|

市場調查報告書

商品編碼

1687098

義大利太陽能:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Italy Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

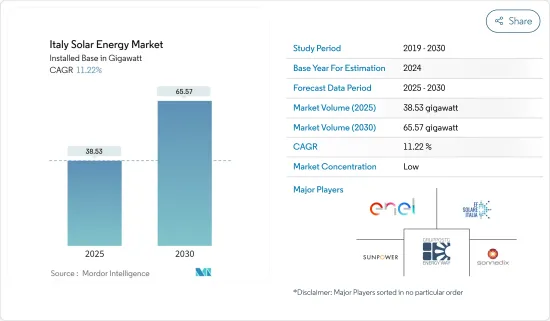

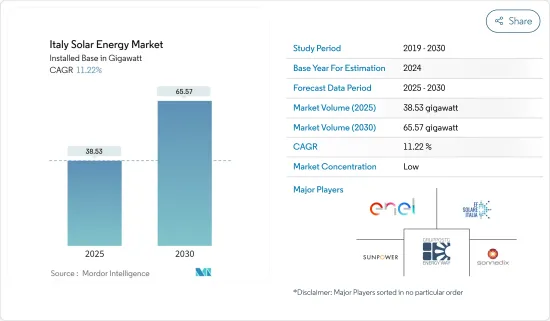

義大利太陽能市場規模(安裝基數)預計將從 2025 年的 38.53 GW 成長到 2030 年的 65.57 GW,預測期內(2025-2030 年)的複合年成長率為 11.22%。

主要亮點

- 從中期來看,政府鼓勵可再生能源發電的支持政策和太陽能光電設備成本的下降預計將成為預測期內推動義大利太陽能發電市場發展的因素之一。

- 然而,預計在預測期內,風能等替代再生能源來源的採用越來越多、電網基礎設施和能源儲存系統有限將阻礙市場的成長。

- 然而,預計未來海上太陽能設施將為市場參與者提供充足的機會。

義大利太陽能市場趨勢

太陽能光伏 (PV) 領域佔據市場主導地位

- 光伏(PV)是含有光伏材料的電池陣列,可將太陽的輻射或能量轉換為直流電。它們之所以昂貴,是因為它們由各種半導體(通常是矽)和高導電性電線組成,以減少電流損耗。但由於營運成本較低,預計未來幾年成本將進一步下降。

- 由於政府推出優惠措施推動太陽能發電應用,併網太陽能市場的成長也可能加速。例如,義大利政府於 2022 年初在其 DL Energia 法令中引入了新規定,以降低家庭和企業的能源費用。義大利企業已經能夠獲得計劃回扣,幾個南部地區也獲得了屋頂太陽能光電和能源效率的財政措施。

- 政府宣布的新規包括大幅簡化安裝容量在50kW至200kW之間的商業屋頂太陽能發電系統的許可。在義大利,這些系統被允許在該國被稱為「Scambio sul posto」的淨計量製度下運作。

- 2022年5月,歐盟委員會宣布,將強制要求2027年在商業和公共建築屋頂安裝太陽能光電,2029年在住宅建築屋頂安裝太陽能光電。此外,歐盟的可再生能源目標從40%提高到45%。預計這些規定將在未來幾年內提升義大利併網太陽能光電市場的滲透率。

- 義大利政府也計劃大幅提高裝置容量至60GW左右,到2030年終生產超過72TWh至74TWh的電力。 2023年初,義大利能源和環境部宣布,其目標是到2030年增加至少70GW的可再生能源容量。這些目標預計將推動新太陽能發電廠,特別是公用事業規模太陽能發電廠的部署大幅成長。

- 根據國際可再生能源機構 (IRENA) 的數據,2022 年太陽能裝置容量較 2021 年成長了 10.97%。在預測期內,未來幾年這一數字可能會增加。

- 因此,在政府優惠政策的支持下,隨著太陽能發電的持續發展和裝置容量的不斷增加,預計預測期內太陽能發電將佔據市場主導地位。

即將實施的計劃和政府政策預計將推動市場

- 義大利是世界領先的太陽能消費國之一,也是全球太陽能發電容量擴張的主要貢獻者。該國的太陽能新增裝置容量市場是世界上最大的市場之一。在歐盟內部,義大利的太陽能產業僅次於德國。

- 義大利政府推廣太陽能的原因有幾個。首先,它致力於減少對石化燃料的依賴,增加可再生在能源結構中的比重。這符合義大利的國家能源和氣候計劃,該計劃的目標是到 2030 年實現可再生能源在最終能源消費量總量中的佔比達到 45%。

