|

市場調查報告書

商品編碼

1686321

工業酵素-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Industrial Enzymes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

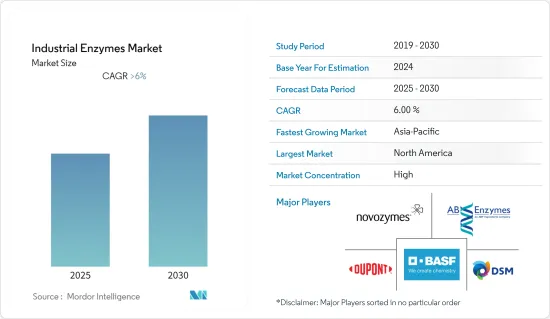

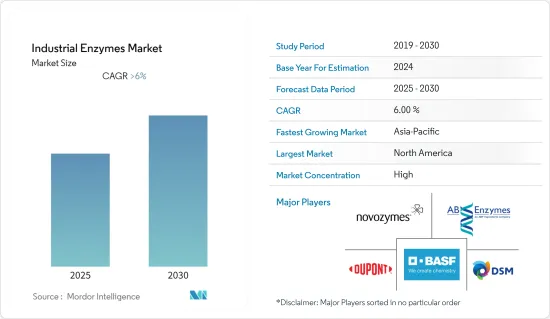

預計工業酵素市場在預測期內的複合年成長率將超過 6%。

工業酵素市場的成長受到 COVID-19 疫情的阻礙。全球原料供應鏈和酵素生產工廠的關閉和停工正在影響多個終端用戶產業。生質燃料產業受到新冠疫情的嚴重影響。預計 2022 年全球運輸生質燃料產量將大幅提高,將對工業酵素市場產生正面影響。

主要亮點

- 中期推動工業酵素市場成長的關鍵因素是酵素應用的多樣化,包括食品和飲料、製藥、清潔劑、化妝品和其他行業。此外,由於有關化學品使用的環境規範和法規不斷加強,對酵素的需求不斷增加,預計將推動工業酵素市場的成長。

- 然而,酶的溫度和 pH 值限制、各市場的監管限制以及原料競爭等因素預計會阻礙市場成長。

- 預計新產品創新和不斷擴大的應用基礎將在預測期內提供大量機會。

- 預計北美將主導市場,而亞太地區預計將在整個預測期內以最高的複合年成長率成長。

工業酵素市場趨勢

食品和飲料應用的需求不斷成長

- 食品和飲料產業佔據工業酵素市場的主導地位。這是成長最快的應用領域,主要受不斷成長的世界人口及其不斷增強的購買力的推動。健康意識也是人們對更好的食品品質、更安全的生產和加工以及更高的營養價值的需求不斷增加的一個因素。

- 當今消費者對具有天然風味和口味的高品質食品的需求日益成長,這是通用趨勢。這一趨勢引發了利用工業酵素應用開發風味和口感工程食品的需求。這些酵素在代謝反應中維生素和營養物質的分解以及複雜分子相互轉化為較小分子的過程中發揮著至關重要的作用,起到催化劑的作用。

- 澱粉酶、纖維素酶、木聚醣酶、果膠酶、蛋白酶、脂肪酶、葡萄糖基轉移酶、阿拉伯聚醣酶、聚半乳醣醛酸酶、凝乳酶和BETA-葡聚醣酶等食品酵素對全球食品添加劑產業至關重要。

- 食品業不斷致力於為消費者開發新的乳製品、食品和食品產品。隨著食品飲料產業新產品的開發,酵素在產業中的應用不斷增加。

- 根據加拿大統計局公佈的資料,2021年食品和飲料零售額為1,146億美元。

- 根據美國人口普查局發布的報告,美國食品和飲料零售額從2020年的8,502億美元大幅成長至2021年的8,803億美元。

- 隨著食品工業技術創新和發展的不斷加快,工業酵素在脂肪改質和甜味劑技術中得到廣泛的應用,從而推動了工業酵素市場的發展。

- 預計所有上述因素將在預測期內增加對工業酵素的市場需求。

北美佔據市場主導地位

- 北美佔有最大的佔有率,佔全球市場的30%以上。北美主導工業酵素市場。

- 美國在全球工業酵素市場佔有領先地位。該國佔據了世界上最大的收益佔有率,主要得益於飲料和生質燃料的生產。對精釀啤酒的需求不斷成長可能會促進工業酵素市場的成長。

- 美國是僅次於中國的世界第二大汽車生產國。根據OICA的數據,2021年汽車產量為9,167,214輛。美國全國汽車經銷商協會(NADA)預測,2022年美國新輕型汽車銷售將成長3.4%,達到1,550萬輛。由於汽車的普及和價格的上漲,預計未來汽車產量將會增加。這將推動汽車內裝所需的皮革加工的成長。

