|

市場調查報告書

商品編碼

1687973

工業標籤:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Industrial Labels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

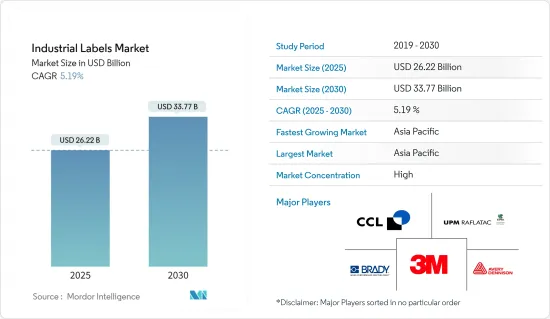

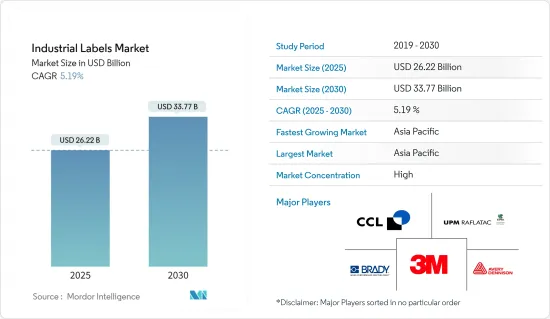

工業標籤市場規模預計在 2025 年為 262.2 億美元,預計到 2030 年將達到 337.7 億美元,預測期內(2025-2030 年)的複合年成長率為 5.19%。

關鍵亮點

- 市場概況與成長軌跡:工業標籤市場呈現顯著的成長軌跡,預計將從 2022 年的 223.5 億美元擴大到 2028 年的 305.2 億美元。 36.55% 的成長率主要歸因於電子、汽車、醫療、食品飲料等行業的需求增加。隨著工業標籤印刷技術的進步,對產品識別和可追溯性的需求不斷增加,這推動了市場的擴張。

- 複合年成長率:預計 2023 年至 2028 年市場複合年成長率為 5.19%。

- 數位印刷的成長:到 2028 年,數位印刷領域將達到 144 億美元,複合年成長率為 6.24%。

- 食品和飲料產業:食品和飲料產業的價值在 2022 年為 38.3 億美元,預計到 2028 年將達到 49.5 億美元。

- 安全標籤的擴展:預計到 2028 年,警告/安全標籤將成長到 76.2 億美元,複合年成長率為 5.38%。

- 食品和飲料產業推動顯著成長:食品和飲料產業在推動工業標籤市場方面發揮關鍵作用。嚴格的政府法規、創新的包裝趨勢以及工業標籤解決方案的進步都為這一領域的擴張做出了重大貢獻。標籤不僅對於產品識別很重要,而且對於合規性、品牌推廣和促銷也很重要。

- 監管合規:FDA 2022 年營養成分錶更新推動新標籤需求

- 全球趨勢:印度提案的2022年星級標籤系統標誌著食品標籤資訊化程度不斷提高的全球趨勢。

- 智慧標籤整合:RFID 標籤在飲料產業中越來越受歡迎,以提高可追溯性和永續性。

- 高速解決方案:食品和飲料行業擴大轉向先進、高品質的標籤系統來滿足其包裝需求。

- 亞太地區市場將顯著成長:亞太地區是工業標籤成長最快的市場之一,受益於經濟成長、技術進步以及醫療保健和包裝食品等行業需求的成長。快速的工業化和日益增強的健康意識進一步刺激了成長。

- 中國市場成長:中國工業標籤市場預計將從 2022 年的 30.1 億美元成長到 2028 年的 40.5 億美元,複合年成長率為 4.91%。

- 印度激增:印度工業標籤市場預計將從 2022 年的 20.3 億美元成長到 2028 年的 30.8 億美元,複合年成長率為 7.04%。

- 艾利丹尼森的 AD Stretch舉措將於 2022 年在亞太地區推出,該計畫將促進與新興企業的合作,創造創新的標籤解決方案。

- 對製藥業的影響:製藥業採用新的標籤技術對亞太地區的市場成長做出了重大貢獻。

- 技術進步塑造市場動態:工業標籤市場正在經歷變革時期期,由印刷和智慧標籤技術進步所推動。這些技術為各個領域提供了更有效率、更具成本效益和更高品質的工業標籤解決方案。

