|

市場調查報告書

商品編碼

1684074

印尼水泥:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Indonesia Cement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

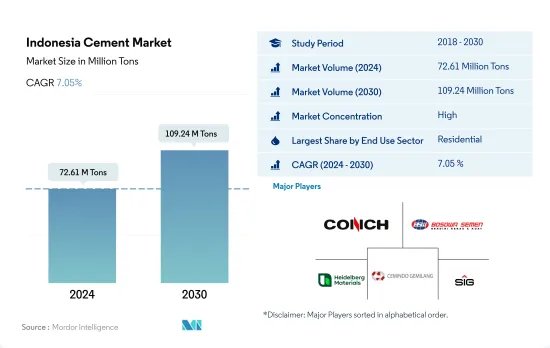

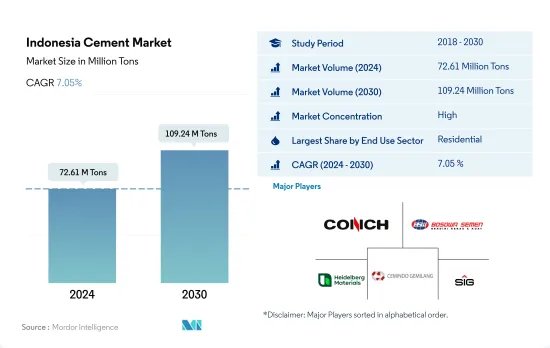

預計 2024 年印尼水泥市場規模為 7,261 萬噸,預計 2030 年將達到 1.0924 億噸,預測期內(2024-2030 年)的複合年成長率為 7.05%。

印尼工業建築業在政府投資的支持下可望推動水泥產量

- 水泥是建築中必不可少的粘合劑,它可以黏附在石頭、磚塊和瓷磚等建築材料上並變硬。它廣泛應用於住宅、商業、基礎設施和工業計劃。 2022年,印尼水泥市場容量與前一年同期比較減14.19%。產能過剩和原料價格高漲(尤其是煤炭和原油),抑制了中國建築業對水泥的需求。不過,預計 2023 年這一數字將轉為正值,市場銷售量預計將成長 21.63%。

- 2022 年,住宅建築佔據了印尼水泥市場的主導地位,佔 3,060 萬噸。由於經濟適用住宅計劃、人口快速成長、可支配收入增加以及強勁的購買力等因素推動了對住宅的需求,市場預計將在 2023 年實現成長。 2023年住宅建築占地面積預計將比2022年增加5,600萬平方英尺,相應印尼住宅建築水泥市場規模預計將成長21.63%。

- 預測期內,印尼工業建築水泥市場預計將以 9.61% 的複合年成長率最快成長。該國正穩步向製造業主導型經濟轉型,並計劃在 2045 年將自己打造成為東協電動車和石化產品的中心。 「透過國產品促進國內生產 (P3DN)」等舉措將進一步推動此工業化進程,進而帶來更多製造單位的建設,進而增加對水泥的需求。

印尼水泥市場趨勢

預計到 2028 年,印尼的商業房地產市場規模將達到 1.39 兆美元,這可能會刺激商業領域的需求。

- 2022年,印尼新建商業占地面積預計將與前一年同期比較9.7%。這一下降是由於新冠疫情期間建築活動下降後恢復正常所致。疫情爆發前,印尼商業建築的年能耗強度就已呈現下降趨勢,年均下降率為2.64%。然而,2023 年將出現復甦,新的商業占地面積將成長 5.7%,這得益於對新的辦公室、倉庫和零售空間的需求激增的外國直接投資 (FDI)。

- 在新冠疫情期間,印尼 2020 年和 2021 年新增商業占地面積大幅增加,達到約 960 萬平方英尺。政府致力於振興經濟,採取了多項措施,例如放寬私人和公共計劃建築相關的檢疫規定。這使得員工可以返回現場工作,企業可以繼續運作。值得注意的是,印尼2020年完工建築量預計將達到約1.32兆印尼盾,2021年將增加至1.42兆印尼盾。

- 預計到 2030 年,印尼的新商業占地面積將比 2023 年大幅成長約 58.72%。這一成長是由於對購物中心、辦公室和其他商業空間的需求不斷增加。零售房地產領域已成為該國特別有吸引力的行業。例如,商業房地產市場預計到2028年將達到1.39兆美元。印尼新的商業占地面積預計將保持穩定成長,預測期內複合年成長率為6.82%。

