|

市場調查報告書

商品編碼

1686552

壓鑄:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Die Casting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

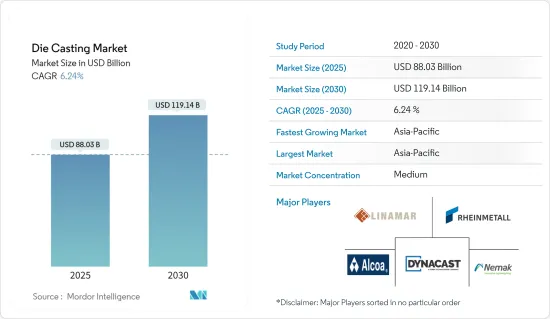

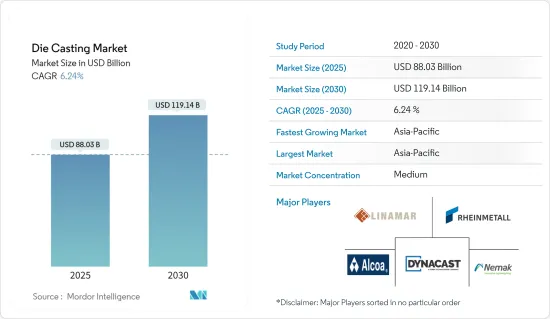

預計 2025 年壓鑄市場規模為 880.3 億美元,到 2030 年將達到 1,191.4 億美元,預測期內(2025-2030 年)的複合年成長率為 6.24%。

新冠疫情為製造業帶來沉重打擊。隨著全球主要經濟體進入封鎖狀態,供應鏈中斷。在此期間,所有製造單位和OEM工廠被迫停止生產和運作。隨著經濟復甦,消費者偏好轉向更輕的汽車,汽車產業對壓鑄件的需求也顯著回升。預計這一趨勢將持續並推動市場成長。

從中期來看,壓鑄行業供應鏈的日益複雜化、汽車市場的擴大、壓鑄件在工業機械中的滲透率的提高、建築行業的成長以及電氣和電子設備中鋁鑄件的採用將極大地推動所研究的市場。 CAFE 標準和 EPA 減少汽車排放氣體、提高燃油經濟性的政策正在鼓勵汽車製造商透過使用輕質非鐵金屬來減輕汽車重量。因此,採用壓鑄件作為輕量化策略是汽車產業前者市場的主要驅動力。

由於鋁壓鑄件具有較高的導熱性,電氣和電子產業對鋁壓鑄件的需求不斷成長,這可能會推動預測期內的成長。隨後,採用壓鑄件作為輕量化策略已成為汽車領域前者市場的主要驅動力。然而,原物料供應緊張、原物料價格波動以及冶金業排放氣體的環境法規是市場成長的主要障礙。

由於中國和印度等國家對汽車的需求不斷增加,以及鋁壓鑄在各種應用中的使用不斷增加,預計亞太地區將佔據壓鑄市場的最大市場佔有率。由於建築和汽車行業產量的增加,北美鋁壓鑄市場預計也將顯著成長。

壓鑄市場趨勢

鋁有望在壓鑄製程中發揮關鍵作用

多年來,許多工業應用對鋁高壓鑄件的需求一直在增加,因為它可以生產重量輕的零件,並在複雜形狀方面具有很高的靈活性。

近年來,隨著新技術的發展,汽車零件不斷進步和創新。其中,輕量化材料在汽車零件製造上的應用正受到各國的重視。

汽車受歡迎的主要原因之一是採用輕質汽車材料提高了汽車的燃油效率。

此外,必須在不損害安全性、品質或性能的情況下減輕車輛重量。鋁壓鑄件耐用且可無限回收,由於其眾多優點,鋁已成為製造商的首選。

此外,大型公司不斷增加收購和聯盟活動,以進一步加強市場滲透。例如,

- 2022年8月,文燦集團宣布將在安徽省六安經濟技術開發區興建新能源汽車鋁壓鑄件生產基地。

- 2021 年 10 月,我們成立了 Sandhar Engineering Private Limited 作為完全子公司,從事一系列鎖定裝置、電氣、電子、機械、汽車和工業零件的製造和組裝業務。

- 2021 年 4 月,Jaya Hind Industries 將與 KS Huayu Alutech GmbH (KSATAG) 的技術合作夥伴關係延長至 2027 年,用於製造汽車汽缸體和缸頭。我們也將業務範圍擴大到 Sunrise Industries 的新零件,包括電動車和底盤的結構件。

- 2021 年 3 月,Sandhar Technologies 與 Unicast Autotech 簽署了一份不具約束力的合作備忘錄,以收購該公司的鋁壓鑄業務。

