|

市場調查報告書

商品編碼

1685959

智慧標籤:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Smart Label - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

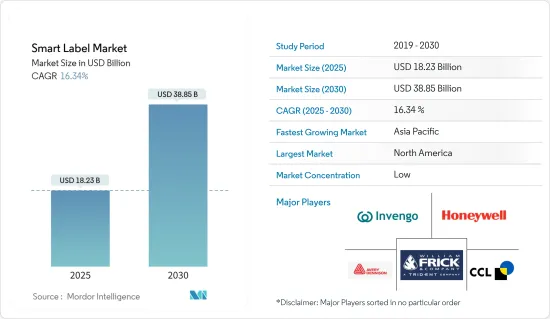

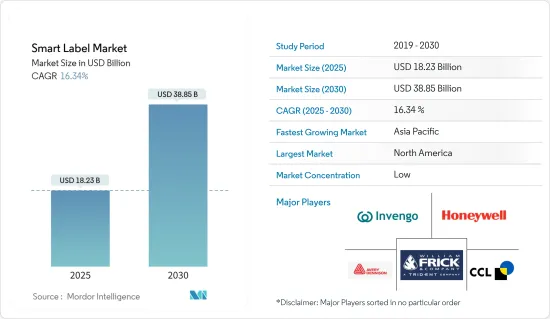

智慧標籤市場規模預計在 2025 年為 182.3 億美元,預計到 2030 年將達到 388.5 億美元,預測期內(2025-2030 年)的複合年成長率為 16.34%。

智慧標籤已成為零售、醫療保健和物流領域最廣泛的技術之一,被視為實現更高效率和盈利的理想手段,同時為從倉庫到配送中心的整個供應鏈提供產品真實性和可追溯性。

主要亮點

- 由於消費者行為和生活方式的改變,電子商務平台對安全和可追溯食品的興趣日益濃厚,消費者的健康和安全意識也不斷增強。根據IBM的一項調查,71%的消費者願意為提供完全透明度和可追溯性的公司平均額外支付37%的溢價。食品供應鏈是最複雜和最分散的供應鏈之一,70% 的公司在其原始供應商和內部客戶系統之間存在「可見性差距」。

- 2023 年 4 月,CCL Industries 宣布收購專門針對醫療保健領域的硬體和軟體解決方案供應商 E-Agile。此次收購還包括 eAgile 的標籤嵌入式 RFID嵌體專業知識和 Alert Systems ApS 的智慧財產權。 eAgile 的加入有望增強 CCL Label 的醫療保健和專業部門,並增強整個組織的 RFID 能力。此外,總部位於丹麥的私人公司Alert Systems 專門為歐洲零售商提供防盜解決方案,並將補充查核點的商品可用性解決方案 (MAS) 產品線。

- 這些標籤將作為實現智慧供應鏈的工具。標籤在消費品的行銷和廣告中發揮著重要作用。這可以透過提供產品資訊和分析這些標籤收集的資料來存取消費者購買模式來實現。製造商降低供應鏈成本以實現最接近的效率水平是推動需求的關鍵促進因素,並鼓勵積極採用這些解決方案以在各個終端用戶行業中獲得先發優勢。

- 此外,客戶消費模式的不斷改進和網際網路的快速普及直接影響了電子商務的擴張。因此,電子商務可能會產生對智慧標籤的持續需求,用於產品的追蹤和追溯。為了從這種情況中獲得最大利益,智慧標籤製造商正在推出先進的標籤解決方案,特別是針對電子商務領域。

- 由於印刷所用溶劑的溶解性,智慧標籤取決於其在運輸過程中承受惡劣氣候條件和陽光照射的能力。許多標籤會因暴露在陽光、化學物質以及骯髒或潮濕的環境中而受損,因此標籤必須能夠承受運輸、儲存或使用過程中的惡劣條件。

