|

市場調查報告書

商品編碼

1690132

木質顆粒:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Wood Pellet - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

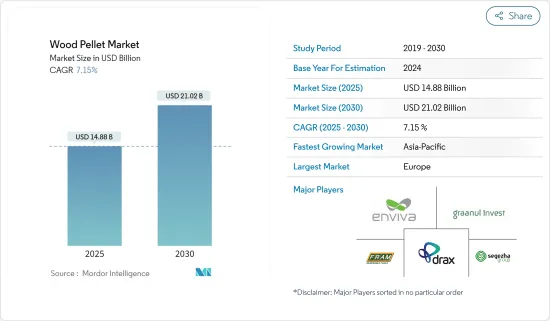

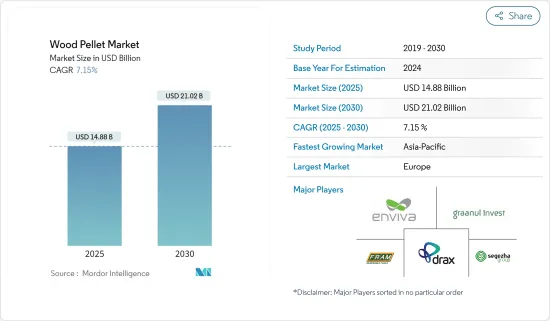

預計 2025 年木質顆粒市場規模為 148.8 億美元,預計到 2030 年將達到 210.2 億美元,預測期內(2025-2030 年)的複合年成長率為 7.15%。

中期市場促進因素包括清潔能源發電對木質顆粒的需求不斷成長,尤其是在歐洲。

然而,全球範圍內擴大採用和實施太陽能、風能和地熱能等替代可再生能源可能會阻礙預測期內的市場成長。

然而,據全球生質能源協會稱,木質顆粒有潛力在發電設施中取代煤炭。隨著近年來技術的發展,木質顆粒正在透過熱解、熱液碳化和蒸汽爆破等各種製程進行熱升級。熱升級使木質顆粒能夠作為具有煤炭特性的燃料。亞太地區擁有全球最多的燃煤發電廠,預計將成為未來市場的成長機會。

預計 2022 年歐洲木質顆粒產量將大幅增加,並將在預測期內佔據大部分市場佔有率。

木質顆粒市場趨勢

暖氣應用可望主導市場

- 顆粒是一種固態生質能燃料,主要由木材殘渣和稻草等其他農產品生產。與原始生質能相比,顆粒的具體優勢包括標準化特性、高能量含量和高密度。

- 用於供暖的木質顆粒主要用於住宅和商業領域的食品、烹飪、燒烤和家庭供暖。它的噴射成本長期以來一直低於其他燃料,使其成為更經濟的選擇,並解決了住宅和商業領域的關鍵問題。

- 木質顆粒是一種緻密的生質能燃料,燃燒後可產生電能和熱能。 21 世紀末,多個國家的木質顆粒產量、消費量和商業量大幅增加。消費量的成長是由工業發電廠推動的,在這些發電廠中,木質顆粒通常與煤共燃或替代煤。

- 根據德國能源木材和顆粒協會的數據,到 2022 年,德國的顆粒加熱系統數量將達到 648,000 個,高於 2021 年的 57 萬個。

- 此外,木質顆粒作為再生能源來源,受到許多國家政府的補貼和鼓勵,近年來許多國家推出或更新了與木質顆粒供暖相關的政策和計劃。

- 英國政府已實施僅限顆粒燃料的品質禁令,該禁令將於 2022 年 11 月 23 日生效,為期一年。這意味著,在禁令生效期間,生質能鍋爐或從 OFGEM 獲得可再生熱能激勵支付的工廠使用的木質顆粒將不需要遵守燃料品質標準。政府於 2022 年 2 月修改了法規,要求具有生質能供應商名單 (BSL) 編號的木質燃料也必須符合相關品質標準。

- 因此,鑑於上述情況,預計在預測期內,加熱應用將佔據木質顆粒的主導地位。

歐洲主導市場

- 預計 2022 年至 2028 年間,歐洲木質顆粒需求將增加 30-40%。歐洲佔全球顆粒需求的 50% 以上。此外,球團也被用於學校、辦公室等地方政府和政府建築的煤炭轉化計劃。