- 根據經濟複雜性觀察站(OEC)發布的報告,美國皮鞋出口額從2021年10月到2022年10月增加了809萬美元,從2,850萬美元增加到3,650萬美元。

- 由於加工食品需求的不斷成長以及加工食品行業中酶的應用不斷增加,推動了該國對工業酶的需求,因此墨西哥的工業酶市場正在快速成長。

- 此外,由於跨國食品和飲料製造商的投資增加,墨西哥的食品和飲料產業可能會擴張。食品加工行業最近從雀巢獲得了 7 億美元的投資,用於對全國 16 家工廠進行現代化改造,並在韋拉克魯斯建造一家新工廠。

- 在加拿大,對烘焙點心的需求正在從傳統的麵包消費趨勢轉向煎餅、紙杯蛋糕、可頌麵包和麵包捲等烘焙產品的消費增加。這可能會增加食品和飲料行業對工業酶的需求。

- 美國工業的高消費量與人們對解決環境問題的綠色技術的認知、生產力的提高和產品價值的提高有關,從而帶動了研發部門和使用酵素的行業的成長。

工業酵素行業概況

工業酵素市場由五大公司主導:諾維信、杜邦、荷蘭皇家帝斯曼、英聯酶(AB Enzymes)和BASF。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 美洲生質燃料需求激增

- 酵素應用和利基產品的多樣化

- 限制化學品使用的嚴格環境標準

- 限制因素

- 酵素的溫度和pH值限制

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 類型

- 碳水化合物分解酶

- 澱粉酶

- 纖維素酶

- 蛋白酶

- 胰蛋白酶(API 和非 API)

- 其他蛋白酶

- 脂肪酶

- 其他類型

- 碳水化合物分解酶

- 應用

- 食品加工

- 動物飼料

- 衛生保健

- 紡織產品

- 皮革加工

- 清潔劑和清潔劑

- 生質燃料

- 化妝品

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 南非

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)分析**/排名分析

- 主要企業策略

- 公司簡介

- AB Enzymes

- Advanced Enzyme Technologies

- Amano Enzyme Inc.

- BASF SE

- Biocatalysts

- BioResource International Inc.

- Chr. Hansen Holding AS

- DuPont

- DSM

- Enzyme Development Corporation

- Lesaffre

- Novozymes

第7章 市場機會與未來趨勢

- 新產品創新及應用領域拓展

- 新興經濟體產業需求不斷成長

The Industrial Enzymes Market is expected to register a CAGR of greater than 6% during the forecast period.

The industrial enzymes market's growth is hampered by the COVID-19 pandemic, as lockdowns and the shutdown of raw material supply chains and enzyme production plants globally have impacted several end-user industries. The biofuel industry has been strongly impacted by the COVID19 pandemic. In 2022, global transport biofuel production has improved significantly, creating a positive impact on the industrial enzymes market.

Key Highlights

- Over the medium term, the major factors driving the growth of the industrial enzymes market are the growing diversity in enzyme applications such as food and beverage, pharmaceuticals, detergents, cosmetics, and other industries. Also, the growing demand for enzymes due to increasing environmental norms and regulations regarding the use of chemicals is likely to boost the market growth of industrial enzymes.

- On the flip side, factors such as restricted temperature and pH level of enzymes, regulatory constraints for various markets and competition for raw materials are expected to hinder the market growth.

- New product innovations and expansions of application bases are anticipated to provide numerous opportunities over the forecast period.

- North America dominated the market and Asia-Pacific is likely to register the highest CAGR through the forecast period.

Industrial Enzymes Market Trends

Growing Demand from Food and Beverage Applications

- The food and beverage segment dominates the industrial enzymes market. This is the fastest-growing application segment, mainly supported by the ever-growing global population and its increasing purchasing power. Health awareness is also a factor in people's increasing demand for food quality, safer production processing, and improved nutritional value.

- The increasing demand for high-quality foods in terms of natural flavor and taste has become a common trend among present consumers. This trend triggered the need for the development of flavored and tasty processed foods using industrial enzyme applications. These enzymes act as catalysts by playing important roles in the breaking down of vitamins and nutrients in the metabolic reactions and inter-conversion of complex molecules to smaller molecules.

