|

市場調查報告書

商品編碼

1690124

歐洲遠端資訊處理:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Telematics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

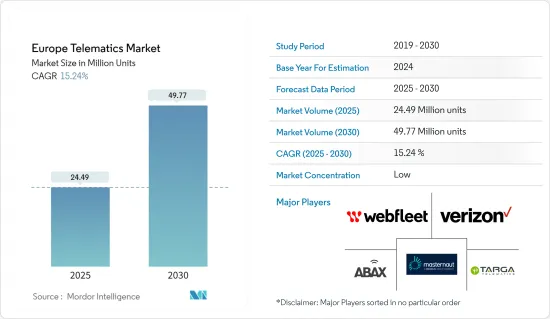

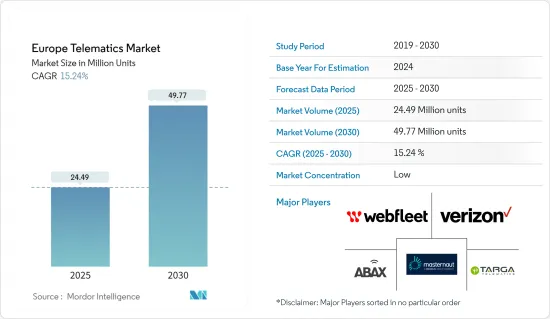

預計 2025 年歐洲遠端資訊處理市場規模將達到 2,449 萬台,到 2030 年將達到 4,977 萬台,預測期內(2025-2030 年)的複合年成長率為 15.24%。

主要亮點

- 推動歐洲地區市場成長的因素之一是事故數量的增加。根據歐盟委員會預測,2022年歐洲每百萬人口的道路交通事故死亡人數將達46人。多項研究表明,其中很大一部分是由重型商用車造成的。例如,根據美國國家醫學圖書館的一項研究,在歐洲,重型商用車佔致命道路事故的 14.2%,佔警方報告的道路事故的 4.5%。

- 商用車和乘用車領域對於導航、安全和遠距離診斷技術的需求正在日益成長。車輛遠端資訊處理的主要促進因素包括歐盟法規、當地政策限制、汽車產量增加以及運輸業的低利潤率。遠端資訊處理設備和服務的擴展以及政府監管的加強將推動該技術成為主流。

- 當車輛配備遠端資訊處理系統時,使用者可以即時檢查車輛的位置。這使得它可以向司機發送理想的路線,以避免堵塞、延誤和事故。它還允許您選擇距離客戶最近的車輛,從而縮短響應時間並提供快速響應的服務。如果您是一家送貨上門的企業,您可以向您的客戶提供追蹤鏈接,以便他們可以查看其車輛的位置。這使得客戶能夠提前做好交貨準備。

- 遠端資訊處理技術在各個領域已經存在了幾十年,但直到最近幾年它才成為車隊管理中的一種現象。該技術結合通訊和資訊學,揭示有關車輛運行的寶貴見解。車隊遠端資訊處理系統有兩個組成部分:安裝在車隊車輛上的設備和收集、儲存和傳輸資訊的軟體。

- 新冠疫情的爆發對整體汽車產業的成長產生了重大影響,大範圍的封鎖和旅行限制嚴重影響了整體銷售和需求。此外,對體力勞動使用的一些限制也影響了汽車製造商的生產能力,迫使他們要么關閉工廠,要么以有限的產能繼續生產,從而導致汽車行業放緩。

歐洲遠端資訊處理市場趨勢

乘用車大幅成長

- 根據世界衛生組織的資料,該地區該行業成長的主要驅動力之一是歐盟道路上事故數量的增加,其中許多受害者是與業務相關的道路事故。這促使政府機構更新員工安全和福利法規,衛生和安全部門也發布了改進的指南,以幫助組織遵守和執行其法律責任。

- 遠端資訊處理生態系統的使用源自於行動資源管理和機器對機器通訊的引入。此外,遠端資訊處理廣泛應用於石油和天然氣、採礦、公共、食品、宅配、建設業、廢棄物管理、警察和緊急服務等行業,以及馬達客車、公共交通、計程車和輔助交通等運輸車輛,用於在全部區域運送勞動力和貨物。