- 根據美國對外農業服務局的報告,2022年歐盟顆粒消費量將達2,480萬噸,與前一年同期比較增加1.2%。歐洲約 66% 的顆粒消費量來自住宅和商業部門,34% 來自工業部門。各國的情況有所不同。在荷蘭和丹麥,主要驅動力是工業(電力和熱電聯產)。在義大利、德國和法國,住宅供暖佔木質顆粒使用量的大部分。

- 該地區大多數國家正計劃關閉或改造其混燃發電廠,其中有幾個國家正在轉向 100%木質顆粒燃料。例如,維美德於 2023 年 5 月宣布,將在芬蘭赫爾辛基的 Salmisaari ‘A’ 發電廠將 Helen 的燃煤區域供熱鍋爐和鼓泡流體化床(BFB) 燃燒轉換為木質顆粒燃燒。這一轉變推進了公司擺脫煤炭的目標,同時加強了永續能源系統的建設。

- 同時,2022年7月,歐盟為因應烏克蘭戰爭,禁止進口用於發電的俄羅斯木質生質能。據報導,歐盟正在從美國和東歐進口木質顆粒,以取代俄羅斯木質生質能供應。自戰爭開始以來,Enviva 增加了對歐盟的出貨量,並宣布與一位未透露姓名的歐洲客戶達成一項為期 10 年的協議,到 2027 年每年供應 80 萬噸顆粒。

- 此外,在研究期間,該地區市場技術進步也可能增加對木質顆粒的需求。

- 因此,鑑於上述情況,預計歐洲將在預測期內佔據市場主導地位。

木質顆粒產業概況

木質顆粒市場適度整合。市場的主要企業包括(不分先後順序)Enviva Partners LP、AS Graanul Invest、Drax Group Plc、Fram Renewable Fuels LLC 和 Segezha Group JSC。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2029 年市場規模與需求預測(美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 清潔能源產出對木質顆粒的需求不斷增加

- 木質顆粒製造基礎設施的成長

- 限制因素

- 擴大採用和部署替代可再生能源

- 驅動程式

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 應用

- 加熱

- 發電

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 法國

- 義大利

- 德國

- 英國

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 印尼

- 日本

- 韓國

- 馬來西亞

- 泰國

- 越南

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 奈及利亞

- 卡達

- 埃及

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Enviva Partners LP

- AS Graanul Invest

- Drax Group PLC

- Fram Renewable Fuels LLC

- Segezha Group JSC

- Lignetics Inc.

- Biopower Sustainable Energy Corp.

- Asia Biomass Public Company Limited

- PT South Pacific

- Market Ranking/Share Analysis

第7章 市場機會與未來趨勢

- 由於技術發展,木質顆粒的溫度升高

The Wood Pellet Market size is estimated at USD 14.88 billion in 2025, and is expected to reach USD 21.02 billion by 2030, at a CAGR of 7.15% during the forecast period (2025-2030).

Over the medium period, the primary drivers for the market include increasing demand for wood pellets in clean energy generation, especially in the European region.

On the other hand, the adoption and increasing deployment of alternative renewable energy sources such as solar photovoltaic, wind energy, and geothermal in various parts of the world is likely to hinder market growth during the forecast period.

Nevertheless, as per the World Bioenergy Association, wood pellets have the potential to replace coal in power generation facilities. With technology development in recent years, wood pellets have undergone thermal upgrading through various processes like torrefaction, hydrothermal carbonization, and steam explosion. The thermal upgrading enables wood pellets to act as a fuel with coal properties. The Asia-Pacific region, with the world's highest number of coal power plants, is expected to be an opportunity for the market to grow in the future.

With a significant production of wood pellets during 2022, Europe was expected to have a significant share of the market during the forecast period.

Wood Pellet Market Trends

Heating Application Expected to Dominate the Market

- Pellets are a solid biomass fuel, primarily produced from wood residues and agricultural by-products like straw. Specific advantages of pellets as compared to unprocessed biomass include standardized properties, high energy content, and high density.

- Wood pellets for heating applications are primarily used in residential and commercial sectors for food, cooking and grilling, and supplying heat to homes. Since the cost of shots remained cheaper than other fuels for a long time, it has become a more economical option, addressing the primary concern of the residential and commercial sectors.

- When burned, utility wood pellets (wood pellets) are a densified biomass fuel that can create power or heat. Wood pellet production, consumption, and commerce significantly increased in a few nations during the late 2000s. Industrial power plants, where wood pellets are usually co-fired with or replaced by coal, are the source of consumption growth.

