|

市場調查報告書

商品編碼

1685879

德國太陽能-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Germany Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

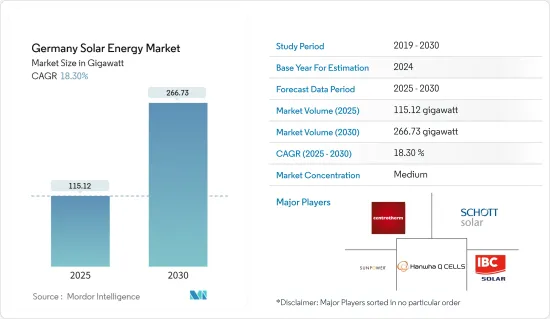

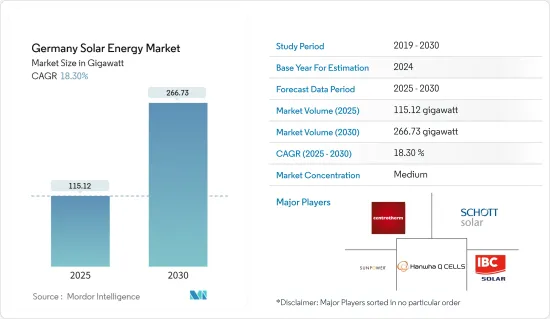

預計2025年德國太陽能市場規模為115.12吉瓦,至2030年預計將達到266.73吉瓦,預測期間(2025-2030年)的複合年成長率為18.3%。

主要亮點

- 從中期來看,太陽能基礎設施成本下降加上傳統能源來源電價上漲預計將推動德國太陽能市場的成長。

- 另一方面,替代能源的日益普及預計將阻礙市場成長。

- 然而,太陽能電池技術正在不斷進步,包括太陽能電池組件效率的提高。這些舉措正在為德國太陽能市場創造巨大的機會。

德國太陽能市場的趨勢

光伏發電(PV)預計將佔據市場主導地位

- 近年來,德國太陽能市場發生了重大變化。作為世界領先的可再生能源供應國之一,德國一直優先發展太陽能產業。這項努力植根於該國雄心勃勃的能源轉型目標,即“能源轉型”,旨在減少碳排放,逐步淘汰核電,走向永續能源的未來。

- 太陽能技術,尤其是太陽能發電面板成本的下降,對德國市場的擴張發揮著至關重要的作用。太陽能板價格越來越便宜,提高了太陽能裝置的投資收益,對消費者和企業來說吸引力也越來越大。太陽能設備價格的穩定下降也使得太陽能比傳統能源來源更具競爭力。

- 2023 年 7 月,全球太陽能發電工程開發商和營運商 Emeren Group Ltd 宣布將 11.5 MWp 太陽能發電工程出售給瑞士能源公司 MET Group。該計劃將在「準備建造」(「RTB」)階段出售,預計 MET 集團將建造和營運該發電廠。該太陽能發電廠將位於德國梅克倫堡-西波美拉尼亞州肯茨林。預計商業營運將很快開始。

- 根據國際可再生能源機構《2024年再生能源容量》的資料,德國太陽能發電裝置容量將從2022年的67,477兆瓦成長到2023年的81,737兆瓦,僅在一個財政年度就增加14,260兆瓦。

- 2023年9月,Uniper做出策略決策,在德國埃爾斯弗萊特建立一座300MWp太陽能發電廠。該計劃用地面積約281公頃。所選地點靠近亨德多夫和威廉港的資產所在地。根據「Photovoltaik Wesermarsch」區域能源概念,該發電廠預計將對永續能源生產做出重大貢獻。

- 此外,德國太陽能市場展現出強大的國際競爭力。德國擁有多家領先的光伏技術製造商和供應商,在全球光伏產業中發揮關鍵作用。德國太陽能光電產品和技術的出口對該國經濟成長和貿易順差貢獻巨大。

- 總之,德國太陽能光電市場是一個充滿活力且快速擴張的產業,得益於政府的支持政策、技術成本的下降、對永續性的承諾、創新的資金籌措模式和強大的國際競爭力,該市場正在經歷令人矚目的成長。

電價上漲透過傳統機制推動市場

- 德國擁有巨大的太陽能潛力,可再生能源公司正在利用這一潛力繼續增加其在可再生能源結構中的佔有率。然而,由於近年來使用石化燃料技術發電以及電力銷售管道多樣化,電力價格大幅上漲。

