|

市場調查報告書

商品編碼

1651055

中東電動車電池:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Middle-East Electric Vehicle Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

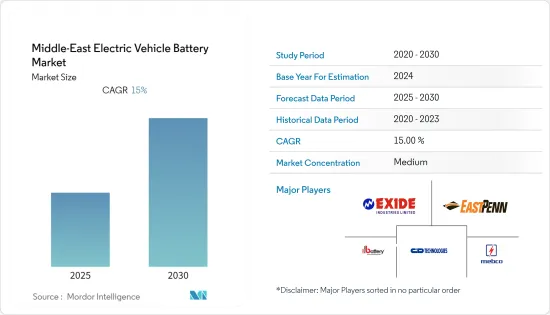

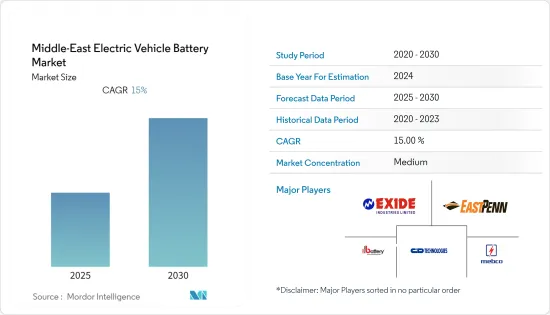

預計預測期內中東電動車電池市場複合年成長率將達到 15%。

2020 年,新冠疫情對市場產生了負面影響。目前市場已恢復至疫情前的水準。

關鍵亮點

- 從長遠來看,預計市場將受到阿拉伯聯合大公國、沙烏地阿拉伯和阿曼等中東各國和地區日益普及電動車以及政府措施的推動。

- 然而,電動車成本高、鈷等關鍵原料的供需缺口以及缺乏充電基礎設施預計將抑制市場成長。

- 增加對公共充電基礎設施的投資以及提高電動車的效率預計將在不久的將來為市場成長創造巨大的機會。

- 由於電動車在全國的普及,阿拉伯聯合大公國有望主導市場。

中東電動車電池市場趨勢

鋰離子電池可望佔據市場主導地位

- 鋰主要用於電池應用,製造鋰電池。 2021年,電池應用領域在中東地區佔有最大佔有率。

- 鋰離子電池可分為兩類:一次性電池和可充電電池。一次性鋰電池使用金屬鋰作為負極。這些電池比其他標準電池具有更長的壽命(更高的充電密度)。這些電池用於壽命較長的關鍵設備,例如植入多年的心律調節器和其他電子醫療設備。

- 同樣在 2021 年 11 月,澳洲鋰探勘和開發公司 Lepidico 宣布已與 AD Ports Group 工業城和自由區叢集的子公司阿布達比哈利法工業區 (KIZAD) 簽署協議,建立中東首個利用工程製程的鋰離子電池生產設施。工廠用地面積約57,000平方公尺。此外,Lepidico還將投資9,500萬美元在阿布達比建造化學轉化工廠,初期投資期為25年。

- 此外,2022年3月,杜拜Regency Group與Seashore Group成立的合資企業宣布,計劃於2023年1月前推出阿拉伯聯合大公國首個電池回收設施,並在兩年後推出該地區首個高科技鋰離子電池生產工廠。

- 近年來,中東地區的電動車銷量大幅成長,這可能是受該地區政府減少二氧化碳排放的主導的推動。 2020 年電動車銷量約為 4,421 輛,2021 年將增至 7,554 輛。

- 考慮到以上所有因素,預計預測期內鋰離子電池將主導中東電動車市場。

阿拉伯聯合大公國發展迅速

- 阿拉伯聯合大公國是中東地區領先的經濟體之一。近年來,該國乘用車銷量不斷成長,2020 年乘用車銷量約 15.4 萬輛,2021 年將上升至 20.8 萬輛。

- 然而,OEM製造商正在競相加快投入資源在阿拉伯聯合大公國生產全電動車車型的進程。杜拜一直致力於實現電氣化的長期目標。近年來,杜拜推出了多項舉措,鼓勵居民做出更永續的選擇。

