|

市場調查報告書

商品編碼

1687860

歐洲中重型卡車租賃:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Europe Medium and Heavy Duty Truck Rental Leasing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

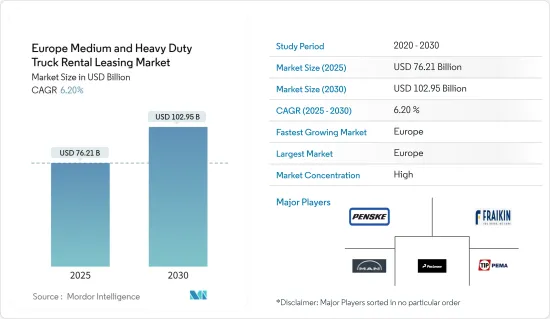

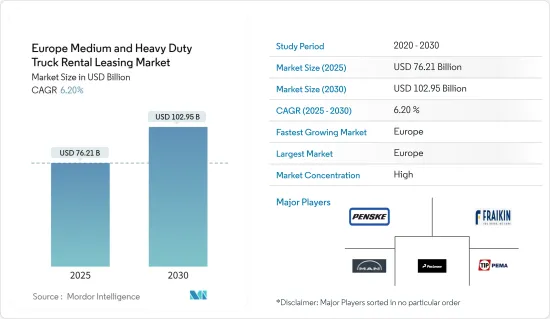

歐洲中重型卡車租賃市場規模預計在2025年為762.1億美元,預計到2030年將達到1029.5億美元,複合年成長率為6.2%(預測期:2025-2030年)。

2020 年,COVID-19 疫情導致製造工廠關閉、運輸業中斷以及中小型企業停工,阻礙了整個歐洲市場的成長。然而,隨著監管法規的放寬,一些物流公司已將重點轉向租賃中型和重型卡車,而不是購買新卡車,以避免高昂的前期成本。預計這些市場趨勢將會持續下去,為市場帶來長期的正面成長。

從長遠來看,推動市場成長的另一個主要因素是市場參與企業提供的優質租賃優惠和積極的廣告宣傳。過去幾年,日益嚴格的車輛排放法規、車輛安全性的進步以及快速發展的物流、零售和電子商務行業成為歐盟市場對新型先進卡車需求的主要驅動力。卡車租賃公司同樣受到上述因素的影響。

歐洲主要國家的政府正在實施嚴格的排放法規,這對卡車租賃市場的成長產生了積極影響,因為它減少了自有車輛和道路車輛的數量。歐盟最新發布的2021年重型汽車認證資料顯示,不同卡車子組的燃油消費量在24公升/100公里至33公升/100公里之間,但二氧化碳排放強度差異較大。 42 軸城市送貨卡車(4-UD)的平均排放為 307gCO2/t-km,是遠距牽引拖車(5-LH)57gCO2/t-km 的五倍以上。

歐洲中大型卡車租賃市場趨勢

歐洲排放法規排放嚴格

歐盟道路上有近六百萬輛卡車。其中近98.3%使用柴油,1%使用汽油,其餘則使用其他燃料。 2018年5月,歐盟委員會提出立法草案,制定首個重型車輛二氧化碳排放標準。 2019年2月,雙方就該標準達成了初步協議。作為第一步,該標準提案重型貨車,其排放量佔重型車輛總排放的65-70%。

德國、法國、英國等歐盟主要國家已在部分城市嚴格禁止舊款柴油貨車行駛。這些禁令對歐盟國家的運輸服務產生了重大影響。因此,零售和物流公司越來越青睞排放標準改進的卡車和環保卡車,例如混合動力卡車和電動卡車。

像 Penske 這樣的歐洲租賃巨頭正在投資數千萬美元用於運輸管理平台,以幫助托運人最佳化其供應鏈、減少浪費、確定需要改進的領域、縮短週期時間並減少庫存。例如,2021 年 7 月,Penske Truck Rental 為其消費者卡車租賃客戶推出了首款行動應用程式。這可以讓自行搬家的人更有效率、更有效地管理搬家。此外,Penske Truck Rental 應用程式還包含保險捆綁選項。

