|

市場調查報告書

商品編碼

1686620

菲律賓太陽能:市場佔有率分析、行業趨勢和成長預測(2025-2030年)Philippines Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

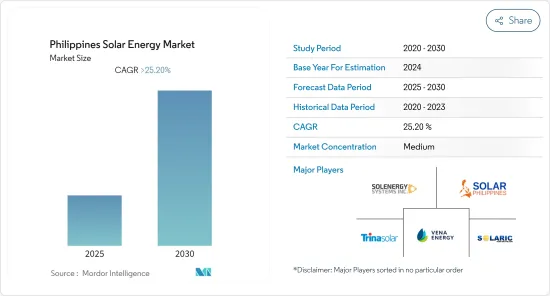

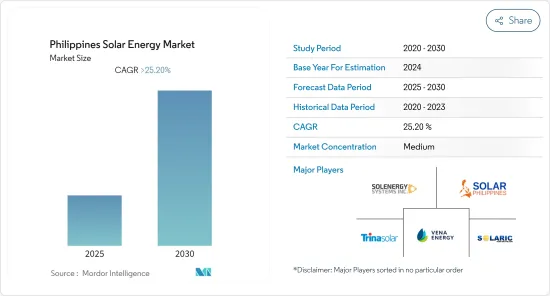

預計預測期內菲律賓太陽能市場的複合年成長率將超過 25.2%。

主要亮點

- 從中期來看,預計快速的經濟發展和人口成長等因素將在預測期內推動市場發展。預計在預測期內,利用太陽能發電的需求不斷增加以及太陽能發電系統價格的下降將推動市場發展。

- 然而,該國低效率的電網基礎設施預計將在未來幾年阻礙市場成長。

- 然而,據估計,透過用太陽能等可再生能源取代或整合柴油發電機,該國每年可節省超過 2 億美元。菲律賓的小島由以發電機為基礎的微電網供電,燃料為進口柴油和船用油。由於電網不穩定、發電能力不足以及補貼燃料短缺,這些島嶼經常遭遇停電和意外停電。因此,利用太陽能和其他可再生能源的離網電氣化有望成為未來的一大商機。

菲律賓太陽能市場趨勢

光伏發電(PV)顯著成長

- 太陽能為菲律賓日益成長的能源需求提供了直接的解決方案。隨著太陽能光電設備成本的穩定下降以及安裝和試運行太陽能發電工程所需時間的縮短,太陽能光電系統在菲律賓各地的消費者和產業中越來越受歡迎。

- 由於全國範圍內太陽能發電裝置的不斷增加,預計預測期內小規模太陽能發電的採用將會增加,從而導致太陽能發電行業顯著成長。菲律賓能源部(DOE)發布了《2020-2040 年菲律賓能源計畫》,設定了該國可再生能源佔總發電結構比重到 2030 年達到 35% 、到 2040 年達到 50% 的目標。這一發展將加速菲律賓對太陽能的採用。

- 根據國際可再生能源機構(IEA)的數據顯示,截至2022年,該國太陽能發電裝置容量為162.5萬千瓦,與前一年同期比較增18%。在菲律賓,工業和商業部門對太陽能的需求不斷增加,這可能會對太陽能市場的成長產生正面影響。

- 小型太陽能光伏(PV)已在菲律賓住宅領域廣泛應用,這主要是由於光伏技術成本的下降和淨計量的引入。

- 然而,儘管有淨計量政策,自 2013 年以來,住宅和商業領域 100kW 以下的光伏裝置成長有限。成長緩慢主要是由於行政、財務和監管障礙,阻礙了中小型業主安裝屋頂太陽能。

- 因此,隨著全國太陽能光電站安裝量的不斷增加,預測期內太陽能發電產業很可能主導菲律賓太陽能市場。

太陽能成本下降推動市場

- 在過去六年裡,太陽能產業透過規模經濟大幅降低了成本。設備充斥市場,價格暴跌。 2011年,太陽能板價格下跌了48.4%,自2008年以來,太陽能發電系統的成本已下降了30%以上。截至2022年,太陽能光電(PV)組件比2011年便宜80%以上,全國太陽能發電裝置的數量不斷增加,推動了市場的成長。

- 2010年至2022年間,太陽能發電成本下降了近四分之三,並且還會持續下降。不斷的技術改進,例如提高太陽能電池組件的效率,正在推動成本的降低。這些高度模組化技術的工業化帶來了規模經濟帶來的巨大效益,並加劇了改善製造流程和競爭性供應鏈的競爭。

- 截至2021年,全球組件價格已跌至0.24美元/瓦。隨著太陽能板價格的下降,消費者對安裝太陽能電池板以享受稅收優惠和減少電費表現出興趣,從而影響了菲律賓太陽能市場的成長。

- 因此,預計太陽能發電系統價格的下降將增加菲律賓太陽能光電的採用率,並在預測期內推動市場發展。

菲律賓太陽能產業概況

菲律賓太陽能市場較分散。主要企業包括(排名不分先後)Solar Philippines Power Project Holdings、Solenergy Systems Inc.、Vena Energy、Solaric Corp. 和 Trina Solar Ltd.。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 菲律賓太陽能市場的發展

- 可再生能源結構(2022年)

- 太陽能裝置容量及2028年預測

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 太陽能發電需求不斷成長

- 太陽能發電系統價格下降

- 限制因素

- 電網基礎設施效率低下

- 驅動程式

- PESTLE分析

第5章 按技術細分的市場

- 光伏(PV)

- 聚光型太陽光電(CSP)

第6章競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 市場佔有率分析

- 主要企業簡介

- Solar Philippines Power Project Holdings

- Solenergy Systems Inc.

