|

市場調查報告書

商品編碼

1687220

北美資料中心:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)North America Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

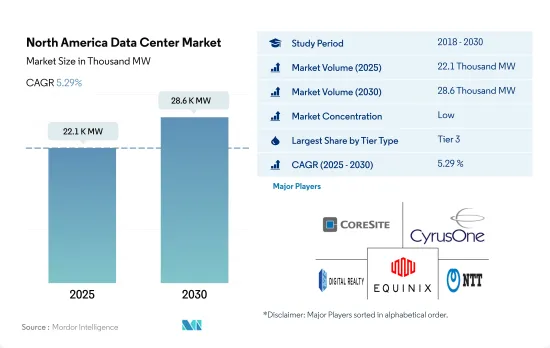

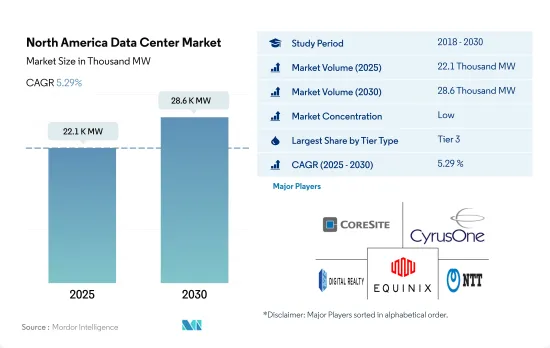

北美資料中心市場規模預計在 2025 年達到 22,100 兆瓦,預計到 2030 年將達到 28,600 兆瓦,複合年成長率為 5.29%。預計 2025 年主機託管收益將達到 259.326 億美元,2030 年將達到 422.277 億美元,預測期內(2025-2030 年)的複合年成長率為 10.24%。

2023 年, 層級 3資料中心將佔據大部分佔有率;第四層級將成為成長最快的細分市場

- 預計 2023 年層級 4資料中心將達到 5,881.0 MW,到 2029 年將超過 12,547.2 MW,複合年成長率為 13.46%。

- 未來幾年,對層級和層級設備的需求將穩定下降,但由於長期和不可預測的停電,成長仍將持續。雖然這些層級和層級地區已經有充足的零售主機託管供應,但對更低延遲和更高效率的需求不斷成長也推動了大型計劃滿足超大規模雲端需求的需求。

- 對資料處理、儲存和分析的需求不斷成長,可能會導致大多數客戶最終轉向層級 3 和層級 4 設施。 2022年, 層級 3車型憑藉其顯著的功能優勢佔據了大部分市場。該地區大多數層級資料中心都位於北美,不僅提供眾多電力和冷卻通道,而且具有高度的冗餘度。這些資料中心的運轉率約為 99.982%,相當於每年停機時間為 1.6 小時。此外,由於邊緣和雲端連接的使用增加,預計層級資料中心的擴張將繼續。

- 預計層級 4 類型的複合年成長率為 15.51%。一些已開發國家正在採用層級 4 認證,以受益於全面的容錯和組件冗餘。 2022 年,北美共有 81 個層級 4資料中心。隨著越來越多的公司提供雲端基礎的服務, 層級 4資料中心將在未來幾年呈指數級成長,從而鼓勵其他公司建造提供採用最佳技術的主機託管空間的設施。

美國佔據該地區市場的大部分佔有率,預計在預測期內將繼續佔據主導地位。

- 過去幾年,由於雲端運算的採用和資料生成的興起,該地區對資料中心的需求激增。推動北美資料中心市場擴張的關鍵因素是物聯網的日益普及、5G網路的不斷發展、新興市場的蓬勃發展以及對線上娛樂內容高速串流媒體的需求不斷成長。

- 北美超大規模主機託管資料中心的總IT負載容量預計將達到4,481.2兆瓦(MW),到2029年將達到12,047.5MW,複合年成長率為14.63%。預計到 2023 年將開發超過 13,000 兆瓦的容量,到 2029 年將增加到 25,000 兆瓦以上。其中超過一半的新增容量將由美國的超級資料中心增加,其次是大型資料中心。用戶對資料中心的需求規模和數量不斷成長。