- 過去五年來,運往歐洲的汽車數量急劇增加。福斯、標緻雪鐵龍和雷諾-日產聯盟這三大汽車製造商主導歐洲的乘用車銷售,因此佔該地區所有聯網汽車出貨量的約一半。聯網汽車是一種內建連線的乘用車。未來,大多數連網汽車將配備支援4G和5G的遠端資訊處理控制單元(TCU)。

- 隨著道路上車輛數量的增加,維持嚴格安全標準的需要也隨之增加,推動了產業的發展。此外,物流業對車輛管理系統的需求不斷成長、監管要求提高車輛和乘客安全性以及平板電腦和智慧型手機與汽車的整合度不斷提高,預計都將推動市場的發展。

- 遠端資訊處理系統的成本(包括安裝、維護和回饋)仍然是該地區產業成長的主要障礙。但研究也發現,燃料損失和保險費等其他成本的節省很可能足以彌補最初的推出成本。此外,歐盟委員會進行的一項汽車技術研究發現,使用事件資料記錄器具有積極的成本效益比。在這些趨勢的推動下,越來越多的汽車製造商透過提供出廠遠端資訊處理解決方案進入遠端資訊處理領域。

- 基於行動、基於視訊的安全解決方案和車輛性能服務管理解決方案等附加價值服務的出現,正在加強歐洲乘用車遠端資訊處理市場的成長機會。雖然嵌入式車隊管理服務 (FMS) 在大型和中型車隊中的普及率相對較高,但解決更好的商業案例、意識和適當的培訓等挑戰是小型車隊擴張的關鍵,並且更多的供應商將這些解決方案整合到工廠中。

英國佔很大佔有率

- 由於輕型卡車和皮貨車等輕型商用車產量的增加,英國遠端資訊處理市場預計將經歷強勁成長。商用車營運商使用遠端資訊處理來最佳化卡車維護、燃料使用和許多其他方面。輕型商用車銷售數據波動,但根據歐洲汽車工業協會 (ACEA) 的數據,英國在歐洲輕型商用車總銷量中僅次於法國。

- 與傳統的資料追蹤系統(僅提供對駕駛員行為和即時車輛位置的洞察)不同,這些車輛產生的資料為公司提供了寶貴的資訊以提高效率,例如避免擁塞、創造壓力較小的駕駛環境並減少車輛對環境的影響。

- 該國電子商務和物流行業的成長正在增加對輕型商用車的需求,進一步為歐洲商業領域的遠端資訊處理市場創造了高成長機會。根據OICA報告(2022年),輕型商用車產量為80,210輛,與前一年同期比較增加44%。

- 多家汽車製造商正致力於建立戰略聯盟和夥伴關係關係,以擴大該國輕型商用車的生產。例如,2023年4月,電動車品牌B-ON與國際汽車有限公司宣佈建立合作夥伴關係,支持在英國進口和銷售B-ON的四款汽車系列。透過此次合作,兩家公司旨在為客戶提供低成本、零排放的商用車隊解決方案,支援該國的電氣化,並進一步加速歐洲市場對遠端資訊處理的需求。

- 遠端資訊處理技術可以成為運輸和物流行業解決駕駛員短缺問題的有效解決方案。這項創新技術可對您的整個車隊和行動資產進行即時追蹤和可視性,從而減少駕駛員的手動工作。同樣重要的是,要對駕駛時間進行電子監控以確保合規。 2023 年 5 月,Trakm8 宣布與 CityFibre 建立戰略夥伴關係,為 CityFibre 的貨車車隊配備 RH600 4G 整合遠端資訊處理攝影機,以提高車輛安全性並協助監控駕駛行為,符合公司更廣泛的永續性目標。

