|

市場調查報告書

商品編碼

1683811

中東犯罪與打擊:市場佔有率分析、產業趨勢、統計和成長預測(2025-2030 年)Middle East Crime and Combat - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

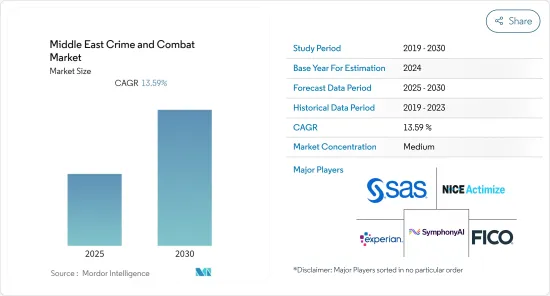

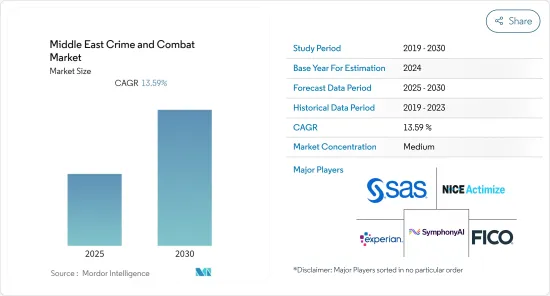

預測期內,中東犯罪和打擊市場預計將以 13.59% 的複合年成長率成長。

主要亮點

- 監管機構致力於減少與行動錢包、電子付款和電子貨幣發行等新付款方式相關的洗錢問題。它還高度重視打擊網路犯罪和減輕與虛擬貨幣相關的洗錢威脅。

- 隨著傳統付款(尤其是即時付款、高價值付款、加密貨幣和新產品開發)的變化,監管期望和審查也在迅速演變。過去幾年,監管機構致力於實現銀行反洗錢合規計畫的現代化,鼓勵技術創新,並改善金融機構之間的協作和溝通。

- 2023 年 1 月,阿拉伯聯合大公國中央銀行針對持牌金融機構 (LFI) 發布了新的洗錢防制和打擊恐怖主義融資 (AML/CFT) 指南。據阿拉伯聯合大公國中央銀行稱,該計劃將幫助大型金融機構評估風險並有效履行反洗錢/反恐怖主義融資的合法要求,同時考慮到金融行動特別工作組 (FATF) 的標準。

- 洗錢防止法鼓勵金融機構提高透明度、採用先進技術並建立全面的客戶檔案。希望更積極主動的銀行可能需要隨時了解法規和政策,並建立基礎設施來整合更多的資料來源。 KYC 流程是自動化的,提供了良好的客戶體驗。

- 由於金融服務監管的嚴格性以及全球金融犯罪的高風險,洗錢已成為金融服務機構關注的重點。隨著反洗錢合規監管環境的變化,擁有深入反洗錢知識和技能的熟練人才已成為開發反洗錢解決方案所面臨的挑戰。

- 新冠肺炎疫情以來,洗錢案件仍在增加,各企業致力於制定防範洗錢的策略措施。例如,2022年12月,人工智慧交易監控技術供應商ThetaRay和專注於金融包容性的GCC行動銀行解決方案NOW Money宣布合作,部署ThetaRay雲端基礎的反洗錢解決方案來監控跨國付款,並支援預防金融科技付款管道上的金融犯罪和洗錢。

中東犯罪與戰鬥市場趨勢

數位和行動付款解決方案的採用正在推動市場

- 即使新冠疫情之後,金融服務業也正在經歷重大轉型。此外,鑑於數位化在全球不斷成長的人口的金融生活中發揮著重要作用,電子付款是這一轉變的核心。隨著付款日趨無現金化,支付產業在支持整體性的作用已成為重中之重。付款也是經濟的安全支柱,同時促進數位經濟的成長和創新。

- 亞馬遜、蘋果、 PayPal和Facebook等大公司繼續向線上和行動付款解決方案投入巨額資金。從獨立的網路商店發展到綜合的網路購物生態系統正在為數位付款創造新的經營模式和機會。