預計鋁壓鑄市場在預測期內將繼續成長,以滿足汽車和非汽車產業對輕質和高導電性金屬零件日益成長的需求。

亞太地區將迎來顯著成長

預計預測期內亞太地區將佔據壓鑄市場的最大市場佔有率。汽車行業的成長、工業領域的需求以及風力渦輪機和通訊應用的不斷擴大預計將推動亞太地區壓鑄市場以更快的速度發展。

預計印度和中國的廉價勞動力和低製造成本將進一步推動亞太地區的市場成長。此外,對電動和混合動力汽車的需求不斷成長,促使汽車製造商將注意力轉向使用鋁等輕質材料來取代所有類型車輛中較重的鋼材和鋼材。例如

- 2022年5月,泰米爾納德邦小型工業發展公司投資5.8億印度盧比,建立鋁高壓鑄通用設備中心。

隨著全國汽車製造業的擴張,汽車輕量材料的需求很有可能增加。例如

- 2021 年 2 月,MG Motors 宣布可能投資 150 億印度盧比用於擴建和本地化營運,以提高其位於古吉拉突邦Halol 工廠的生產能力。

- 印度政府提案在預測期內將印度每輛電動車的鋁使用量從 29 公斤增加到 160 公斤。

此外,電動車製造商也積極採購這些壓鑄機,因為他們採用這項技術來滿足日益成長的消費者需求。

為了維持市場競爭力,許多公司正在採取擴大生產能力等成長策略。例如

- 2021年7月,伊之密將在美國和印度建立壓鑄技術服務中心(TSC),提供壓鑄單元、模具、壓鑄製程、產品調試一體化解決方案。

- 2021 年 2 月,Endurance Technologies 在位於泰米爾納德邦 Kancheepuram 區 Vadagal 市 Vallam 的新工廠開始商業生產。該工廠生產鋁壓鑄件、整合式碟式煞車組件和控制調變器,並向現代、起亞和皇家恩菲爾德供應機械加工鋁鑄件。

壓鑄業概況

壓鑄市場由幾家主要企業主導,例如:其中包括 Neamk、Alcoa Corporation、Linamar Corporation 和 Dynacast。這些市場的關鍵參與者正致力於透過各種合併、聯盟、合資和收購來擴大其全球影響力。例如,

- 2022 年 3 月,利納馬集團收購了 GF Casting Solutions (GF) 50% 的股份。透過此次收購,利納馬公司增強了產品系列。

- 2022 年 1 月,Gibbs Die Casting 的子公司 Koch Enterprises, Inc. 收購了 Amprod Holdings, LLC。透過此次收購,該公司擴大了在美國的產品系列。

- 2022 年 1 月,我們成立了完全子公司Sandhar Auto Electric Solutions Private Limited,並開始提供電動車業務和先進技術解決方案。 Sandhar Auto Electric Solutions Private Limited 主要從事電池電動車、氫燃料電池汽車、生質燃料技術汽車、全地形車 (ATV) 和其他先進汽車技術汽車的零件製造業務。

- 2021 年 8 月,利納馬集團宣布與荷蘭 Innovative Mechatronic Systems BV(IMSystems)建立合作關係。此次夥伴關係將致力於將阿基米德驅動傳動系統推向市場。

- 2021 年 4 月,Aludyne 宣布收購 Shiloh Industries CastLight 部門。該部門生產鋁壓鑄件。

- 2021 年 2 月,Endurance Technologies 宣布已在位於印度泰米爾納德邦 Kancheepuram 的新工廠開始商業生產。該工廠將生產鋁壓鑄件並整合二輪車和四輪車的碟式煞車零件。

- 2020 年 4 月,Endurance Technologies 收購了位於義大利特倫蒂諾的 Adler SpA 99% 的股份。此次收購預計將整合義大利和德國的 10 家製造工廠,擴大該公司在歐洲的影響力。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 按應用

- 車

- 電氣和電子

- 工業的

- 其他

- 按工藝

- 壓力鑄造

- 真空壓鑄

- 擠壓壓鑄

- 其他

- 按原料

- 鋁

- 鎂

- 鋅

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 泰國

- 馬來西亞

- 印尼

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 南非

- 土耳其

- 其他中東和非洲地區

- 北美洲

第6章競爭格局

- 供應商市場佔有率

- 公司簡介

- Form Technologies Inc.(Dynacast)

- Nemak

- Endurance Technologies Limited

- Sundaram Clayton Ltd

- Shiloh Industries

- Georg Fischer Limited

- Koch Enterprises(Gibbs Die Casting Group)

- Bocar Group

- Engtek Group

- 萊茵金屬股份公司(萊茵金屬汽車,原 KSPG AG)

- Rockman Industries

- Ryobi Die Casting Ltd

- Linamar Corporation

- Meridian Lightweight Technologies UK Ltd

- Sandhar Group

- Alcoa Corporation

第7章 市場機會與未來趨勢

The Die Casting Market size is estimated at USD 88.03 billion in 2025, and is expected to reach USD 119.14 billion by 2030, at a CAGR of 6.24% during the forecast period (2025-2030).