- 幾家大公司簽署的租約總合超過60MW,有些甚至超過100MW。大多數大型超大規模資料中心業者佔了超過 70% 的淨吸收量,預計到 2029 年將成長 5% 以上。預計未來幾年美國超大規模資料中心市場的成長速度將超過北美其他地區。近期的經濟和稅收激勵措施是美國資料中心市場發展的主要驅動力。

- 加拿大是一個正在成長的資料中心市場。支持性的法規環境和涼爽的氣候資料中心市場提供了支持,使其成為營運的理想選擇。物聯網 (IoT)、雲端運算和巨量資料正在推動加拿大對資料儲存和處理能力的需求。因此,新設施正在建設,舊設施正在擴建。

北美資料中心市場趨勢

擴大網路覆蓋範圍以及 4G 和 5G 的持續普及可能會推動市場成長

- 無限的資料通訊速率、不斷擴大的 5G 網路覆蓋範圍以及不斷增加的網路容量導致 2021 年新增 5G用戶數量不斷增加。隨著遊戲、XR 和基於影片的應用程式的採用預計將增加,每分鐘使用產生的資料量預計將大幅成長。為了滿足用戶的需求,需要更高的視訊解析度,更多的上行流量和裝置資料被卸載到雲端運算資源。預計到 2028 年,北美的 5G 用戶普及率將最高,達到所有其他地區的 90%。

- 在 2021 年的預測期內,早期採用 5G 的熱門城市將引領流量成長的步伐。預計未來幾年5G將佔行動資料流量的10%以上。流量成長的推動力是覆蓋範圍的擴大以及 4G 普及率的持續高企,這與智慧型手機用戶數量和每部智慧型手機平均資料使用量的增加有關。例如,截至2021年,美國將有約3.28億智慧型手機用戶,到2027年,北美智慧型手機用戶數將達到3.58億。

- 隨著 LTE 的普及,寬頻服務的提供也成為可能。大約 75% 的行動用戶每週都會上網,其中超過一半的用戶透過行動裝置上網。社群網路位居第二,超過 60% 的行動用戶每周至少造訪一次社群網站。這項使用量相當於 2021 年每天 15 至 30 分鐘的視訊串流。預計來自社交媒體和其他應用程式的流量也會增加。預計2021年每月行動資料流量將達到6GB,到2029年將成長到30GB以上。

5G網路的擴展和5G智慧型手機銷售的成長將推動市場成長

- 智慧型手機普及率仍有成長空間。到2021年底,智慧型手機將佔北美行動連線的83%。預計到 2025 年智慧型手機連線數將增加 3,000 萬,從傳統網路(2G 和 3G)遷移將繼續支持智慧型手機的普及。預計到 2027 年,北美行動資料流量的成長將增加兩倍以上,而這一成長仍將在很大程度上依賴智慧型手機普及率的提高。自 2007 年蘋果推出第一款 iPhone 以來,智慧型手機的普及率一路飆升。 2016 年,預計 43.5% 的美國人將擁有 iPhone。

- 在美國,5G 已開始流行,到 2021 年大約四分之一的行動連線將是 5G。疫情後的經濟復甦、5G 智慧型手機銷售的成長以及整體行銷舉措推動了這一勢頭。消費者對升級到 5G 的興趣日益濃厚,當前的 5G 客戶表示有興趣擴展他們的 5G 計劃,以包括串流媒體影片、音樂、遊戲、體育直播和雲端儲存等內容和服務。預計這將鼓勵更多人購買智慧型手機並增加智慧型手機用戶數量。

- 北美約有 90% 的人使用網路。在美國和加拿大,Facebook 的每月有效用戶(MAU) 總數為 2.66 億。這表明該地區智慧型手機的普及率很高。智慧型手機需要即時處理大量資料,因此需要使用資料中心進行儲存。由於智慧型手機的強勁成長,預計該地區的資料中心數量在預測期內將會增加。

