|

市場調查報告書

商品編碼

1686645

智慧計量(AMI) -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Smart Meters (AMI) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

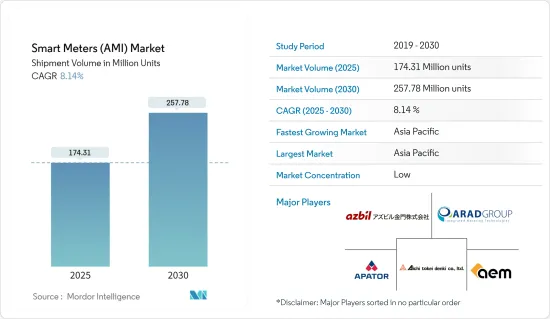

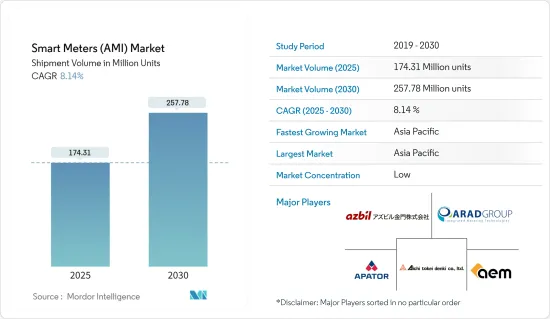

智慧電錶市場規模(基於出貨量)預計將從 2025 年的 1.7431 億台擴大到 2030 年的 2.5778 億台,預測期內(2025-2030 年)的複合年成長率為 8.14%。

主要亮點

- 智慧電錶正在全球被引入電力、天然氣和水等公共產業領域。這些儀表具有雙向通訊功能,可即時追蹤供應商和消費者的公用事業使用情況。此功能不僅使供應商能夠遠端啟動、讀取和切斷供應,而且還有助於實施家庭能源管理系統 (HEMS) 和建築能源管理系統 (BEMS)。此類系統既適用於單一住宅,也適用於整棟建築,並能提供電力消耗的透明視圖。隨著智慧電錶的普及,它們將增強能源管理和效率,有助於實現各種地方永續性目標。

- 隨著經濟活動的激增導致能源消耗的增加,能源效率已成為全球的首要任務。考慮到這一點,世界各地正在迅速整合各行業的智慧電錶等節能解決方案,以最佳化能源和公用事業的使用。政府和組織越來越重視永續能源實踐,而且這種勢頭還會持續下去。智慧電錶有望透過促進更有效率的能源發行和消耗為這些努力做出貢獻。

- 財政獎勵和政府對電網數位化的支持政策正在推動智慧電錶市場的成長。這些因素將推動未來幾年智慧電錶市場的發展,並為該領域的未來創新和進步奠定堅實的基礎。

- 然而,智慧電錶市場面臨挑戰,尤其是與更換電力供應商相關的成本。由於這些系統依賴數位組件和連接,因此它們有可能隨著技術變革而過時,並可能限制其在不同供應商之間的適應性。此外,每個公用事業公司獨特的使用者介面使智慧電錶相容性變得複雜,而缺乏標準化的介面開發則加劇了這項挑戰。

- 此外,持續的全球景氣衰退可能會減少對電子設備的需求,從而導致對智慧電錶的需求減少,阻礙市場成長。

智慧電錶(AMI)市場趨勢

智慧電錶佔據市場主導地位,這一趨勢在預測期內仍將持續

- 商業建築對智慧電錶的需求很高。企業正在其辦公室和其他空間採用這些計量表來最佳化收費。商業空間通常跨越多層,因此監控電力消耗以減少浪費非常重要。這些智慧電錶還可以檢測供電線路中斷情況,從而快速做出反應。

- 根據英國領先的新房屋擔保和保險公司國家住宅建築委員會 (NHBC) 的資料,2024 年第二季登記建造的住宅有 29,281 套。建築數量的增加表明英國對智慧電錶的需求不斷成長。

- 此外,許多公司正在推出創新解決方案來滿足日益成長的智慧電錶需求。例如,Areti於2024年5月宣布其在羅馬的智慧電錶數量已超過100萬台,並計劃在2025年底前在羅馬及其附近的福爾梅洛市更換約170萬台智慧電錶。