- 數位印刷的優點:與傳統方法相比,數位標籤印刷具有更高的清晰度和清晰度。

- 智慧標籤整合:支援 RFID 和 NFC 的工業標籤正在增強客戶參與和可追溯性。

- 永續解決方案:2023 年 4 月,艾利丹尼森推出了針對電子商務領域的永續AD XeroLinr DT 標籤。

- 環保材料:為了回應環境法規,人們對使用環保材料和水基黏合劑的興趣日益濃厚。

- 競爭格局與未來展望:工業標籤市場分散,艾利丹尼森、3M、CCL Industries 等全球領先企業在主導。為了保持競爭力,公司專注於策略性收購、合作夥伴關係和產品開發。

- CCL 收購 2023 年,CCL Industries 收購了 eAgile Inc. 和 Alert Systems ApS,以加強其智慧標籤產品。

- 永續性重點:人們越來越傾向於使用環保標籤製造程序和材料。

- 未來驅動力:工業環境日益複雜以及對安全高效標籤系統的需求將繼續推動需求。感測器融合和RFID系統的整合有望為全面的資料收集和管理開闢新的途徑。

工業標籤市場趨勢

其他行業占主要佔有率

- 最大的細分市場:其他產業在工業標籤市場中,其他產業細分市場將佔據最大的市場佔有率,到 2022 年將佔 40.36%。該細分市場的重要性在於它在各個工業細分市場中的應用範圍廣泛,超出了主要的最終用途類別。

- 市場規模:2022 年市場規模為 90.2 億美元,預計到 2028 年將達到 128.6 億美元,複合年成長率為 5.95%。

- 需求促進因素:對產品識別、供應鏈效率和法規遵循的需求不斷增加,推動各產業的需求。

- 技術進步:RFID 等智慧標籤技術對於該領域的發展至關重要,尤其是在惡劣的工業環境中。

- 防偽措施:假冒產品的增加促使製造商採用先進的標籤代碼來確保產品的真實性和品牌保護。

成長最快的區域:亞太地區

亞太地區將在工業標籤市場中佔據最大市場佔有率,到 2022 年將達到 36.67%。該地區的成長受到工業化以及醫療保健和包裝食品等領域的需求的推動。

- 市場規模:2022 年亞太市場價值為 82 億美元,預計到 2028 年將達到 115.5 億美元,複合年成長率為 5.75%。

- 經濟成長:亞太地區新興市場的快速經濟發展正在推動該地區對工業標籤的需求。

- 技術創新:艾利丹尼森在亞太地區推出的 AD 拉伸計畫專注於與應對永續性挑戰的新興企業夥伴關係。

- 對製藥業的影響:受文明病的刺激,製藥業的成長促進了對先進標籤解決方案的需求。

工業標籤產業概況

分析報告:工業標章市場的競爭格局

全球企業集團佔主導地位

工業標籤市場由艾利丹尼森、3M公司、CCL工業等全球企業集團主導,這些公司擁有豐富的資源、全球影響力和多樣化的產品系列。這些公司透過創新、技術進步和策略性收購獲得了優勢。

歷史悠久、實力雄厚的公司:艾利丹尼森和 3M 等公司成立於 1902 年至 1951 年之間,在全球擁有數千名員工,其影響力可見一斑。

技術創新:市場領導優先考慮研發投資和 RFID 等新技術,以保持產業領先地位。

多樣化的產品:CCL Industries 的產品範圍涵蓋農業、化學和安全領域,有助於其保持領先地位。

全球足跡:CCL Industries 的國際影響力使其能夠滿足廣泛的市場需求。

未來成功策略:技術創新、環保標章解決方案和防偽措施是工業標章市場未來成功的關鍵。採用高解析度數位印刷、UV 印刷和環保替代品的公司將具有競爭優勢。

先進的印刷技術:對於希望提高標籤性能和永續性的公司來說,投資高品質的印刷技術至關重要。

永續性:向環保材料和工藝的轉變將推動優先考慮環保解決方案的製造商的成長。

防偽:製藥和汽車等行業擴大採用安全標籤技術來打擊仿冒品。

擴大產品系列:跟上新興產業和不斷發展的監管標準對於長期的市場成功至關重要。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 技術簡介:識別技術