- 2023年2月,義大利能源和環境部宣布,政府計畫在2030年為國家電網增加至少70吉瓦的可再生能源容量。為了實現這一目標,政府正在起草一項法令,加快可再生能源計劃的許可程序。

- 例如,2022年3月,義大利政府在DL Energia法令中宣布了一攬子新措施。新規定顯著簡化了安裝容量在 50kW 至 200kW 之間的商業屋頂太陽能光電(PV)系統的許可流程。這些系統有資格參與義大利的淨計量計劃,即「Scambio sul posto」。

- 根據國際可再生能源機構(IRENA)的數據,2022 年可再生能源容量較 2021 年成長了 5.33%。這一成長歸因於過去一年該地區新計畫的啟動和政府實施的支持政策。在預測期內和未來幾年,這一數字可能還會增加。

- 根據環境與能源安全部發布的《2021年國家能源狀況與年度數據關係》報告,經過7年的抑製成長,太陽能市場新增容量為21吉瓦(+3%)。義大利表現出最強勁的趨勢,成長了 83%,這得益於超級獎金計畫提供的優惠待遇。

- 義大利政府的這些措施也反映在太陽能發電量的大幅增加。例如,2022年太陽能發電總量為27.55吉瓦時,較2016年成長逾24.6%。此外,計劃在2030年引入超過7,000萬千瓦可再生能源,未來太陽能的引入預計還會進一步增加。

- 因此,由於雄心勃勃的可再生能源目標和政府的支持性舉措,如稅額扣抵、淨計量和對太陽能領域的投資,預計太陽能市場在預測期內將大幅成長。

義大利太陽能產業概況

義大利太陽能市場比較分散。主要企業包括(不分先後順序):Gruppo STG SRL、Sonnedix Power Holdings Ltd、EF Solare Italia SpA、SunPower Corporation 和 Enel SpA。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 降低安裝太陽能發電的成本

- 政府對可再生能源的支持政策

- 限制因素

- 其他能源來源的普及

- 驅動程式

- 供應鏈分析

- PESTLE分析

第5章 市場區隔

- 類型

- 光伏(PV)

- 聚光型太陽光電(CSP)

- 最終用戶

- 住宅

- 工業和商業

- 實用規模

- 擴張

- 屋頂

- 地面安裝

第6章 競爭格局

- 併購、合資、合作、協議

- 主要企業策略

- 公司簡介

- Gruppo STG SRL

- Sonnedix Power Holdings Ltd

- SunPower Corporation

- SunEdison Inc.

- Enel SpA

- Peimar SRL

- EF Solare Italia SpA

- 市場排名分析

第7章 市場機會與未來趨勢

- 適合安裝太陽能設備的近海區域

簡介目錄

Product Code: 55026

The Italy Solar Energy Market size in terms of installed base is expected to grow from 38.53 gigawatt in 2025 to 65.57 gigawatt by 2030, at a CAGR of 11.22% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, supportive government policies to promote renewable power generation and the declining cost of Solar PV installations are expected to be some of the driving factors for the solar energy market in Italy during the forecast period.

- On the other hand, the increasing adoption of alternate renewable sources such as wind and limited grid infrastructure and storage systems are expected to hinder the market growth during the forecast period.

- Nevertheless, offshore areas for solar installation are expected to provide ample opportunities for market players in the future.

Italy Solar Energy Market Trends

Solar Photovoltaic (PV) Segment to Dominate the Market

- Photovoltaics (PVs) are arrays of cells containing solar photovoltaic material that converts radiation or energy from the sun into direct current electricity. They consist of various semiconductors, usually silicon, and highly conductive wire to reduce any current loss, making them expensive. However, low operational costs are expected to further lower the costs in the coming years.

- The growth of the on-grid solar PV market is also likely to accelerate due to the government's favorable initiatives to boost its adoption. For instance, in early 2022, the Italian government launched new provisions in the DL Energia decree to decrease energy bills for households and businesses. Italian companies can now secure project rebates, and several southern regions have also been granted a fiscal break for rooftop solar PV and energy efficiency.

- The new provisions published by the government include an extreme simplification of permits to install commercial rooftop PV systems with a capacity of between 50 kW and 200 kW. In Italy, these systems are allowed to operate under the country's net metering scheme, known as Scambio sul posto.

- In May 2022, the European Commission announced a mandate for rooftop solar on commercial and public buildings by 2027 and for residential buildings by 2029. In addition, the EU target for renewable energy increased from 40% to 45%. Such mandates are anticipated to push the adoption of Italy's on-grid solar PV market in the coming years.