- 2022 年 12 月,阿布達比第一銀行 (FAB)、金融科技公司 Magnati 和 PCFC 子公司 PayRow Net 建立了新的數位付款管道合作夥伴關係。新平台的建立是為了「改造現有的付款閘道,增強消費者付款流程並改善使用者體驗」。

- 同時,2022 年 12 月,阿布達比伊斯蘭銀行推出了代幣化非接觸式付款系統。 ADIB Pay 系統由 Visa 和中國拍拍寶科技共同開發。 ADIB Pay 是一種可附加到穿戴式裝置上的實體扣,從而無需攜帶實體卡。

- 2022 年 10 月,在中東、北非和巴基斯坦 (MENAP) 地區提供貨幣服務的金融超級應用程式 JinglePay 與中東和非洲領先的數付款解決方案提供商和金融科技推動者阿拉伯金融服務公司 (AFS) 建立了戰略合作關係。 JinglePay 和 AFS 將合作在巴林提供創新的數位付款和卓越的客戶體驗。這項合作將加強 JinglePay 在該地區的影響力,並使人們更容易管理他們的日常財務。

- 電子商務平台和付款方式可能被濫用於洗錢目的。犯罪分子經常利用網路市場進行非法貿易,並提高商品和服務價格,以使他們的非法資金合法化。透過將非法收益轉換為看似合法的電子商務交易,犯罪分子得以掩蓋其資金來源。根據Worldpay的數據,截至2022年,數位和付款付款中東和北非地區電子商務第二常用的付款方式,佔所有電子商務付款的27%。

- 此外,創造性的技能、技術、程序和傳統基於技術流程的創新應用可以幫助監管者、監督和受監管公司克服上述許多反洗錢/反恐怖主義融資問題。透過促進資料收集、處理和分析,科技可以幫助相關人員更有效、即時地檢測和管理洗錢和恐怖主義融資 (ML/TF) 問題。其好處包括更快的支付和交易、更準確的身份驗證系統、監控、記錄保存以及主管當局和監管實體之間的資訊交流。

貿易監控解決方案主導市場

- 強大的交易監控系統對於有效的反洗錢(AML)生態系統至關重要。在後疫情時代,大多數交易都在數位平台上進行,這一點變得更加重要。

- 當客戶交易過程中出現違反規則或違反您的客戶資料的情況時,交易監控軟體會向您發出警報。如果軟體產生警報,反洗錢交易監控流程將自動停止。此循環持續運行,並由公司的合規或風險部門進行審查。

- 在後疫情時代,金融機構在反洗錢和恐怖主義資金籌措方面面臨更大挑戰。公共公司正在採取預防措施,剷除捲入金錢餐詐騙的失業人口。政府也對幾家交易監控系統不完善的金融機構進行了處罰。

- 該市場還將部署人工智慧和機器學習等先進技術來繪製和檢測不同帳戶擁有者之間的異常交易。例如,2021 年 4 月,ThetaRay 宣布其基於 AI 的反洗錢 (AML) 分析將在公有和私有雲端上提供,包括 Azure、Google 和 AWS。

- 這個新的應用程式可以幫助監控所有交易中的可疑模式,包括不同類型的付款、用戶、受益人、設備、商家、帳戶和卡片。此外,它還提供了適當的行動計劃來阻止、通過或挑戰交易。

- 此外,新的行動付款服務提供者的進入也對交易監控解決方案產生了進一步的需求。例如,2023 年 2 月,沙烏地阿拉伯通訊服務供應商Mobily 與瑞典科技公司愛立信合作,在該國擴展了其 Mobily Pay 服務。新的解決方案將允許用戶透過該平台進行非接觸式付款、匯款、國際轉帳、數位卡卡片付款、現金現金回饋、帳單支付、手機充值等。