- Vena Energy

- Solaric Corp.

- Trina Solar Ltd.

- AC Energy

- Cleantech Global

- Citicore Power Inc.

- Aboitiz Power Corporation

- Helios Solar Energy Corporation(HSEC)

第7章 市場機會與未來趨勢

- 利用可再生能源實現離網電氣化

簡介目錄

Product Code: 53322

The Philippines Solar Energy Market is expected to register a CAGR of greater than 25.2% during the forecast period.

Key Highlights

- Over the medium period, factors such as rapid economic development and a growing population are expected to drive the market during the forecast period. The growing demand for solar energy-based power generation and declining photovoltaic system prices are expected to drive the market during the forecast period.

- On the other hand, the country's inefficient electricity grid infrastructure is expected to hinder the market's growth in the coming years.

- Nevertheless, it is estimated that replacing/integrating diesel generators with renewable energy, like solar, can save the country over USD 200 million per year. Small islands in the Philippines are powered by generator-based mini-grids fueled by imported diesel and bunker (freighter) oil. These islands suffer from blackouts and unplanned power outages due to grid instability, inadequate generation capacity, and lack of subsidized fuel. Therefore, off-grid electrification through renewable energy sources, such as solar, is expected to create a significant opportunity in the future.

Philippines Solar Energy Market Trends

Solar Photovoltaic (PV) to Register Significant Growth

- Solar energy provides an immediate solution to the country's growing energy needs. With steadily falling solar power equipment costs and the short time needed to install and commission solar power projects, solar photovoltaic systems are increasingly becoming popular among consumers and industries across the Philippines.

- With the increased solar PV installations across the country, the solar PV segment is expected to grow significantly due to increasing small-scale solar PV deployment during the forecast period. The Department of Energy (DOE) released the Philippine Energy Plan 2020-2040, establishing the country's goal for renewable energy to reach 35% of its power generation mix by 2030 and 50% by 2040. This development, in turn, will culminate in the increasing deployment of solar PV across the country.

- According to International Renewable Energy Agency, as of 2022, the country witnessed 1,625 MW of solar PV installations with an annual growth rate of 18% compared to the previous year. It is observing growing demand for solar PV from industrial and commercial segments, which may positively impact the growth of the solar energy market in the Philippines.

- Small-scale solar photovoltaic (PV) has been widely adopted by the residential sector in the Philippines, mainly due to the declining cost of PV technology and the introduction of net metering.

- However, despite the net metering policy, the residential and commercial sector has witnessed limited growth for PV installation of up to 100 kW in size since 2013. The slow growth has been mainly due to administrative, financial, and regulatory hurdles, preventing small owners and medium-sized enterprises from installing rooftop solar.

- Hence, due to the increasing solar photovoltaic installations across the country, the solar PV segment will likely dominate the Philippine solar energy market during the forecast period.

Declining Costs of Solar PV to Drive the Market

- The solar industry has cut costs dramatically through economies of scale in the past six years. As the market was flooded with equipment, prices plummeted. In 2011, the price of solar panels declined by 48.4%, while the PV system costs dropped by more than 30% since 2008. As of 2022, solar photovoltaic (PV) modules were more than 80% cheaper than in 2011, culminating in an increase in solar installations across the country and favoring the market's growth.

- The cost of electricity from solar PV declined by almost three-fourths during 2010-2022 and continues to decline. Continuous technological improvements, including higher solar PV module efficiencies, drive cost reductions. The industrialization of these highly modular technologies yielded impressive benefits from economies of scale and greater competition to improved manufacturing processes and competitive supply chains.

- As of 2021, global module prices dipped as low as USD 0.24/W. As the prices of solar panels are declining, consumers are showing interest in installing solar panels to incur tax benefits and low electricity bills, which impacts the growth of the solar energy market in the Philippines.

- Thus, the declining photovoltaic system prices are expected to increase the adoption of solar power in the Philippines and drive the market during the forecast period.

Philippines Solar Energy Industry Overview

The Philippines Solar Energy Market is moderately fragmented. Some of the major companies include (in no particular order) Solar Philippines Power Project Holdings, Solenergy Systems Inc., Vena Energy, Solaric Corp., and Trina Solar Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Evolution of Solar Power Market in the Philippines

- 4.3 Renewable Energy Mix, 2022

- 4.4 Solar Energy Installed Capacity and Forecast, in GW, till 2028

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.1.1 The Growing Demand for Solar Energy-Based Power Generation

- 4.7.1.2 Declining Photovoltaic System Prices

- 4.7.2 Restraints

- 4.7.2.1 The Country's Inefficient Electricity Grid Infrastructure

- 4.7.1 Drivers

- 4.8 PESTLE Analysis

5 MARKET SEGMENTATION - BY TECHNOLOGY

- 5.1 Solar Photovoltaic (PV)

- 5.2 Concentrated Solar Photovoltaic (CSP)

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Market Share Analysis

- 6.4 Key Company Profiles

- 6.4.1 Solar Philippines Power Project Holdings

- 6.4.2 Solenergy Systems Inc.

- 6.4.3 Vena Energy

- 6.4.4 Solaric Corp.

- 6.4.5 Trina Solar Ltd.

- 6.4.6 AC Energy

- 6.4.7 Cleantech Global

- 6.4.8 Citicore Power Inc.

- 6.4.9 Aboitiz Power Corporation

- 6.4.10 Helios Solar Energy Corporation (HSEC)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Off-Grid Electrification Through Renewable Energy Sources

02-2729-4219

+886-2-2729-4219