住宅需求的增加可能會推動住宅產業的成長

- 2022 年,印尼新建住宅占地面積較 2021 年成長了 7.10%。這一成長是由人口成長、富裕程度提高和都市化推動的。政府主導的住宅支持預計將在 2022 年達到 29 兆印度盧比,在住宅融資流動性工具計畫下,到 2023 年將增加至 32 兆印度盧比。該舉措旨在建造至少 220,000 套住宅。住宅建築業將經歷顯著的成長。預計到 2023 年,這一數字與前一年同期比較增加到約 5,600 萬平方英尺。

- 2020年,印尼新建住宅占地面積較2019年成長7.06%。這是政府的策略性舉措,優先發展建築業,以緩解景氣衰退並支持收入減少的家庭。因此,包括檢疫在內的建設活動限制已大大放寬。然而,2021年趨勢出現逆轉,住宅開工占地面積下降約12.54%。這主要是由於建築業的外國直接投資(FDI)下降。 2021年建築業外國直接投資與前一年同期比較減51%。

- 預測期內,印尼新建住宅占地面積預計將以 6.08% 的複合年成長率成長。這一成長歸功於該國日益加快的都市化,這得益於政府舉措以及國內外投資。這些因素直接或間接地加劇了該國日益成長的住宅需求,並最終促進了住宅建設。一些預測顯示,到 2030 年,每年將需要建造 82 萬至 100 萬套住宅才能滿足不斷成長的需求。

印尼水泥產業概況

印尼水泥市場高度集中,前五大公司佔94.25%的市佔率。該市場的主要企業是:安徽海螺水泥股份有限公司、Bosowa Semen、海德堡材料、PT Cemindo Gemilang Tbk 和 SIG(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 終端使用領域趨勢

- 商業的

- 業/設施

- 基礎設施

- 住宅

- 主要基礎設施計劃(目前和已宣布)

- 法律規範

- 價值鏈與通路分析

第 5 章。市場區隔(包括市場規模、2030 年預測、成長前景分析)

- 最終用途領域

- 商業的

- 業/設施

- 基礎設施

- 住宅

- 產品

- 混合水泥

- 纖維水泥

- 普通矽酸鹽水泥

- 白水泥

- 其他類型

第6章 競爭格局

- 重大策略舉措

- 市場佔有率分析

- 業務狀況

- 公司簡介

- Anhui Conch Cement Company Limited

- Bosowa Semen

- Heidelberg Materials

- PT Cemindo Gemilang Tbk

- PT. HAOHAN CEMENT INDONESIA

- PT. Jui Shin Indonesia

- PT. SEMEN JAKARTA

- PT. Sinar Tambang Arthalestari

- SCG

- SIG

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架(產業吸引力分析)

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 50002027

The Indonesia Cement Market size is estimated at 72.61 million Tons in 2024, and is expected to reach 109.24 million Tons by 2030, growing at a CAGR of 7.05% during the forecast period (2024-2030).

Indonesia's industrial construction sector, supported by government investments, is predicted to bolster cement production

- Cement, a crucial binding agent for construction, hardens to adhere to building materials like stones, bricks, and tiles. It finds extensive use in residential, commercial, infrastructure, and industrial projects. In 2022, Indonesia's cement market volume dipped by 14.19% compared to the previous year. Overcapacity and surging prices of raw materials, notably coal and crude oil, dampened cement demand in the country's construction sector. However, a positive shift was expected in 2023, with the market projected to grow by 21.63% in volume.

- In 2022, residential construction held a dominant position in Indonesia's cement market, accounting for a significant 30.6 million tons. In 2023, the market was poised for growth, with factors such as affordable housing initiatives, a burgeoning population with rising disposable incomes, and robust purchasing power set to drive demand for new residential units. The increase in new floor area for residential construction in 2023, compared to 2022, was projected to amount to 56 million sq. ft. Correspondingly, the Indonesian cement market for residential construction was anticipated to grow by 21.63% in volume.

- Indonesia's cement market for industrial construction is expected to witness the fastest CAGR of 9.61% in volume during the forecast period. The country is steadily transitioning into a manufacturing-focused economy and aims to position itself as an ASEAN hub for electric vehicles and petrochemicals by 2045. Initiatives like "Increase the Use of Domestic Products (P3DN)" further bolster this industrialization drive, leading to increased construction of manufacturing units and a subsequent rise in cement demand.