歐洲車聯網產業概況

歐洲遠端資訊處理市場的競爭十分激烈,多家參與者激烈地爭奪市場佔有率佔有率。併購是市場參與者增強市場力量的重要策略。此外,隨著新參與企業尋求提供專業化服務和創新經營模式,競爭預計將會更加激烈。主要供應商包括 Verizon Communications Inc.、Webfleet Solutions BV、ABAX UK Ltd、Mastersnaut Limited 和 Targa Telematics SpA。

2023年5月,Targa Telematics宣布收購Viasat Group Spa,以加強在義大利市場的領導地位並加速其在歐洲的擴張。透過此次收購,該公司旨在進一步增強其在物聯網領域的創造力,並開發用於聯網行動的解決方案和數位服務。

同樣在 2023 年 3 月,Targa Telematics 宣布與福特建立戰略合作夥伴關係,以擴展聯網汽車解決方案並整合來自該汽車製造商車輛的資料。

2022 年 10 月,Webfleet 將宣布與位於巴黎附近的新 eOEM Musée 建立策略合作夥伴關係,以提供整合的遠端資訊處理解決方案。該公司的遠端資訊處理解決方案使 Muses 能夠監控車輛健康狀況並預測性地安排維護。此外,Muses 客戶將能夠使用 Webfleet 的全部功能,從而最佳化車隊效率並降低成本。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 現有政策和規範

- 歐洲車隊管理者面臨的主要挑戰

- 評估宏觀經濟趨勢對產業的影響

第5章 市場動態

- 市場促進因素

- 歐盟法規和政策規則日益增多

- 路線計算、車輛追蹤、燃油竊盜等方面的進步

- 市場挑戰/限制

- 安裝成本高

- 缺乏不間斷、無縫的網路連接

第6章 技術簡介與分析

第7章 市場區隔

- 商業的

- 當前市場狀況及安裝基礎

- LCV與MCV/HCV盛行率比較

- 車聯網服務收益分析

- 按國家

- 英國

- 比荷盧

- 挪威

- 瑞典

- 波蘭

- 丹麥

- 芬蘭

- 其他歐洲國家

- 按類別分類:乘用車

- 嵌入式OEM遠端資訊處理系統的當前市場狀況與裝置量

- 區域分析—趨勢和動態的定性分析

第8章 競爭格局

- 公司簡介

- Webfleet Solutions Bv

- Verizon Communications Inc.

- Abax Uk Ltd

- Masternaut Limited

- Targa Telematics Spa

- Gurtam Inc.

- Mix Telematics Limited

- Mercedes-benz Group Ag (daimler Ag)

- Volvo Group

- Scania Ab

- Man Truck & Bus Se (traton Se)

- Daf Trucks Nv (paccar Inc.)

第9章投資分析及市場前景

The Europe Telematics Market size is estimated at 24.49 million units in 2025, and is expected to reach 49.77 million units by 2030, at a CAGR of 15.24% during the forecast period (2025-2030).

Key Highlights

- One of the primary drivers for market growth in the European region is the growing number of accidents. According to the European Commission, the rate of road deaths per million inhabitants in the European region was 46 in 2022. Several studies indicate that a significant portion of this is caused by heavy commercial vehicles. For instance, according to a National Library of Medicine survey, heavy goods vehicles are involved in 14.2% of fatal road crashes and 4.5% of police-reported road crashes in Europe.

- The demand for technology facilitating navigation, safety, and remote diagnostic is elevating the commercial as well as passenger vehicle space. The primary drivers of vehicle telematics include the European Union regulations, Local policy regulations, rise in the production number of automotive vehicles, coupled with small profit margins in the transportation industry. An expanding array of telematics devices and services, along with focused government mandates, will enable the technology to break into the mainstream.

- With telematics installed in vehicles, users can view their vehicle's location in real-time. This enables sending the ideal route for drivers to avoid traffic jams, delays, or accidents. It also helps increase the response times by choosing the vehicle that is closest to the customer location to deliver prompt and responsive service. In the case of businesses that deliver products, they can provide customers with a Tracking Link that assists them to view the location of the vehicle. This enables the customers to prepare in advance for the delivery.