The COVID-19 outbreak hit the manufacturing industry adversely. The disruptions were caused in the supply chain as several major economies of the world were in lockdown. All the manufacturing units and OEM plants were forced to halt production and operations during this period. With the recovery of economies, the demand returned to the market witnessing huge demand for die-cast parts in the automotive industry as the consumer preference changed to lightweight vehicles. The trend is expected to continue and drive market growth.

Over the medium term, the market studied is largely driven by supply chain complexities in the die-casting industry, expanding automotive market, increasing penetration of die-casting parts in industrial machinery, growing constructional sector, and employing aluminum casts in electrical and electronics. CAFE standards and EPA policies to cut down automobile emissions and increase fuel efficiency are driving the automakers to reduce the weight of the automobile by employing lightweight non-ferrous metals. Subsequently, employing die-cast parts as a weight reduction strategy is acting as a major driver for the former market in the automotive segment.

Rising demand for aluminum die-casting parts in the electrical and electronics industry owing to its high thermal conductivity is likely to drive growth during the forecast period. Subsequently, employing die-cast parts as a weight reduction strategy is acting as a major driver for the former market in the automotive segment. However, a crunch in raw material supply, volatility in raw material prices, and environmental regulations on emissions for the metallurgy industries are acting as major barriers to market growth.

The Asia-Pacific region is anticipated to hold the largest market share in the die-casting market due to the rise in demand for automobiles in countries such as China and India and the rise in the use of aluminum die-casting for various applications. North America is also expected to witness significant growth in the aluminum die-casting market due to growing output from the construction and automotive sectors.

Die Casting Market Trends

Aluminum Anticipated to Play Key Role in Die Casting Process

The demand for aluminum high-pressure die-casting parts has been increasing across numerous industrial applications over the years, as the process manufactures lightweight parts and provides high flexibility for complex shapes.

In recent years, automotive parts have witnessed advancements and innovations with the evolution of new technologies. Among them, the use of lightweight materials for the manufacturing of auto components has been gaining attention across the country.

One of the important reasons for this popularity is the enhanced fuel economy of automobiles with the adoption of lightweight automotive materials manufacturing crucial parts.

Additionally, the lightweight of vehicles must be done without compromising on safety, quality, and performance. Aluminum die-cast parts are durable and can be endlessly recycled therefore, aluminum is most preferred by manufacturers due to its varied advantages.

Moreover, there is a rising number of acquisitions and partnerships by the major players to further enhance development in the market. For instance,

- In August 2022, Wencan Group Co., Ltd. announced that it intends to build a production base of aluminum die-cast parts for New Energy Vehicles (NEVs) in Lu'an Economic and Technological Development Zone, Anhui Province.

- In October 2021, Sandhar Engineering Private Limited was incorporated as a wholly owned Subsidiary Company for carrying out the business of manufacturers, and assembling various Locking Devices, Electrical, Electronics, Mechanical, Automobile, and Industrial parts.

- In April 2021, Jaya Hind Industries extended its technical partnership with KS Huayu AlutechGmbH (KSATAG) for the manufacturing of automotive cylinder blocks and cylinder heads till 2027. The scope of the agreement has also been expanded to cover new parts from Sunrise Industries, such as Electric Vehicles, Structural parts for Chassis, etc.

- In March 2021, Sandhar Technologies entered a non-binding Memorandum of Understanding with Unicast Autotech to acquire its aluminum die-casting business

The growth of the aluminum die-casting market is likely to continue to increase during the forecast period to meet the increasing demand for lightweight components and high-conductivity metal parts from the automotive and non-automotive sectors.

Asia-Pacific Region Likely to Witness Significant Growth

The Asia-Pacific region is anticipated to hold the largest market share in the die-casting market during the forecast period. The growing automobile industry, demand from the industrial sector, and increased scope of application in windmills and telecommunications are expected to drive the die-casting market at a faster pace in the Asia-Pacific region.

Cheaper labor and low manufacturing costs in India and China are expected to further accelerate the market growth in the Asia-Pacific region. In addition, increased demand for electric and hybrid vehicles has turned automakers' focus to using lightweight materials like aluminum as a substitute for heavier steel and iron in all types of vehicles. For instance,

- In May 2022, Tamil Nadu Small Industries Development Corporation invested an amount of INR 5.8 Crore to establish a common facility center for aluminum high-pressure die casting.

