|

市場調查報告書

商品編碼

1687893

貨運-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Freight Forwarding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

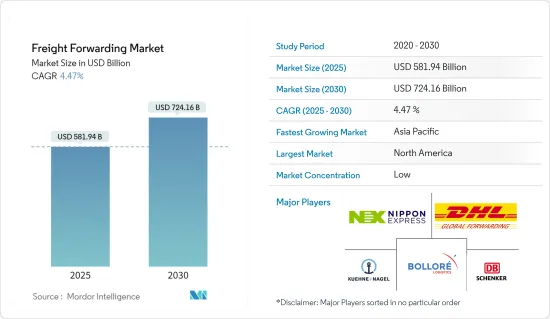

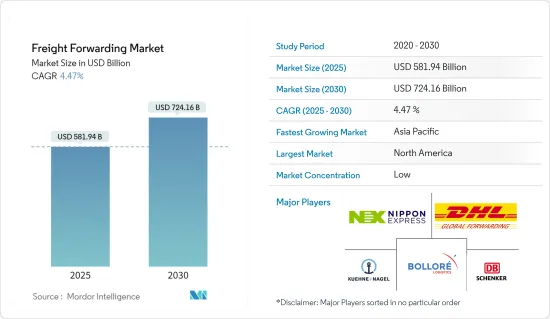

2025 年貨運市場規模估計為 5,819.4 億美元,預計到 2030 年將達到 7,241.6 億美元,預測期內(2025-2030 年)的複合年成長率為 4.47%。

人工智慧、區塊鏈和雲端運算等技術的快速應用為貨運行業帶來了挑戰。為了高效營運,對這些技術的投資需求日益增加。 2023年9月,Uber Freight宣布物流技術全面進化,以增強國際貨運能力。優步處理的貨運量達到價值 180 億美元,正在推出投資於先進技術和人工智慧軟體的新一代產品。

除了貨機航班恢復外,航空客運運力也正在回歸市場。 2023年,國際航空客運量恢復至疫情前水準。這一比例仍然很高,但比疫情之前有所下降。全球供應鏈繼續受到涉及中國、美國、俄羅斯、烏克蘭和歐洲的貿易限制的干擾。供應商正在尋求中國、東南亞和南亞以外的採購管道。

根據貨運業專家介紹,海運貨運市場的發展速度超出了預期。我們從供應鏈努力滿足前所未有的疫情需求,轉變為需求放緩的環境,導致船舶和貨櫃供應過剩,凸顯了全球經濟長期低迷的風險。政府在促進航運路線方面也發揮作用。自2023年3月起,印度和俄羅斯正在考慮使用橫跨北極圈的北海航線進行海上貿易。

貨運市場趨勢

跨境海上貿易成長推動貨運業

由於海上運輸和跨境貿易的成長,貨運代理市場規模正在大幅成長。全球化和國際商業合作使得跨境貿易的成長,催生了對高效率物流解決方案日益成長的需求。

2023年9月,哈薩克副總理謝里克·朱曼加林主持召開營運總部會議,監督哈中俄吉烏邊陲及裏海交通、物流和貿易中心建設進展。目前工程正在建設中,預計2030年完工。碼頭年吞吐量為1000萬噸,可容納一個100萬噸的普通貨物碼頭、一個150萬噸的糧食碼頭、一個550萬噸的液體貨物碼頭和一個200萬噸的通用碼頭。

此外,由於全球範圍內大量貨物的運輸,海上貿易的成長進一步增強了貨運業服務的重要性。全球領先的貨運代理公司之一 CH Robinson 於 2023 年 9 月開設了一家新工廠,以促進跨墨西哥邊境的貿易。該設施位於德克薩斯州拉雷多,是最大的跨境物流設施。此舉將使該公司在墨西哥邊境的用地面積擴大到 150 萬平方英尺(約為大型購物中心的一半大小),並提供 40 萬平方英尺的倉庫空間、154 個碼頭門和可容納 700 輛拖車的空間。

增加空運以縮短時間將推動市場成長

貨運代理產業的一個主要成長機會在於物流領域中航空貨運的使用日益增多。空運的速度使其成為對時間敏感的貨物運輸的有效選擇,尤其是生鮮產品或高價值的物品。

北美航空貨運市場佔有率正在快速成長。截至 2023 年 10 月,美國航空貨運將受益於冬季航班時刻表的擴展,美國航空在 2024 年 11 月至 2024 年 3 月期間將營運超過 12,500 個來回航班。該航空公司正在增加其飛往所有主要國際市場的服務,擁有超過 6,900 個專用寬體跨大西洋航班。

2023 年 8 月,Cargo-partner 從芝加哥推出了新的空運解決方案,以協助客戶向英國出口貨物。 2023 年 6 月 1 日,Cargo-partner 將啟動從芝加哥到倫敦希斯洛機場的空運業務的新整合,為國內外客戶提供支援。該服務每週出發一次,由內部貿易專家團隊監督。