智慧標籤市場趨勢

零售終端用戶產業佔較大市場佔有率

- 智慧標籤在零售業中越來越受歡迎,用於追蹤和識別產品。這些標籤上採用 RFID(無線射頻識別)或其他技術來追蹤整個供應鏈和商店中的物品。智慧標籤可以透過提供存量基準和位置的即時資訊來幫助商家更有效地管理庫存。商家可以輕鬆更新標籤上的產品訊息,從而實現更準確的定價和行銷。

- 根據印度國際貿易部的數據,2023 年至 2027 年間,印度零售電子商務產業預計將以 14.1% 的年複合成長率(CAGR)成長。阿根廷和巴西在零售電商產業也取得了長足的進步。

- 透過將RFID技術融入電子商務,企業可以避免諸如可用庫存和實際庫存不匹配等錯誤,從而導致銷售和客戶忠誠度的損失、客戶出貨問題以及網路購物與實體店和倉庫不整合的庫存問題,使管理更加複雜。

- NFC(近距離場通訊)標籤可在零售業中以多種方式使用,以改善顧客購物體驗並提高效率。 NFC 標籤的一個應用是電子貨架標籤系統 (ESL)。零售商可以使用嵌入這些數位價格標籤的 NFC 技術的行動裝置或個人電腦即時更改產品價格和資訊。這節省了時間和資源,同時減少了定價錯誤的可能性。

- 市場參與者正在開拓新的解決方案來滿足客戶的需求。例如,2023年2月,北美小型電子紙顯示器技術供應商Danavation Technologies Corp.宣布,該公司已贏得四份安裝額外數位智慧標籤的新契約。該公司表示,將從 2023 年開始在加拿大和美國的10 家新零售店安裝數位智慧標籤。

- 總體而言,智慧標籤市場前景光明,並有可能透過即時庫存追蹤、提高客戶參與和促進永續性徹底改變零售業。隨著零售商不斷採用先進技術並尋求創新解決方案來提高業務效率,預計未來幾年對智慧標籤產品的需求將會成長。

北美佔據大部分市場佔有率

- 北美是世界上最大的智慧標籤市場之一,其中美國佔大部分。該國巨大需求的背後是各種大大小小的零售商的存在。在美國,沃爾瑪等零售巨頭主導,帶動相關活動增加,大幅拉動了該國智慧標籤市場的成長。沃爾瑪正在為牛仔褲等男士服裝添加電子識別標籤,此舉旨在讓該零售商更好地控制其庫存。

- 2023 年 1 月,艾利丹尼森簽署協議收購 Thermopatch,後者是一家專門為體育、工作服和酒店業提供標籤、裝飾和轉印服務的公司。收購完成後,Thermopatch 將併入艾利丹尼森零售品牌和資訊解決方案 (RBIS) 服裝解決方案部門。這項策略性舉措使艾利丹尼森能夠利用其行業專業知識和提供優質服務來加速外部裝飾業務的成長。

- 食品公司正在使用智慧標籤來提供額外的營養和成分資訊,以便更好地與消費者建立聯繫,並有助於減少該國的食物廢棄物。美國農業部 (USDA) 和食品藥物管理局(FDA) 宣布了一項關於對細胞肉和其他食品進行標記的框架協議。這些新興國家的發展有望增加該國正在研究的市場規模。此外,該國的供應商正在投資技術以提高整個供應鏈的可追溯性,區塊鏈的使用與智慧標籤一起增加。

- 在美國,員工竊盜和商店行竊(包括有組織的零售犯罪)現象正在增加。為了打擊零售犯罪的驚人成長,相關人員正在開發基於 RFID 的智慧標籤來追蹤紡織品和服飾。

- 數位技術的新進展正在影響加拿大的印刷業,使其更具競爭力並鼓勵對該行業的投資。數位印刷、整合系統、客戶介面軟體和後製自動化等新技術的採用提高了業務效率,並顯著改善了交付給最終用戶的產品的品質。

