|

市場調查報告書

商品編碼

1689684

北美 ATV 和 UTV市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)North America ATV And UTV - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

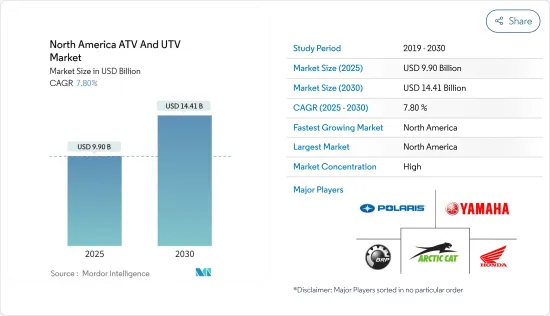

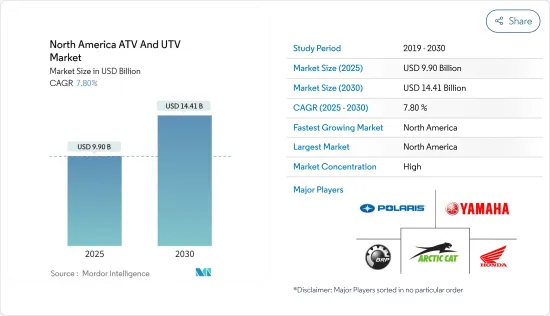

北美 ATV 和 UTV 市場規模估計和預測在 2025 年將達到 99 億美元,預計到 2030 年將達到 144.1 億美元,在市場估計和預測期(2025-2030 年)內複合年成長率為 7.8%。

冒險運動和休閒活動市場正在崛起,導致對 ATV 和 UTV 的需求增加,尤其是在軍事活動中。由於這些車輛不允許在高速公路和主幹道上行駛,政府部門正在增加預算來開發新的越野路。這將使休閒愛好者受益並促進該地區的冒險體育活動。預計這些因素將在未來五年內支持市場成長。

過去,全地形車(ATV)和多用途車(UTV)主要用於休閒目的。然而,如今它們被應用於農業、狩獵、巡邏、園藝等各種行業。預計很快美國將引領此類車輛的市場,其次是加拿大和墨西哥。這是由於政府措施、與 ATV 和 UTV 相關的新法律以及補貼。

全地形車在該地區正迅速變得越來越受歡迎。這是由於新的測試指南和更嚴格的法律規範的實施,使得新型越野車配備了更多的安全功能。

北美 ATV 和 UTV 市場趨勢

體育產業大幅成長

- 人們對體育和休閒的興趣日益濃厚,是推動市場成長的關鍵因素。為了應對日益成長的二氧化碳排放擔憂,製造商不斷致力於開發不同環保版本的汽車。預計將進一步擴大全地形車的市場規模。

- 在製造用於體育活動的 ATV 和 UTV 時,考慮的主要標準是其性能。這些車輛設計輕巧,以便於加速;具有更硬的懸吊設置,以便於更好地操控;並且重心較低,以便於提高穩定性。

- 這一類別的車輛主要用於各種高辛烷值賽車活動,包括但不限於在乾旱或沙漠條件下的沙丘賽車、穿越茂密的叢林和森林地區的越野賽車、在崎嶇和具有挑戰性的地形上爬坡以及需要快速加速和快速操縱的直線加速賽。

- 過去,運動型和賽車型全地形車主要採用二行程引擎,這種引擎具有出色的加速性能。然而,如今市面上四衝程引擎產品越來越多。

- 目前,北美舉辦多項專業賽車錦標賽和系列賽。全國越野大賽系列賽、ATV 全國越野摩托車錦標賽、冠軍泥地賽車等都是使用不同類型的 ATV 和 UTV 的賽事。

- 在這個市場營運的主要企業也正在採取多項舉措,以增加馬達休閒步道的通道,以補充採用並利用機會。

- 例如,2023年8月,Yamaha Motor Co, Ltd.株式會社宣布,Yamaha戶外通道舉措(OAI)的累積籌資額已超過600萬美元。最新的融資週期體現了YamahaOAI 的使命,即保護、改善和擴大摩托車和戶外休閒公共土地的使用權。實現這一目標的是透過開發、保護和恢復 40,000 多英畝土地和 600 英里馬達休閒路徑的計劃。