- 因此,石化燃料發電的高成本可以幫助德國過渡到更便宜的可再生能源,例如太陽能。預計這將成為消費者、公共產業、商業和工業相關人員採用太陽能發電基礎設施的成長動力,從而增加德國太陽能市場的滲透率。

- 2024年3月,德國能源部也宣布關閉7座燃煤褐煤發電廠。該國計劃在未來十年內徹底淘汰燃煤發電,並轉向利用太陽能和風能等更傳統的能源來獲取電力。

- 2023年5月,德國政府宣布將放寬太陽能發電的官僚障礙。德國政府的目標是到 2030 年在德國安裝 215 吉瓦的太陽能發電設施,七年內將現有容量增加兩倍以上。

- 2022年6月德國家庭電費為每度電0.3279歐元,2023年6月上漲至0.4125歐元,漲幅為25.8%。由於這些原因,德國對更便宜的太陽能電力的需求日益成長。

- 此外,德國政府的「德國太陽能一攬子計畫」旨在到2030年安裝215GW的太陽能板。 2022年6月,德國政府將把住宅太陽能發電廠的上網電價提高到750kW,同時鼓勵終端消費者安裝太陽能屋頂發電廠,透過將電力注入傳統電網來賺取收入。預計政府的這種干預措施將從長遠來看推動太陽能市場的發展。

- 在當前的市場情勢下,電價上漲迫使鋼鐵、水泥、食品和飲料等能源密集型產業停產或減產。這凸顯了在德國整合太陽能等可再生能源的重要性。

- 因此,在公用事業和獨立電力生產商銷售的電價上漲的背景下,這些因素預計將推動德國太陽能市場的成長。

德國太陽能產業概況

德國太陽能市場相當分散。市場的主要企業(不分先後順序)包括 IBC Solar AG、Centrotherm International AG、SunPower Corporation、Energie Baden-Wurttemberg AG 和 Hanwha Corporation。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 德國太陽能裝置容量及2029年預測

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 市場促進因素

- 透過常規機制提高電價

- 太陽能基礎設施成本下降

- 市場限制

- 與其他替代能源的競爭

- 市場促進因素

- 供應鏈分析

- PESTLE分析

第5章市場區隔

- 按類型

- 太陽能發電

- 聚光型太陽光電

- 按應用

- 實用工具

- 商業/工業

- 住宅

第6章競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- BayWa re AG

- Centrotherm International AG

- Sun Power Corporation

- AE Alternative Energy GMBH

- Hanwha Corporation

- IB Vogt GmbH

- Energie Baden-Wurttemberg AG

- IBC SOLAR AG

- Vattenfall AB

- Solnet Green Energy OY

第7章 市場機會與未來趨勢

- 太陽能製造的技術進步

簡介目錄

Product Code: 48882

The Germany Solar Energy Market size is estimated at 115.12 gigawatt in 2025, and is expected to reach 266.73 gigawatt by 2030, at a CAGR of 18.3% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the decreasing cost of solar energy infrastructure, coupled with the increasing electricity prices from conventional energy sources, are expected to drive the growth of the German solar energy market.

- On the other hand, the increasing adoption of alternate energy sources is expected to hinder the market's growth.

- Nevertheless, there is a rise in technological advancements in solar technology, such as increasing solar module efficiency. These measures present tremendous opportunities for the German solar energy market.

Germany Solar Energy Market Trends

Solar Photovoltaic (PV) Expected to Dominate the Market

- The German solar energy market has undergone significant transformations in recent years. As one of the leading countries in adopting renewable energy, Germany has consistently prioritized the development of its solar sector. This commitment is rooted in the country's ambitious energy transition goals, known as the "Energiewende," which seek to reduce carbon emissions, phase out nuclear power, and shift toward a sustainable energy future.

- The declining costs of solar technology, particularly photovoltaic panels, have played a pivotal role in expanding the market in Germany. As solar panels have become more affordable, the return on investment for solar installations has improved, making them increasingly appealing to consumers and businesses. The steady decrease in solar equipment prices has also led to an increase in the competitiveness of solar power against traditional energy sources.

- In July 2023, Emeren Group Ltd, a global solar project developer and operator, announced the successful sale of an 11.5 MWp PV project to the Swiss-based energy company MET Group. The project was sold at the Ready-to-Build ("RTB") stage, and MET Group is expected to complete the construction and operate the power plant. The solar PV power plant will be located in Kentzlin, Germany, in the state of Mecklenburg-Western Pomerania. Commercial operations are expected to start soon.

