|

市場調查報告書

商品編碼

1683533

歐洲木質顆粒-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Wood Pellet - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

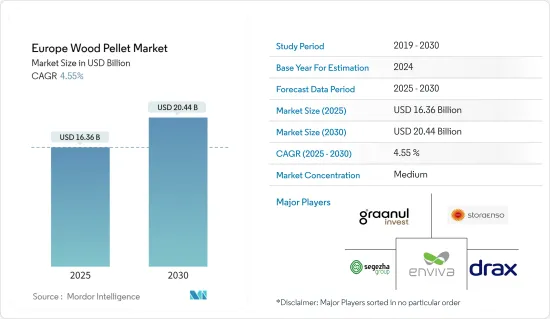

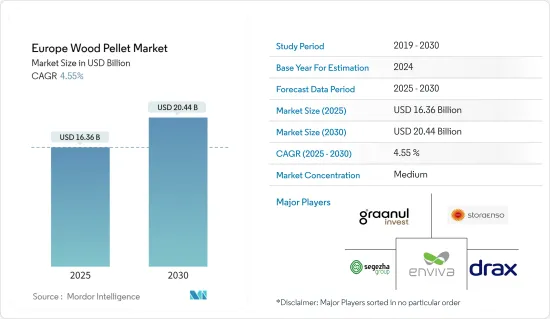

預計 2025 年歐洲木質顆粒市場規模為 163.6 億美元,預計到 2030 年將達到 204.4 億美元,預測期內(2025-2030 年)的複合年成長率為 4.55%。

主要亮點

- 從中期來看,清潔能源發電和供暖應用對木質顆粒的需求增加預計將推動歐洲木質顆粒市場的發展。

- 然而,清潔能源替代品的競爭加劇以及政府對木質顆粒補貼的終止可能會阻礙預測期內的市場成長。

- 然而,新應用的出現和木質顆粒技術的進步預計將推動未來市場的成長。

- 由於木質顆粒在各種應用中的採用越來越多,預計英國將主導歐洲木質顆粒市場。

歐洲木質顆粒市場的趨勢

加熱應用領域預計將佔據市場主導地位

- 用於供暖的木質顆粒主要用於住宅和商業領域,用於食品、烹飪、燒烤和為住宅供暖。這些木質顆粒與連接的管道、鍋爐和暖氣散熱器一起用於建造家庭供暖系統。用於暖氣方面有顆粒集中暖氣鍋爐,顆粒爐,顆粒集中暖氣爐等。

- 由於木質顆粒消費量的增加,尤其是在德國和法國,歐洲木質顆粒市場的暖氣應用領域預計將產生巨大的需求。歐洲是世界上最大的木質顆粒市場。 2022 年,該地區木質托盤總消費量量為 2,480 萬噸 (MMT)。根據歐盟委員會 (EC) 的指令和歐盟成員國 (MS) 的激勵措施,預計 2023 年需求將進一步擴大至 2,560 萬噸。

- 預計未來幾年住宅供暖對木質顆粒的需求不斷增加將推動市場成長。住宅用途包括家用爐灶和容量低於50千瓦的暖氣鍋爐。容量超過50kW的中小型商務用包括住宅和公共建築使用的熱鍋爐。

- 木質顆粒可用作生質能鍋爐或專用顆粒燃燒爐的家庭暖氣燃料。顆粒爐優於傳統的木質爐,因為它們燃燒更清潔,產生的煙霧和煙灰更少。木質顆粒密度高,水分含量低(低於 10%),這使得它們可以在爐子中以更高的溫度燃燒,從而提高效率,並且產生的灰燼比傳統木柴(低於 2%)少得多。

- 使用木質顆粒加熱是減少電費的替代方案。由於燃料成本上升,歐洲消費者正在尋找替代供暖方法。

- 根據爐灶行業聯合會的數據,木柴是最便宜的家庭暖氣燃料,每千瓦時成本比電加熱低 74%,比燃氣加熱低 21%。預計木質顆粒的這些優勢將在預測期內增加其在加熱應用中的需求。

- 德國、義大利、法國、丹麥和瑞典是使用木質顆粒取暖的主要國家。根據《2023年EPC調查》,2022年德國將成為木質顆粒加熱的最大用戶,銷售量達320萬噸。

- 在德國和義大利,木質顆粒產生的熱量有70%以上用於住宅供暖,而在丹麥和瑞典,木質顆粒主要用於熱電聯產供熱。氣候在木質顆粒消費中扮演重要角色。由於預計未來歐洲國家的氣候將變得更加寒冷,預計在預測期內用於供暖的顆粒利用率將會增加。

- 因此,預計預測期內加熱應用領域將佔據市場主導地位。

英國可望主導市場

- 在英國,顆粒用於多種用途,包括住宅供暖、發電站、商業供暖和熱電聯產廠。顆粒燃料也被用於學校、辦公室等地方政府和政府建築的煤炭轉化計劃。

- 截至 2024 年,大多數混燃發電廠已經關閉或改造,一些發電廠正在轉向使用 100%木質顆粒作為燃料。其中最大的是位於北約克郡的德拉克斯發電廠。六台 65MWe 發電機組當中,有四台已經改裝為僅使用木質顆粒運作。