- The Italian government has also planned to significantly increase the installed solar PV capacity by up to about 60 GW to produce more than 72 TWh to 74 TWh of electricity by the end of 2030. In early 2023, the Italian Energy and Environment Ministry announced that it aims to add at least 70 GW of renewable energy capacity by 2030. These targets are expected to result in significant growth in deploying new solar PV plants, especially utility-scale sized PV plants.

- According to the International Renewable Energy Agency (IRENA), in 2022, the Solar Energy Installed Capacity increased by 10.97 % compared to 2021; the increase is due to new projects started in the past year. This number is likely to increase in the upcoming years during the forecast period.

- Thus, with such ongoing developments and capacity additions supported by favorable government policies, the solar PV segment is expected to dominate the market during the forecast period.

Upcoming Projects and Government Policies Expected to Drive the Market

- Italy is a prominent consumer of solar electricity worldwide and a significant contributor to the growth of solar energy capacity worldwide. The country's market for solar energy capacity additions is one of the largest globally. Within the European Union, Italy is ranked second, just behind Germany, in terms of its photovoltaic sector.

- The Italian government is promoting solar energy for several reasons. Firstly, it is committed to reducing the country's dependence on fossil fuels and increasing its share of renewable energy in the energy mix. This aligns with Italy's national energy and climate plans, which aim to achieve a 45% share of renewable energy in gross final energy consumption by 2030.

- In February 2023, the Energy and Environment Ministry of Italy announced that the government plans to add a minimum of 70 GW of renewable energy capacity to the national grid by 2030. To achieve this goal, the government is developing a decree to expedite the permit process for renewable energy projects.

- For instance, in March 2022, the Italian government released a new package of measures in the DL Energia decree. One of the new provisions includes a significant simplification of the permit process for installing commercial rooftop photovoltaic (PV) systems with a capacity ranging from 50 kW to 200 kW. These systems are eligible to participate in Italy's net metering scheme, which is known as the "Scambio sul posto."

- According to the International Renewable Energy Agency (IRENA), in 2022, the Renewable Energy Capacity increased by 5.33 % compared to 2021; the increase is due to new projects started and Supportive Government Policies implemented in the region during the past year. This number is likely to increase in the upcoming years during the forecast period.

- According to the Relazione annuale situazione energetica nazionale dati 2021, a report published by the Ministry of Environment and Energy Security in 2021, after seven years of reduced growth, there was an increase (+3%) in the solar energy market with 21 GW of additional capacity. Italy witnessed the greatest trend, with an increase of 83%, owing to the incentives provided by the super bonus mechanism.

- These actions from the Italian government have also been reflected in a significant increase in electricity generation through solar energy sources. For instance, in 2022, the total electricity generation through solar energy was recorded at 27.55 GWh, which was an increase of more than 24.6% compared to 2016. Furthermore, with plans to install more than 70 GW of renewable energy by 2030, the installation of solar energy is further expected to increase in the future.

- Therefore, the solar energy market is expected to grow significantly during the forecast period, owing to the ambitious renewable energy targets and supportive government initiatives, such as tax credits, net metering, and investments in solar energy sectors.

Italy Solar Energy Industry Overview

The Italian solar energy market is fragmented. Some of the major companies include Gruppo STG SRL, Sonnedix Power Holdings Ltd, EF Solare Italia SpA, SunPower Corporation, and Enel SpA (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definiton

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Recent Trends and Developments

- 4.2 Government Policies and Regulations

- 4.3 Market Dynamics

- 4.3.1 Drivers

- 4.3.1.1 Declining Cost of Solar PV Installations

- 4.3.1.2 Supportive Government Policies For Renewable Energy

- 4.3.2 Restraints

- 4.3.2.1 Penetration of Other Energy Sources

- 4.3.1 Drivers

- 4.4 Supply Chain Analysis

- 4.5 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Solar Photovoltaic (PV)

- 5.1.2 Concentrated Solar Power (CSP)

- 5.2 End-user

- 5.2.1 Residential

- 5.2.2 Industrial and Commercial

- 5.2.3 Utility-Scale

- 5.3 Deployment

- 5.3.1 Rooftop

- 5.3.2 Ground-mounted

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Gruppo STG SRL

- 6.3.2 Sonnedix Power Holdings Ltd

- 6.3.3 SunPower Corporation

- 6.3.4 SunEdison Inc.

- 6.3.5 Enel SpA

- 6.3.6 Peimar SRL

- 6.3.7 EF Solare Italia SpA

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Offshore Areas for Solar Installation

02-2729-4219

+886-2-2729-4219