- 因此,交易監控不僅由技術驅動,而且擴大託管在雲端基礎的應用程式上,以跟上銀行業數位化的步伐。隨著人工智慧和機器學習的出現,該領域預計將顯著成長。

中東犯罪與戰鬥業概況

中東犯罪和打擊市場相當分散,主要參與者包括 SAS Institute Inc.、NICE Actimize(NICE Ltd)、Experian Information Solutions Inc(Experian Ltd)、Symphony Innovation LLC 和 Fair Isaac Corporation(FICO)。市場參與者正在採用聯盟、協議、企業擴張和收購等策略來增強其產品供應並獲得永續的競爭優勢。

- 2022 年 11 月,FICO 同意將其 Siron 合規業務轉移給金融機構監管技術和流程自動化領域的領導者 IMTF。該協議涉及軟體和智慧財產權,將使 IMTF 能夠開發和擴展 Siron 套件,以支援全球應用程式和相關 SaaS。

- 2022 年 10 月,NICE Actimize 宣布 Target Group 採用了該公司的 AI 和雲端基礎的Essentials 反洗錢和反詐騙解決方案。 Target Group 的目標是透過一流的金融犯罪和合規技術和服務來保護其客戶,同時受益於人工智慧和雲端基礎的解決方案提供的業務效率。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 數位和行動付款解決方案的採用率不斷提高

- 政府對合規管理的嚴格規定

- 市場挑戰/限制

- 專業技能人才短缺

- 市場機會

- 採用雲端基礎的反洗錢解決方案打擊金融犯罪

第6章 中東地區洗錢、賄賂及金融犯罪預防監理狀況及政府舉措

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 埃及

- 卡達

- 伊朗

- 伊拉克

- 科威特

- 其他中東地區

第7章 市場區隔

- 按解決方案

- 客戶資訊(KYC)系統

- 合規彙報

- 交易監控

- 審核和彙報

- 其他解決方案(詐欺偵測與防護、案件管理)

- 按實施模型

- 在雲端

- 本地

第8章 競爭格局

- 公司簡介

- SAS Institute Inc.

- NICE Actimize(NICE Ltd)

- Experian Information Solutions Inc.(Experian Ltd)

- Symphony Innovation LLC

- Fair Isaac Corporation

- ACI Worldwide Inc.

- Fiserv Inc.

- Oracle Corporation

- Tata Consultancy Services Limited

- Refinitiv Ltd

- Larsen & Toubro Infotech Limited

- Profile Software SA

- Temenos

- Fidelity National Information Services Inc.(FIS)

- Wolter Kluwer NV

- iSPIRAL IT Solutions Ltd

第9章投資分析

第10章:投資分析市場的未來

The Middle East Crime and Combat Market is expected to register a CAGR of 13.59% during the forecast period.

Key Highlights

- The regulatory bodies are focused heavily on minimizing the money-laundering concerns connected with emerging payment methods such as mobile wallets, e-payments, and e-money issuers. They have emphasized combating cybercrime and reducing any money laundering threats related to virtual currency.

- Regulatory expectations and oversight are evolving rapidly with the changes to traditional payment, specifically in real-time payments, high-value payments, cryptocurrency, and new product development. For several years, regulators have focused on modernizing AML compliance programs at banks, encouraging innovation, and improving the coordination and transfer of information between financial institutions.

- In January 2023, the UAE central bank issued new guidelines for licensed financial institutions (LFIs) on anti-money laundering and combatting the financing of terrorism (AML/CFT). According to CBUAE, initiatives will aid LFIs in evaluating risks and carrying out their legal AML/CFT requirements effectively while considering the Financial Action Task Force (FATF) standards.

- Anti-money laundering laws encourage financial institutions to be more transparent, implement advanced technology, and build comprehensive customer profiles. Banks aiming to be more proactive may need to ensure their policies are up-to-date and in line with the new regulations and that their infrastructure can integrate more data sources. Their KYC processes are automated, all while offering a great customer experience.

- With stringent regulations focused on financial services and the sophisticated risks of financial crimes around the globe, money laundering has been a critical concern for financial service organizations. Procuring skilled resources with the in-depth knowledge and skill-set of AML aligned with the changing regulatory landscape of AML compliance is posing a challenge for the development of AML solutions.