- According to the German Energy Wood and Pellet Association, in 2022, there were 648 thousand pellet heating systems in Germany, an increase compared to 570 thousand in 2021.

- Moreover, as a renewable energy source, wood pellets have received subsidies and incentives from governments in many countries, and many countries either launched or updated their policies and schemes related to wood pellets for heating applications in recent years.

- The UK government has implemented a suspension of fuel quality for pellets exclusively, which went into effect on November 23, 2022, for up to one year. This means that while the rest is in effect, the fuel quality criteria for wood pellets used in biomass boilers and plants where the owner receives Renewable Heat Incentive payments from OFGEM are not required. The government revised regulations in February 2022 to require that any wood fuel having a Biomass Suppliers List (BSL) number also meet the relevant quality criteria.

- Therefore, owing to the above points, the heating application is expected to dominate the wood pellet during the forecast period.

Europe to Dominate the Market

- Europe's demand for wood pellets is expected to increase by 30-40% between 2022 and 2028. Europe represents more than 50% of global pellet demand. Moreover, pellets have also made their way into coal conversion projects in local authority or public administration buildings such as schools and offices.

- According to the USDA Foreign Agricultural Service Report, in 2022, the EU's pellet consumption reached 24.8 million tonnes, up 1.2% from the previous year. The household and commercial sectors consumed around 66% of European pellets, while the industry consumed 34%. The situation varies from one country to the next. The main driver for the Netherlands and Denmark is industrial use (for electricity and CHP). Residential heating accounts for most wood pellet use in Italy, Germany, and France.

- Most countries in the region plan to close or convert co-firing power stations, with several moving to 100% wood pellets for fuel. For instance, in May 2023, Valmet announced the convert Helen Ltd's coal-fired district heat boiler and bubbling fluidized bed (BFB) combustion to enable wood pellet firing at the Salmisaari 'A' power plant in Helsinki, Finland. The conversion promotes the company's goal of phasing out coal and simultaneously strengthens the construction of a sustainable energy system.

- On the other hand, in July 2022, the European Union banned importing Russian woody biomass used to generate energy in response to the war in Ukraine. According to reports, the EU has imported wood pellets from the United States and Eastern Europe to replace the Russian woody biomass supply. Enviva has increased EU shipments since the war began and announced a 10-year contract with an unnamed European customer to provide 800,000 metric tons of pellets yearly by 2027.

- Further, technological advancements in the market in the region are also likely to increase the demand for wood pellets during the studied period.

- Hence, owing to the above points, Europe is expected to dominate the market during the forecast period.

Wood Pellet Industry Overview

The wood pellet market is moderately consolidated. Some of the key players in the market include (in no particular order) Enviva Partners LP, AS Graanul Invest, Drax Group Plc, Fram Renewable Fuels LLC, and Segezha Group JSC, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecasts in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand for Wood Pellets in Clean Energy Generation

- 4.5.1.2 Growing Wood Pellet Manufacturing Infrastructure

- 4.5.2 Restraints

- 4.5.2.1 The Adoption and Increasing Deployment of Alternative Renewable Energy

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Heating

- 5.1.2 Power Generation

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States of America

- 5.2.1.2 Canada

- 5.2.1.3 Rest of the North America

- 5.2.2 Europe

- 5.2.2.1 France

- 5.2.2.2 Italy

- 5.2.2.3 Germany

- 5.2.2.4 United Kingdom

- 5.2.2.5 Spain

- 5.2.2.6 Nordic Countries

- 5.2.2.7 Turkey

- 5.2.2.8 Russia

- 5.2.2.9 Rest of the Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Indonesia

- 5.2.3.4 Japan

- 5.2.3.5 South Korea

- 5.2.3.6 Malaysia

- 5.2.3.7 Thailand

- 5.2.3.8 Vietnam

- 5.2.3.9 Rest of the Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of the South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Nigeria

- 5.2.5.5 Qatar

- 5.2.5.6 Egypt

- 5.2.5.7 Rest of the Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Enviva Partners LP

- 6.3.2 AS Graanul Invest

- 6.3.3 Drax Group PLC

- 6.3.4 Fram Renewable Fuels LLC

- 6.3.5 Segezha Group JSC

- 6.3.6 Lignetics Inc.

- 6.3.7 Biopower Sustainable Energy Corp.

- 6.3.8 Asia Biomass Public Company Limited

- 6.3.9 PT South Pacific

- 6.4 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Thermal Upgradation of Wood Pellets Due to Technological Development