|

市場調查報告書

商品編碼

1686634

燃氣渦輪機-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Gas Turbine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

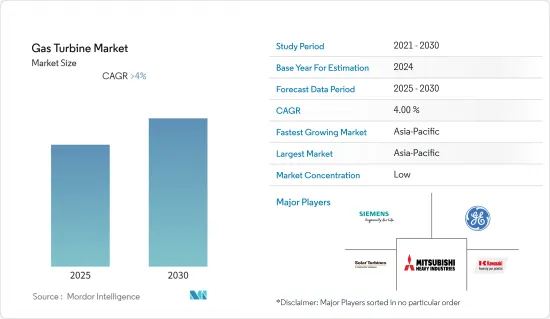

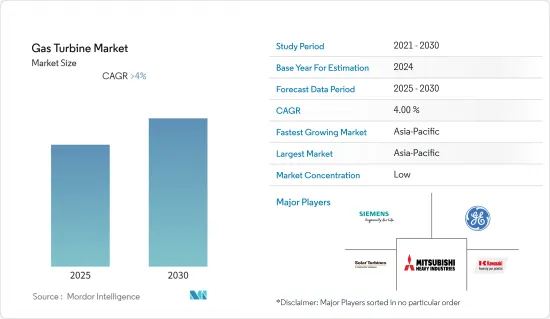

預計預測期內燃氣渦輪機市場的複合年成長率將超過 4%。

市場受到了 COVID-19 疫情的負面影響。但現在已達到疫情前的水準。

預計降低營業成本、低排放氣體和高功率密度等因素將推動市場成長。全球電力需求的不斷成長、技術進步導致頁岩氣產量的增加以及各國選擇透過燃氣發電廠發電,預計將推動全球燃氣渦輪機市場的成長。

然而,可再生能源的採用日益增加,尤其是在美國、中國、巴西和印度等國家,預計將阻礙燃氣渦輪機市場的成長。

天然氣發電廠的需求正在上升,各國正透過技術手段進行全球性努力以減少二氧化碳排放。聯合循環領域預計將提供巨大的市場機會,因為它的整體電氣效率通常在 50-60% 之間,而開式循環僅為 33%。

預計在預測期內,亞太地區對燃氣渦輪機的需求將大幅成長,這主要是由於人們對該地區污染水平上升的擔憂日益加劇。

燃氣渦輪機市場趨勢

電力產業可望主導市場

2021年,天然氣發電量達6,518.5 TWh。考慮到環境影響,包括美國、中國、德國和印度在內的許多國家都選擇使用天然氣發電廠發電。

建立核能發電廠需要大量投資,也涉及與安全相關的營運風險。隨著天然氣發電成為最安全的選擇,全球市場對燃氣渦輪機的需求預計將上升。截至2021年,全球二氧化碳排放為389.76億噸,且日益快速增加。日本、俄羅斯、緬甸和德國等國家正在對發電廠徵稅以減少排放。這可能會導致世界各地更多地採用燃氣發電廠。

分散式發電和逐步淘汰核能發電廠的趨勢日益增強,預計將為預測期內全球電力產業燃氣渦輪機市場的擴張提供機會。

亞太地區可望主導市場

印度、中國、日本、緬甸等國家工業化、都市化的快速發展,導致該地區對電力的需求不斷增加,因而帶動了許多發電工程的開發。

印度電力業以燃煤發電為主,佔2021年總發電量的74%。該國在可再生和天然氣發電方面擁有巨大潛力,有助於實現脫碳目標並實現《巴黎協定》的目標。 2022年3月,GE燃氣發電公司和哈爾濱電氣公司宣布,深圳能源Group Limited已訂單位於中國廣東省深圳市光明區的光明聯合循環發電廠設備訂單。通用電氣將提供三台 GE 9HA.01燃氣渦輪機。在中國,燃氣發電裝置容量近年來成長較快,預計到2025年將新增裝置容量40至50吉瓦。

澳洲、日本和馬來西亞等國家對核能發電的社會共識日益增強,預計在預測期內將增加燃氣渦輪機的使用率。

燃氣渦輪機產業概況

全球燃氣渦輪機市場中等程度分散。市場上主要企業包括(不分先後順序)西門子股份公司、三菱重工、通用電氣、川崎重工和瓦錫蘭公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 市場概述

- 研究範圍

- 市場定義

- 調查前提

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 2027 年市場規模與需求預測

- 近期趨勢和發展

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 按容量

- 小於30MW

- 31-120 MW

- 超過120MW

- 按類型

- 複合迴圈

- 開放式循環

- 按最終用戶產業

- 力量

- 石油和天然氣

- 其他最終用戶產業

- 按地區

- 亞太地區

- 北美洲

- 歐洲

- 南美洲

- 中東和非洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Siemens AG

- Mitsubishi Heavy Industries Ltd

- General Electric Company

- Kawasaki Heavy Industries Ltd

- Wartsila Oyj Abp

- IHI Corporation

- Solar Turbines Incorporated

- Bharat Heavy Electricals Limited

- Ansaldo Energia SpA

- *List Not Exhaustive

第7章 市場機會與未來趨勢

The Gas Turbine Market is expected to register a CAGR of greater than 4% during the forecast period.