- Although telematics technology has been used in many areas for decades, it is only in the last several years that it has become a phenomenon in fleet management. This technology combines telecommunications and informatics to uncover valuable insights into a fleet's operations. A fleet telematics system has two components: a device installed on fleet vehicles and software that collects, stores, and transmits information.

- The outbreak of the COVID-19 pandemic had a significant impact on the growth of the automotive industry in general, as the widespread lockdown and travel restrictions significantly impacted sales and demand in general. Several restrictions imposed regarding the use of a manual workforce also impacted the production capability of automotive manufacturers, who were also forced to either shut down their operations or continue with limited production capabilities, bringing a slowdown in the automotive industry.

Europe Telematics Market Trends

Passenger Vehicles to Witness Significant Growth

- One of the primary drivers for the segments' growth in the region is the rising number of accidents on EU roads, with a large proportion of victims being victims of work-related road collisions, according to WHO data. This has prompted government bodies to update their legislation concerning the safety and well-being of employees, with health and safety authorities issuing improved guidance for organizations to help them comply with legal responsibilities and enforce them.

- The use of the telematics ecosystem has resulted from the introduction of mobile resource management and machine-to-machine communication. Furthermore, telematics is widely used by industries such as oil, gas, mining, utilities, food, courier delivery, construction businesses, waste management, police and emergency organizations, and transit fleets such as motorcoach, public transit, taxi, and paratransit to move their workforce and goods across their area.

- Car shipments to Europe have increased dramatically during the last five years. The top three automotive firms - Volkswagen, PSA, and Renault Nissan Alliance - account for about half of the connected car shipments in Europe, owing to their dominance in passenger car sales in the region. The linked automobile is envisioned as a passenger vehicle with an embedded connection. In the future, most connected automobiles will have 4G and 5G-enabled Telematics Control Units (TCU).

- As the number of cars on the road grows, there is a greater requirement to maintain strong safety standards, which propels the industry forward. Furthermore, the market is expected to develop due to an increase in demand for fleet management systems in the logistics sector, regulatory mandates to improve vehicle and passenger safety, and an increase in the integration of tablets and smartphones in automobiles.

- The cost of telematics systems, including installation, maintenance, and feedback, continues to be a major impediment to the region's industrial growth. However, studies suggest that reductions in other costs, such as fuel damage and insurance premiums, are more than likely to compensate for the early start-up costs. Furthermore, according to research conducted by the European Commission on automotive technology, the usage of event data recorders has a positive benefit-to-cost ratio. Driven by such trends, more and more automotive manufacturers are entering the telematics industry landscape by providing factory-fitted telematics solutions.

- With the imminent arrival of value-added services such as mobile base video-based safety solutions, and vehicle performance service management solutions, growth opportunities are strengthening in the passenger vehicle telematics market in Europe. While penetration of embedded fleet management services (FMS) in large and medium fleets is relatively high, addressing challenges such as better business cases, awareness, and adequate training, are key to expansion within small fleets, which is encouraging more and more vendors to factory fit these solutions.

United Kingdom to Hold Major Share

- The telematics market in the United Kingdom will witness high growth due to the increasing production of light commercial vehicles such as small trucks, pick-up vans, etc. Commercial vehicle operators use telematics in the optimization of various elements, including truck maintenance, fuel usage, and others. Although the sale of light commercial vehicles fluctuates, the United Kingdom is second only to France in the total sale of LCVs in Europe, according to ACEA.

- The data generated by these vehicles give the companies valuable information to improve their efficiency by avoiding congestion, creating lower-stress driving environments, and the environmental impact on the vehicles, unlike traditional data tracking systems that only provide insights into driver behavior and real-time vehicle location.

- The growing e-commerce businesses and logistic industries in the country have increased the demand for light commercial vehicles, further creating a high-growth opportunity for the Europe telematics market in the commercial segment. According to the OICA Report (2022), the production of the light commercial vehicle stood at 80,210 units, an increase of 44% as compared to the previous year.