- Post-COVID-19, money laundering cases are still growing, and, as a result, companies are getting involved in strategic developments to prevent them. For instance, in December 2022, ThetaRay, a provider of AI-powered transaction monitoring technology, and NOW Money, the GCC's mobile banking solution focused on financial inclusion, announced a collaboration to implement ThetaRay's cloud-based AML solution to monitor cross-border payments and support in the prevention of financial crimes and money laundering on the fintech's payments platform.

Middle East Crime And Combat Market Trends

Increased Adoption of Digital/Mobile Payment Solutions to Drive the Market

- Even in the post-COVID-19 scenario, the financial services industry is moving toward significant transformation. Moreover, given the vital significance that digitization is playing in the financial life of an increasing proportion of the world's population, electronic payments are at the core of this shift. Payments are progressively becoming cashless, and the industry's role in supporting inclusivity has become a key priority. Payments also contribute to the growth of digital economies and encourage innovation, all while serving as a secure backbone for the economy.

- Prominent players like Amazon, Apple, PayPal, and Facebook are continually investing significant amounts of money into online and mobile payment solutions. The ongoing development from independent online shops toward integrated online shopping ecosystems has created space for new business models and opportunities for digital payment methods.

- In December 2022, First Abu Dhabi Bank (FAB), FinTech Magnati, and PayRow Net, a PCFC company, launched a new digital payment platform collaboration. The new platform is being created to "transform the existing payment gateway, leading to an enhanced consumer payment process and improved user experience."

- Meanwhile, in the same month of December 2022, Abu Dhabi Islamic Bank introduced a tokenized contactless payment system. The "ADIB Pay" system is a collaboration between Visa and China-based Tappy Technologies. ADIB Pay is a physical clasp that can be attached to wearable objects, eliminating the need for a real card to be carried.

- In October 2022, Jingle Pay, a financial super-app that delivers money services in the Middle East, North Africa, and Pakistan (MENAP) region, formed a strategic relationship with Arab Financial Services (AFS), the Middle East & Africa's major digital payments solutions provider and Fin-Tech enabler. Jingle Pay and AFS are likely to collaborate to provide innovative digital payments and a great customer experience in Bahrain. The collaboration enhances Jingle Pay's footprint in the region, making it easier for people to manage their finances on a daily basis.

- E-commerce platforms and payment methods can be misused for money laundering purposes. Criminals may utilize online marketplaces to conduct fraudulent transactions or inflate the prices of goods/services as a means to legitimize their illicit funds. By converting illegal proceeds into seemingly legitimate e-commerce transactions, criminals can obscure the origin of the funds. According to Worldpay, digital and mobile payments were the second most popular payment method used for e-commerce in the Middle East &African region as of 2022, accounting for 27% of the total e-commerce payments.

- Moreover, creative skills, techniques, and procedures, as well as an innovative application of traditional technology-based processes, can assist regulators, supervisors, and regulated firms in overcoming many of the stated AML/CFT issues. Technology can assist actors in detecting and managing money laundering and terrorist financing (ML/TF) concerns more efficiently and in real-time time by facilitating data collection, processing, and analysis. Advantages include faster payments and transactions, more accurate identification systems, monitoring, record keeping, and information exchange between competent authorities and regulated organizations.

Transaction Monitoring Solutions to Hold Major Share

- A well-formulated transaction monitoring system is crucial for an effective anti-money laundering (AML) ecosystem. It is more profound in the post-pandemic world, where most transactions are being performed over digital platforms.

- Transaction monitoring software alerts when a situation violates the rules and is against the customer profile during customer transactions. Once the software generates an alarm, the transaction monitoring process conducted by AML is automatically stopped. The cycle continues to be executed and reviewed by the firm's compliance or risk department.

- In the post-pandemic scenario, financial institutions face an even larger challenge in AML and terrorist financing. Public firms are taking preventive measures to combat jobless people involved in money mule scams. The government has also penalized several financial institutions for incompetent transaction monitoring systems.

- The market is also witnessing the implementation of advanced technologies such as artificial intelligence and machine learning to map and detect unusual transactions among different account holders. For instance, in April 2021, ThetaRay announced that its AI-based anti-money laundering (AML) analytics would be available on public and private clouds, including Azure, Google, and AWS, which uses unsupervised machine learning to monitor financial transactions, integrate data, and triaging alerts in real-time.