- 德拉克斯發電廠是英國最大的發電站,到 2023 年將生產英國總電力的 5% 左右。它也是世界上最大的生質能發電廠,每年接收約 650 萬噸(MT)顆粒,佔該國年度顆粒進口量的大部分。該公司還在美國和加拿大擁有 17 家顆粒工廠,為發電廠供應原料。

- 然而,根據英國政府的數據,該國在 2023 年進口了 600 萬噸木質顆粒,而 2022 年為 752 萬噸,2021 年為 913 萬噸。

- 根據聯合國糧食及農業組織的數據,2022 年該國木質顆粒產量約 326,000 噸。木質顆粒產量與前一年同期比較大幅成長約7.2%。

- 英國政府已製定計劃,到 2035 年發展碳捕獲、利用和儲存(CCUS) 的競爭性市場,並於 2023 年 12 月宣布擴大 CfD 計劃,以支持生質能源的捕碳封存(BECCS)。預計到 2050 年,這些計劃將使英國經濟每年成長 50 億歐元,使英國成為該技術的先驅。

- Drax 每年獲得數億英鎊的補貼來資助其營運。 2027年,英國政府計劃停止對未燃燒生質能發電的支持。

- 為了防止補貼在 2027 年後逐步取消,Drax 正在尋求為其木材燃燒業務獲得新的長期補貼。該公司旨在透過其計劃中的 BECCS(生物能源與碳捕獲)計劃實現這一目標。該計劃最初提案在現有發電能力的一半上增加碳捕獲和儲存(CCS),該公司表示這將每年產生 8 噸負排放。目標是將 CCS 添加到所有發電能力中。

- 2024 年 1 月,作為 CfD 計畫延伸的一部分,英國政府核准在德拉克斯發電廠引入碳捕獲技術的計畫。該工廠將獲准在其四個生質能裝置中的兩個裝置中安裝該技術,這些裝置透過燃燒木質顆粒發電。

- 因此,由於這些發展,預計英國將在預測期內主導歐洲木質顆粒市場。

歐洲木質顆粒產業概況

歐洲木質顆粒市場正朝向半固體發展。市場的主要企業包括 Stora Enso Oyj、Enviva Partners LP、AS Graanul Invest、Drax Group PLC 和 Segezha Group PJSC。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2029 年市場規模與需求預測

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 清潔能源生產對木質顆粒的需求不斷增加

- 供熱應用

- 限制因素

- 清潔能源替代品的競爭日益激烈,政府對木質顆粒的支持也終止

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 應用

- 加熱

- 發電

- 地區

- 德國

- 英國

- 法國

- 荷蘭

- 比利時

- 西班牙

- 俄羅斯

- 歐洲其他地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Stora Enso Oyj

- Enviva Partners LP

- AS Graanul Invest

- Drax Group PLC

- Segezha Group PJSC

- Svenska Cellulosa Aktiebolaget SCA

- German Pellets GmbH

- Pure Biofuel Ltd

- Pfeifer Group

- Erdenwerk Gregor Ziegler GmbH

- 市場排名分析

第7章 市場機會與未來趨勢

- 木質顆粒技術的新應用與進展

簡介目錄

Product Code: 91897

The Europe Wood Pellet Market size is estimated at USD 16.36 billion in 2025, and is expected to reach USD 20.44 billion by 2030, at a CAGR of 4.55% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, the increasing demand for wood pellets in clean energy generation and heat-supply applications will likely drive the European wood pellets market.

- On the other hand, the increasing competition from alternative clean energy sources and the ending of supportive government schemes for wood pellets will likely hinder market growth during the forecast period.

- Nevertheless, the emerging applications and advancements in wood pellet technology are expected to boost the market's growth in the future.

- The United Kingdom is expected to dominate the European wood pellet market due to the increasing adoption of wood pellets for various applications.

Europe Wood Pellet Market Trends

The Heating Application Segment is Expected to Dominate the Market

- Wood pellets for heating applications are primarily used in residential and commercial sectors for food, cooking and grilling, and supplying heat to homes. These wood pellets, along with connected pipes, boilers, and heating radiators, are used to build heating systems at home. For heating proposes, several systems using wood pellets include pellet central heating boilers, pellet stoves, and pellet central heating stoves.

- The heating application segment of the European wood pellet market is expected to generate significant demand due to the rising consumption of wood pellets, especially in Germany and France. Europe is the largest global wood pallet market. In 2022, the region's total wood pallet consumption accounted for 24.8 million metric tons (MMT). According to the European Commission's (EC) mandates and incentives by EU Member States (MS), demand was expected to further expand to 25.6 MMT in 2023.

- The increasing demand for wood pellets for residential heating purposes is expected to fuel the market's growth in the future. Residential uses include domestic stoves and dedicated heat boilers with a capacity below 50 kW. Small-to-medium-scale commercial use with more than 50 kW capacity includes heat boilers used in residential and public buildings.