- 2023 年第二季度,奧勒岡州的三個主要計劃獲得了 OAI 的支持。這些計劃旨在增強奧勒岡國家休閒區、蒂拉穆克州立森林和羅格-錫斯基尤國家森林的馬術區的體驗。這些計劃包括資訊標誌和重要橋樑及集結區的建設,體現了 OAI 致力於在未來幾年內增強奧勒岡州休閒機會的承諾。

- 在美國,由於越野地形的增加、馬達運動協會對休閒的推廣以及全國拉力錦標賽的興起等因素,ATV 和 UTV 的受歡迎程度預計將在未來十年大幅成長。因此,預測期內 ATV 和 UTV 的需求可能會受到影響。

預計美國將主導市場

- 休閒支出的增加和越野賽事的增加正在推動美國ATV 和 UTV 市場的成長。年輕人對冒險和越野活動的日益偏好,以及各種價位的產品種類繁多是推動這一成長的因素。

- 美國軍方大量使用 ATV 和 UTV,以多樣化其用途。這包括遠距運送部隊和彈藥。對車輛在崎嶇地形上行駛的需求推動了 ATV 和 UTV 市場的成長。

- 隨著全地形車和多用途車輛通道坡道開始出現在美國公園,消費者的興趣預計將日益成長。休閒ATV 和 UTV 基礎設施的擴建是一個具有吸引力的市場驅動力,因為它不僅解決了可及性問題,而且還刺激了對這些越野車的需求成長。這為美國全地形車和多功能車市場創造了巨大的成長機會。

- 該國多個地方政府正在致力於推廣使用全地形和多用途車輛用於休閒和體育目的。

- 2023年8月,美國威斯康辛州綠湖地區商會執行董事麗莎·邁耶(Lisa Meyer)向全委員會發表講話,討論核准綠湖市全地形和多地形車輛路線。

- 2023年7月,美國愛荷華州安克尼市將允許全地形車輛通行。這個新的法律規範引入了一些精心設計的先決條件和豁免,以確保營運安全。此舉促使當地製造商抓住機遇,尋求向該國擴張。

北美 ATV 和 UTV 行業概況

北美 ATV 和 UTV 市場由幾家主要企業,包括 Polaris Industries Inc.、American Honda Motor Co. Inc.、BRP Inc.、Arctic Cat 和 Yamaha Motor。大多數公司都是透過後向整合來擴大其影響力。市場領導正專注於推出具有增強功能的新型 ATV 和 UTV 車型,以產品系列多樣化。

- 2023 年 7 月 領先的高性能 ATV 和 UTV 配件製造商 RJWC Powersports 宣布與著名的 ATV 和 UTV 售後零件分銷商 Kimpex 建立新的分銷合作夥伴關係。此次策略夥伴關係將加速 RJWC 強力運動在加拿大市場的擴張。

- 2023年4月 正在開發印度市場的Powerland Tachyon為美國市場開發了一款強大的新型ATV。正在開發的產品是一款採用四個輪內馬達的全輪驅動汽車。峰值功率為50HP,輸出扭力為210Nm。美國銷售價格為15,000美元(不含稅)。

- 2023 年 3 月Yamaha Motor Co, Ltd.有限公司(美國)將向Yamaha勞工工會局 (BULU) cRU (BULU) 計劃投資超過 119,500 美元。YamahabULU cRU 將為 2023 年 SxS(搖擺賽季)和 2023 年 ATV(全地形車)賽季的特定係列和級別中符合條件的賽車手提供 15,000 美元的獎金。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 休閒和馬達運動活動增多

- 市場限制

- 提供高價值且維護成本低

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場區隔

- 按車型

- 運動型全地形車

- 多用途地形車 (UTV)

- 按應用

- 運動的

- 農業

- 其他用途

- 按燃料類型

- 汽油驅動

- 電的

- 按國家

- 美國

- 加拿大

- 北美其他地區

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- American Honda Motor Co. Inc.