Indonesia Cement Market Trends

Indonesian commercial real estate market volume is projected to reach USD 1.39 trillion by 2028 and is likely to augment the demand for commercial sector

- In 2022, Indonesia witnessed a 9.7% decline in the volume of new commercial floor area compared to the previous year. This drop was a result of a return to normalcy following a decline in building activities during the COVID-19 pandemic. Even before the pandemic, commercial buildings in Indonesia were already showing a downward trend in annual energy intensity, accounting for a rate of 2.64% per year. However, in 2023, the country saw a rebound, registering a 5.7% increase in the volume of new commercial floor area, driven by a surge in foreign direct investment (FDI) necessitating new offices, warehouses, and retail spaces.

- Amidst the COVID-19 pandemic, in 2020 and 2021, Indonesia witnessed a significant surge in the volume of new commercial floor area, accounting for approximately 9.6 million square feet. The government's focus on revitalizing the economy led to measures such as easing construction-related quarantines, both in private and public projects. This allowed employees to resume work on-site and companies to continue their operations. Notably, the value of completed constructions in Indonesia stood at around IDR 1.32 quadrillion in 2020 and rose to IDR 1.42 quadrillion in 2021.

- The volume of new commercial floor area in Indonesia is projected to witness a robust growth of around 58.72% by 2030 compared to 2023. This surge is driven by a rising demand for shopping malls, offices, and other commercial spaces. The retail real estate segment is emerging as a particularly captivating sector in the country. For instance, the volume of the commercial real estate market is anticipated to reach USD 1.39 trillion by 2028. The commercial new floor area in Indonesia is expected to maintain steady growth, registering a CAGR of 6.82% during the forecast period.

Increase in demand for housing units is likely to augment the residential sector's growth

- In 2022, Indonesia witnessed a 7.10% volume growth in residential new floor area compared to 2021. This surge can be attributed to increased population, wealth, and urbanization. The government-led housing aid reached IDR 29 trillion in 2022, which was projected to increase to IDR 32 trillion in 2023 under the Housing Financing Liquidity Facility scheme. This initiative aims to construct at least 220 thousand houses. The residential construction sector is poised to witness a significant growth rate. It was estimated to increase to approximately 56 million square feet in 2023 compared to the preceding year.

- In 2020, the volume of residential new floor areas in Indonesia grew by 7.06% compared to 2019. This was a strategic move by the government, prioritizing construction to mitigate the economic downturn and support households grappling with reduced incomes. Consequently, restrictions on construction activities, including quarantines, were significantly eased. However, in 2021, the trend reversed, with a decline of about 12.54% in residential new floor area, primarily attributed to a dip in foreign direct investment (FDI) in the construction sector. FDI for construction plummeted by 51% in 2021 compared to the previous year.

- The residential new floor area in Indonesia is projected to witness a CAGR of 6.08% in volume during the forecast period. This growth stems from the country's increasing urbanization, bolstered by government initiatives and foreign and domestic investments. These factors, directly and indirectly, underscore the mounting housing needs in the nation, ultimately driving residential building construction. Projections indicate that to meet the escalating demand, the country would require between 820,000 and 1 million housing units annually by 2030.

Indonesia Cement Industry Overview

The Indonesia Cement Market is fairly consolidated, with the top five companies occupying 94.25%. The major players in this market are Anhui Conch Cement Company Limited, Bosowa Semen, Heidelberg Materials, PT Cemindo Gemilang Tbk and SIG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End Use Sector Trends

- 4.1.1 Commercial

- 4.1.2 Industrial and Institutional

- 4.1.3 Infrastructure

- 4.1.4 Residential

- 4.2 Major Infrastructure Projects (current And Announced)

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size, forecasts up to 2030 and analysis of growth prospects.)

- 5.1 End Use Sector

- 5.1.1 Commercial

- 5.1.2 Industrial and Institutional

- 5.1.3 Infrastructure

- 5.1.4 Residential

- 5.2 Product

- 5.2.1 Blended Cement

- 5.2.2 Fiber Cement

- 5.2.3 Ordinary Portland Cement

- 5.2.4 White Cement

- 5.2.5 Other Types

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Anhui Conch Cement Company Limited

- 6.4.2 Bosowa Semen

- 6.4.3 Heidelberg Materials

- 6.4.4 PT Cemindo Gemilang Tbk

- 6.4.5 PT. HAOHAN CEMENT INDONESIA

- 6.4.6 PT. Jui Shin Indonesia

- 6.4.7 PT. SEMEN JAKARTA

- 6.4.8 PT. Sinar Tambang Arthalestari

- 6.4.9 SCG

- 6.4.10 SIG

7 KEY STRATEGIC QUESTIONS FOR CONCRETE, MORTARS AND CONSTRUCTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219