murata Machinery USA, Inc.

- 7.1.3 Beumer Group

- 7.1.4 Dematic Group

- 7.1.5 Mecalux S.A

- 7.1.6 Kardex AG

- 7.1.7 Toyota Material Handling

- 7.1.8 Coesia Middle East DMCC (Flexlink)

- 7.1.9 SSI Schaefer

- 7.1.10 PCM ME (FZC)