第5章市場動態

- 市場促進因素

- 食品和飲料預計將強勁成長

- 亞太地區成長強勁

- 數位印刷的成長

- 擴展安全標籤

- 市場限制

- 原料成本上漲

第6章市場區隔

- 按原料

- 金屬標籤

- 塑膠/聚合物標籤

- 按機制

- 壓力標籤

- 收縮套標

- 其他機制

- 依產品類型

- 警告/安全標籤

- 品牌標籤

- 耐候標籤

- 資產標籤

- 其他

- 透過印刷技術

- 類比印刷

- 數位印刷

- 按最終用戶產業

- 電子業

- 飲食

- 汽車

- 醫療保健

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 亞洲

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 北美洲

第7章競爭格局

- 公司簡介

- Avery Dennison Corporation

- 3M Company

- CCL Industries Inc.

- Brady Corporation

- UPM Raflatac

- DuPont de Nemours Inc.

- Brook+Whittle Ltd

- OMNI SYSTEMS

- Asean Pack

- Computer Imprintable Label Systems Ltd(CISL Ltd)

- LabelTac.com

- Orianaa Decorpack Pvt. Ltd

- Dura-ID Solutions Limited

- GA International Inc.

第8章投資分析

第9章:市場的未來

The Industrial Labels Market size is estimated at USD 26.22 billion in 2025, and is expected to reach USD 33.77 billion by 2030, at a CAGR of 5.19% during the forecast period (2025-2030).

Key Highlights

- Market Overview and Growth Trajectory: The Industrial Labels Market is experiencing a significant growth trajectory, expanding from USD 22.35 billion in 2022 to an anticipated USD 30.52 billion by 2028. This growth of 36.55% is primarily driven by increasing demand from industries such as electronics, automotive, healthcare, and food and beverage. The need for product identification and traceability has intensified, alongside technological advancements in industrial label printing, boosting the market's expansion.

- CAGR: The market is expected to grow at a CAGR of 5.19% from 2023 to 2028.

- Digital Printing Growth: The digital printing segment is set to reach USD 14.40 billion by 2028, at a CAGR of 6.24%.

- Food and Beverage Segment: Valued at USD 3.83 billion in 2022, the food and beverage sector is forecast to hit USD 4.95 billion by 2028.

- Security Labels Expansion: Warning/Security Labels are expected to grow to USD 7.62 billion by 2028, at a CAGR of 5.38%.

- Food and Beverage Sector Driving Significant Growth: The food and beverage industry plays a pivotal role in driving the industrial labels market. Stringent government regulations, innovative packaging trends, and advancements in industrial labeling solutions are key contributors to this sector's expansion. Labels are critical not only for product identification but also for compliance, branding, and promotions.

- Regulatory Compliance: The FDA's update to the Nutrition Facts label in 2022 has increased demand for new labels.

- Global Trends: India's star rating-based labeling system, proposed in 2022, signifies a trend toward more informative food labeling globally.

- Smart Label Integration: RFID-enabled labels are gaining momentum in the beverage industry for enhanced traceability and sustainability.

- High-Speed Solutions: The adoption of advanced high-quality labeling systems is growing to meet the food and beverage sector's packaging demands.

- APAC Region Witnessing Significant Market Growth: The Asia-Pacific (APAC) region is one of the fastest-growing markets for industrial labels, benefiting from economic growth, technological advancements, and increased demand from industries like healthcare and packaged food. Rapid industrialization and rising health awareness have further accelerated growth.