- Yamaha Motor Co. Ltd

- Arctic Cat Inc.

- Kwang Yang Motor Co. Ltd

- Polaris Industries Inc.

- BRP Inc.

- Suzuki Motor of America Inc.

- Kawasaki Heavy Industries Ltd

- DRR USA Inc.

- Daymak Inc.

- Kubota Corporation

- Deere and Company

第7章 市場機會與未來趨勢

第 8 章。各品牌 ATV 和 UTV 規格

The North America ATV And UTV Market size is estimated at USD 9.90 billion in 2025, and is expected to reach USD 14.41 billion by 2030, at a CAGR of 7.8% during the forecast period (2025-2030).

The market for adventure sports and recreational activities is on the rise, leading to an increased demand for ATVs and UTVs, particularly in military activities. Since these vehicles are not permitted to be used on highways and main roads, government authorities in various regions have increased their budgetary allocations to develop new off-road trails. This can be beneficial for recreational enthusiasts and boost adventure sports activities in the area. These factors are expected to support the market's growth over the next five years.

Previously, all-terrain vehicles (ATVs) and utility task vehicles (UTVs) were primarily used for recreational purposes. However, these vehicles have now found their way into various industries, such as agriculture, hunting, patrolling, and gardening. Shortly, the United States is expected to lead the market for these vehicles, followed by Canada and Mexico. This is due to the government's initiatives, new laws related to ATVs and UTVs, and subsidies.

The popularity of ATVs is increasing rapidly in the region. This is due to the implementation of new testing guidelines and strict regulatory oversight, resulting in the incorporation of more safety features into new off-road vehicles.

North America ATV And UTV Market Trends

Sports Segment Witnessing Major Growth

- The increasing interest of people in sports and recreational activities has become a significant factor driving the growth of the market. Manufacturers are constantly working to develop various eco-friendly versions of these vehicles to address the growing concerns around carbon emissions. This is expected to further boost the market size of all-terrain vehicles.

- When manufacturing ATVs and UTVs for sporting activities, the primary criterion taken into consideration is their performance. These vehicles are designed to be lightweight to facilitate acceleration, have stiffer suspension settings for better handling, and have a low center of gravity for added stability.

- Vehicles belonging to this category are primarily deployed in a variety of high-octane racing events, including but not limited to dune racing in arid and desert-like conditions, cross-country racing that involves traversing through dense forests and wooded areas, hill climbing where drivers navigate steep and challenging terrains, and drag racing that demands high-speed acceleration and swift maneuvering.

- Earlier, ATVs for sports and racing featured two-stroke engines, as they offered better acceleration. However, this has changed in the current scenario, as the market has more offerings of four-stroke engines.

- Currently, a high number of professional racing championships and series are being conducted across North America. The Grand National Cross-Country Series, ATV National Motocross Championship, and Championship Mud Racing are a few such events where different kinds of ATVs and UTVs are used.

- The key companies operating in the market are also taking multiple initiatives to increase access to motorized recreational trails to supplement the penetration and capitalize on the opportunity.

- For instance, in August 2023, Yamaha Motor Corporation announced that Yamaha's Outdoor Access Initiative (OAI) surpassed USD 6 million in cumulative funding. This latest funding cycle showcases Yamaha OAI's mission to protect, improve, and expand access to public land for motorized and outdoor recreation. It is done through projects that build, protect, and restore access to more than 40,000 acres and 600 miles of trail for motorized recreation.

- In the second quarter of 2023, three major projects in Oregon received support from OAI. These projects are aimed at enhancing the riding experience in the Oregon Sand Dunes National Recreation Area, Tillamook State Forest, and the prospect of riding area in the Rogue-Siskiyou National Forest. These projects include informative wayfinding signage, construction of vital bridges and staging areas, and demonstration of OAI's commitment to improving recreational opportunities in Oregon for many years to come.

- The United States is expected to see a significant increase in the popularity of ATVs and UTVs over the next decade due to factors such as the growing number of off-road terrains, increased promotion of recreational activities by motorsports associations, and the rise of national rally championships. As a result, demand for ATVs and UTVs is likely to be influenced during the forecast period.