- 根據美國能源資訊署(EIA)的數據,2023年美國公用事業規模的發電設施將產生約4.178兆千瓦時(kWh)的電力,顯示美國電力需求將持續成長。電力公司越來越需要更好地管理和最佳化其能源發行網路。因此,隨著有關能源消耗的詳細資訊的出現,智慧電錶在該國的採用率預計將會增加,這可以幫助消費者發現利用智慧電錶減少能源使用和節省資金的機會。

- 增加對智慧電網計劃的投資是推動市場成長的主要因素之一。據中國國家電網公司稱,這家總部位於北京的國有公司計劃今年增加對國家電網建設的投資,以穩定國家的就業和能源消耗。該公司表示,2023年將為電網計劃撥款超過5,200億元人民幣(769.5億美元)。由於後續穩定經濟的措施,預計今年電力消耗量將進一步上升。

- 根據美國能源資訊署(EIA)的數據,預計未來30年全球發電量將成長一倍以上,到2050年將達到約14.7兆瓦。 2020年全球裝機發電能力為7.1兆瓦,顯示全球電力需求持續成長。電力公司越來越需要管理和最佳化其能源發行網路。

亞太地區佔主要市場佔有率

- 中國對智慧電錶的需求不斷成長是一個關鍵趨勢,受到多種因素的影響,包括政府政策、快速都市化、智慧電網技術的進步以及對能源效率和減碳的日益重視。作為世界上最大的能源消費國之一,中國正在大力投資電網現代化,而智慧電錶的引入是這項戰略舉措的核心要素。

- 由於中國唯一電網營運商國家電網公司和中國南方電力集團公司的嚴格要求,中國目前在亞太地區的智慧電錶部署方面處於領先地位。然而,隨著中國智慧電錶全面部署的臨近,年度需求量明顯下降,顯示推廣階段正在逐漸結束。

- 中國是智慧電錶製造領域的主要參與者,當地企業實力雄厚。該公司也是最大的智慧電錶生產商之一,其產品在推廣階段主要在國內銷售。中國市場由國營企業主導,非中國公司幾乎不可能在中國境內有效競爭。

- 此外,隨著國內對智慧電錶的需求不斷成長,企業也進行了多項投資。例如,三菱電機公司於2024年6月宣布,將與系統整合商光榮科技服務股份有限公司及台灣主要通訊公司中華電信合作提供智慧電錶系統。

- 日本政府宣布計劃撥款 20 兆日圓(1,550 億美元),以刺激對新電網技術、節能住宅和其他可減少該國二氧化碳排放的技術的投資。這項重大投資凸顯了政府致力於推廣永續能源解決方案的決心。

- 印度政府正積極推動智慧電錶的研發。為了實現全印度的普遍用電,政府還建立了智慧電網,承諾提供實惠的價格和其他客戶利益。實現這種智慧電網的第一步是引入先進的計量基礎設施(AMI)。智慧電錶國家計畫(SMNP)促進了智慧電錶在全國的推廣。該舉措由電力部下屬的公共部門合資企業能源效率服務有限公司(EESL)統籌。

智慧電錶(AMI)市場概況

某些地區的智慧電錶市場正在成長。這是因為 AEM、手錶、Apator SA、Arad Group 和 Azbil Kimmon 等主要企業都努力保持市場競爭力。例如,中國市場的衰退導致全球層面的競爭加劇。同時,歐洲的擴張和美國的替代計劃為市場供應商創造了新的機會。

此外,大規模投資的介入也提高了現有企業的門檻,加劇了競爭。此外,智慧電錶正在被推廣到各種最終用戶和地區。因此,需求的大幅成長加上政府努力增加各個地區的部署數量,預計將導致市場參與者之間的競爭加劇,以滿足日益成長的需求。

此外,智慧家庭和工業解決方案的日益普及,加上政府的支持政策,正在鼓勵一些新參與企業進入市場。 SteamaCo 等製造業新興企業已獲得種子投資,為非洲製造智慧離網電錶。

該公司得到了多家解決方案新興企業公司的支持,其中包括 Sympower,該公司幫助公用事業公司將智慧電錶設備連接到最終用戶,並使用電錶資料建立可靠的智慧電網。因此,由於對能源問題的日益關注,市場競爭水平很高,預計在預測期內競爭將會加劇。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 產業價值鏈分析