- China's Market Growth: China's industrial labels market is expected to grow from USD 3.01 billion in 2022 to USD 4.05 billion by 2028, with a CAGR of 4.91%.

- India's Surge: India's industrial labels market will rise from USD 2.03 billion in 2022 to USD 3.08 billion by 2028, registering a CAGR of 7.04%.

- Technological Adoption: Avery Dennison's AD Stretch initiative launched in APAC in 2022 fosters collaboration with startups to create innovative labeling solutions.

- Pharmaceutical Impact: The pharmaceutical sector's adoption of new labeling technologies is significantly contributing to market growth in APAC.

- Technological Advancements Shaping Market Dynamics: The industrial labels market is undergoing a transformation driven by technological innovations in printing and smart labels. These technologies are providing more efficient, cost-effective, and higher-quality industrial labeling solutions across various sectors.

- Digital Printing Superiority: Digital label printing offers improved sharpness and clarity compared to traditional methods.

- Smart Label Integration: RFID and NFC-enabled industrial labels are enhancing customer engagement and traceability.

- Sustainable Solutions: In April 2023, Avery Dennison introduced the sustainable AD XeroLinr DT label, targeting the e-commerce sector.

- Eco-Friendly Materials: The industry is increasingly focusing on the use of eco-friendly materials and water-based adhesives to meet environmental regulations.

- Competitive Landscape and Future Outlook: The industrial labels market is fragmented, with global leaders like Avery Dennison, 3M, and CCL Industries leading the charge in innovation and market expansion. Companies are focusing on strategic acquisitions, collaborations, and product development to maintain their competitive edge.

- CCL's Acquisitions: In 2023, CCL Industries acquired eAgile Inc. and Alert Systems ApS to enhance its intelligent label offerings.

- Sustainability Focus: There is a growing shift towards environmentally friendly label production processes and materials.

- Future Growth Drivers: Increased complexity in industrial environments and the need for safe, efficient labeling systems will continue driving demand. Integration of sensor fusion with RFID systems is expected to open new avenues for comprehensive data collection and management.

Industrial Labels Market Trends

Other Industries Holds Major Share

- Largest Segment: :Other Industries : The Other Industries segment holds the largest market share in the Industrial Labels Market, with a 40.36% share in 2022. This segment's significance is attributed to its diverse industrial applications across sectors beyond the main end-use categories.

- Market Size: The segment was valued at USD 9.02 billion in 2022 and is expected to reach USD 12.86 billion by 2028, with a CAGR of 5.95%.

- Driving Demand: The growing need for product identification, supply chain efficiency, and regulatory compliance drives demand across various industries.

- Technological Advancements: Smart labeling technologies like RFID are crucial to this segment's growth, especially in challenging industrial environments.

- Anti-Counterfeiting Measures: The rise in counterfeiting has led manufacturers to adopt advanced label codes for product authenticity and brand protection.

Fastest-Growing Regional Segment: Asia-Pacific

APAC holds the largest market share in the Industrial Labels Market, accounting for 36.67% in 2022. The region's growth is fueled by industrialization and demand from sectors like healthcare and packaged food.

- Market Value: The APAC market was valued at USD 8.20 billion in 2022 and is projected to reach USD 11.55 billion by 2028, with a CAGR of 5.75%.

- Economic Growth: Rapid economic development in APAC's emerging markets drives demand for industrial labeling in the region.

- Technological Innovation: Avery Dennison's AD Stretch program, launched in APAC, focuses on partnerships with startups to tackle sustainability challenges.

- Pharmaceutical Impact: Growth in the pharmaceutical industry, spurred by lifestyle diseases, is contributing to demand for advanced labeling solutions.

Industrial Labels Industry Overview

Analyst Report: Competitive Landscape of the Industrial Labels Market

Global Conglomerates Dominate:

The Industrial Labels Market is led by global conglomerates like Avery Dennison, 3M Company, and CCL Industries, which possess extensive resources, global reach, and diverse product portfolios. These companies dominate through innovation, technological advancements, and strategic acquisitions.