歐洲其他地區將經歷強勁成長

其他被視為歐洲的國家包括荷蘭、俄羅斯、瑞典、波蘭和比利時。

在希臘,不允許租賃沒有司機的卡車。該國的公司經常從其他國家購買二手卡車來滿足其運輸需求。因此,希臘卡車的平均使用年限接近20年。

英國在 2021 年的收益方面也佔據了相當大的市場佔有率,預計在預測期內將會成長。幾家大公司正在投資研發先進技術,以吸引客戶、克服日益嚴重的司機短缺問題並獲得市場佔有率。

繼三年計畫之後,該協會推出了“插電式承諾”,目標是到2025年註冊30萬輛插電式汽車。因此,租賃業有望擁抱電動卡車。 Magtec、戴姆勒和雷諾等製造商都已將電動卡車納入英國市場的產品組合中。

預計預測期內市場將經歷顯著成長。

歐洲中重型卡車租賃業概況

著名的卡車租賃服務供應商包括 Penske Truck Leasing Inc.、Paccar Leasing GmbH、Fraikin、Tip Trailer Services Germany GmbH 和 Man Financial Services/euro-leasing。由於卡車租賃公司以及提供租賃服務的卡車OEM都在大力向客戶推廣其車隊管理服務,因此所研究的市場競爭非常激烈。

2022 年 4 月,Free2move 收購了首個貨車和卡車租賃元搜尋引擎 Comparateur-location-utilitaire.fr,以擴展和改善其面向私人和 B2B 客戶的商用車租賃服務。

2021 年 4 月,聯合租賃公司 (United Rentals Inc.) 達成協議,以每股 19 美元的現金收購通用金融公司 (General Finance Corporation)。此次收購擴大了該公司在該地區的租賃服務並穩定了其地理影響力。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場區隔

- 按預訂類型

- 線下預訂

- 線上預訂

- 按租賃類型

- 短期租賃

- 長期租賃

- 按國家

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 其他歐洲國家

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Truck Rental Firms

- Tip Trailer Services Germany GmbH

- United Rentals Inc.

- Penske Truck Leasing

- Paccar Leasing Gmbh(paccar Inc.)

- Heisterkamp Truck Rental

- Easy Rent Truck and Trailer GmbH

- Man Financial Services/Euro-leasing

- Ryder Group

- Fraikin

- Truck Manufacturers

- PACCAR Inc.

- Mercedes Benz Group AG

- AB Volvo

- Traton SE

- ISUZU Motors Ltd

- IVECO SpA

- Truck Rental Firms

第7章 市場機會與未來趨勢

The Europe Medium and Heavy Duty Truck Rental Leasing Market size is estimated at USD 76.21 billion in 2025, and is expected to reach USD 102.95 billion by 2030, at a CAGR of 6.2% during the forecast period (2025-2030).

The COVID-19 pandemic hampered the market's growth across the European region as lockdowns and shutdowns of manufacturing facilities in 2020 resulted in disruptions in the transportation sector and the closure of small and medium-scale industries. However, as restrictions eased, several logistic companies shifted their focus on renting and leasing medium and heavy-duty trucks instead of buying new ones to avoid high initial costs. Such trends in the market are likely to continue and offer long-term positive growth for the market.

Over the long term, one of the other notable factors driving the market growth is the exceptional rental offers and aggressive advertising by the players in the market. Increasing regulations on vehicle emissions, advancements in vehicle safety, and rapidly growing logistics, retail, and e-commerce sectors have significantly driven the demand for new advanced trucks in the EU market over the past years. Truck rental companies have also been equally impacted by the factors mentioned above.

The strict emission control regulations implemented by the governments of key European countries positively influence the growth of the truck rental market as it reduces the number of sales of owned and road vehicles. The recently published heavy-duty vehicle certification data for 2021 from the European Union found that while the fuel consumption values across the different truck subgroups oscillated between 24 L/100 km and 33 L/100 km, the specific CO2 emissions showed greater variation. Urban delivery trucks with a 42 axle configuration (4-UD) emitted on average 307 gCO2/t-km, which is over five times as much as long-haul tractor-trailers (5-LH) with emissions of 57 gCO2/t-km.