United States Expected to Dominate the Market

- The increasing recreational expenditure and the rising number of off-roading events are driving the growth of the ATV and UTV market in the United States. The growing preference of the youth toward adventure and off-road events and the availability of a wide range of products across varied prices are the factors that drive this growth.

- The US military uses more ATVs and UTVs for diversifying their applications. It includes transporting armed forces and ammunition across long distances. The need for vehicles to run in rough terrain provides an impetus to the growth of the ATV and UTV market.

- The growing establishment of dedicated all-terrain vehicle and utility terrain vehicle pathways within US parks is expected to stimulate heightened consumer interest. This expansion of recreational ATV and UTV infrastructure serves as a compelling market driver, as it not only addresses the accessibility issues but also encourages greater demand for these off-road vehicles. It presents substantial growth opportunities within the all-terrain vehicles and utility terrain vehicles market in the United States.

- Several local bodies in the country are taking initiatives to promote all-terrain vehicle and utility terrain vehicles for recreational and sporting purposes.

- In August 2023, Green Lake Area Chamber of Commerce Executive Director Lisa Meier, Wisconsin, United States, addressed the committee of the whole on the subject of approving all-terrain vehicle and utility terrain vehicle routes in the city of Green Lake.

- In July 2023, Ankeny City, Iowa, United States, granted permission for utility terrain vehicles to navigate its streets. This new regulatory framework introduces specific prerequisites and exemptions meticulously crafted to ensure operational safety. Due to this measure, the manufacturers in the country take advantage of it and explore their reach in the country.

North America ATV And UTV Industry Overview

The North American ATV and UTV market is dominated by several key players, including Polaris Industries Inc., American Honda Motor Co. Inc., BRP Inc., Arctic Cat, and Yamaha Motor Co. Ltd. Most companies are expanding their presence by backward integration. Market leaders emphasize launching new models of ATVs and UTVs with enhanced features to diversify their product portfolio.

- July 2023: RJWC Powersports, a leading manufacturer of high-performance ATV and UTV accessories, announced a new distribution partnership with Kimpex, a reputed distributor of aftermarket parts for ATV and UTV. This strategic collaboration will facilitate RJWC Powersport's expansion into the Canadian market.

- April 2023: Indian Manufacturer Powerland Tachyon developed a powerful new ATV for the US markets. The developed product contains an all-wheel drive using four in-wheel motors. They offer 50 HP of peak power and 210 Nm Output torque. The product price in the United States is estimated to be USD 15,000 before taxes.

- March 2023: Yamaha Motor Corp., United States, funded over USD 119,500 under the Yamaha BULU (Bureau of Labor Unions) cRU (BULU) program. Yamaha bULU cRU is offering USD 15,000 bonus funds for eligible and qualified racers in selected series and classes in the 2023 SxS (Swing Season) and 2023 ATV (All-Terrain Vehicle) racing seasons.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Recreational and Motorsports Activities

- 4.2 Market Restraints

- 4.2.1 High Value and Maintenance Cost Offered

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value (USD))

- 5.1 By Vehicle Type

- 5.1.1 Sport ATVs

- 5.1.2 Utility Terrain Vehicle (UTVs)

- 5.2 By Application

- 5.2.1 Sports

- 5.2.2 Agriculture

- 5.2.3 Other Applications

- 5.3 By Fuel Type

- 5.3.1 Gasoline Powered

- 5.3.2 Electric Powered

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Rest of the North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 American Honda Motor Co. Inc.

- 6.2.2 Yamaha Motor Co. Ltd

- 6.2.3 Arctic Cat Inc.

- 6.2.4 Kwang Yang Motor Co. Ltd

- 6.2.5 Polaris Industries Inc.

- 6.2.6 BRP Inc.

- 6.2.7 Suzuki Motor of America Inc.

- 6.2.8 Kawasaki Heavy Industries Ltd

- 6.2.9 DRR USA Inc.

- 6.2.10 Daymak Inc.

- 6.2.11 Kubota Corporation

- 6.2.12 Deere and Company