- Food enzymes, such as amylase, cellulase, xylanase, pectinase, protease, lipase, glucosyltransferase, arabinanase, polygalacturonanace, chymosin, and beta-glucanase, among others, have become an essential part of the global food additives industry.

- The food industry is continuously involved in developing new dairy products, beverages, and food items for consumers. With the development of new products in the food and beverage industry, the application of enzymes in the industry has continuously increased.

- As per data published by StatCan in Canada, the retail sales of food and beverages was USD 114.60 billion in 2021.

- According to a report published by US Census Bureau, the sale of retail food and beverage in United States increased significantly from USD 850.2 billion in 2020 to USD 880.3 billion in 2021.

- With the increased innovation and development of technologies in the food industry, industrial enzymes have found extensive applications in fat modification and sweetener technology, thereby driving the industrial enzymes market.

- All the aforementioned factors are expected to increase the market demand for industrial enzymes during the forecast period.

North America to Dominate the Market

- North America has the highest share, accounting for more than 30% of the global market. North America dominated the industrial enzymes market.

- The United States occupies the top position in the global industrial enzymes market. The country has the largest revenue share globally, owing largely to beverage and biofuel production. The increasing demand for craft beer is likely responsible for the industrial enzyme market's growth.

- The United States is the second largest automotive manufacturing country globally, falling only behind China. According to OICA, automotive production in 2021 accounted for 9,167,214 units. The National Automobile Dealers Association (NADA) predicts that the United States new light-vehicle sales are likely to increase by 3.4% to 15.5 million units in 2022. The production of automobiles is anticipated to ascend in the upcoming future owing to the rising popularity and affordability of the vehicles. This will lead to the growth of leather processing which is required for upholstery in automobiles.

- As per the report published by he Observatory of Economic Complexity (OEC), the leather exports of United States Leather Footwear have increased by USD 8.09 million from USD 28.5 million to USD 36.5 million from October 2021 to October 2022.

- The industrial enzymes market is witnessing rapid growth in Mexico due to the increasing demand for processed food and increased applications of enzymes in the processed food industry, which are driving the demand for industrial enzymes in Mexico.

- Further, the food & beverage industry in Mexico is likely to upscale with growing investments by multinational food & beverage producers. The food processing industry has recently attracted investment worth USD 700 million from Nestle to modernize its 16 factories in the country and construct a new one in Veracruz.

- In Canada, the demand for baked goods has moved from the traditional bread consumption trend to the increasing consumption of bakery goods, such as pancakes, cupcakes, croissants, and rolls. This, in turn, is likely to drive the demand for industrial enzymes used in the food and beverage industry.

- The high consumption in the U.S. industries is correlated with awareness regarding green technologies addressing environmental issues, enhanced productivity, and better product value, thus, leading to growth in the research and development sector and industries using enzymes.

Industrial Enzymes Industry Overview

The industrial enzymes market is consolidated in nature and is dominated by the top five players, namely, Novozymes, DuPont, Royal DSM, AB Enzymes, and BASF.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Surge in Demand for Biofuels in the Americas

- 4.1.2 Growing Diversity in Enzyme Applications and Niche Products

- 4.1.3 Stringent Environmental Norms Curbing the Usage of Chemicals

- 4.2 Restraints

- 4.2.1 Restricted Temperature and pH Levels of Enzymes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Carbohydrases

- 5.1.1.1 Amylases

- 5.1.1.2 Cellulases

- 5.1.2 Proteases

- 5.1.2.1 Trypsins (API and Non-API)

- 5.1.2.2 Other Proteases

- 5.1.3 Lipases

- 5.1.4 Other Types

- 5.1.1 Carbohydrases

- 5.2 Application

- 5.2.1 Food Processing

- 5.2.2 Animal Feed

- 5.2.3 Healthcare

- 5.2.4 Textiles

- 5.2.5 Leather Processing

- 5.2.6 Detergents and Cleaners

- 5.2.7 Bio Fuel

- 5.2.8 Cosmetics

- 5.2.9 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Australia and New Zealand

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis** / Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AB Enzymes

- 6.4.2 Advanced Enzyme Technologies

- 6.4.3 Amano Enzyme Inc.

- 6.4.4 BASF SE

- 6.4.5 Biocatalysts

- 6.4.6 BioResource International Inc.

- 6.4.7 Chr. Hansen Holding AS

- 6.4.8 DuPont

- 6.4.9 DSM

- 6.4.10 Enzyme Development Corporation

- 6.4.11 Lesaffre

- 6.4.12 Novozymes

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 New Product Innovation and Expansion of Application Base

- 7.2 Increasing Demand from Industries in Emerging Economies