|

市場調查報告書

商品編碼

1692116

視訊遠端資訊處理:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Video Telematics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

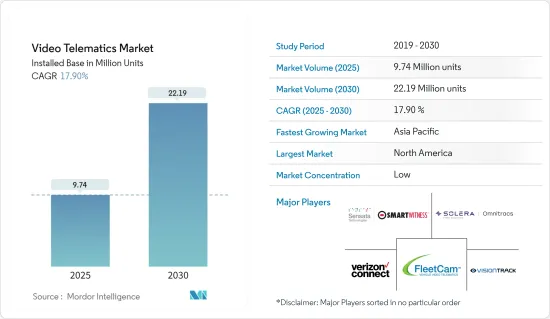

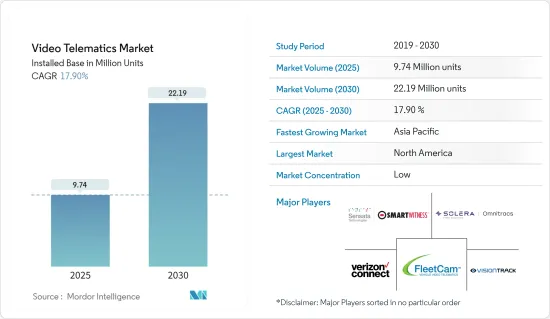

視訊遠端資訊裝置量市場規模預計將從 2025 年的 974 萬成長到 2030 年的 2,219 萬,預測期內(2025-2030 年)的複合年成長率為 17.9%。

視訊遠端資訊處理是一種結合視訊監控和車輛分析的視訊攝影機系統。它由多個具有專門感測器的高解析度攝影機組成。視訊遠端資訊處理是指將攝影機和分析與車輛追蹤結合的技術。此外,公司還可以使用視訊遠端資訊處理來記錄碰撞證據、管理駕駛員風險並提供安全保障。

主要亮點

- 視訊遠端資訊處理解決方案讓駕駛員有責任感。這些解決方案用於定期效能檢查和監控。視訊遠端資訊處理系統還包括檢測感測器。這些感測器向駕駛員告知多種安全功能。車主可以意識到各種安全隱患,如超速、停車標誌違規檢測、車道偏離警告、前方碰撞警報等,這將推動市場成長。

- 車輛遠端資訊處理中最明顯的趨勢之一是攝影機的整合,從而可以在商用車環境中實現各種基於視訊的解決方案。視訊遠端資訊處理是指商用車隊中使用的各種基於攝影機的解決方案,既可以作為獨立應用程式使用,也可以作為傳統車隊遠端資訊處理功能集的補充。

- 視訊遠端資訊處理使企業能夠創建一個大規模資料主導決策、預測分析和解決問題的平台。隨著車隊遠端資訊處理的使用,視訊遠端資訊處理的機會預計將會增加。

- 視訊監控系統被視為侵犯隱私,遭到各種公民自由團體和活動人士的反對。人們希望他們的個人資訊只被合法地用於特定目的,這引發了人們對誰會觀看這些影片以及這些影片可能被如何濫用的擔憂。預計這將對市場成長構成挑戰。

視訊遠端資訊處理市場趨勢

輕型商用車將佔據較大市場佔有率

- LCV 是一類主要用於商業目的運輸貨物和/或乘客的車輛。輕型商用車通常比卡車和巴士等大型商用車更小、更輕。輕型商用車通常用於城內營運、本地配送和宅配服務。

- 在歐盟、澳洲和紐西蘭,LCV 是一種總重量不超過 3.5 噸的商務傳輸車輛。輕型商用車有多種類型,包括皮卡車、廂型車、三輪車、吉普車、小型卡車和底盤駕駛室。輕型商用車通常也更青睞大都會圈,這主要是因為大型車輛在都市區的使用量有限。輕型商用車通常包括廂型車、三輪車、皮卡車和小型巴士,如果符合重量標準,長度可達七公尺。