- 例如,作為推進阿拉伯聯合大公國綠色交通解決方案議程的一部分,到2030年實現25%的城市出行無人駕駛,該市已在2025年前在全酋長國完成大量充電站的建設。已註冊的電動車在2021年之前將免收充電費,並在2022年之前免收停車費。

- 此外,2022 年 5 月,杜拜投資公司 M Glory Holding Group 宣布可能很快就會開設一家電動車製造廠,這表明其作為阿拉伯聯合大公國製造業擴大策略的一部分,將進入競爭激烈的電動車市場。該工廠投資 15 億澳元,將建在杜拜工業城,總佔地 93,000平方公尺,將成為中東地區最大的工廠之一,目標是每年生產 55,000 輛電動車。這將導致汽車對電動車電池的使用增加。

- 此外,2022年9月,阿布達比哈利法工業區宣布將建造一個25,000平方公尺的電動車組裝工廠,由智慧電動車(EV)公司NWTN營運,從事電動車製造、研發和車輛測試。該設施將由 NWTN 營運,這是一家從事電動車 (EV) 製造、研發和車輛檢測的智慧電動汽車公司。

- 因此,基於上述幾點和該國最近的趨勢,預計阿拉伯聯合大公國在預測期內將大幅成長。

中東電動車電池產業概況

中東的電動車電池市場是細分的。主要企業(不分先後順序)包括 C&D Technologies Inc.、East Penn Manufacturing Co. Ltd.、Exide Industries Ltd.、First National Battery Pty Ltd 和 Middle East Battery Company (MEBCO)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2027 年市場規模及需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 電池類型

- 鉛酸電池

- 鋰離子電池

- 其他電池類型

- 汽車模型

- 純電動車 (BEV)

- 插電式混合動力汽車(PHEV)

- 混合動力電動車 (HEV)

- 地區

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 阿曼

- 其他中東地區

第6章 競爭格局

- 併購、合資、合作、協議

- 主要企業策略

- 公司簡介

- East Penn Manufacturing Co. Inc

- C&D Technologies Inc.

- Exide Industries Ltd

- First National Battery Pty Ltd

- Middle East Battery Company(MEBCO)

- GS Yuasa Corporation

- Mebco

- Tesla Inc.

第7章 市場機會與未來趨勢

The Middle-East Electric Vehicle Battery Market is expected to register a CAGR of 15% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the long term, Factors such as the growing usage of electric vehicles across various countries and Middle-Eastern regions such as the United Arab Emirates, Saudi Arabia, and Oman with supportive government policies are expected to drive the market.

- On the other note, the high cost of electric vehicles, the demand-supply gap of vital raw materials such as cobalt, and the lack of charging infrastructure are expected to restrain the market's growth.

- Nevertheless, increasing investments in deploying the public charging infrastructure clubbed with the increasing efficiency of the electric vehicle are expected to create a significant opportunity for the market's growth in the near future.

- The United Arab Emirates is expected to dominate the market due to the growing usage of electric vehicles across the country.

Middle-East Electric Vehicle Battery Market Trends

Lithium-ion Battery is Expected to Dominate the Market

- Lithium is majorly used in battery applications for the production of lithium batteries. The battery application segment accounted for the largest share of the Middle-Eastern region in 2021.

- Lithium-ion batteries can be categorized into two segments, namely, disposable and rechargeable. Disposable lithium batteries use lithium in the metallic form as an anode. These batteries have a longer life (high charge density) than other standard batteries. These batteries find applications in critical devices with long life, such as pacemakers and other electronic medical devices implanted for many years.