- According to data from the International Renewable Energy Agency RE Capacity 2024, the solar energy PV installations in Germany increased from 67,477 MW in 2022 to 81,737 MW in 2023, adding 14,260 MW in just one financial year, thus promising strong growth in the market.

- In September 2023, Uniper made a strategic decision to establish a 300 MWp photovoltaic plant in Elsfleth, Germany. This project is expected to cover an area of approximately 281 hectares. The chosen location is near the Huntorf and Wilhelmshaven asset locations. By aligning with the regional energy concept "Photovoltaik Wesermarsch," this plant is expected to contribute significantly to sustainable energy production.

- Furthermore, the German solar energy market has exhibited robust international competitiveness. The country is home to several leading solar technology manufacturers and suppliers, making it a key player in the global solar industry. Germany's export of solar products and technology contributes significantly to the country's economic growth and trade surplus.

- In conclusion, Germany's solar PV market is a dynamic and rapidly expanding sector that has witnessed remarkable growth due to supportive government policies, declining technology costs, a commitment to sustainability, innovative financing models, and strong international competitiveness.

Increase in Prices of Electricity Procured from Conventional Mechanisms Expected to Drive the Market

- Germany has vast solar energy potential, and accordingly, renewable energy companies have continued to leverage this potential to ramp up their share in the renewable energy mix. However, electricity generation from fossil-fuel technologies and various means of selling electricity have substantially increased prices in recent years.

- Hence, the high cost of electricity generation from fossil fuels could help Germany transition to cheaper renewable energy resources, such as solar energy. This is anticipated to act as a growth driver for consumers, utilities, commercial, and industrial stakeholders to install solar energy generation infrastructure, thereby increasing the market penetration of solar energy in Germany.

- In March 2024, the German Energy Ministry also announced shutting down seven coal-lignite-fired power plants. The country aims to fully phase out coal power by the end of the decade and switch to Electricity Procurement from Conventional Mechanisms like Solar and Wind.

- In May 2023, the German government announced that it would ease bureaucratic hurdles for solar power as the country set a new record for photovoltaic installations during the first quarter. The government aims to have 215 GW of solar installed in Germany by 2030, more than tripling existing capacity in seven years.

- In June 2022, household electricity prices in Germany were EUR 0.3279 per kilowatt Hour, which increased to EUR 0.4125 per kilowatt Hour in June 2023, citing a 25.8% increase. Such reasons invite a demand for more electricity offtake from cheaper solar energy resources in Germany.

- Moreover, the Germany Solar Package, which the government rolled out, aims to install 215 GW of solar panels by 2030. In June 2022, the Government of Germany increased the feed-in tariff for solar energy power plants up to 750 kW for residential areas, which also encourages end-consumers to install solar PV rooftop power plants and earn revenue by injecting electricity into the conventional grid. These government interventions are expected to enhance the solar energy market in the long term.

- In the current market scenario, the high electricity prices have forced high-energy-intensive industries such as steel, cement, food, and beverage to either shut down or curtail the rate of production. This has highlighted the importance of the integration of renewable energy resources such as solar in Germany.

- Hence, such factors are expected to drive the growth of the solar energy market in Germany in a scenario where electricity prices sold by utility or independent power producers are shooting up.

Germany Solar Energy Industry Overview

The German solar energy market is moderately fragmented. Some of the major players in the market (in no particular order) include IBC Solar AG, Centrotherm International AG, SunPower Corporation, Energie Baden-Wurttemberg AG, and Hanwha Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 German Solar Energy Installed Capacity and Forecast, in GW, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Market Drivers

- 4.5.1.1 Increase in Prices of Electricity Procured from Conventional Mechanisms

- 4.5.1.2 Decline in Cost of Solar Energy Infrastructure

- 4.5.2 Market Restraints

- 4.5.2.1 Competition from Other Alternative Energy Sources

- 4.5.1 Market Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Solar Photovoltaic

- 5.1.2 Concentrated Solar Power

- 5.2 By Application

- 5.2.1 Utility

- 5.2.2 Commercial/Industrial

- 5.2.3 Residential

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BayWa r.e. AG

- 6.3.2 Centrotherm International AG

- 6.3.3 Sun Power Corporation

- 6.3.4 AE Alternative Energy GMBH

- 6.3.5 Hanwha Corporation

- 6.3.6 IB Vogt GmbH

- 6.3.7 Energie Baden-Wurttemberg AG

- 6.3.8 IBC SOLAR AG

- 6.3.9 Vattenfall AB

- 6.3.10 Solnet Green Energy OY

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Solar PV Manufacturing

02-2729-4219

+886-2-2729-4219