Europe Medium & Heavy-Duty Truck Rental Market Trends

Rising Emission Standards in Europe

There are nearly 6 million trucks on EU roads. Almost 98.3% of them run on diesel, 1% on gasoline, and the remainder on other fuels. In May 2018, the European Commission presented a legislative proposal for setting up the first-ever CO2 emission standards for heavy-duty vehicles. A provisional agreement was reached on the same in February 2019. As a first step, these standards are proposed for large lorries, which account for 65-70% of all emissions from heavy-duty vehicles.

Major European Union countries, including Germany, France, and the United Kingdom, have strictly prohibited older diesel trucks from operating in a few cities. Such bans have had a significant impact on transportation services in EU countries. As a result, companies in retail and logistics have begun to prefer trucks with improved emission standards, as well as eco-friendly trucks, such as hybrid and electric trucks, in their business operations.

Renting and leasing behemoths in Europe, such as Penske, have invested tens of millions of dollars in transportation management platforms to assist shippers in optimizing their supply chains, reducing waste, identifying areas for improvement, reducing cycle time, and reducing inventory, all of which reduce overall costs. For instance, in July 2021, Penske Truck Rental introduced its first-ever mobile app for consumer truck rental customers. It could provide do-it-yourself movers with the ability to manage their moves more efficiently and effectively. Additionally, the Penske Truck Rental app incorporates insurance bundling options.

Rest of Europe is witnessing significant growth

The countries considered in the rest of Europe are the Netherlands, Russia, Sweden, Poland, and Belgium, among others.

In Greece, companies are not permitted to lease trucks without a driver. Businesses in the country frequently buy used trucks from other countries to meet their transportation needs. As a result, Greece's average truck age is approaching 20 years.

The United Kingdom also held a significant market share in terms of revenue in 2021 and is expected to grow during the forecast period. Several major players are investing in the R&D of advanced technology to attract customers, overcome the growing problem of driver shortages, and gain market share.

Following the three-year plan, the association launched a 'Plug-in Pledge,' aiming to register 300,000 plug-in vehicles by 2025. As a result, the rental industry is expected to adopt electric trucks. Manufacturers such as Magtec, Daimler, and Renault have electric trucks in their portfolios for the UK market.

Based on such developments, the market is expected to witness considerable growth during the forecast period.

Europe Medium & Heavy-Duty Truck Rental Industry Overview

Some prominent truck rental leasing service providers include Penske Truck Leasing Inc., Paccar Leasing GmbH, Fraikin, Tip Trailer Services Germany GmbH, Man Financial Services/euro-leasing, and others. The intensity of competition in the market studied is high, as truck rental firms, as well as truck OEMs that offer rental services, have been rigorously promoting their fleet management services to customers.

In April 2022, Free2move acquired the first metasearch for van and truck rental Comparateur-location-utilitaire.fr to expand and improve its rental services of commercial vehicles to private customers and B2B clients.

In April 2021, United Rentals Inc. signed an agreement to acquire General Finance Corporation for USD 19 per share in cash, representing a total enterprise value of approximately USD 996 million, including the assumption of USD 400 million net debt. This acquisition stabilizes its geographical presence by expanding rental services in the region.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Billion)

- 5.1 By Booking Type

- 5.1.1 Offline Booking

- 5.1.2 Online Booking

- 5.2 By Rental Type

- 5.2.1 Short-term Leasing

- 5.2.2 Long-term Leasing

- 5.3 By Country

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 France

- 5.3.4 Spain

- 5.3.5 Italy

- 5.3.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Truck Rental Firms

- 6.2.1.1 Tip Trailer Services Germany GmbH

- 6.2.1.2 United Rentals Inc.

- 6.2.1.3 Penske Truck Leasing

- 6.2.1.4 Paccar Leasing Gmbh (paccar Inc.)

- 6.2.1.5 Heisterkamp Truck Rental

- 6.2.1.6 Easy Rent Truck and Trailer GmbH

- 6.2.1.7 Man Financial Services/Euro-leasing

- 6.2.1.8 Ryder Group

- 6.2.1.9 Fraikin

- 6.2.2 Truck Manufacturers

- 6.2.2.1 PACCAR Inc.

- 6.2.2.2 Mercedes Benz Group AG

- 6.2.2.3 AB Volvo

- 6.2.2.4 Traton SE

- 6.2.2.5 ISUZU Motors Ltd

- 6.2.2.6 IVECO SpA

- 6.2.1 Truck Rental Firms