- 快速的都市化以及零售和電子商務公司的訂單不斷增加,推動了需要高效物流的輕型商用車的成長。為了滿足日益成長的需求,行業主要參與者正在投資擴大生產能力並推出新的 LCV 車型。例如,2023 年 9 月,阿蕭克利蘭 (Ashok Leyland) 旗下 Hinduja Group 的電動車部門 Switch Mobility 宣布推出兩款新型電動輕型商用車 (LCV),稱為 IeV 系列。 IeV 3 和 IeV 4 旨在提供高效、環保的最後一哩運輸解決方案。

- 據印度汽車製造商工業(SIAM)稱,2023會計年度印度輕型和重型商用車銷量預計將增加,分別售出604,000輛和359,000輛。據阿蕭克利蘭稱,23會計年度輕型商用車銷量較上年度長約27%。

- 遠距和短距離快速運輸新鮮蔬菜、水果和消費品的需求不斷成長,預計將增加對輕型商用車的需求,從而進一步為所研究的市場增加有利優勢。

- 還有多項技術創新正在加速市場發展。 2023 年 4 月,為全球商用車隊提供服務的視訊遠端資訊新興企業LightMetrics 在 A 輪資金籌措中從紅杉資本印度公司籌集了 850 萬美元。該公司的解決方案利用邊緣人工智慧來分析安裝在車輛上的攝影機的視訊來源,以便更好地了解駕駛員的行為、減少事故並提高安全性。利用這筆資金籌措,LightMetrics 將專注於加強其多元化團隊,為未來的發展做好準備。

- 其中包括工程、產品、行銷、客戶成功、銷售和分析。該公司宣布,將繼續投資尖端人工智慧技術、新產品和解決方案,以增強其服務產品並為其整個業務的車隊提供更多價值。新資金也將用於探索汽車保險等相關機會。

北美佔有最大市場佔有率

- 汽車產業正在經歷重大轉型期,ADAS(高級駕駛輔助系統)、MaaS(變革時期即服務提供者)、網聯化、自動駕駛、共享/訂閱和電氣化(CASE)等新領域的發展,利用物聯網技術的新產業的進入,以及共乘和汽車共享等新服務的出現。所有這些應用都需要快速的資料傳輸、分析和部署。這些因素正在推動北美視訊遠端資訊處理市場的成長。

- KBB 稱,2023 年第一季美國電動車銷量略低於 258,900 輛。與 2022 年第一季的銷售額相比,這一同比成長約 44.9%。

- 人工智慧儀表板攝影機正在推動市場成長。 AI雙儀錶板攝影機整合了人工智慧(AI)、邊緣運算以及前置和麵向駕駛員的鏡頭,可以記錄和分析即時資料,提供警報以幫助駕駛員避免危險情況並提供事件的因果關係。駕駛員會收到主動駕駛通知和性能指導,以鼓勵個人安全駕駛。

- 根據 BEA 的數據,輕型卡車仍然是 2023 年 5 月美國汽車市場最重要的細分市場,銷量低於 2023 年 4 月的 1.07 輛,較去年同期成長約 23.06%。

- 市場的主要企業正在擴大其在數位移動領域的影響力,以滿足日益成長的聯網汽車需求。 2023 年 1 月,Forward Thinking Systems (FTS) 宣布將 OBD-II(車載診斷 II)診斷和遠端資訊處理資料整合到其 FleetCam Pro 行車記錄器中。此次突破性的無線韌體更新使 FleetCam Pro 能夠透過 OBD-II 連接埠直接連接到車輛的引擎控制單元 (ECU),以獲取大量車輛診斷和遠端資訊處理資料,包括引擎轉速、車速、燃油量、運作、引擎小時數、診斷故障碼 (DTC)、車輛識別號碼等。