- Also, in November 2021, Australian lithium exploration and development company Lepidico announced the signing of an agreement with Khalifa Industrial Zone Abu Dhabi (KIZAD), a subsidiary of AD Ports Group's Industrial Cities & Free Zone cluster, to establish the first lithium-ion battery production facility in the Middle East, utilizing a first of its kind designed process. The plant covers a land area of around 57,000 sqm. Additionally,y Lepidico plans to invest USD 95 million for the chemical conversion plant in Abu Dhabi for an initial term of 25 years.

- Furthermore, in March 2022, a joint venture between Dubai's Regency Group and Seashore Group announced their plans to launch the first battery recycling facility in the UAE by January 2023 and the region's first hi-tech lithium-ion battery production plant in two years.

- In the last couple of years, there has been a significant rise in EV sales in the Middle East region, which can be ascribed to the government initiative to lower carbon emissions in the region. In 2020, the total EV sales were around 4,421 units which increased to 7,554 units in 2021.

- Owing to the o above points, Lithium-ion battery is expected to dominate the Middle-East Electric Vehicle Market during the forecast period.

United Arab Emirates to Grow Significantly

- The United Arab Emirates is one of the leading economies in the Middle East region. In the last couple of years, the country witnessed a rise in passenger car sales; in 2020, the passenger car sales were around 1,54 thousand units which increased to 208 thousand units in 2021.

- However, OEM manufacturers are competing to expedite the process of dedicating resources to create fully electric models in the United Arab Emirates. Dubai has been working toward its long-term goal of electrification. It has launched several initiatives over the past few years to encourage sustainable choices among its residents.

- For instance, to promote the United Arab Emirates' plans for green mobility solutions and as part of its plan to have 25% of the city's trips converted into driverless journeys by 2030, the city completed the construction of a significant number of charging stations in the emirate by 2025. It exempts registered electric vehicles from charging fees until 2021 and parking fees until 2022.

- Further, in May 2022, M Glory Holding Group, an investment company in Dubai, announced it is soon likely to open an EV manufacturing plant, marking its foray into the highly competitive EV market amid the UAE's strategy to expand its manufacturing sector. The AED 1.5 billion facility at Dubai Industrial City - which will have a total land area of 93,000 square meters - will be one of the largest in the Middle East and aims to make 55,000 EVs a year. This, in turn, culminates in the growth in the usage of EV batteries for vehicles.

- Additionally, in September 2022, Khalifa Industrial Zone Abu Dhabi announced that it would construct a 25,000 square meter electric vehicle assembly facility, which will be operated by NWTN, an intelligent electric vehicle (EV) company for the manufacturing, research and development, and vehicle testing of electric vehicles. This will aid in the usage of EV batteries across the country.

- Therefore, owing to the above points and the country's recent developments, the United Arab Emirates is expected to grow significantly in the forecast period.

Middle-East Electric Vehicle Battery Industry Overview

The Middle-East Electric Vehicle Battery Market is fragmented. Some of the key players (in no particular order) include C&D Technologies Inc., East Penn Manufacturing Co. Inc., Exide Industries Ltd, First National Battery Pty Ltd, and Middle East Battery Company (MEBCO).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lead-acid Battery

- 5.1.2 Lithium-ion Battery

- 5.1.3 Other Battery Types

- 5.2 Vehicle Type

- 5.2.1 Battery Electric Vehicle (BEV)

- 5.2.2 Plug-in Hybrid Electric Vehicle (PHEV)

- 5.2.3 Hybrid Electric Vehicle (HEV)

- 5.3 Geography

- 5.3.1 Saudi Arabia

- 5.3.2 The United Arab Emirates

- 5.3.3 Oman

- 5.3.4 Rest of Middle-East

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 East Penn Manufacturing Co. Inc

- 6.3.2 C&D Technologies Inc.,

- 6.3.3 Exide Industries Ltd,

- 6.3.4 First National Battery Pty Ltd

- 6.3.5 Middle East Battery Company (MEBCO)

- 6.3.6 GS Yuasa Corporation

- 6.3.7 Mebco

- 6.3.8 Tesla Inc.