- 加拿大食品和消費品部(FCPC)推出了一種創新的智慧標籤,使消費者能夠即時輕鬆地獲取無法列印在產品標籤上的資訊。這是 FCPC 成員公司正在努力實現的健康飲食策略的一部分,旨在提高其向消費者提供的產品的透明度。許多加拿大大公司也在努力利用智慧標籤來培育透明的文化。

智慧標籤產業概況

全球智慧標籤市場較為分散,主要參與者包括艾利丹尼森公司、CCL Industries Inc.、William Frick & Company、霍尼韋爾國際公司和Invengo Information Technology。市場參與者正在採用合作、協議和收購等策略來增強其產品供應並獲得永續的競爭優勢。例如

- 2024 年 5 月,Roambee 面向物流業推出了配備真正的 5G GPS 技術的開創性「剝離和運輸」智慧標籤。這款 4" x 6" 標籤利用 NIST 校準的 5G、GPS、溫度、濕度、衝擊和光感測器,透過「類似條碼」的介面重新定義使用者互動。一次性設計適合一次性使用,為企業提供無與倫比的二級分銷管道即時監控、直接客戶出貨和全面的產品流資料,而傳統的可重複使用追蹤器往往落後。

- 2024 年 6 月,印刷和低功耗電子紙顯示產品供應商 Ynvisible Interactive Inc. 宣布與專門從事供應鏈視覺化數位解決方案的瑞士公司 Hive-Zox 建立策略夥伴關係。此次合作旨在將 Ynvisible 的電子紙顯示器融入緊湊、智慧的標籤中,用於監控藥品和醫療保健品的運輸。 Hive-Zox 正準備提高產量,目標是每年超過 100 萬台。同時,Hive-Zox 推出了 Connected Label,這是一款針對製藥和醫療保健產業的經濟高效的自動化監控解決方案。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 產業價值鏈分析

- COVID-19 市場影響

第5章市場動態

- 市場促進因素

- 對安全性和追蹤解決方案的需求不斷增加

- 市場限制

- 缺乏普遍標準、有安全隱患、無法抵禦惡劣天氣條件

第6章市場區隔

- 依技術

- 電子商品監控系統 (EAS)

- RFID

- 感測標籤

- NFC

- 電子貨架標籤(ESL)

- 按最終用戶產業

- 零售

- 醫療保健和製藥

- 後勤

- 製造業

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章競爭格局

- 公司簡介

- Avery Dennison Corporation

- CCL Industries Inc.

- William Frick & Company

- Honeywell International Inc.

- Invengo Information Technology Co. Ltd

- Scanbuy Inc.

- Sato Holdings Corp.

- Alien Technology

- Zebra Technologies Corp.

- Roambee Corporation

第8章投資分析

第9章:市場的未來

The Smart Label Market size is estimated at USD 18.23 billion in 2025, and is expected to reach USD 38.85 billion by 2030, at a CAGR of 16.34% during the forecast period (2025-2030).

Smart labels are becoming one of the most popular technologies across the retail, healthcare, and logistics sectors and are viewed as an ideal means to achieve greater efficiencies and profitability while providing the authenticity of an item and its traceability from the warehouse to the distribution center throughout the supply chain.

Key Highlights

- The changing consumer behavior and lifestyle have brought a higher interest in safe and traceable food on e-commerce platforms and raised public consciousness of health and safety in general. According to an IBM study, 71% of consumers are ready to pay an additional average premium of 37% for companies providing full transparency and traceability. While the food supply chain is one of the most complex and fragmented supply chains, 70% of firms have "visibility gaps" between the initial supplier and internal clients' systems.

- In April 2023, CCL Industries Inc. announced its acquisition of eAgile Inc., a provider of hardware and software solutions tailored for the healthcare sector. This acquisition also includes eAgile's expertise in RFID inlays integrated into labels and the intellectual property of Alert Systems ApS. The integration of eAgile is expected to bolster CCL Label's Healthcare & Specialty division, enhancing its RFID capabilities across the organization. In addition, Alert Systems ApS, a privately held company based in Denmark, specializes in anti-theft solutions for European retailers, complementing Checkpoint's merchandise availability solutions (MAS) product lines.