視訊遠端訊息行業概況

視訊遠端資訊處理市場高度分散,主要參與者包括 SmartWitness(Sensata Technologies)、Verizon Connect(Verizon Communications Inc)、Omnitracs(Solera Holdings Inc)、FleetCam (Pty) Ltd 和 VisionTrack。市場參與企業正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2023 年 10 月-Verizon Connect 宣布其新的人工智慧行車記錄器解決方案現已在歐洲、中東和非洲地區以及亞太地區的部分國家推出。 AI Dashcam 提供一系列先進的車隊創新,讓車隊管理人員更深入了解危險事件。當駕駛員出現危險駕駛行為時,他們可以收到即時車載指導警報。

- 2023 年 10 月-Lytx Inc. 宣布推出天氣災害警報,所有客戶均可作為 Lytx Lab 標籤內的計劃使用。這項新的人工智慧地理空間技術基於 Lytx Vision 平台,由 Lytx Lab 開發,Lytx Lab 是一個創意培養箱,Lytx 工程師和安全專家在這裡與客戶合作以滿足市場需求。天氣災害警報使車隊管理人員能夠根據地理空間標準和 NOAA 天氣資料獲得通知,從而做出即時決策,實現更安全、更有效率的駕駛。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 產業價值鏈分析

- 新冠疫情及其他宏觀經濟因素對市場的影響

第5章 市場動態

- 市場促進因素

- 車隊遠端資訊處理的應用日益廣泛

- 更加重視安全和合規管理

- 基於物聯網、人工智慧和機器學習的視訊智慧解決方案的興起

- 市場挑戰

- 視訊監控系統中的隱私和安全問題

第6章 市場細分

- 按類型

- 整合系統

- 獨立系統

- 按應用

- 公車

- 大型卡車

- LCV

- 搭乘用車

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 拉丁美洲

- 中東和非洲

第 7 章 傳統車輛監控系統介紹

第 8 章供應商市場佔有率與定位

- 視訊遠端資訊處理供應商市場佔有率

- 北美供應商排名

- 歐洲供應商排名

第9章 競爭格局

- 公司簡介

- SmartWitness(Sensata Technologies)

- Verizon Connect(Verizon Communications Inc.)

- Omnitracs(Solera Holdings Inc.)

- FleetCam(Pty)Ltd

- VisionTrack

- Lytx Inc.

- Nauto Inc.

- SureCam(Europe)Limited

- LightMetrics Inc.

- NetraDyne Inc.

- Geotab Inc.

- AT&T Inc.

- Fleet Complete Inc.

- Samsara Inc.

- Octo Group SpA

- Motive Technologies Inc.

- One Step GPS LLC

- MiX Telematics Ltd

- Trimble Transportation(Trimble Inc.)

- Streamax Technology Co. Ltd

- Howen Technologies Co. Ltd

- Micronet, Ltd

- PFK Electronics

- Blackvue(Pittasoft Co. Ltd)

- Garmin Ltd

第10章 投資分析

第 11 章市場機會與未來成長

The Video Telematics Market size in terms of installed base is expected to grow from 9.74 million units in 2025 to 22.19 million units by 2030, at a CAGR of 17.9% during the forecast period (2025-2030).

Video telematics is a video camera system that combines video surveillance and vehicle analytics. It consists of several high-resolution linked cameras with specialized sensors. Video telematics refers to a technology that combines cameras and analytics with fleet tracking. Further, companies can use video telematics to record collision evidence, manage driver risk, and provide security.

Key Highlights

- Video telematics solutions instill a sense of responsibility in drivers. These solutions are used to examine and monitor performance regularly. Video telematics systems also include detection sensors. These sensors notify the driver of several safety features. Vehicle owners can become aware of various safety hazards, such as exceeding speed limits, detecting stop sign violations, having lane-drifting warnings, forwarding collision warnings, and more, driving the market growth.

- One of the most visible trends in the fleet telematics sector is the integration of cameras to enable various video-based solutions in commercial vehicle environments. Video telematics refers to a wide range of camera-based solutions used in commercial vehicle fleets as standalone applications or as an addition to the feature set of traditional fleet telematics.

- Organizations can use video telematics to build a platform to make data-driven decisions, provide predictive analytics, and assist enterprises in solving large-scale challenges. elematics will give businesses widespread capability in fleet vehicles, allowing fleets to eliminate logistical hassles. Video telematics opportunities are expected to expand due to the use of fleet telematics.

