|

市場調查報告書

商品編碼

1684068

印度水泥:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)India Cement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

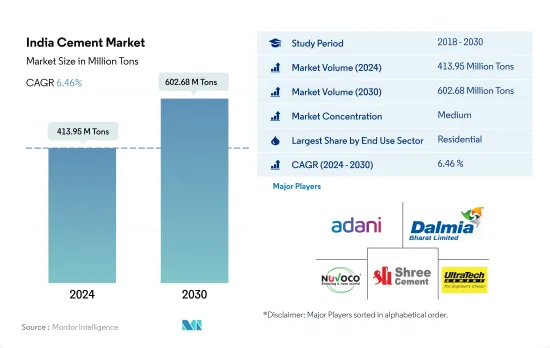

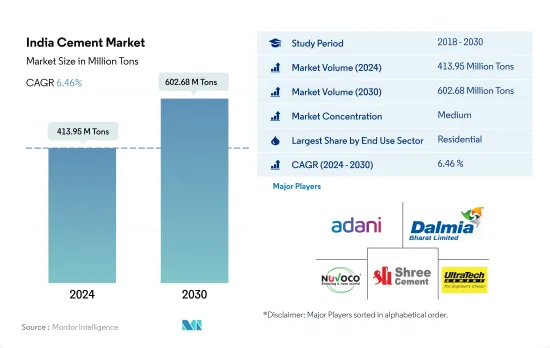

預計 2024 年印度水泥市場規模為 4.1395 億噸,到 2030 年將達到 6.0268 億噸,預測期內(2024-2030 年)的複合年成長率為 6.46%。

預計到 2030 年,印度甲級辦公空間將達到 12 億平方英尺,這將推動水泥需求。

- 2022年,受住宅和基礎建設領域強勁需求的推動,印度水泥消費量將年增與前一年同期比較 %。到 2023 年,印度水泥市場預計將佔亞太市場的 12.82% 左右。

- 2022 年,住宅領域佔 60.88%,是印度最大的水泥消費領域。該國正在經歷快速的都市化,加上政府措施以及國內外投資,住宅需求日益成長。預計這一趨勢將導致住宅大幅增加。據預測,2023年住宅建築占地面積將達26.6億平方米,2030年將達32.7億平方米。因此,預計到2030年住宅水泥市場將較2023年大幅增加1.17億噸。

- 印度商業部門預計將成為成長最快的水泥消費領域,預測期內複合年成長率將達到 8.60%。 2023 年至 2030 年間,商業占地面積預計將增加 3.58 億平方英尺。激增的原因是人們對購物中心、辦公空間、零售店和其他商業設施的需求不斷增加。例如,印度七大城市的甲級辦公室市場規模預計到2026年將擴大至10億平方英尺,2030年將進一步達到12億平方英尺。因此,印度商業領域水泥市場規模預計將從2023年的3,932萬噸激增至2030年的7,005萬噸。

印度水泥市場的趨勢

預計到 2030 年,印度甲級辦公室市場規模將達到 12 億平方英尺,這可能會推動商業建築領域的需求。

- 2022 年,印度新的商業占地面積比 2021 年成長了 6.2%。零售業需求強勁,尤其是在前七大城市(德里國家首都轄區、班加羅爾、海得拉巴、孟買、普納、清奈和加爾各答),購物中心面積超過 260 萬平方英尺,比 2021 年成長 27%。展望 2023 年,由於外國直接投資 (FDI) 的激增推動了對新辦公、零售和其他設施的需求,該行業的新增占地面積預計將激增 3,800 萬平方英尺。尤其是,預計2023年建築業的外國直接投資流入將達到9,600萬美元。

- 2020 年,印度新建商業占地面積較 2019 年下降 68.3%。下降的主要原因是政府在全國範圍內實施封鎖,導致正在進行的計劃暫停、供應鏈緊張並影響了勞動力的可用性。然而,隨著 2021 年限制措施的放鬆,出現了強勁復甦,新建占地面積激增約 5.26 億平方英尺。此外,2021 年綠建築舉措顯著增加,約有 55% 的商業計劃採用了永續性,進一步刺激了該領域的需求。

- 展望 2030 年,印度新的商業占地面積預計將達到 3.58 億平方英尺,較 2023 年大幅成長。這一成長帶來了對購物中心、辦公空間和其他商業設施的需求。例如,印度前七大城市的甲級辦公大樓市場到 2026 年將擴大到 10 億平方英尺,到 2030 年將進一步擴大到 12 億平方英尺。因此,預計該國新的商業占地面積在預測期內將實現 5.26% 的強勁成長率。