北美資料中心產業概況

北美資料中心市場分散,前五大公司佔19.67%。市場的主要企業包括 CoreSite(美國塔公司)、CyrusOne Inc.、Digital Realty Trust Inc.、Equinix Inc. 和 NTT Ltd.。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 市場展望

- 負載能力

- 占地面積

- 主機代管收入

- 安裝的機架數量

- 機架空間利用率

- 海底電纜

第5章 產業主要趨勢

- 智慧型手機用戶數量

- 每部智慧型手機的資料流量

- 行動資料速度

- 寬頻資料速度

- 光纖連接網路

- 法律規範

- 加拿大

- 墨西哥

- 美國

- 價值鍊和通路分析

第6章市場區隔

- 資料中心規模

- 大規模

- 超大規模

- 中等規模

- 超大規模

- 小規模

- 層級類型

- 1層級和2級

- 層級

- 層級

- 吸收量

- 未使用

- 使用

- 按主機託管類型

- 超大規模

- 零售

- 批發的

- 按最終用戶

- BFSI

- 雲

- 電子商務

- 政府

- 製造業

- 媒體與娛樂

- 電信

- 其他

- 國家

- 加拿大

- 墨西哥

- 美國

- 北美其他地區

第7章競爭格局

- 市場佔有率分析

- 商業狀況

- 公司簡介.

- Cologix Inc.

- CoreSite(America Tower Corporation)

- CyrusOne Inc.

- Cyxtera Technologies

- Digital Realty Trust Inc.

- Edgecore(Partners Group)

- Equinix Inc.

- Flexential Corp.

- NTT Ltd

- Quality Technology Services

- Switch

- Vantage Data Centers LLC

第8章:CEO面臨的關鍵策略問題

第9章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 全球市場規模和DRO

- 資訊來源及延伸閱讀

- 圖表清單

- 關鍵見解

- 資料包

- 詞彙表

The North America Data Center Market size is estimated at 22.1 thousand MW in 2025, and is expected to reach 28.6 thousand MW by 2030, growing at a CAGR of 5.29%. Further, the market is expected to generate colocation revenue of USD 25,932.6 Million in 2025 and is projected to reach USD 42,227.7 Million by 2030, growing at a CAGR of 10.24% during the forecast period (2025-2030).

Tier 3 data centers accounted for majority share in terms of volume in 2023; Tier 4 is the fastest-growing segment

- The tier 4 data center reached 5881.0 MW in 2023 and is further projected to exhibit a CAGR of 13.46%, surpassing 12547.2 MW by 2029.

- Over the coming years, demand for facilities in tiers 1 and 2 will steadily decrease, but growth will continue due to protracted and unpredictable outages. While there is already an adequate supply of retail colocation in these tier 1 and tier 2 locations, large-scale projects are also driving demand to fulfill growing hyperscale cloud requirements as the demand for lower latency and greater efficiency develops.

- The majority of clients will eventually move to tier 3 and tier 4 facilities due to the increasing demand for data processing, storage, and analysis. The tier 3 type held the majority of the market in 2022 due to the significant benefits of its features. Most tier 3 data centers in the area are located in North America, providing numerous channels for power and cooling as well as a high level of redundancy. These data centers have an uptime of about 99.982%, which equals 1.6 hours of downtime annually. Additionally, it is anticipated that the expansion in tier 3 data centers will continue to increase with the increased usage of edge and cloud connectivity.

- The tier 4 type is anticipated to increase at a CAGR of 15.51%. To benefit from total fault tolerance and component redundancy, several industrialized nations are working on adopting the Tier 4 certification. In 2022, there were 81 tier 4 data centers in North America. Tier 4 data centers will grow dramatically in the coming years as more companies are offering cloud-based services, which has prompted other companies to build facilities to offer colocation space with the greatest technology.