The growing expansion of automotive manufacturing industries across the country is likely to increase the demand for lightweight materials for automotive applications. For instance,

- In February 2021, MG Motors announced that INR 1,500 crore may be invested in the expansion and localization of its business to increase its production capacity at the Halol plant in Gujarat.

- The government of India has proposed the use of aluminum per vehicle in India from 29 Kg to 160 Kg for the electric vehicle during the forecast period.

In addition, the companies manufacturing electric vehicles are also actively procuring these pressure diecasting machines and are adopting this technology to make themselves ready for growing consumer demand.

Several players adopt growth strategies, such as manufacturing capacity expansion, to stay competitive in this market. For instance,

- In July 2021, YIZUMI established the Die Casting Technical Service Center (TSC) in the United States and India that offers integrated solutions for die casting cells, dies, die casting process, and product debugging.

- In February 2021, Endurance Technologies commenced commercial production at its new plant in Vallam, Vadagal, Kancheepuram, Tamil Nadu. The plant manufactures aluminum die-castings and carries out the integration of disc brake components with control brake modulators for supplying machined aluminum castings to Hyundai, Kia, and Royal Enfield.

Die Casting Industry Overview

The Die Casting market is dominated by several key players such as Neamk, Alcoa Corporation, Linamar Corporation, Dynacast, and many others. These key players in the market are focusing on expanding their presence globally through various mergers, partnerships, joint ventures, and acquisitions. For instance,

- In March 2022, Linamar Corporation acquired a 50% interest in GF Casting Solutions (GF). Through this acquisition, Linamar Corporation enhanced its product portfolio in automotive applications.

- In January 2022, Koch Enterprises, Inc., a subsidiary of Gibbs Die Casting acquired Amprod Holdings, LLC. Through this acquisition, the company expanded its product portfolio across the United States.

- In January 2022, Sandhar Auto Electric Solutions Private Limited was incorporated as a wholly owned Subsidiary Company to undertake e-mobility business and to provide Advanced Technology Solutions. Sandhar Auto Electric Solutions Private Limited is primarily involved in the business of manufacturing parts/components for Battery Electric Vehicles, Hydrogen Fuel Cell Vehicles, Biofuel based technology Vehicle, All Terrain Vehicles (ATVs), and any other Advanced Automotive Technology Vehicles.

- In August 2021, Linamar Corporation announced the partnership with Netherlands-based Innovative Mechatronic Systems B.V. (IMSystems). The partnership focuses on bringing the Archimedes Drive transmission system to market.

- In April 2021, Aludyne announced that it had acquired Shiloh Industries CastLight division. This division manufactures aluminum die-casting parts.

- In February 2021, Endurance Technologies announced that it had started commercial production at the new plant in Kancheepuram, Tamil Nadu, India. The plant will manufacture aluminum die-castings and integration of disc brake components for two and four-wheelers.

- In April 2020, Endurance Technologies acquired a controlling equity stake of 99% in Adler SpA, based out of Trentino, Italy. The acquisition is expected to improve the company's reach across Europe, with the aid of ten manufacturing plants combined in Italy and Germany.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Billion)

- 5.1 By Application

- 5.1.1 Automotive

- 5.1.2 Electrical and Electronics

- 5.1.3 Industrial

- 5.1.4 Other Applications

- 5.2 By Process

- 5.2.1 Pressure Die Casting

- 5.2.2 Vacuum Die Casting

- 5.2.3 Squeeze Die Casting

- 5.2.4 Other Processes

- 5.3 By Raw Material

- 5.3.1 Aluminum

- 5.3.2 Maginesium

- 5.3.3 Zinc

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 France

- 5.4.2.3 Germany

- 5.4.2.4 Italy

- 5.4.2.5 Russia

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Thailand

- 5.4.3.6 Malaysia

- 5.4.3.7 Indonesia

- 5.4.3.8 South Korea

- 5.4.3.9 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Turkey

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Form Technologies Inc. (Dynacast)

- 6.2.2 Nemak

- 6.2.3 Endurance Technologies Limited

- 6.2.4 Sundaram Clayton Ltd

- 6.2.5 Shiloh Industries

- 6.2.6 Georg Fischer Limited

- 6.2.7 Koch Enterprises (Gibbs Die Casting Group)

- 6.2.8 Bocar Group

- 6.2.9 Engtek Group

- 6.2.10 Rheinmetall AG (Rheinmetall Automotive, formerly KSPG AG)

- 6.2.11 Rockman Industries

- 6.2.12 Ryobi Die Casting Ltd

- 6.2.13 Linamar Corporation

- 6.2.14 Meridian Lightweight Technologies UK Ltd

- 6.2.15 Sandhar Group

- 6.2.16 Alcoa Corporation