- 宏觀經濟因素對全球智慧電錶市場的影響

第5章市場動態

- 市場促進因素

- 加大智慧電網計劃投資

- 需要提高公用事業效率

- 加強政府監管

- 智慧城市部署的成長

- 所有最終用戶對永續公用事業供應的需求

- 市場挑戰

- 高成本和安全隱患

- 與智慧電錶整合困難

- 缺乏基礎設施資本投資和投資報酬率

- 更換電力供應商的成本

第6章市場區隔

- 按地區 - 智慧燃氣表

- 北美洲

- 美國

- 加拿大和中美洲

- 歐洲

- 英國

- 法國

- 義大利

- 亞洲

- 中國

- 日本

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

- 北美洲

- 按地區 - 智慧水錶

- 北美洲

- 美國

- 加拿大和中美洲

- 歐洲

- 英國

- 法國

- 義大利

- 亞洲

- 中國

- 日本

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

- 北美洲

- 按地區 - 智慧電錶

- 北美洲

- 美國

- 加拿大和中美洲

- 歐洲

- 英國

- 法國

- 義大利

- 亞洲

- 中國

- 日本

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章競爭格局

- 公司簡介

- AEM

- Aichi Tokei Denki Co.Ltd.

- Apator SA

- Arad Group

- Azbil Kimmon Co. Ltd.

- Badger Meter Inc.

- Diehl Stiftung & Co. KG

- Elster Group GmbH(Honeywell International Inc.)

- General Electric Company

- Hexing Electric company Ltd.

- Holley Technology Ltd.

- Itron Inc.

- Jiangsu Linyang Energy Co. Ltd.

- Kamstrup A/S

- Landis+GYR Group AG

- Mueller Systems LLC(Muller Water Products Inc.)

- EDMI Limited(OSAKI ELECTRIC CO. LTD.)

- Neptune Technology Group Inc.(Roper Technologies, Inc.)

- Ningbo Sanxing Medical Electric Co., Ltd

- Pietro Fiorentini SpA

- Sagemcom SAS

- Sensus USA Inc.(Xylem Inc.)

- Aclara Technologies LLC(Hubbell Inc.)

- Wasion Holdings Limited

- Yazaki Corporation

- Zenner International GmbH & Co. KG

- Market Rankings Analysis

- Smart Electricity Meter Market

- Smart Gas Meter Market

- Smart Water Meter Market

第8章 市場機會與未來趨勢

- 智慧電錶市場的未來

- 智慧燃氣表市場的未來

- 智慧水錶市場的未來

The Smart Meters Market size in terms of shipment volume is expected to grow from 174.31 million units in 2025 to 257.78 million units by 2030, at a CAGR of 8.14% during the forecast period (2025-2030).

Key Highlights

- Globally, utilities such as electricity, gas, and water are increasingly adopting smart meters. These meters enable real-time tracking of utility usage for both suppliers and consumers through their two-way communication feature. This functionality not only allows suppliers to remotely start, read, and cut off supply but also aids in implementing home energy management systems (HEMS) and building energy management systems (BEMS). Such systems offer a transparent view of electric power consumption, catering to both individual homes and entire buildings. As smart meters become more prevalent, they are set to enhance energy management and efficiency, aligning with the sustainability goals of various regions.

- As economic activities surge, leading to increased energy consumption, energy efficiency has taken center stage as a global priority. In light of this, regions worldwide are rapidly integrating energy-efficient solutions, like smart meters, across diverse industries to optimize energy and utility usage. This momentum is likely to persist, with governments and organizations increasingly valuing sustainable energy practices. Smart meters are poised to be instrumental in these endeavors, promoting more efficient energy distribution and consumption.

- Financial incentives for grid digitalization, coupled with supportive government policies, are fueling growth in the smart metering market. These elements are set to broaden the market for smart meters in the years ahead, laying a solid groundwork for future innovations and advancements in the sector.

- However, the smart metering market faces challenges, particularly concerning the costs associated with switching utility suppliers. Given that these systems depend on digital components and connectivity, they risk becoming obsolete with technological shifts, which can restrict their adaptability across various suppliers. Furthermore, the unique user interfaces of each utility provider complicate the interchangeability of smart meters, a challenge intensified by the lack of standardized interface developments.

- Additionally, the ongoing global economic downturn has dampened the demand for electronic devices, leading to a reduced appetite for smart meters, which could hinder market growth.