- Several automobile manufacturers are focusing on strategic collaboration or partnership to expand the production of light commercial vehicles in the country. For instance, in April 2023, B-ON and International Motors Limited, electric car brands, announced a collaboration to support the import and distribution of B-ON's four-vehicle lineup in the United Kingdom. Through this partnership, both companies aim to support electrification in the country and offer low-cost, zero-emission commercial fleet solutions for customers, further accelerating the demand for telematics in the European market.

- Telematics technology could be an efficient solution for the transport and logistics industry in managing driver shortages. This innovative technology offers real-time tracking and visibility of entire fleets and mobile assets, reducing the drivers' manual work. It is also essential to electronically monitor driving hours for compliance. In May 2023, Trakm8 announced a strategic partnership with CityFibre to equip CityFibre's fleet of vans with the RH600 4G Integrated Telematics Camera to improve fleet safety, help monitor driving behavior, and align with the company's broader sustainability targets.

Europe Telematics Industry Overview

The intensity of competitive rivalry in the European telematics market is high, with the presence of multiple players vying for market share in a fairly contested space. Mergers and acquisitions can be identified as a key strategy followed by market incumbents to strengthen market dominance. Furthermore, the competition is expected to increase further, with newer players looking to offer specialized offerings and innovative business models. Key Vendors include Verizon Communications Inc., Webfleet Solutions BV, ABAX UK Ltd, Masternaut Limited, and Targa Telematics SpA, among others.

In May 2023, Targa Telematics announced the acquisition of Viasat Group Spa to strengthen its leadership in the Italian market and accelerates its expansion in Europe. Through this acquisition, the company aims to mark the creation in the field of IoT and the development of solutions and digital services for connected mobility.

Similarly, in March 2023, Targa Telematics announced a strategic partnership with Ford to expand its range of connected car solutions and the integration of data from the car manufacturer's vehicles.

In October 2022, Webfleet announced a strategic partnership with Muses, a new eOEM based near Paris, to offer integrated telematics solutions. The company's telematics solution enables Muses to monitor fleet health and predictive schedule maintenance. It provides Muses' customers' access to the full Webfleet suite to optimize fleet efficiency and reduce cost.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Existing Policies and Norms

- 4.5 Key Operational Challenges of Fleet Managers in Europe

- 4.6 Assessment of the Impact of Macroeconomic Trends on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in EU Regulations and Local Policy Rules

- 5.1.2 Advancements Such as Route Calculation, Vehicle Tracking, and Fuel Pilferage

- 5.2 Market Challenges/Restraints

- 5.2.1 High Installation Cost

- 5.2.2 Lack of Uninterrupted and Seamless Internet Connectivity

6 TECHNOLOGY SNAPSHOT AND ANALYSIS

7 MARKET SEGMENTATION

- 7.1 Commercial

- 7.1.1 Current Market Scenario And Installed Base

- 7.1.2 Penetration Of Lcv Vs. Mcv/hcv

- 7.1.3 Telematics Service Revenue Analysis

- 7.1.4 By Country

- 7.1.4.1 United Kingdom

- 7.1.4.2 Benelux

- 7.1.4.3 Norway

- 7.1.4.4 Sweden

- 7.1.4.5 Poland

- 7.1.4.6 Denmark

- 7.1.4.7 Finland

- 7.1.4.8 Rest Of Europe

- 7.2 Segmentation - By Passenger Vehicle

- 7.2.1 Current Market Scenario And Installed Base Of Embedded Oem Telematics Systems

- 7.2.2 Region Analysis - Qualitative Analysis Of Trends And Dynamics

8 8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Webfleet Solutions Bv

- 8.1.2 Verizon Communications Inc.

- 8.1.3 Abax Uk Ltd

- 8.1.4 Masternaut Limited

- 8.1.5 Targa Telematics Spa

- 8.1.6 Gurtam Inc.

- 8.1.7 Mix Telematics Limited

- 8.1.8 Mercedes-benz Group Ag (daimler Ag)

- 8.1.9 Volvo Group

- 8.1.10 Scania Ab

- 8.1.11 Man Truck & Bus Se (traton Se)

- 8.1.12 Daf Trucks Nv (paccar Inc.)