- Video surveillance systems have been viewed as a violation of privacy and are opposed by various civil liberties groups and activists. There have been increasing concerns about who watches the video and how it might be misused because people expect their personal information to be used only for legitimate and specific purposes. This is expected to challenge the market's growth.

Video Telematics Market Trends

LCVs to Hold Significant Market Share

- LCVs are a category of vehicles primarily designed for transporting goods or passengers for commercial purposes. LCVs are typically smaller and lighter than heavy commercial vehicles such as trucks and buses. They are commonly used for intra-city operations, local distribution, and delivery services.

- An LCV in the European Union, Australia, and New Zealand is a commercial carrier vehicle with a gross vehicle weight of no more than 3.5 metric tons. LCVs can include various vehicle types, such as pickup trucks, vans, three-wheelers, jeeps, light trucks, and chassis cabs. LCVs also generally prefer metropolitan areas, chiefly due to restrictions on using heavy-duty vehicles in urban areas. They commonly include vans, three-wheelers, pickup trucks, and minibusses, which fit the weight criteria and are up to 7 meters long.

- Rapid urbanization and increased orders from retail and e-commerce companies have supported the growth of light commercial vehicles as the companies require efficient logistics. Major industry players are focusing on investing in capacity expansion and launching new models of light commercial vehicles to address the growing need. For instance, in September 2023, Switch Mobility, the electric vehicle division of Ashok Leyland's Hinduja Group, announced to launch of two new electric light commercial vehicles LCVs, known as the IeV series. The IeV 3 and IeV 4 vehicles are designed to provide efficient and environmentally friendly last-mile transportation solutions.

- According to the Society of Indian Automobile Manufacturers (SIAM), the fiscal year 2023 witnessed an increase in the sales of light commercial vehicles and heavy commercial vehicles in India, with 604 thousand units and 359 thousand units sold, respectively. According to Ashok Leyland, in fiscal year 2023, light commercial vehicles witnessed an increase in sales volume by around 27% compared to the previous year.

- The rising need to rapidly transport fresh vegetables, fruits, and consumer goods over long and short distances is anticipated to increase the demand for light commercial vehicles, further adding a lucrative advantage to the studied market.

- The market is also witnessing several innovations that are advancing the development of the studied market. In April 2023, LightMetrics, a video telematics startup serving commercial vehicle fleets globally, raised USD 8.5 million in a Series A funding round from Sequoia Capital India. Their solution utilizes edge AI and analyzes video feeds from the camera installed in vehicles to understand driver behavior better, reduce accidents, and improve safety. With this fundraiser, LightMetrics would focus on strengthening various teams to set the stage for future growth.

- This includes engineering, product, marketing, customer success, sales, and analytics. The company announced that it would continue to invest in cutting-edge AI technologies, new products, and solutions to strengthen its offerings and deliver more value to fleets across its operations. The funds raised would also be used to explore adjacent opportunities like auto insurance.

North America to Hold the Largest Market Share

- The automotive industry is undergoing a significant transformation as a result of the development of new areas such as advanced driver assistance systems (ADAS), mobility-as-a-service providers (MaaS), connectivity, autonomous, sharing/subscription, and electrification (CASE), and the entry of new industries utilizing IoT technology and the emergence of new services like ride-sharing and car-sharing. All these applications necessitate speedy data transfer, analysis, and deployment. These factors are propelling the growth of the North American video telematics market.

- According to KBB, in the first quarter of 2023, just under 258,900 battery-electric vehicles were sold in the United States. This year-over-year increase was around 44.9% compared to the sales recorded in the f1Q of 2022.

- The market's growth is driven by AI dashboard cameras. The AI dual dashboard camera integrates artificial intelligence (AI), edge computing, and forward- and driver-facing cameras to record and analyze real-time data, provide alerts to help drivers avoid risky situations, and offer event causation. Drivers receive positive driving notifications and performance coaching to encourage individuals to drive safely.