Smart Meters (AMI) Market Trends

Smart Electricity Meter Dominates the Market and will Continue the Trend Over the Forecast Period

- Smart electricity meters are in high demand within commercial buildings. Businesses are adopting these meters in offices and other spaces to optimize billing. Since commercial spaces often span multiple floors, monitoring power consumption and minimizing waste is crucial. These smart meters can also detect supply line disturbances, allowing for swift responses.

- Data from the National House Building Council (NHBC), the UK's leading new home warranties and insurance provider, reveals that 29,281 new homes were registered for construction in Q2 2024. This uptick in construction signals a rising demand for smart meters in the UK.

- Furthermore, numerous companies are launching innovative solutions to meet the rising demand for smart meters. For example, in May 2024, Areti announced surpassing the milestone of 1 million smart meters in Rome, with plans to replace the roughly 1.7 million meters in Rome and the nearby municipality of Formello by the close of 2025.

- According to the Energy Information Administration (EIA), in 2023, nearly 4,178 billion kilowatt hours (kWh) of electricity were generated at utility-scale electricity generation facilities in the United States, which shows the demand for electricity in the United States is growing continuously. There is a growing need for utilities to manage better and optimize their energy distribution network. Thus, the availability of detailed information about energy consumption, which can help the consumer identify opportunities to reduce energy usage and save money with smart electricity meters, is projected to increase the adoption of smart electricity meters in the country.

- Increased investments in smart grid projects are one of the main drivers fueling market growth. According to the State Grid Corp. of China, the Beijing-based state-owned company plans to increase its investment in domestic grid construction this year to stabilize the nation's employment and energy consumption. The company announced it would allocate more than CNY 520 billion (USD 76.95 billion) to power grid projects in 2023. This year's power consumption is anticipated to rise further due to follow-up measures to stabilize the economy.

- According to the Energy Information Administration (EIA), global electricity generation capacity is expected to more than double in the next three decades, reaching approximately 14.7 terawatts by 2050. In 2020, the world's installed electricity capacity stood at 7.1 terawatts, which shows the demand for electricity around the globe is growing continuously. There is a growing need for utilities to manage and optimize their energy distribution networks.

Asia Pacific Holds Major Market Share

- The increasing demand for smart electricity meters in China represents a significant trend influenced by various factors, including government policies, rapid urbanization, advancements in smart grid technology, and a growing emphasis on energy efficiency and carbon reduction. As one of the world's largest energy consumers, China has been making substantial investments in modernizing its electricity grid, with the deployment of smart meters being a central component of its strategic initiatives.

- China currently leads the Asia Pacific region in smart meter rollouts, driven by stringent mandates from the State Grid Corporation of China and China Southern Power Grid, the country's sole grid operators. However, as China approaches the full deployment of smart meters, there is a noticeable reduction in annual demand, signaling the gradual conclusion of the rollout phase.

- China is a major player in the manufacturing of smart electricity meters, with a strong presence of local companies. It is also one of the largest producers of smart electricity meters, primarily consumed domestically during the rollout phase. The Chinese market is dominated by state-owned enterprises, making it nearly impossible for non-Chinese companies to compete effectively within the country.

- Additionally, companies have made several investments in response to the country's growing demand for smart electricity meters. For instance, in June 2024, Mitsubishi Electric Corporation announced its collaboration with system integrator Glory Technology Service Inc. and Taiwan's leading telecommunications company, Chunghwa Telecom Co., Ltd., to deliver a Smart-meter System.

- The Japanese government has announced plans to allocate JPY 20 trillion (USD 155 billion) to foster investments in new power grid technology, energy-efficient homes, and other technologies to reduce the nation's carbon footprint. This substantial financial commitment underscores the government's dedication to promoting sustainable energy solutions.

- The Indian government is diligently advancing the development of smart electricity meters. To achieve universal power access across India, the government also established smart grids that promise affordability and other customer benefits. The initial stride toward realizing these smart grids is the adoption of Advanced Metering Infrastructure (AMI). The Smart Meter National Program (SMNP) facilitates the nationwide deployment of smart meters. This initiative is overseen by Energy Efficiency Services Limited (EESL), a joint venture of public sector undertakings under the Ministry of Power.

Smart Meters (AMI) Market Overview

The smart meters market has grown in certain regions. This is leading companies like AEM, Aichi Tokei Denki Co.Ltd., Apator SA, Arad Group, and Azbil Kimmon Co. Ltd., strive to maintain a competitive edge in the market. For instance, the receding market in China increased this competitive intensity at a global level. At the same time, the rollouts in Europe and replacement projects in the United States offered new opportunities for the market vendors.