The United States holds the majority share of the regional market, with its dominance expected to continue during the forecast period

- Over the past few years, there has been a sharp increase in the demand for data centers in the region due to growing cloud adoption and rising data generation. The major drivers of the expansion of the data center market in North America have been the rising popularity of IoT, the increased development of 5G networks, the COVID-19 pandemic, and the increasing demand for high-speed streaming of online entertainment content.

- The total IT load capacity of hyper-scale colocation data centers in North America is 4,481.2 megawatts (MW), and by 2029, it is expected to reach 1,2047.5 MW after registering a CAGR of 14.63%. By 2023, more than 13,000 MW of capacity were to be under development, and by 2029, this is expected to increase to more than 25,000 MW. More than half this new capacity is being added in the United States by mega data centers, followed by massive-size data centers. The size and quantity of user requirements for data centers kept expanding.

- Several sizable businesses have inked leases totaling more than 60 MW, some even over 100 MW. Most big hyperscalers are responsible for a net absorption percentage of more than 70%, which is to rise by more than 5% by 2029. The hyperscale data center market in the United States is predicted to grow the fastest in North America over the coming years. Recent economic incentives and tax benefits have been key factors in constructing the US data center market.

- Canada is a growing nation in the data center market. A supportive regulatory environment and cool climate support the data center market and are ideal for operations. The Internet of Things (IoT), cloud computing, and big data drive Canada's demand for data storage and processing capabilities. As a result, new facilities are being built, and old ones are being expanded.

North America Data Center Market Trends

The expansion of network coverage and the continued high adoption of 4G and 5G expansion may drive market growth

- The unlimited data rates, enhanced 5G network coverage, and increased network capacity drew more and more new 5G subscribers in 2021. With the adoption of gaming, XR, and video-based apps anticipated to rise, the amount of data created per minute of use was expected to increase considerably. To satisfy users, these experiences required greater video resolutions, more uplink traffic, and data from devices offloaded to cloud computing resources. North America was projected to have the highest 5G subscription penetration, reaching 90%, by 2028 compared to all other areas.

- Popular cities with early 5G rollouts set the pace for traffic growth during the forecast period in 2021. 5G was expected to account for more than 10% of mobile data traffic in the upcoming years. The expansion of coverage and the continued high adoption of 4G, which was related to an increase in smartphone subscriptions and average data usage per smartphone, were driving traffic growth. For instance, as of 2021, there were about 328 million smartphone owners in the United States, and by 2027, there will be 358 million smartphone subscriptions in North America.

- The use of high bandwidth services was made possible by the expansion of LTE availability. About 75% of people who used mobile services visited the internet on a weekly basis, with more than half of them doing so from their mobile devices. The second-largest category was social networking, with more than 60% of mobile users visiting a social networking site at least once each week. The usage equated to 15 to 30 minutes of daily video streaming in 2021. Increased traffic was also expected to result from social networking and other apps. In 2021, monthly mobile data traffic was anticipated to reach 6 GB and increase to more than 30 GB by 2029.

5G network expansion and increased sales of 5G smartphones will boost the market's growth

- Smartphone adoption has some room to expand. By the end of 2021, smartphones accounted for 83% of mobile connections in North America. With 30 million additional smartphone connections anticipated by 2025, the migration away from legacy networks (2G and 3G) will continue to support smartphone adoption in the coming years. The expansion of mobile data traffic in North America, which was anticipated to more than triple by 2027, will continue to depend heavily on rising smartphone penetration. Since Apple unveiled the first iPhone in 2007, the popularity of smartphones has skyrocketed. By 2016, it was expected that 43.5% of all Americans would own an iPhone.

- In the United States, where 5G made up approximately one out of every four mobile connections in 2021, 5G was starting to become widely used. The economic recovery following the pandemic, increased sales of 5G smartphones, and general marketing initiatives have all helped increase momentum. Consumer interest in upgrading to 5G was increasing, and current 5G customers were showing an increased interest in expanding their 5G plans to include content and services like streaming video, music, gaming, live sports, and cloud storage. This was expected to encourage more people to purchase smartphones, increasing the number of smartphone users.