The market was negatively impacted by the COVID-19 pandemic. However, the market has now reached pre-pandemic levels.

Factors such as lower operating costs, lower emissions, and high-power density are expected to drive the market's growth. Increasing demand for electricity across the world, advancements in the technologies leading to an increase in shale gas production, and various countries opting for the generation of power through gas-fired plants are expected to drive the global gas turbine market's growth.

However, increasing renewable energy deployments, especially in countries like the United States, China, Brazil, and India, are expected to hinder the growth of the gas turbine market.

There is a rise in demand for natural gas-fired plants and global initiatives across the countries for the reduction in emission of carbon dioxide, based on the technology. The combined cycle segment would provide significant opportunities to the market due to its overall electrical efficiency, typically ranging from 50-60% compared to open cycle with 33%.

Asia-Pacific is witnessing substantial growth in the demand for gas turbines during the forecast period, primarily due to growing concerns about increasing pollution levels in the region.

Gas Turbine Market Trends

Power Sector is Expected to Dominate the Market

In 2021, the electricity generated by natural gas amounted to 6518.5TWh. On the note of environmental impact, many countries such as the United States, China, Germany, and India opt for power generation through natural gas-fired power plants.

Setting up nuclear-based power plants requires a lot of investments and includes operational risks associated with safety concerns. Power generation through natural gas-fired will be the safest option, which is expected to increase the demand for gas turbines in the global market. As of 2021, global carbon dioxide emissions accounted for 38976 million tonnes, which is rapidly increasing day-to-day. Countries like Japan, Russia, Myanmar, and Germany are imposing taxes on power plants to reduce emissions. This will improve the adoption of gas-fired power plants across the world.

The increasing trend of distributed power generation and the replacement of phased-out nuclear and coal plants are expected to provide opportunities for the expansion of the global gas turbine market in the power sector during the forecast period.

Asia-Pacific is Expected to Dominate the Market

Rapid industrialization in the countries like India, China, Japan, and Myanmar and increasing urbanization are driving an ever-growing power demand in this region, culminating in the development of numerous power generation projects.

The Indian power sector is dominated by coal-based generation, accounting for 74% of the total electricity generation in 2021. The country has a huge potential for renewable energy and gas-based power generation for decarbonization and to meet the targets according to the Paris Agreement. In March 2022, GE Gas Power and Harbin Electric announced that Shenzhen Energy Group Corporation Co. ordered the equipment for its Guangming combined cycle power plant, located in the Shenzhen Guangming district of Guangdong province in China. General Electric will provide three GE 9HA.01 gas turbines. In China, gas-fired power capacity has been witnessing faster growth compared to recent years, and it is expected to add 40 to 50 GW of new capacity by 2025.

Countries like Australia, Japan, and Malaysia, with a growing social consensus against nuclear power, are expected to propel the utilization of gas turbines during the forecast period.

Gas Turbine Industry Overview

The global gas turbine market is moderately fragmented. The key players in the market include (in no particular order) Siemens AG, Mitsubishi Heavy Industries Ltd, General Electric Company, Kawasaki Heavy Industries Ltd, and Wartsila Oyj Abp, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 MARKET OVERVIEW

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Market Dynamics

- 4.4.1 Drivers

- 4.4.2 Restraints

- 4.5 Supply-Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products and Services

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Capacity

- 5.1.1 Less than 30 MW

- 5.1.2 31-120 MW

- 5.1.3 Above 120 MW

- 5.2 By Type

- 5.2.1 Combined Cycle

- 5.2.2 Open Cycle

- 5.3 By End-User Industry

- 5.3.1 Power

- 5.3.2 Oil and Gas

- 5.3.3 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.2 North America

- 5.4.3 Europe

- 5.4.4 South America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Siemens AG

- 6.3.2 Mitsubishi Heavy Industries Ltd

- 6.3.3 General Electric Company

- 6.3.4 Kawasaki Heavy Industries Ltd

- 6.3.5 Wartsila Oyj Abp

- 6.3.6 IHI Corporation

- 6.3.7 Solar Turbines Incorporated

- 6.3.8 Bharat Heavy Electricals Limited

- 6.3.9 Ansaldo Energia SpA

- 6.4 *List Not Exhaustive