- These labels are used as a tool to enable smart supply chains. They play a vital role in the marketing and advertising of consumer products. This can be achieved through the provision of product information, as well as the analysis of consumer buying patterns that can be accessed from the data collected by these labels. Cost-cutting over the supply chain by manufacturers to be closer to the nearest level of efficiency has been a critical factor that has augmented the demand and prompted the proactive adoption of these solutions to gain the first-mover advantage in the individual end-user industry.

- Moreover, increasing customer spending patterns and rapid internet penetration are directly influencing the expansion of e-commerce. Thus, consistent demand for smart labels is likely to be generated by e-commerce for product tracking and tracing. To benefit the most from this scenario, smart label manufacturers are launching advanced label solutions, particularly for the e-commerce sector.

- The ability of a smart label to withstand harsh climatic conditions during shipping and exposure to sunlight plays an important role due to the dissolving nature of solvents used during printing. The labels should have the ability to face tough conditions during shipping, storage, or point-of-use, as many labels are subject to damage when exposed to sunlight, chemicals, and dirty or wet environments.

Smart Label Market Trends

Retail End User Industry to Hold Significant Market Share

- In the retail industry, smart labels are becoming increasingly popular for tracking and identifying merchandise. RFID (radio-frequency identification) or other technologies are used in these labels to track products throughout the supply chain and in-store. Smart labels have the potential to assist merchants in managing inventories more efficiently by delivering real-time information on stock levels and locations. Merchants can easily update product information on labels, which also enables more accurate pricing and marketing.

- According to the International Trade Administration, between 2023 and 2027, India is poised to boast a projected compound annual growth rate (CAGR) of 14.1% in its retail e-commerce sector. Not far behind, Argentina and Brazil are also making significant strides in the retail e-commerce industry.

- By incorporating RFID technology into e-commerce, firms can avoid mistakes like the available stock not matching the actual one, which results in a loss of sales and customer confidence, problems with customer shipments, and issues with a stock that does not integrate online shopping with the actual store or warehouse, which results in more complex management.

- NFC (near field communication) labels can be utilized in a variety of ways in the retail business to improve the customer shopping experience and increase efficiency. One application for NFC labels is electronic shelf labeling systems (ESL). Retailers can change product pricing and information in real time using a mobile device or PC with NFC technology embedded into these digital price tags. This saves time and resources while also lowering the chance of price errors.

- The players in the market are developing new solutions to cater to customers. For instance, in February 2023, Danavation Technologies Corp., a North American-founded and based technology provider of tiny e-paper displays, announced that the company received new contracts for four further installations of new digital smart labels. The firm mentioned installing digital smart labels in ten recent retail locations in Canada and the United States since the start of 2023.

- Overall, the future of the smart label market looks promising, with the potential to revolutionize the retail sector by offering real-time inventory tracking, improving customer engagement, and promoting sustainability. As retailers continue to adopt advanced technologies and seek innovative solutions to improve operational efficiency, the demand for smart label products is projected to grow in the coming years.

North America to Hold Major Share in the Market

- North America is one of the largest markets for smart labels across the world, with the United States accounting for a significant share of the region. The country's huge demand can be attributed to the vast presence of retail stores, both small and large. Retail goliaths like Walmart and other businesses are in charge in the United States, driving the uptick in activity and significantly boosting the country's growth in the smart label market. Walmart has been putting electronic identification tags on men's clothing, like jeans, as the retailer tries to gain more control over its inventory.

- In January 2023, Avery Dennison inked a deal to acquire Thermopatch, a specialist in labeling, embellishments, and transfers for the sports, workwear, and hospitality sectors. Following the acquisition, Thermopatch was set to integrate into Avery Dennison's Retail Branding and Information Solutions (RBIS) Apparel Solutions division. This strategic move positions Avery Dennison to leverage its collective industry expertise, emphasizing its quality service to propel growth in external embellishments.