- According to BEA, light trucks remained the most significant US auto market segment in May 2023, down from over 1.07 unit sales in April 2023 and increasing by approximately 23.06% year-on-year.

- Key players in the market are expanding their presence in digital mobility to cater to the increased demand for connected cars. In January 2023, Forward Thinking Systems (FTS) announced the integration of OBD-II (On-Board Diagnostics II) diagnostics and telematics data into its FleetCam Pro dash camera. This groundbreaking, over-the-air firmware update will enable the FleetCam Pro to connect directly to the vehicle's Engine Control Unit (ECU) through an OBD-II port and capture extensive vehicle diagnostic and telematics data, including engine RPM, vehicle speed, fuel level, odometer mileage, engine run time, diagnostic trouble codes (DTC), and vehicle identification numbers.

Video Telematics Industry Overview

The video telematics market is highly fragmented, with the presence of major players like SmartWitness (Sensata Technologies), Verizon Connect (Verizon Communications Inc.), Omnitracs (Solera Holdings Inc.), FleetCam (Pty) Ltd, and VisionTrack. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- October 2023 - Verizon Connect announced that the new Artificial Intelligence Dashcam solution is available in selected nations in EMEA and APAC. Delivering an array of advanced fleet innovations, the AI Dashcam provides more insights into dangerous events for fleet managers. It gives drivers real-time, in-cab coaching alerts during high-risk driving behaviors.

- October 2023 - Lytx Inc. announced the rollout of its Weather Hazard Alerts, available to all clients as a project within the Lytx Lab tab in their accounts. This new AI-powered geospatial technology created on the Lytx Vision Platform was developed within Lytx Lab, an idea incubator and a way for Lytx engineers and safety experts to collaborate with customers to address market needs. Weather Hazard Alerts allow fleet managers to get notifications based on geospatial criteria and NOAA weather data to enable real-time decision-making for safer and more efficient driving.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Adoption of Fleet Telematics

- 5.1.2 Increasing Emphasis on Safety and Compliance Management

- 5.1.3 Increasing IoT, AI, and Machine Learning Based Solutions for Video Intelligence

- 5.2 Market Challenges

- 5.2.1 Privacy and Security Issues for Video Surveillance Systems

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Integrated Systems

- 6.1.2 Standalone Systems

- 6.2 By Application

- 6.2.1 Buses

- 6.2.2 Heavy Trucks

- 6.2.3 LCVs

- 6.2.4 Passenger Cars

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 INTRODUCTION TO TRADITIONAL VEHICLE SURVEILLANCE

8 VENDOR MARKET SHARE AND POSITIONING

- 8.1 Video Telematics Vendor Market Share

- 8.2 North America Vendor Ranking

- 8.3 Europe Vendor Ranking

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 SmartWitness (Sensata Technologies)

- 9.1.2 Verizon Connect (Verizon Communications Inc.)

- 9.1.3 Omnitracs (Solera Holdings Inc.)

- 9.1.4 FleetCam (Pty) Ltd

- 9.1.5 VisionTrack

- 9.1.6 Lytx Inc.

- 9.1.7 Nauto Inc.

- 9.1.8 SureCam (Europe) Limited

- 9.1.9 LightMetrics Inc.

- 9.1.10 NetraDyne Inc.

- 9.1.11 Geotab Inc.

- 9.1.12 AT&T Inc.

- 9.1.13 Fleet Complete Inc.

- 9.1.14 Samsara Inc.

- 9.1.15 Octo Group SpA

- 9.1.16 Motive Technologies Inc.

- 9.1.17 One Step GPS LLC

- 9.1.18 MiX Telematics Ltd

- 9.1.19 Trimble Transportation (Trimble Inc.)

- 9.1.20 Streamax Technology Co. Ltd

- 9.1.21 Howen Technologies Co. Ltd

- 9.1.22 Micronet, Ltd

- 9.1.23 PFK Electronics

- 9.1.24 Blackvue (Pittasoft Co. Ltd)

- 9.1.25 Garmin Ltd