住宅需求增加和房地產行業的擴張將刺激住宅行業的需求

- 2022年,印度住宅占地面積成長9.4%,高於前一年。印度住宅需求激增,前七大城市(德里國家首都轄區、班加羅爾、海得拉巴、孟買、浦那、普納清奈和加爾各答)總合建造約 402,000 套新房,比 2021 年增加 44%。 2023 年第一季,這些城市的住宅銷售量達到 114,000 套,比上年大幅增加 99,500 多套。因此,預計 2023 年印度新建住宅占地面積將比 2022 年增加約 7,100 萬平方英尺。

- 2020年,印度住宅產業遭遇挫折,新屋占地面積與前一年同期比較%。下降的原因是全國範圍內的封鎖、供應鏈中斷、勞動力短缺、建築生產率放緩以及外國投資下降。不過,印度住宅房地產市場在 2021 年有所復甦,排名前七位的城市增加了約 163,000 套住宅。這一激增導致 2021 年住宅領域的新建占地面積與 2020 年相比大幅增加,達到約 6.49 億平方英尺。

- 展望未來,預計 2023 年至 2030 年間印度住宅產業的複合年成長率將達到 2.95%。這一成長得益於持續的住宅需求、不斷增加的投資和有利的政府政策。特別是到2030年,預計印度40%以上的人口將居住在都市區,這將帶來約2500萬套額外經濟適用住宅的需求。此外,到2030年,主要城市的住宅房地產市場預計將達到150萬套,這將進一步推動該產業的需求。

印度水泥業概況

印度水泥市場適度整合,前五大公司佔據59.22%的市場佔有率。該市場的主要企業是:Adani Group、Dalmia Bharat Limited、Nuvoco Vistas Corp Ltd.、Shree Cement Limited 和 UltraTech Cement Ltd.(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 終端使用領域趨勢

- 商業的

- 業/設施

- 基礎設施

- 住宅

- 主要基礎設施計劃(目前和已宣布)

- 法律規範

- 價值鏈與通路分析

第 5 章。市場區隔(包括市場規模、2030 年預測、成長前景分析)

- 最終用途領域

- 商業的

- 業/設施

- 基礎設施

- 住宅

- 產品

- 混合水泥

- 纖維水泥

- 普通矽酸鹽水泥

- 白水泥

- 其他類型

第6章 競爭格局

- 重大策略舉措

- 市場佔有率分析

- 業務狀況

- 公司簡介

- Adani Group

- Birla Corporation

- Dalmia Bharat Limited

- Heidelberg Materials

- India Cements Ltd.

- JK Cement Ltd.

- Nuvoco Vistas Corp Ltd.

- Ramco Cements

- Shree Cement Limited

- UltraTech Cement Ltd.

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50002021

The India Cement Market size is estimated at 413.95 million Tons in 2024, and is expected to reach 602.68 million Tons by 2030, growing at a CAGR of 6.46% during the forecast period (2024-2030).

India's Grade A office space will reach 1.2 billion sq. f by 2030, which is likely to drive the demand for cement

- In 2022, India's cement consumption volume surged by 17.01% compared to the previous year, driven by the robust demand from the residential and infrastructure construction sectors. By 2023, India's cement market is projected to capture approximately 12.82% of the broader Asia-Pacific market.

- With a share of 60.88% in 2022, the residential sector stands as the largest consumer of cement in India. The country's increasing urbanization, coupled with government initiatives and both foreign and domestic investments, are fueling the demand for housing. This trend is expected to drive a significant uptick in residential building construction. Projections indicate that the new floor area for residential buildings will reach 2.66 billion sq. f in 2023 and is set to climb further to 3.27 billion sq. f by 2030. Consequently, the cement market for the residential sector is anticipated to witness a substantial growth of 117 million ton by 2030 compared to 2023.

- India's commercial sector is poised to emerge as the fastest-growing consumer of cement, boasting a robust CAGR of 8.60% during the forecast period. The new floor area for commercial buildings is estimated to expand by 358 million sq. f between 2023 and 2030. This surge is attributed to the escalating demand for shopping malls, office spaces, retail outlets, and other commercial establishments. For instance, India's Grade A office market in its top seven cities is projected to swell to 1 billion sq. f by 2026, further reaching 1.2 billion sq. f by 2030. Consequently, the cement market for India's commercial sector is expected to soar from 39.32 million ton in 2023 to 70.05 million ton in 2030.