貨運業概況

貨運代理市場由全球、區域和本地參與者組成。規模較小、車隊和儲存空間有限的本地企業繼續為市場提供服務。排名前20的公司佔據了50%以上的市場。 DHL Global Forwarding、DB Schenker、Kuehne+Nagel International AG、DSV、Expeditors International 以及其他貨運代理市場的全球公司。貨運市場佔有率穩定成長,商機機會,企業需要擁抱科技,走向數位化,擴大經營規模,提高經營效率。全球網路對於任何公司來說都至關重要。東協物流市場的併購對國際投資者的吸引力越來越大。隨著商業和貿易活動的活性化,全球物流公司正在向東協地區擴張。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

- 分析方法

- 研究階段

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 行業法規政策

- 技術簡介和數位趨勢

- 深入了解貨運技術進步

- 價值鏈/供應鏈分析

- 貨運市場的數位化

- 貨運市場定價與收益分析

- 貨運代理市場的區域洞察

- COVID-19 市場影響

第5章市場動態

- 市場促進因素

- 電子商務帶來的需求增加

- 市場限制

- 燃料成本增加

- 市場機會

- 物流行業數位化

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者和消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第6章市場區隔

- 按運輸方式

- 空運

- 海運

- 公路貨物運輸

- 鐵路貨運

- 依客戶類型

- B2B

- B2C

- 按應用

- 工業/製造業

- 零售

- 醫療保健

- 石油和天然氣

- 飲食

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 其他亞太地區

- 拉丁美洲、中東和非洲

- 巴西

- 南非

- 海灣合作理事會國家

- 其他中東和非洲地區

- 北美洲

第7章競爭格局

- 市場集中度概覽

- 公司簡介

- Kuehne+Nagel International AG

- DB Schenker

- Bollore Logistics

- DHL Global Forwarding

- Nippon Express Co. Ltd

- Dsv Global Transports and Logistics

- The Maersk Group

- CH Robinson

- Panalpina

- United Parcel Service

- FedEx Corp.

- Walmart Group

- MGF(Manitoulin Global Forwarding)

- Hellmann Worldwide Logistics

- Expeditors International

- Dachser

- Imerco

- Sinotrans India Private Limited

- CEVA Logistics

- Uber Freight LLC*

- 其他公司

第8章 市場機會與未來趨勢

第9章 附錄

- 宏觀經濟指標(GDP分佈、按活動分類、運輸和倉儲業對經濟的貢獻)

- 對外貿易統計 - 出口和進口(按產品)

- 深入了解主要出口和進口國家/地區目的地

The Freight Forwarding Market size is estimated at USD 581.94 billion in 2025, and is expected to reach USD 724.16 billion by 2030, at a CAGR of 4.47% during the forecast period (2025-2030).

The prompt adoption of technologies such as AI, blockchain, and cloud computing presents a challenge to the freight forwarding industry. The need to invest in these technologies for efficient operation is growing. In September 2023, Uber Freight announced a complete evolution in logistics technologies to power the international movement of goods. With freight worth USD 18 billion, Uber is launching a new generation of products that invest in its advanced technology development abilities and AI-powered software.

In addition to the resumption of freighter schedules, more airline passenger capacity is returning to the market. In 2023, international air travel returned to the pre-pandemic level. The rate remains high but still shallow compared to before the pandemic. Global supply chains persist in being disrupted by trade restrictions involving China, the United States, Russia, Ukraine, and Europe. Suppliers seek other locations to source from outside China, Southeast Asia, and South Asia.

According to freight forwarding industry experts, the ocean forwarding market is evolving faster than expected. The transition from a supply chain struggling to keep up with unprecedented pandemic demand to a weak demand environment is now oversupplied with ships and containers, highlighting the risk of a prolonged global economic downturn. The role of governments is also to facilitate sea routes. As of March 2023, India and Russia considered using the Northern Sea Route, which spans the Arctic, for shipping.

Freight Forwarding Market Trends

Growth In Cross-Border and Sea Trade Driving the Forwarding Industry

The freight forwarding market size has grown significantly, driven by the increasing movement of seaborne transport and cross-border trade. Increasing demand for efficient logistics solutions has been created by the increase in cross-border trade enabled by globalization and international business cooperation.

In September 2023, to monitor progress in the construction of transport, logistics, and trade centers on the borders with China, Russia, the Kyrgyz Republic, Uzbekistan, and the Caspian Sea, Kazakh Deputy Prime Minister, Serik Zhumangarin, convened a meeting of the operational headquarters. The construction work is currently underway and is expected to be completed by 2030. With an accommodation of 10 million tons per year, the terminal can house a 1-million-ton general cargo terminal, a 1.5-million-ton grain terminal, a 5.5-million-ton liquid cargo terminal, and a 2-million-ton universal terminal.