- The new application may help monitor suspicious patterns across all transactions, including various types of payments, users, beneficiaries, devices, merchants, accounts, and cards. It further provides an appropriate action plan to block, pass, or challenge the transaction.

- Moreover, the entry of new mobile payment service providers is further creating a demand for transaction monitoring solutions. For instance, in February 2023, Mobily, a Saudi Arabian telecom service provider, expanded Mobily Pay services in the county via a partnership with Swedish technology company Ericsson. The new solution allows users to make contactless payments, money transfers, international remittances, digital card payments, cash-back, bill payments, mobile top-ups, and more through the platform.

- Thus, transaction monitoring is not only witnessing technological implications but is also being hosted on cloud-based applications to cater to the increasing digitization of the banking industry. This segment is expected to grow significantly with the advent of AI and machine learning.

Middle East Crime And Combat Industry Overview

The Middle East Crime and Combat Market is moderately fragmented, with the presence of major players like SAS Institute Inc., NICE Actimize (NICE Ltd), Experian Information Solutions Inc. (Experian Ltd), Symphony Innovation LLC, and Fair Isaac Corporation (FICO). Players in the market are adopting strategies such as partnerships, agreements, company expansions, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- In November 2022, FICO agreed to transition its Siron compliance business to IMTF, a regulatory technology and process automation leader for financial institutions. This agreement is relevant to software and intellectual property and enables IMTF to develop and extend the Siron Suite and support the applications and related SaaS offerings globally.

- In October 2022, NICE Actimize announced that Target Group had chosen its AI and cloud-based Essentials anti-money laundering and anti-fraud solutions. Target Group's objectives include protecting its customers with best-in-class financial crime and compliance technology and services while benefiting from the operational efficiencies offered by artificial intelligence and cloud-based solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products and Services

- 4.2.5 Degree of Competition

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Adoption of Digital/Mobile Payment Solutions

- 5.1.2 Stringent Government Regulations for Compliance Management

- 5.2 Market Challenges/Restraints

- 5.2.1 Lack of Skilled Professional

- 5.3 Market Opportunities

- 5.3.1 Adoption of Cloud-based AML Solutions to Combat Financial Crimes

6 REGULATORY LANDSCAPE AND GOVERNMENT EFFORTS ON ANTI-MONEY LAUNDERING, ANTI-BRIBERY, AND FINANCIAL CRIME IN THE MIDDLE EASTERN COUNTRIES

- 6.1 United Arab Emirates

- 6.2 Saudi Arabia

- 6.3 Egypt

- 6.4 Qatar

- 6.5 Iran

- 6.6 Iraq

- 6.7 Kuwait

- 6.8 Rest of Middle East

7 MARKET SEGMENTATION

- 7.1 By Solutions

- 7.1.1 Know Your Customer (KYC) Systems

- 7.1.2 Compliance Reporting

- 7.1.3 Transaction Monitoring

- 7.1.4 Auditing and Reporting

- 7.1.5 Other Solutions (Fraud Detection and Protection and Case Management)

- 7.2 By Deployment Model

- 7.2.1 On-cloud

- 7.2.2 On-premises

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 SAS Institute Inc.

- 8.1.2 NICE Actimize (NICE Ltd)

- 8.1.3 Experian Information Solutions Inc. (Experian Ltd)

- 8.1.4 Symphony Innovation LLC

- 8.1.5 Fair Isaac Corporation

- 8.1.6 ACI Worldwide Inc.

- 8.1.7 Fiserv Inc.

- 8.1.8 Oracle Corporation

- 8.1.9 Tata Consultancy Services Limited

- 8.1.10 Refinitiv Ltd

- 8.1.11 Larsen & Toubro Infotech Limited

- 8.1.12 Profile Software SA

- 8.1.13 Temenos

- 8.1.14 Fidelity National Information Services Inc. (FIS)

- 8.1.15 Wolter Kluwer NV

- 8.1.16 iSPIRAL IT Solutions Ltd