- Almost 90% of people in North America use the internet. In the United States and Canada, Facebook had a combined 266 million monthly active users (MAU). This demonstrated the widespread use of smartphones in the region, which essentially necessitates the use of data centers for storage since they demand real-time processing of sizable data chunks. A rise in data centers was expected to be seen in the region during the anticipated period as a result of good smartphone growth.

North America Data Center Industry Overview

The North America Data Center Market is fragmented, with the top five companies occupying 19.67%. The major players in this market are CoreSite (America Tower Corporation), CyrusOne Inc., Digital Realty Trust Inc., Equinix Inc. and NTT Ltd (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 MARKET OUTLOOK

- 4.1 It Load Capacity

- 4.2 Raised Floor Space

- 4.3 Colocation Revenue

- 4.4 Installed Racks

- 4.5 Rack Space Utilization

- 4.6 Submarine Cable

5 Key Industry Trends

- 5.1 Smartphone Users

- 5.2 Data Traffic Per Smartphone

- 5.3 Mobile Data Speed

- 5.4 Broadband Data Speed

- 5.5 Fiber Connectivity Network

- 5.6 Regulatory Framework

- 5.6.1 Canada

- 5.6.2 Mexico

- 5.6.3 United States

- 5.7 Value Chain & Distribution Channel Analysis

6 MARKET SEGMENTATION (INCLUDES MARKET SIZE IN VOLUME, FORECASTS UP TO 2030 AND ANALYSIS OF GROWTH PROSPECTS)

- 6.1 Data Center Size

- 6.1.1 Large

- 6.1.2 Massive

- 6.1.3 Medium

- 6.1.4 Mega

- 6.1.5 Small

- 6.2 Tier Type

- 6.2.1 Tier 1 and 2

- 6.2.2 Tier 3

- 6.2.3 Tier 4

- 6.3 Absorption

- 6.3.1 Non-Utilized

- 6.3.2 Utilized

- 6.3.2.1 By Colocation Type

- 6.3.2.1.1 Hyperscale

- 6.3.2.1.2 Retail

- 6.3.2.1.3 Wholesale

- 6.3.2.2 By End User

- 6.3.2.2.1 BFSI

- 6.3.2.2.2 Cloud

- 6.3.2.2.3 E-Commerce

- 6.3.2.2.4 Government

- 6.3.2.2.5 Manufacturing

- 6.3.2.2.6 Media & Entertainment

- 6.3.2.2.7 Telecom

- 6.3.2.2.8 Other End User

- 6.4 Country

- 6.4.1 Canada

- 6.4.2 Mexico

- 6.4.3 United States

- 6.4.4 Rest of North America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Share Analysis

- 7.2 Company Landscape

- 7.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.3.1 Cologix Inc.

- 7.3.2 CoreSite (America Tower Corporation)

- 7.3.3 CyrusOne Inc.

- 7.3.4 Cyxtera Technologies

- 7.3.5 Digital Realty Trust Inc.

- 7.3.6 Edgecore (Partners Group)

- 7.3.7 Equinix Inc.

- 7.3.8 Flexential Corp.

- 7.3.9 NTT Ltd

- 7.3.10 Quality Technology Services

- 7.3.11 Switch

- 7.3.12 Vantage Data Centers LLC

- 7.4 LIST OF COMPANIES STUDIED

8 KEY STRATEGIC QUESTIONS FOR DATA CENTER CEOS

9 APPENDIX

- 9.1 Global Overview

- 9.1.1 Overview

- 9.1.2 Porter's Five Forces Framework

- 9.1.3 Global Value Chain Analysis

- 9.1.4 Global Market Size and DROs

- 9.2 Sources & References

- 9.3 List of Tables & Figures

- 9.4 Primary Insights

- 9.5 Data Pack

- 9.6 Glossary of Terms