Moreover, the importance of freight forwarding industry services is further strengthened by increased sea trade due to a large volume of goods transported globally. One of the global freight forwarding companies, C.H. Robinson opened a new facility to facilitate trade across the Mexican border in September 2023. In Laredo, Texas, it is the largest cross-border logistics facility. This enlarges the company's footprint at the Mexican border to 1.5 million square feet (about half the area of a large shopping mall), with 400,000 square feet of warehousing space, 154 dock doors, and room for 700 trailers.

Increasing Air Freight to Reduce Time Propelling the Market Growth

The potential for significant freight forwarding industry growth lies in encouraging a higher use of air freight within the logistics sector. Air freight is an efficient option for time-sensitive consignments, particularly for perishable and high-value goods, because of the rapidity of transport.

The air freight forwarding market share of North America is on an exponential rise. As of October 2023, American Airlines Cargo benefited from the expanded winter schedule of more than 12,500 round-trip flights operated by American Airlines between November and March 2024. The carrier operates with increased frequencies on all major international markets, with more than 6,900 widebody flights dedicated to transatlantic routes.

In August 2023, Cargo-partner launched a new air freight solution originating in Chicago to assist clients who export their goods to the United Kingdom. On 1 June 2023, Cargo-partner started a new consolidation of air freight operations from Chicago to Heathrow Airport in London, and it provides support for its domestic and international customers. The service offers weekly departures, with an in-house team of trade experts overseeing the service.

Freight Forwarding Industry Overview

A blend of global freight forwarding companies, regional, and local players exist in the freight forwarding market. Small and medium-sized local operators with limited fleets and storage space continue to serve the market. The market is dominated by the top 20 players, which account for more than 50% of it. DHL Global Forwarding, DB Schenker, Kuehne + Nagel International AG, DSV, Expeditors International, and other global freight forwarding companies in the freight forwarding market. The players need to embrace technology, become more digital, and increase the scale and efficiency of their operations as the freight forwarder market share continues to grow steadily, and there are numerous opportunities. For businesses, an extensive network across the globe is essential. Acquisitions and mergers in the ASEAN logistics market have become increasingly attractive to international investors. As a result of increased business and trade activities, global logistics companies have been expanding in the ASEAN region.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Policies and Regulations

- 4.3 Technology Snapshot and Digital Trends

- 4.4 Insights on Technological Advancements in Freight Forwarding

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Digitalisation of Freight Forwarding Market

- 4.7 Pricing Analysis and Revenue analysis of Freight Forwarding Market

- 4.8 Regional Insights on Freight Forwarding Market

- 4.9 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand From E-commerce Sales

- 5.2 Market Restraints

- 5.2.1 Increasing Fuel Costs

- 5.3 Market Opportunities

- 5.3.1 Digitalizing the Logistics Industry

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Mode Of Transport

- 6.1.1 Air Freight Forwarding

- 6.1.2 Ocean Freight Forwarding

- 6.1.3 Road Freight Forwarding

- 6.1.4 Rail Freight Forwarding

- 6.2 By Customer Type

- 6.2.1 B2B

- 6.2.2 B2C

- 6.3 By Application

- 6.3.1 Industrial And Manufacturing

- 6.3.2 Retail

- 6.3.3 Healthcare

- 6.3.4 Oil And Gas

- 6.3.5 Food And Beverages

- 6.3.6 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.1.3 Mexico

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 France

- 6.4.2.3 United Kingdom

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 South Korea

- 6.4.3.4 India

- 6.4.3.5 Rest of Asia-Pacific

- 6.4.4 LAMEA

- 6.4.4.1 Brazil

- 6.4.4.2 South Africa

- 6.4.4.3 GCC

- 6.4.4.4 Rest of LAMEA

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Kuehne + Nagel International AG

- 7.2.2 DB Schenker

- 7.2.3 Bollore Logistics

- 7.2.4 DHL Global Forwarding

- 7.2.5 Nippon Express Co. Ltd

- 7.2.6 Dsv Global Transports and Logistics

- 7.2.7 The Maersk Group

- 7.2.8 C.H. Robinson

- 7.2.9 Panalpina

- 7.2.10 United Parcel Service

- 7.2.11 FedEx Corp.

- 7.2.12 Walmart Group

- 7.2.13 MGF (Manitoulin Global Forwarding)

- 7.2.14 Hellmann Worldwide Logistics

- 7.2.15 Expeditors International

- 7.2.16 Dachser

- 7.2.17 Imerco

- 7.2.18 Sinotrans India Private Limited

- 7.2.19 CEVA Logistics

- 7.2.20 Uber Freight LLC*

- 7.3 Other Companies

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

9 APPENDIX

- 9.1 Macroeconomic Indicators (GDP Distribution, by Activity, Contribution of the Transport and Storage Sector to Economy)

- 9.2 External Trade Statistics - Exports and Imports, by Product

- 9.3 Insights into the Key Export Destinations and Import Origin Countries