- Food companies are using smart labels to connect with consumers by offering additional nutritional and ingredient information and helping to reduce food waste in the country. The USDA and FDA (Food and Drug Administration) announced a framework agreement to label cell-based meats and potentially other food products. These developments are expected to augment the size of the market studied in the country. Moreover, vendors in the country invest in technologies that drive greater traceability throughout their supply chains, with blockchain being increasingly used along with smart labels.

- The United States is also witnessing increasing employee theft and shoplifting, including organized retail crime. To address the alarming rise in retail crimes, stakeholders are developing smart labels based on RFID to track textiles and garments.

- The effects of new advancements in digital technologies have influenced the Canadian printing industry, making it more competitive and encouraging firms to invest in this domain. The adoption of new technologies, such as digital printing, integrated systems, customer interface software, and post-process automation, has enhanced operating efficiency and significantly improved the quality of products delivered to end users.

- Food and Consumer Products of Canada (FCPC) launched an innovative smart label that gives consumers instant and easy access to information that cannot be printed on product labels. This is a part of the Healthy Eating Strategy that the members of FCPC have undertaken by ushering in higher levels of transparency in the products that they offer to consumers. Many major companies in Canada have also committed to using smart labels to enhance the culture of transparency.

Smart Label Industry Overview

The global smart label market is fragmented, with the presence of major players like Avery Dennison Corporation, CCL Industries Inc., William Frick & Company, Honeywell International Inc., and Invengo Information Technology Co. Ltd. Players in the market are adopting strategies such as partnerships, agreements, and acquisitions to enhance their product offerings and gain a sustainable competitive advantage. For instance,

- In May 2024, Roambee debuted the logistics industry's pioneering 'peel-and-ship' smart label, powered by true 5G GPS technology. This 4-inch x 6-inch label redefines user interaction with its 'barcode-like' interface, harnessing 5G, GPS, and NIST-calibrated sensors for temperature, humidity, shock, and light. Tailored for one-time use, its disposable design grants enterprises unparalleled real-time oversight of secondary distribution channels, customer-direct shipments, and comprehensive product flow data, areas where conventional reusable trackers often lag.

- In June 2024, Ynvisible Interactive Inc., a provider of printed low-power e-paper display products, unveiled a strategic partnership with Hive-Zox, a Switzerland-based firm specializing in digital solutions for supply chain visibility. The collaboration aims to embed Ynvisible's e-paper displays into a compact, intelligent label tailored for monitoring pharmaceutical and healthcare shipments. Hive-Zox is poised to ramp up production, targeting an annual output exceeding 1 million units. Concurrently, Hive-Zox introduced its latest offering, the ConnectedLabel, a cost-effective, automated monitoring solution tailored for the pharmaceutical and healthcare sectors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Security and Tracking Solutions

- 5.2 Market Restraints

- 5.2.1 Lack of Ubiquitous Standards, Safety Concerns, and Inability to withstand Harsh Climatic Conditions

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Electronic Article Surveillance (EAS)

- 6.1.2 RFID

- 6.1.3 Sensing Label

- 6.1.4 NFC

- 6.1.5 Electronic Shelf Label (ESL)

- 6.2 By End-user Industry

- 6.2.1 Retail

- 6.2.2 Healthcare and Pharmaceutical

- 6.2.3 Logistics

- 6.2.4 Manufacturing

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Avery Dennison Corporation

- 7.1.2 CCL Industries Inc.

- 7.1.3 William Frick & Company

- 7.1.4 Honeywell International Inc.

- 7.1.5 Invengo Information Technology Co. Ltd

- 7.1.6 Scanbuy Inc.

- 7.1.7 Sato Holdings Corp.

- 7.1.8 Alien Technology

- 7.1.9 Zebra Technologies Corp.

- 7.1.10 Roambee Corporation