Established Giants: Founded between 1902 and 1951, companies like Avery Dennison and 3M employ thousands globally, underscoring their influence.

Technological Innovation: Market leaders emphasize R&D investments and new technologies like RFID to stay ahead of industry trends.

Diverse Offerings: CCL Industries' product range spans agriculture, chemicals, and security applications, contributing to its leadership position.

Global Footprint: The extensive international presence of these companies allows them to cater to a wide range of markets.

Strategies for Future Success: Technological innovation, eco-friendly labeling solutions, and anti-counterfeiting measures will be crucial to future success in the Industrial Labels Market. Companies that adopt high-resolution digital printing, UV printing, and eco-friendly alternatives will gain a competitive edge.

Advanced Printing Technologies: Investment in high-quality printing techniques is vital for companies looking to enhance label performance and sustainability.

Sustainability: The shift toward environmentally friendly materials and processes will drive growth for manufacturers that prioritize eco-conscious solutions.

Anti-Counterfeiting: Industries like pharmaceuticals and automotive are increasingly adopting secure labeling technologies to combat counterfeiting.

Expanding Product Portfolios: Adapting to emerging industries and evolving regulatory standards will be critical for long-term market success.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot - Identification Technology

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Food and Beverage is Expected to Register Significant Growth

- 5.1.2 APAC to Witness Significant Growth

- 5.1.3 Digital Printing Growth

- 5.1.4 Security Labels Expansion

- 5.2 Market Restraints

- 5.2.1 Increasing Cost of Raw Materials

6 MARKET SEGMENTATION

- 6.1 By Raw Material

- 6.1.1 Metal Labels

- 6.1.2 Plastic/Polymer Labels

- 6.2 By Mechanism

- 6.2.1 Pressure Sensitive Labelling

- 6.2.2 Shrink Sleeve Labelling

- 6.2.3 Other Mechanism

- 6.3 By Product Type

- 6.3.1 Warning/Security Labels

- 6.3.2 Branding Labels

- 6.3.3 Weatherproof Labels

- 6.3.4 Equipment Asset Tags

- 6.3.5 Other Product Types

- 6.4 By Printing Technology

- 6.4.1 Analog Printing

- 6.4.2 Digital Printing

- 6.5 By End-user Industry

- 6.5.1 Electronics Industry

- 6.5.2 Food & Beverage

- 6.5.3 Automotive

- 6.5.4 Healthcare

- 6.5.5 Other End-user Industry

- 6.6 By Geography

- 6.6.1 North America

- 6.6.1.1 United States

- 6.6.1.2 Canada

- 6.6.2 Europe

- 6.6.2.1 Germany

- 6.6.2.2 United Kingdom

- 6.6.2.3 France

- 6.6.2.4 Spain

- 6.6.3 Asia

- 6.6.3.1 China

- 6.6.3.2 Japan

- 6.6.3.3 India

- 6.6.3.4 South Korea

- 6.6.4 Australia and New Zealand

- 6.6.5 Latin America

- 6.6.5.1 Brazil

- 6.6.5.2 Mexico

- 6.6.5.3 Argentina

- 6.6.6 Middle East and Africa

- 6.6.6.1 United Arab Emirates

- 6.6.6.2 Saudi Arabia

- 6.6.6.3 South Africa

- 6.6.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Avery Dennison Corporation

- 7.1.2 3M Company

- 7.1.3 CCL Industries Inc.

- 7.1.4 Brady Corporation

- 7.1.5 UPM Raflatac

- 7.1.6 DuPont de Nemours Inc.

- 7.1.7 Brook + Whittle Ltd

- 7.1.8 OMNI SYSTEMS

- 7.1.9 Asean Pack

- 7.1.10 Computer Imprintable Label Systems Ltd (CISL Ltd)

- 7.1.11 LabelTac.com

- 7.1.12 Orianaa Decorpack Pvt. Ltd

- 7.1.13 Dura-ID Solutions Limited

- 7.1.14 GA International Inc.