Moreover, the involvement of large-scale investment also increases the barriers for the existing players, thereby pushing the industry toward increasing competition. Also, smart meters are increasingly being deployed in various end users and regions. Hence, the substantial increase in demand, coupled with government initiatives to increase the number of rollouts in various regions, is expected to increase the degree of competition amongst the market players to meet the increasing demand.

Additionally, the growing penetration of smart home and industrial solutions coupled with supportive government initiatives has attracted several new players to the market. Manufacturing startups, such as SteamaCo, secured seed investments to build smart off-grid electricity meters for Africa.

The company is supported by several solution provider startups, such as Sympower, which helps utilities connect smart metering devices to their end users and use the metering data to build a reliable smart grid. Therefore, the degree of competition is high and expected to increase in the same in the market study for the forecasted period, owing to the increasing emphasis on energy concerns.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 mpact of Macroeconomic Factors on the Global Smart Meter Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Investments in Smart Grid Projects

- 5.1.2 Need for Improvement in Utility Efficiency

- 5.1.3 Supportive Government Regulations

- 5.1.4 Growth in Smart City Deployment

- 5.1.5 Demand for Sustainable Utility Supply for All End Users

- 5.2 Market Challenges

- 5.2.1 High Costs and Security Concerns

- 5.2.2 Integration Difficulties with Smart Meters

- 5.2.3 Lack of Capital Investment for Infrastructure Installation and Lack of ROI

- 5.2.4 Utility Supplier Switching Costs

6 MARKET SEGMENTATION

- 6.1 By Geography - Smart Gas Meter

- 6.1.1 North America

- 6.1.1.1 United States

- 6.1.1.2 Canada and Central America

- 6.1.2 Europe

- 6.1.2.1 United Kingdom

- 6.1.2.2 France

- 6.1.2.3 Italy

- 6.1.3 Asia

- 6.1.3.1 China

- 6.1.3.2 Japan

- 6.1.4 Australia and New Zealand

- 6.1.5 Latin America

- 6.1.6 Middle East and Africa

- 6.1.1 North America

- 6.2 By Geography - Smart Water Meter

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada and Central America

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 France

- 6.2.2.3 Italy

- 6.2.3 Asia

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.6 Middle East and Africa

- 6.2.1 North America

- 6.3 By Geography - Smart Electricity Meter

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada and Central America

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 France

- 6.3.2.3 Italy

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AEM

- 7.1.2 Aichi Tokei Denki Co.Ltd.

- 7.1.3 Apator SA

- 7.1.4 Arad Group

- 7.1.5 Azbil Kimmon Co. Ltd.

- 7.1.6 Badger Meter Inc.

- 7.1.7 Diehl Stiftung & Co. KG

- 7.1.8 Elster Group GmbH (Honeywell International Inc.)

- 7.1.9 General Electric Company

- 7.1.10 Hexing Electric company Ltd.

- 7.1.11 Holley Technology Ltd.

- 7.1.12 Itron Inc.

- 7.1.13 Jiangsu Linyang Energy Co. Ltd.

- 7.1.14 Kamstrup A/S

- 7.1.15 Landis+ GYR Group AG

- 7.1.16 Mueller Systems LLC (Muller Water Products Inc.)

- 7.1.17 EDMI Limited (OSAKI ELECTRIC CO. LTD.)

- 7.1.18 Neptune Technology Group Inc. (Roper Technologies, Inc.)

- 7.1.19 Ningbo Sanxing Medical Electric Co., Ltd

- 7.1.20 Pietro Fiorentini SpA

- 7.1.21 Sagemcom SAS

- 7.1.22 Sensus USA Inc. (Xylem Inc.)

- 7.1.23 Aclara Technologies LLC (Hubbell Inc.)

- 7.1.24 Wasion Holdings Limited

- 7.1.25 Yazaki Corporation

- 7.1.26 Zenner International GmbH & Co. KG

- 7.2 Market Rankings Analysis

- 7.2.1 Smart Electricity Meter Market

- 7.2.2 Smart Gas Meter Market

- 7.2.3 Smart Water Meter Market

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 8.1 Future of the Market - Smart Electricity Meter

- 8.2 Future of the Market - Smart Gas Meter

- 8.3 Future of the Market - Smart Water Meter