India Cement Market Trends

India's Grade A office market is expected to reach 1.2 billion sq. ft by 2030 and is likely to drive the demand for the commercial construction sector

- In 2022, India's new commercial floor area saw a 6.2% volume growth compared to 2021. The retail sector, particularly in the top seven cities (Delhi NCR, Bangalore, Hyderabad, Mumbai, Pune, Chennai, and Kolkata), witnessed robust demand, adding over 2.6 million sq. ft of mall space, a 27% increase from 2021. Looking ahead to 2023, the sector's new floor area is expected to surge by 38 million sq. ft, driven by a surge in foreign direct investment (FDI) fueling the need for new offices, retail outlets, and other facilities. Notably, the FDI equity inflow for construction development in 2023 was projected to hit USD 96 million.

- In 2020, India's commercial new floor area plummeted by 68.3% in volume compared to 2019. This decline was primarily due to a nationwide lockdown imposed by the government, which disrupted ongoing projects, strained supply chains, and impacted labor availability. However, as restrictions eased in 2021, the country witnessed a significant rebound, with the new floor area surging by approximately 526 million sq. ft. Additionally, 2021 saw a notable uptick in green building initiatives, with around 55% of commercial projects embracing sustainability, further bolstering the demand for the sector.

- Looking ahead to 2030, India's commercial new floor area is projected to hit 358 million sq. ft, a significant jump from 2023. This surge drives a growing appetite for shopping malls, office spaces, and other commercial facilities. For instance, India's Grade A office market in the top seven cities is set to expand to 1 billion sq. ft by 2026 and further to 1.2 billion sq. ft by 2030. Consequently, the country's commercial new floor area is poised to witness a robust CAGR of 5.26% during the forecast period.

Rise in demand for housing units and increasing real estate sector to boost residential sector demand

- In 2022, India witnessed a 9.4% growth in residential floor area, outpacing the previous year. The demand for housing in the country surged, with the top seven cities (Delhi NCR, Bangalore, Hyderabad, Mumbai, Pune, Chennai, and Kolkata) collectively adding approximately 402,000 new units, marking a 44% increase from 2021. In Q1 2023, housing sales in these cities reached 1.14 lakh units, a staggering jump of over 99,500 units from the previous year. Consequently, it was projected that the residential new floor area in India would expand by approximately 71 million sq. ft in 2023 compared to 2022.

- In 2020, the residential sector in India faced a setback, witnessing a 6.25% decline in new floor area compared to the previous year. This decline was attributed to the nationwide lockdown, disruptions in the supply chain, labor shortages, reduced construction productivity, and a dip in foreign investments. However, in 2021, the Indian residential real estate market rebounded, adding around 163,000 new residential units across the top seven cities. This surge translated into a significant increase of about 649 million sq. ft in the residential sector's new floor area in 2021 compared to 2020.

- Looking ahead, the residential sector in India is poised to exhibit a CAGR of 2.95% in terms of volume from 2023 to 2030. This growth can be attributed to sustained housing demand, increased investments, and favorable government policies. Notably, by 2030, it is projected that over 40% of India's population will reside in urban areas, driving a demand for approximately 25 million additional affordable housing units. Furthermore, by 2030, the residential real estate market is expected to hit 1.5 million units in key cities, further fueling the demand in the sector.

India Cement Industry Overview

The India Cement Market is moderately consolidated, with the top five companies occupying 59.22%. The major players in this market are Adani Group, Dalmia Bharat Limited, Nuvoco Vistas Corp Ltd., Shree Cement Limited and UltraTech Cement Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End Use Sector Trends

- 4.1.1 Commercial

- 4.1.2 Industrial and Institutional

- 4.1.3 Infrastructure

- 4.1.4 Residential

- 4.2 Major Infrastructure Projects (current And Announced)

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size, forecasts up to 2030 and analysis of growth prospects.)

- 5.1 End Use Sector

- 5.1.1 Commercial

- 5.1.2 Industrial and Institutional

- 5.1.3 Infrastructure

- 5.1.4 Residential

- 5.2 Product

- 5.2.1 Blended Cement

- 5.2.2 Fiber Cement

- 5.2.3 Ordinary Portland Cement

- 5.2.4 White Cement

- 5.2.5 Other Types

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Adani Group

- 6.4.2 Birla Corporation

- 6.4.3 Dalmia Bharat Limited

- 6.4.4 Heidelberg Materials

- 6.4.5 India Cements Ltd.

- 6.4.6 JK Cement Ltd.

- 6.4.7 Nuvoco Vistas Corp Ltd.

- 6.4.8 Ramco Cements

- 6.4.9 Shree Cement Limited

- 6.4.10 UltraTech Cement Ltd.

7 KEY STRATEGIC QUESTIONS FOR CONCRETE, MORTARS AND CONSTRUCTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219