- Wood pellets can be used as a home heating fuel in biomass boilers or special pellet-burning stoves. Pellet stoves are better than traditional open-wood fireplaces as they burn cleaner with less smoke and soot. As the wood pellets are highly dense and contain low moisture content (lower than 10%), the pellets can burn in the stove at a very high combustion temperature with improved efficiency and much lower ash content (less than 2%) than conventional firewood.

- Using wood pellets for heating is an alternative method of reducing electricity bills. Consumers in Europe are looking for alternative ways to heat their homes following higher fuel bills.

- According to the Stove Industry Alliance, wood logs are the cheapest domestic heating fuel, costing households 74% less per kWh than electric heating and 21% less than gas heating. Such benefits of wood pellets are expected to increase their demand in heating applications during the forecast period.

- Germany, Italy, France, Denmark, and Sweden are the major countries that use wood pellets for heating purposes. According to the EPC Survey 2023, Germany used the highest amount of wood pellets for heating purposes in 2022, which accounted for 3.2 million tons.

- In Germany and Italy, more than 70% of heat generation from wood pellets was used for residential heating, while in Denmark and Sweden, pellets were used mostly for CHP heat. The climate plays an important role in the consumption of wood pellets. As the climate of European countries is expected to have colder seasons in the future, the use of pellets for heating purposes is expected to increase during the forecast period.

- Therefore, the heating application segment is expected to dominate the market during the forecast period.

The United Kingdom is Expected to Dominate the Market

- The United Kingdom uses pellets in numerous applications, such as residential heating, power plants, commercial heating, and combined heat and power plants. Pellets have also made their way into coal conversion projects in local authority buildings and public administration buildings such as schools and offices.

- As of 2024, most of the co-firing power stations have either closed or converted, with several shifting toward using 100% wood pellets for fuel. The largest of these is Drax Power Station in North Yorkshire. It has converted four of its six 65 MWe generating units to run exclusively on wood pellets.

- The Drax power plant is the country's largest, producing around 5% of the United Kingdom's total electricity in 2023. It is also the world's largest biomass-fired power station, taking in around 6.5 million metric tons (MT) of pellets each year and making up the vast majority of the country's annual pellet imports. The company also has 17 pellet plants located in the United States and Canada, which supply raw materials to its power station.

- However, according to the UK government, the country imported 6 million metric tons of wood pellets in 2023, compared to 7.52 million metric tons in 2022 and 9.13 million tons in 2021.

- According to the Food and Agriculture Organization of the United Nations, the country's wood pellet production was about 326 thousand metric tons in 2022. The production of wood pellets witnessed significant growth of about 7.2% compared to the previous year.

- In December 2023, the UK government announced its plans to extend the CfD program to support bioenergy with carbon capture and storage (BECCS) as the country set out its plan to develop a competitive market in Carbon Capture, Usage, and Storage (CCUS) by 2035. The plan is expected to boost the UK economy by EUR 5 billion a year by 2050 and make the country a pioneer in this technology.

- Drax receives hundreds of millions of pounds in annual subsidies to fund its operations. In 2027, the UK government plans to end its support for burning unabated biomass to generate electricity.

- To prevent subsidy closure after 2027, Drax is looking to secure a new long-term subsidy for its wood-burning operation. The company aims to achieve this through its planned Bioenergy with Carbon Capture (BECCS) project. This project initially proposed adding carbon capture storage (CCS) to half of its existing capacity, which the company claims will generate eight metric tons of negative emissions yearly. The aim is to add CCS to its full capacity.

- In January 2024, following the extension of the CfD program, the UK government approved Drax's plans to install carbon capture technology at Drax Power Station. The Power Station will be allowed to install the technology in two of its four biomass units, which burn wood pellets to produce electricity.

- Hence, owing to such developments, the United Kingdom is expected to dominate the European wood pellets market during the forecast period.

Europe Wood Pellet Industry Overview

The European wood pellets market is semi-consolidated. Some of the key players in the market include Stora Enso Oyj, Enviva Partners LP, AS Graanul Invest, Drax Group PLC, and Segezha Group PJSC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand for Wood Pellets in Clean Energy Generation

- 4.5.1.2 Heat-supply Applications

- 4.5.2 Restraints

- 4.5.2.1 Increasing Competition from Alternative Clean Energy Sources and Ending of Supportive Government Schemes for Wood Pellets

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Heating

- 5.1.2 Power Generation

- 5.2 Geography

- 5.2.1 Germany

- 5.2.2 United Kingdom

- 5.2.3 France

- 5.2.4 Netherlands

- 5.2.5 Belgium

- 5.2.6 Spain

- 5.2.7 Russia

- 5.2.8 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Stora Enso Oyj

- 6.3.2 Enviva Partners LP

- 6.3.3 AS Graanul Invest

- 6.3.4 Drax Group PLC

- 6.3.5 Segezha Group PJSC

- 6.3.6 Svenska Cellulosa Aktiebolaget SCA

- 6.3.7 German Pellets GmbH

- 6.3.8 Pure Biofuel Ltd

- 6.3.9 Pfeifer Group

- 6.3.10 Erdenwerk Gregor Ziegler GmbH

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Applications and Advancements in the Wood Pellet Technology

02-2729-4219

+886-2-2729-4219